Guides

10

min read

502 errors killing your retry script? Try AI-powered payment recovery

AI-powered payment recovery systems use machine learning to analyze decline patterns and optimize retry timing, typically achieving 20-50% higher recovery rates than static retry scripts. These platforms handle 502 errors and other failures automatically through intelligent routing and retry strategies, eliminating the need for custom infrastructure while recovering 25-35% of payments on first retry.

Key Facts

• Failed payments cause subscription businesses to lose 10-15% of annual revenue, with 45% of customers never manually retrying after a decline

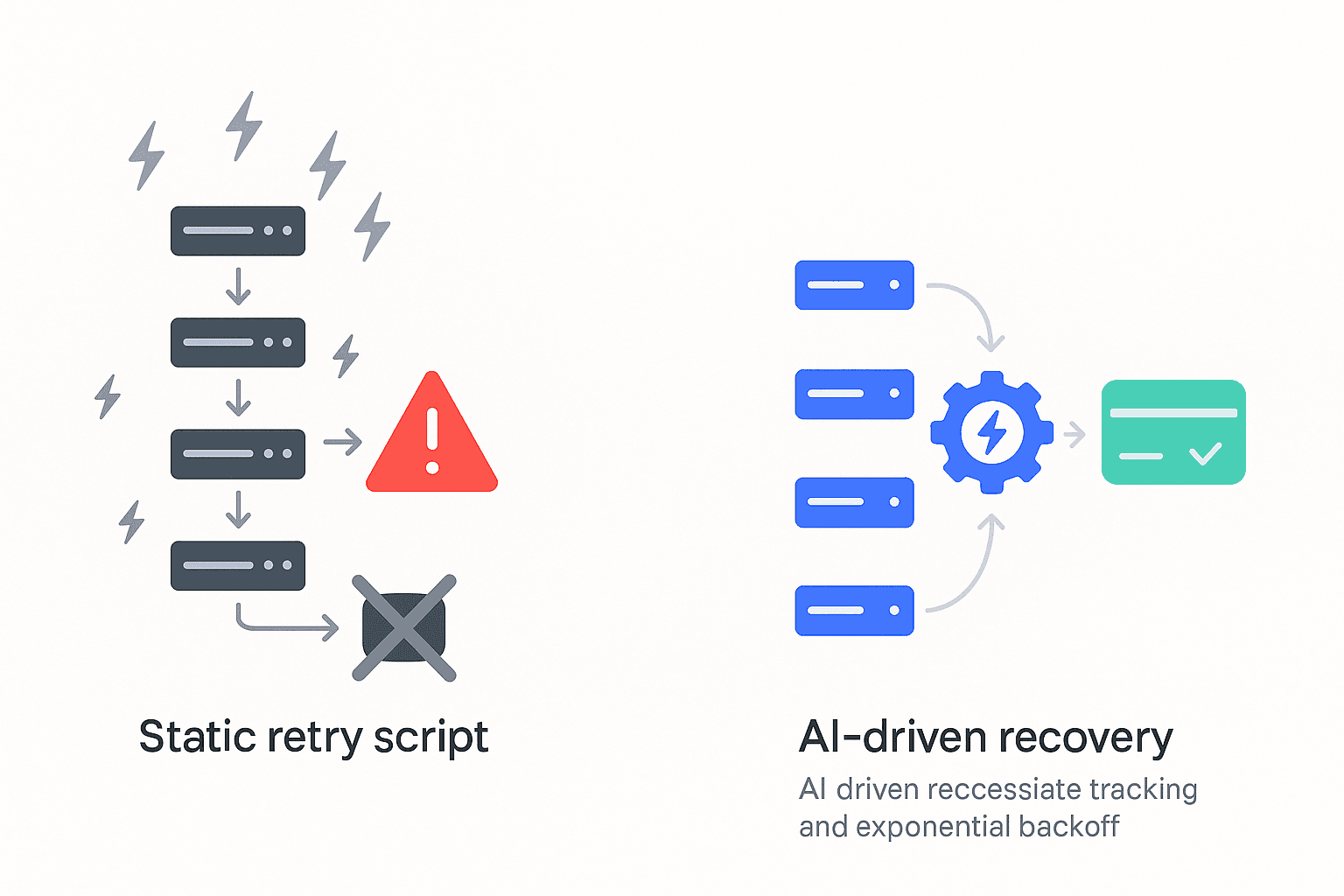

• Static retry scripts fail catastrophically when encountering 502 errors or network issues, lacking the context to distinguish recoverable from permanent failures

• Building robust payment recovery requires handling idempotency, state management, exponential backoff, and compliance standards like SOC 2 Type II

• AI engines analyze billions of transactions to determine optimal retry timing based on decline codes, issuer patterns, and customer behavior

• Modern platforms offer 5-minute no-code setup with pay-for-success pricing models, charging only for successfully recovered payments

• Stripe's AI recovered $6 billion in falsely declined transactions with 70% greater precision and 35% fewer retry attempts

Failed payments are a silent revenue killer. Every month, subscription businesses watch as expired cards, insufficient funds, and mysterious gateway timeouts chip away at their MRR. When your home-grown retry script encounters a 502 error at 2 AM, there is no graceful recovery. The transaction fails, the customer churns, and the revenue vanishes.

The scale of this problem is staggering. Industry research shows that 10-15% of subscription revenue disappears annually due to payment failures such as expired cards and insufficient funds. Even worse, 45% of consumers will not manually retry a payment following its failure. If your system does not recover these transactions automatically, that revenue is gone for good.

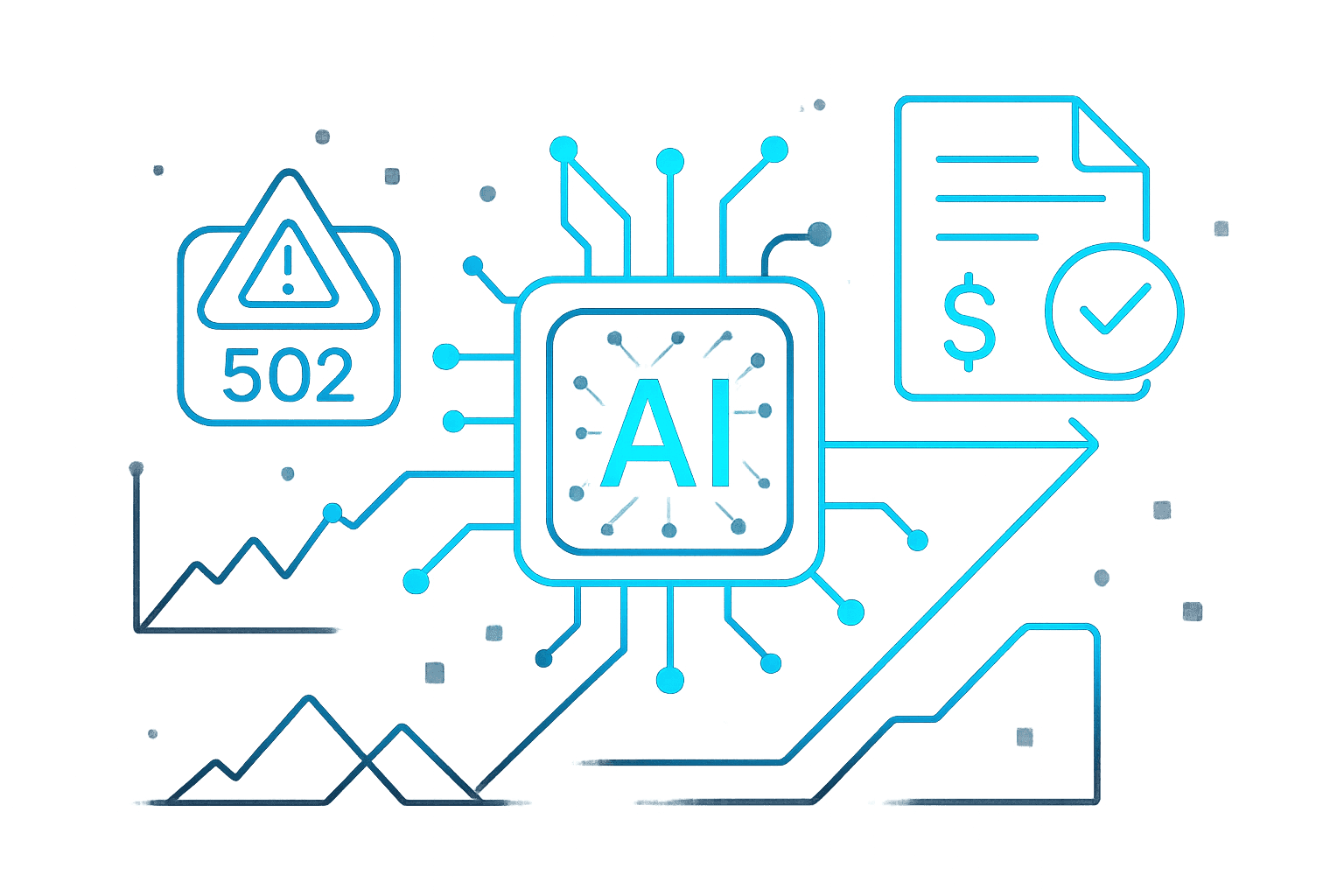

This is where AI-powered payment recovery enters the picture. Instead of rigid scripts that crumble under network pressure, machine learning engines analyze issuer responses, network conditions, and customer history in real time to schedule intelligent retries. The result is a 20--50% increase in recovered revenue without the engineering headaches of maintaining brittle infrastructure.

Why do 502 errors (and other gremlins) turn failed payments into lost revenue?

Payment failures happen far more often than most teams realize. A 502 Bad Gateway error means your retry script received an invalid response from the upstream server. But that is just one flavor of the many gremlins lurking in the payment stack.

Consider the numbers. Card declines, bank rejections, and soft errors collectively wipe out as much as 4% of MRR in high-growth subscription businesses. Over half of US shoppers had their payment declined during an online purchase in 2023, and the downstream effects cascade quickly into involuntary churn.

The problem compounds because failed payments rarely receive the attention they deserve. Engineering teams prioritize new features over maintaining retry logic. Meanwhile, failed payments cost your business thousands, even hundreds of thousands of dollars annually.

When a static retry script encounters transient network issues like 502 errors, it typically retries blindly at fixed intervals. This approach ignores critical context:

Was the failure a soft decline that will likely succeed tomorrow?

Is the issuer experiencing temporary outages?

Has this customer's card been updated through network tokenization?

Without these signals, your script is essentially guessing. That guesswork translates directly into lost revenue and frustrated customers who never intended to cancel.

Key takeaway: HTTP-layer failures like 502 errors are symptoms of a deeper problem. Static retry scripts lack the intelligence to distinguish recoverable failures from permanent declines, costing subscription businesses up to 4% of their MRR.

Home-grown retry scripts: from 502 chaos to idempotency headaches

Building your own payment retry system sounds straightforward until you actually try it. The technical challenges extend far beyond handling 502 errors.

The transient versus permanent error problem

Not all failures are created equal. Server errors return HTTP responses with 5xx error codes, indicating problems on the payment processor's side. These are often transient and worth retrying. But content errors return 4xx codes, signaling that retrying the same request will never succeed.

Your script must correctly classify each failure type. Get it wrong in one direction, and you waste resources on hopeless retries. Get it wrong in the other, and you abandon transactions that would have succeeded with patience.

The idempotency minefield

Transient error conditions are those scenarios where retrying the same request at a later point would likely result in a successful outcome. But here is the catch: if your retry logic lacks proper idempotency controls, you risk charging customers twice.

Idempotency is a web API design principle defined as the ability to apply the same operation multiple times without changing the result beyond the first try. Implementing this correctly requires:

Generating and tracking idempotency keys for every POST request

Building a state machine to track payment lifecycle

Handling edge cases where the initial request succeeded but the response was lost

The 24/7 monitoring burden

Payment failures do not respect business hours. When your retry script breaks at midnight, you need someone available to fix it. As the engineering wisdom goes, "everything fails eventually". The question is whether you have the infrastructure and on-call rotation to respond.

A well-thought-out retry strategy can mean the difference between recovering failed payments and frustrating your users. But designing a robust retry mechanism requires expertise in:

Challenge | Engineering Requirement |

|---|---|

Status tracking | Database schema for payment states |

Retry timing | Exponential backoff implementation |

Queue management | Retry queues and dead letter queues |

Duplicate prevention | Exactly-once delivery semantics |

Most teams underestimate this complexity. They build a simple cron job, encounter their first 502 cascade, and realize they have signed up for a full-time infrastructure project.

Build vs. buy: what's the true cost of a resilient payment-recovery engine?

The build versus buy decision for payment recovery involves far more than comparing license fees to engineering salaries. The hidden costs accumulate quickly.

The data science requirement

Effective retry timing requires machine learning models trained on massive datasets. Recurly's intelligent retry logic uses data from billions of transactions to increase the chances of successful payments. Can your team replicate this with your transaction volume alone?

Building comparable models requires:

Data scientists to design and train algorithms

Infrastructure for model training and deployment

Continuous monitoring for model drift as issuer behavior changes

The compliance overhead

Payment systems touch sensitive financial data. Any solution you build must meet SOC 2 Type II compliance standards, which are becoming table stakes for payment recovery platforms handling sensitive financial data. The audit process alone consumes months of engineering and legal resources.

Regulatory requirements vary by payment method and geography. For example, SEPA payments can only be retried twice, in compliance with SEPA regulations. Building a system that respects these constraints across all your payment methods adds significant complexity.

The embedded AI advantage

Gartner research indicates that by 2026, more than 80% of ISVs will have embedded generative AI capabilities in their enterprise applications, up from less than 1% today. This trend suggests that buying AI-powered solutions will increasingly outperform building from scratch.

The same research warns that through 2025, 30% of generative AI projects will be abandoned after proof of concept due to poor data quality, inadequate risk controls, escalating costs, or unclear business value. Payment recovery is not a core competency for most subscription businesses. Outsourcing it to specialists makes strategic sense.

For a deeper dive into implementation considerations, see our guide on how to implement AI-powered payment recovery.

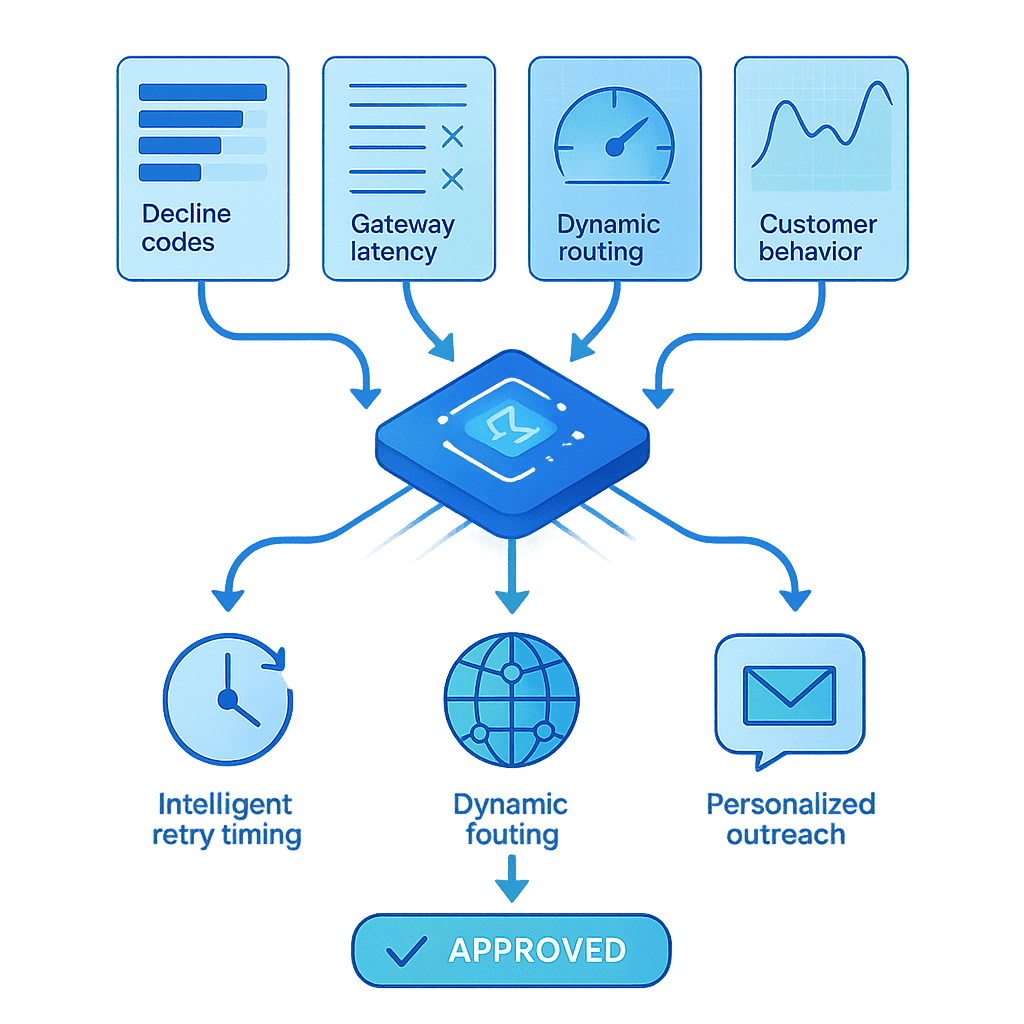

Inside an AI retry engine: how do data signals, smart retries and multi-gateway routing work?

AI-powered payment recovery differs fundamentally from static retry scripts. Instead of following fixed rules, these systems learn from each transaction to optimize future attempts.

Intelligent retry timing

Traditional dunning follows rigid schedules. "Traditional dunning is like fishing with a bent stick hoping for a bite," as Payoptify describes it. "AI-powered recovery is like having smart sonar and an automated fishing fleet working for you 24/7."

AI dunning is strategic: it uses data to pinpoint the best retry times, personalizes outreach across channels customers actually use, and gracefully handles multiple payment gateways. The system analyzes:

Historical success rates by hour and day of week

Decline code patterns from specific issuers

Customer payment behavior over time

Multi-gateway routing

Not all payment processors are equal. Approval rates vary significantly based on card type, geography, and even the time of day. AI retry engines can route transactions through whichever gateway offers the highest success probability at that moment.

Slicker's machine learning model schedules and retries failed payments at optimal times, leveraging industry expertise and dozens of parameters. The engine dynamically determines if an error is retryable, taking into account differences between different issuers and historical performance.

Decline code intelligence

The first retry matters most. On average, Pagos customers find first retries succeed 25--35% of the time. But only if you retry the right transactions at the right time.

AI engines decode decline reasons to understand which failures are recoverable:

Insufficient funds: Retry after payroll dates

Temporary hold: Retry within hours

Lost/stolen card: Do not retry at all

Network timeout: Retry immediately through alternate gateway

Learn more about these mechanisms in our article on how AI enhances payment recovery.

ROI math: how much extra revenue can smart retries unlock?

The financial impact of upgrading from static scripts to AI-powered recovery is substantial and measurable.

Recovery rate improvements

Companies that switch from batch-based to intelligent, individualized retry strategies typically see: 20--50% increase in recovered revenue. This is not a marginal improvement. For a business losing $100,000 monthly to failed payments, that translates to $20,000--$50,000 in additional recovered revenue every month.

Slicker customers usually see between 10 and 20 percentage point increase in the number of recovered payments. On a base recovery rate of 30%, that means jumping to 40--50% recovery, nearly doubling the money saved from involuntary churn.

The compounding effect on LTV

Recovered customers do not just pay one more invoice. They continue their subscriptions, often for months or years. Every 1% lift in recovery can translate into tens of thousands of annual revenue.

Stripe's Adaptive Acceptance results

For context on what is possible at scale, Stripe's AI-powered Adaptive Acceptance recovered a record-high $6 billion in falsely declined transactions, reflecting a 60% year-over-year increase in the retry success rate. Their new AI model achieves 70% greater precision in identifying legitimate transactions that have been falsely declined while reducing retry attempts by 35%.

Fewer retries with higher success rates means lower processing costs and happier issuers.

Slicker vs. FlexPay, GoCardless & others--who comes out on top?

The AI retry engine market includes several established players. Here is how they compare.

FlexPay

FlexPay positions itself as an enterprise solution with multiple integration options, including API and access to 40+ CRMs, enabling quick setup without disrupting existing billing. Their platform uses both "Invisible Recovery" for payments that can be recovered without customer involvement and "Engaged Recovery" for situations requiring customer action.

However, FlexPay's enterprise focus means complex onboarding and custom pricing that may not suit smaller subscription businesses.

GoCardless Success+

GoCardless Success+ claims up to 70% recovery rates for certain failure types. The platform excels at direct debit payments, leveraging its bank-to-bank payment expertise.

The limitation is scope. GoCardless focuses on direct debit, which may leave gaps if your business relies heavily on card payments.

Slicker

Slicker takes a different approach with its pay-for-success pricing model that aligns incentives perfectly. You only pay for successfully recovered payments, eliminating the risk of paying for a solution that does not deliver.

The platform's proprietary AI engine processes each failed payment individually and schedules intelligent, data-backed retries rather than blindly following generic decline-code rules. Multi-gateway routing ensures transactions flow through whichever processor offers the best approval odds.

For a comprehensive comparison, see our top 7 AI retry engines analysis.

Integration & compliance: getting live in minutes, not months

Modern AI recovery platforms have dramatically simplified deployment. The days of multi-month integration projects are over.

Rapid deployment

Slicker's setup process takes 5 minutes in the dashboard to have your instance up and running. This is no-code revenue recovery that connects to major billing platforms without engineering resources. The platform supports popular billing and payment platforms, such as Stripe, Chargebee, Recurly, Zuora, and Recharge, as well as in-house systems.

Compliance standards

SOC 2 Type II compliance is becoming table stakes for payment recovery platforms handling sensitive financial data. When evaluating solutions, verify their compliance certifications and data handling practices.

Regional regulations add complexity. SEPA retries by Recurly enable automatic re-attempts of SEPA Direct Debit payments that fail due to insufficient funds, but within strict limits. Recurly ensures that retry attempts are within the bounds of SEPA rules, offering peace of mind to merchants.

Pricing models

Traditional SaaS pricing charges you whether the solution works or not. Pay-for-success models like Slicker's align vendor incentives with customer outcomes. The vendor only wins when you recover revenue you would otherwise have lost.

Stop firefighting 502s--let AI recover revenue for you

Failed payments will always happen. Cards expire, banks have outages, and network glitches occur at the worst possible times. The question is not whether you will face these challenges, but whether you are equipped to handle them intelligently.

Static retry scripts served their purpose in simpler times. But the complexity of modern payment infrastructure, the diversity of failure modes, and the sophistication of issuer behavior have outpaced what home-grown solutions can handle. Every 502 error that crashes your script represents revenue walking out the door.

AI-powered payment recovery transforms this from a reactive firefight into a systematic revenue optimization process. Machine learning models trained on billions of transactions know when to retry, which gateway to use, and when to give up. They handle compliance automatically and integrate with your existing stack in minutes.

Slicker built its revenue recovery platform around the principle that every failed payment deserves a customized recovery approach. With a one-month free trial and pay-for-success pricing, there is no risk in discovering how much revenue you have been leaving on the table.

Your engineering team has better things to do than maintaining payment retry infrastructure. Let them build your product while Slicker handles the recovery.

Frequently Asked Questions

What causes 502 errors in payment retry scripts?

A 502 Bad Gateway error occurs when a retry script receives an invalid response from the upstream server, often due to network issues or server overloads. These errors can lead to failed transactions and lost revenue if not handled intelligently.

How can AI improve payment recovery from failed transactions?

AI-powered payment recovery uses machine learning to analyze transaction data and optimize retry strategies. It schedules retries based on issuer responses, network conditions, and customer history, increasing the chances of successful payment recovery by 20-50%.

What are the challenges of building a payment retry system in-house?

Building an in-house payment retry system involves handling complex issues like transient vs. permanent errors, idempotency, and 24/7 monitoring. These require significant engineering resources and expertise, often making it more efficient to use specialized AI solutions.

How does Slicker's AI engine enhance payment recovery?

Slicker's AI engine processes each failed payment individually, using data-backed retries and multi-gateway routing to optimize success rates. This approach aligns with their pay-for-success pricing, ensuring you only pay for successfully recovered payments.

What compliance standards should payment recovery platforms meet?

Payment recovery platforms should meet SOC 2 Type II compliance standards to handle sensitive financial data securely. This ensures that the platform adheres to strict data protection and privacy regulations, providing peace of mind for businesses.

Sources

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://stripe.com/blog/ai-enhancements-to-adaptive-acceptance

https://medium.com/javarevisited/how-to-handle-payment-retries-in-system-design-c599c13af880

https://www.slickerhq.com/blog/how-to-implement-ai-powered-payment-recovery-to-mi-00819b74

https://www.slickerhq.com/blog/how-ai-enhances-payment-recovery

https://www.slickerhq.com/blog/one-size-fails-all-the-case-against-batch-payment-retries

WRITTEN BY

Slicker

Slicker