Guides

10

min read

AI-driven smart payment retries: What makes them intelligent?

True AI-driven payment retries use machine learning to analyze each failed transaction individually, classifying decline types and dynamically adjusting retry timing based on issuer patterns and customer behavior. Unlike static retry rules that apply generic schedules, intelligent systems achieve 70-85% recovery rates by learning from outcomes and continuously refining their models, delivering 2-4× better recovery than traditional billing logic.

TLDR

Failed payments cause up to 70% of customer departures in subscription businesses, making intelligent recovery critical for revenue retention

True AI engines classify soft vs hard declines and personalize retry timing for each transaction rather than using static rules

Machine learning platforms achieve 70-85% recovery rates compared to the industry median of 47.6%

Red flags for AI-washing include no model transparency, one-size-fits-all schedules, and missing compliance certifications

Legitimate AI solutions continuously retrain on new outcomes and can explain their decision logic

AI-driven smart payment retries slash involuntary churn by combining granular decline data with real-time machine-learning decisions. In the next few minutes you'll see why static dunning rules fall short, how true intelligence works, and how to spot vendors that are merely riding the AI hype wave.

Why do failed payments need smarter recovery — and where does AI fit?

Failed payments are not a minor nuisance; they are a revenue emergency hiding in plain sight.

"Involuntary churn has become the silent killer of subscription revenue, with up to 70% of customer departures stemming from failed transactions rather than intentional cancellations." — Slicker

Those numbers become even more alarming when you factor in the cost of acquiring a replacement customer. Recurly research compiled from more than 2,000 businesses shows that acquiring a new customer is anywhere from 5 to 25 times more expensive than retaining an existing one. A monthly churn rate of just 5% translates to losing nearly half of your customers—and half of your revenue—in a single year.

Credit card declines alone leave roughly 15% of monthly revenue uncollected. With more than 2,000 potential reasons a payment transaction can fail, recovering that revenue through generic retry schedules is like playing darts blindfolded.

This is where AI-driven recovery enters the picture. Instead of applying the same retry timing to every decline, machine-learning models interpret the specific decline reason, evaluate customer and issuer context, and dynamically adjust retry timing to maximize success.

Key takeaway: Failed payments cause most involuntary churn, and static retry rules cannot adapt to the thousands of variables that determine whether a retry succeeds.

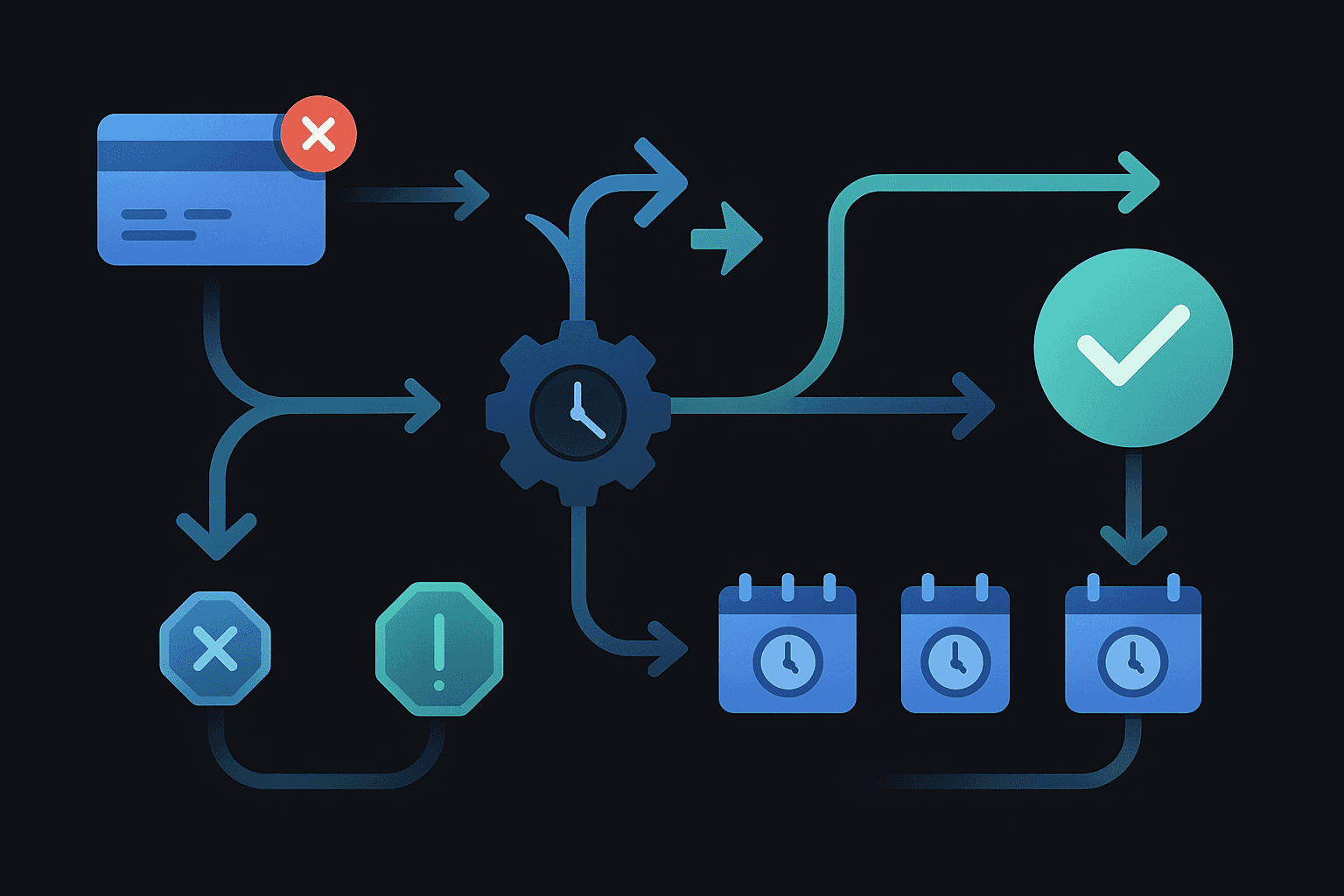

What makes a payment retry engine truly intelligent?

Not every system that carries an "AI" label actually learns. A truly intelligent retry engine combines several layers of machine-learning capability.

1. Granular failure classification

"Machine learning unlocks granular segmentation, predicting which failures are 'soft' (temporary) vs. 'hard' (permanent) and tailoring actions accordingly." — Slicker

Soft declines, such as insufficient funds or a temporary hold, can often be resolved with a well-timed retry. Hard declines, like a stolen-card flag, require customer intervention and should not be repeatedly retried, which wastes authorization attempts and can trigger network penalties.

2. Real-time, transaction-level decisions

Unlike traditional static retry systems that follow generic decline-code rules, modern AI engines process each failed payment individually and schedule intelligent, data-backed retries.

3. Continuous model refinement

Zuora's documentation describes how its machine-learning model evaluates numerous characteristics and payment transactions to identify optimal retry times. When models continuously ingest new outcome data, they improve over time rather than relying on a static ruleset.

Static Retry Logic | ML-Powered Retry |

|---|---|

Same schedule for every decline | Personalized timing per transaction |

Generic decline-code mapping | Soft vs. hard classification |

Fixed retry count | Dynamic retry cadence |

No feedback loop | Model improves with each outcome |

Key takeaway: True intelligence requires per-transaction analysis, soft/hard classification, and a feedback loop that trains the model on every new outcome.

How much can ML lift your payment-recovery benchmarks?

Numbers tell the story best.

The median recovery rate across the industry hovers around 47.6%. AI-powered platforms, however, consistently achieve 70–85% success rates—a potential two- to four-fold improvement.

Slicker's proprietary AI engine delivers 2–4× better recovery than native billing-provider logic. For many subscription businesses, every 1% lift in recovery can translate into tens of thousands of dollars in annual revenue.

Metric | Industry Median | AI-Powered Platforms |

|---|---|---|

Recovery rate | 47.6% | 70–85% |

Lift vs. native logic | Baseline | 2–4× |

These gains compound quickly. If involuntary churn represents 40% of total churn and you cut it in half, you dramatically extend customer lifetime value without spending another dollar on acquisition.

Key takeaway: ML-driven retries routinely double or triple recovery rates compared with static billing logic.

AI-washing red flags: how can you separate buzzwords from real ML?

The term "AI" appears on nearly every fintech landing page. Gartner cautions that security and risk management leaders must evaluate AI progress in light of disappointments from early generative AI deployments and amid widespread "AI agent washing."

Here is a practical checklist to vet vendor claims.

Red flags to watch for

No model transparency. If a vendor cannot explain what inputs the model uses or how it improves, the "AI" may be simple if/then rules.

One-size-fits-all retry schedules. Genuine ML produces different retry timing for different transactions.

No published benchmarks. Legitimate platforms share recovery-rate data or offer proof-of-concept trials.

Missing compliance certifications. SOC 2 compliance has become table stakes for payment platforms handling sensitive data.

Questions to ask vendors

Does the model classify soft vs. hard declines, and how?

How frequently does the model retrain on new transaction outcomes?

Can you share anonymized recovery benchmarks from similar customers?

What compliance certifications (SOC 2, PCI DSS) do you hold?

Gartner's Hype Cycle framework notes that AI investment remains strong, but focus is shifting from GenAI hype to foundational innovations like AI-ready data, AI engineering, and ModelOps. Vendors stuck on buzzwords without operational depth are likely still riding inflated expectations.

Meanwhile, Gartner research indicates that 56% of finance functions plan to increase AI investments by at least 10% in the next two years. The pressure to deliver real ROI means AI-washed products will face increasing scrutiny.

Key takeaway: Demand transparency on model inputs, retraining cadence, and compliance certifications before trusting any "AI" label.

Slicker vs. other payment retry engines: where does intelligence really show?

Several platforms now offer some form of automated payment retry. The depth of their ML capabilities varies significantly.

Zuora Configurable Payment Retry

Zuora allows users to configure retry logic for specific customer groups and payment gateway response codes. Its AI-driven smart retry option uses machine learning to identify optimal retry times. The Cascading Payment Method feature, which dynamically retries with alternative payment methods, is still in the Early Adopter phase and is not supported with the Advanced Payment Manager.

FlexPay

FlexPay positions itself around payment performance management and emphasizes AI-driven precision to recover failed payments. The platform focuses on helping merchants move beyond traditional authorization rates.

Slicker

Slicker brings Silicon Valley innovation to payment recovery with a proprietary AI engine that delivers 2–4× better recoveries than static retry systems. As a Y Combinator-backed company, the platform uses machine learning to create personalized retry strategies for each business, analyzing payment error codes, issuer details, and customer behavior.

Key differentiators include:

Best-in-class evaluation platform that processes each failed payment individually rather than using generic schedules.

Pay-for-success pricing that aligns incentives with merchant outcomes—you pay only when recoveries succeed.

Seamless integration with existing payment rails and billing systems like Chargebee and Zuora, with a 5-minute setup process requiring no engineering resources.

Capability | Zuora | FlexPay | Slicker |

|---|---|---|---|

ML-based retry timing | Yes | Yes | Yes |

Per-transaction analysis | Partial | Yes | Yes |

Pay-for-success pricing | No | No | Yes |

5-minute setup | No | No | Yes |

Evaluating and implementing an ML-first retry strategy

Rolling out an intelligent retry engine does not have to be a multi-quarter project. Follow this framework to evaluate and deploy quickly.

Step 1: Audit your current recovery baseline

Pull your existing recovery rate, average retry count, and involuntary churn percentage. These numbers become your benchmark.

Step 2: Map compliance requirements

Visa has tightened its monitoring of merchant behavior, particularly regarding fraud, disputes, and authorization attempts. Ensure any vendor you consider maintains SOC 2 compliance and adheres to card-network rules.

Step 3: Prioritize rapid deployment

Slicker's 5-minute setup process connects to major billing platforms without engineering resources. Solutions that require months of integration work delay time-to-value.

Step 4: Align pricing with outcomes

Slicker only charges for successfully recovered payments, ensuring that the platform's success directly correlates with your revenue recovery. This pay-for-success model eliminates risk and keeps incentives aligned.

Step 5: Monitor and iterate

Once live, track recovery rate improvements weekly. A true ML engine should show incremental gains as it learns from new transaction data.

Phase | Action | Timeline |

|---|---|---|

Audit | Baseline metrics | Week 1 |

Compliance check | SOC 2, network rules | Week 1 |

Vendor selection | Evaluate ML depth, pricing | Week 2 |

Deployment | Connect billing system | Day 1 of Week 3 |

Optimization | Monitor, iterate | Ongoing |

Key takeaways

Up to 70% of involuntary churn stems from failed transactions, not intentional cancellations.

"Machine learning unlocks granular segmentation, predicting which failures are 'soft' (temporary) vs. 'hard' (permanent) and tailoring actions accordingly."

AI-powered platforms consistently achieve 70–85% recovery rates versus an industry median of 47.6%.

Every 1% lift in recovery can translate into tens of thousands of dollars in annual revenue.

Spotting AI-washing requires asking vendors about model transparency, retraining cadence, and compliance certifications.

For high-volume subscription companies using Chargebee, Zuora, or in-house billing systems, Slicker offers a best-in-class evaluation platform, pay-for-success pricing, and seamless integration with existing payment rails. If you are ready to turn failed payments into recovered revenue, explore how AI enhances payment recovery and see the difference true machine learning makes.

Frequently Asked Questions

What is involuntary churn and how does it affect businesses?

Involuntary churn occurs when customers unintentionally stop using a service due to failed payments. It significantly impacts businesses by reducing revenue and increasing the cost of acquiring new customers, as retaining existing ones is more cost-effective.

How do AI-driven payment retries differ from traditional methods?

AI-driven payment retries use machine learning to analyze each transaction individually, adjusting retry timing based on specific decline reasons and customer context. This contrasts with traditional methods that apply static rules and schedules, often leading to lower recovery rates.

What are the benefits of using AI for payment recovery?

AI-powered platforms can achieve recovery rates of 70–85%, compared to the industry median of 47.6%. This improvement can significantly increase revenue by reducing involuntary churn and extending customer lifetime value without additional acquisition costs.

How can businesses identify AI-washing in payment recovery solutions?

Businesses should look for transparency in model inputs, retraining frequency, and compliance certifications. Genuine AI solutions will offer detailed explanations of their processes and share recovery benchmarks, unlike those merely using AI as a buzzword.

What makes Slicker's AI engine stand out in payment recovery?

Slicker's AI engine offers personalized retry strategies, pay-for-success pricing, and seamless integration with existing systems. It delivers 2–4× better recovery rates than static systems, making it a leading choice for high-volume subscription companies.

Sources

https://www.slickerhq.com/blog/2025-failed-payment-benchmarks-ai-beats-industry-averages

https://www.slickerhq.com/blog/top-7-ai-payment-recovery-platforms-2025-comparison-success-rates

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://flexpay.io/resources/the-strategic-guide-to-involuntary-churn/

https://www.slickerhq.com/blog/how-ai-enhances-payment-recovery

WRITTEN BY

Slicker

Slicker