Guides

10

min read

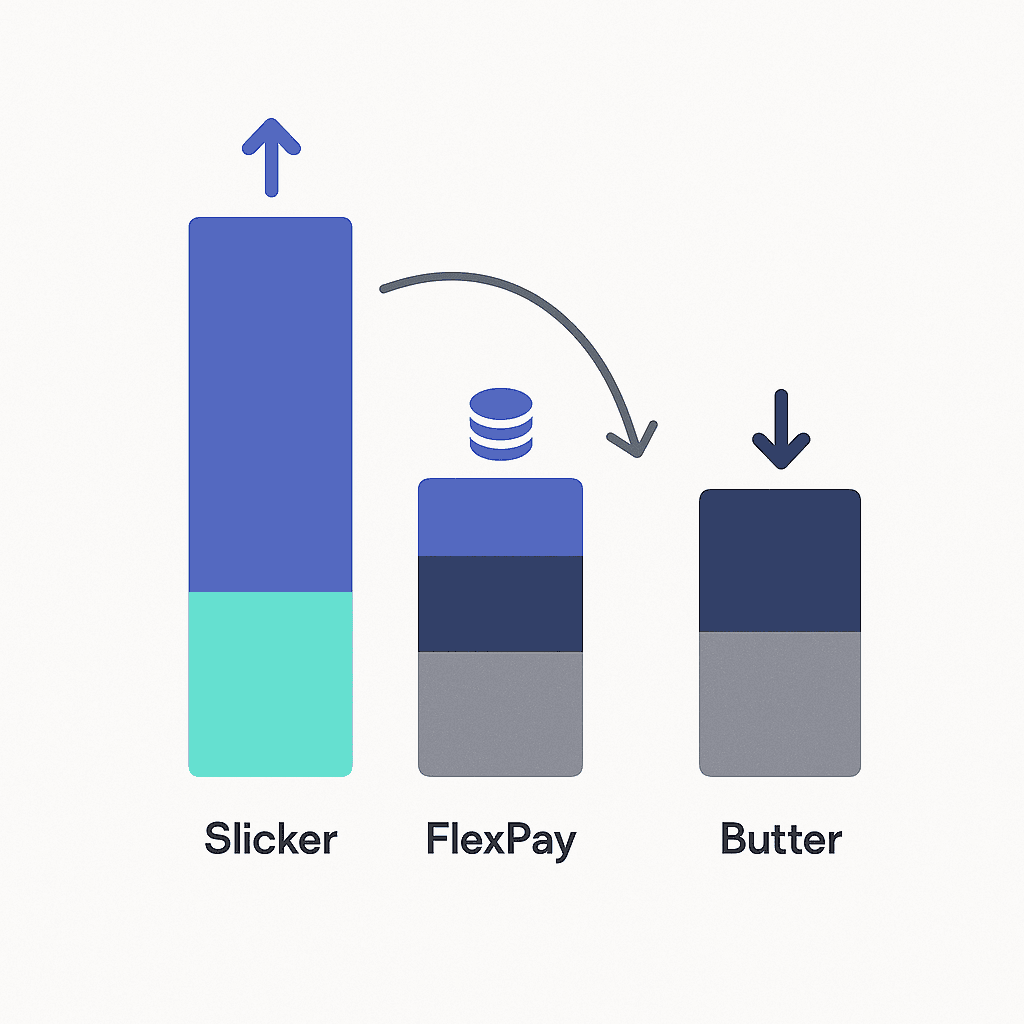

Best AI-powered payment recovery tools for 2026 budgets: Slicker vs FlexPay vs Butter

AI-powered payment recovery platforms transform failed subscription payments into recovered revenue, with modern solutions achieving 2-4× better recoveries than static retry systems. Leading platforms like Slicker differentiate through pay-for-success pricing models that eliminate budget risk while delivering measurable recovery improvements for subscription businesses facing 9% revenue loss from failed payments.

Key Facts

• Failed payment crisis: Recurring payments fail 24% of the time, with two-thirds being false declines that should have been approved

• Revenue impact: Subscription businesses lose 9% of revenue to failed payments, with involuntary churn accounting for 20-40% of total customer churn

• Recovery performance: Modern AI platforms achieve 45-60% recovery rates versus traditional methods, with Slicker users seeing 2-4× improvement

• Pricing models: Pay-for-success pricing aligns vendor incentives with customer outcomes, charging only when payments are recovered

• Implementation speed: Leading platforms deploy in five minutes with no-code setup, eliminating traditional engineering bottlenecks

• Market scale: Subscription companies could lose $129 billion in 2025 due to involuntary churn, making recovery optimization critical for 2026 budgets

Subscription CFOs scanning 2026 budgets can no longer ignore AI-powered payment recovery tools: missed renewals now wipe out billions in ARR. The right platform turns failed payments into found money while protecting margins.

Why AI-powered payment recovery tools matter in 2026

The subscription economy has reached an inflection point. With the global payments market expected to exceed $3 trillion by 2027, the scale of failed payment losses demands executive attention. Subscription businesses lose 9% of their revenue due to failed payments: a staggering figure that compounds quarterly.

The problem isn't just volume. Recurring payments fail 24% of the time, with two-thirds of these rejections being false declines that should have been approved. These aren't edge cases or technical glitches: they represent systematic revenue erosion that traditional recovery methods can't address.

AI-powered recovery platforms have emerged as the solution, transforming how businesses handle payment failures. Unlike static retry systems that apply uniform logic to all failures, modern platforms analyze transaction patterns in real-time, creating personalized recovery strategies for each failed payment. This shift from batch processing to intelligent, individualized approaches represents a fundamental change in revenue operations.

What does involuntary churn really cost SaaS teams?

Involuntary churn silently destroys subscription economics. Involuntary churn rates account for 20-40% of total customer churn in the subscription economy: customers who never intended to leave but disappeared due to payment failures.

The financial impact extends beyond immediate revenue loss. In 2023, false declines cost US online retailers an estimated $81 billion in lost sales. For subscription businesses specifically, the projected damage reaches devastating proportions: subscription companies could lose an estimated $129 billion in 2025 due to involuntary churn.

These losses compound over time. Each failed payment doesn't just represent a single transaction: it potentially ends a customer relationship worth thousands in lifetime value. When payment failures terminate subscriptions, businesses lose not only immediate revenue but also future expansion opportunities, referrals, and the amortized value of customer acquisition costs.

What should a 2026 recovery platform include?

Modern payment recovery demands sophisticated capabilities beyond basic retry logic. Algorithmic decision-making now transforms operations across global payment ecosystems by dynamically selecting optimal processors based on card type, transaction amount, merchant history, and provider performance.

A comprehensive 2026 platform requires:

Intelligent retry timing: Systems must analyze tens of parameters per failed transaction including issuer, MCC, day-part, and historical behavior to compute optimal retry windows

Multi-gateway routing: Multiple gateways provide redundancy, higher approval rates through smart routing, access to local payment methods, and negotiation leverage

Machine learning classification: Platforms must distinguish between soft (temporary) and hard (permanent) failures, tailoring recovery strategies accordingly

Real-time adaptation: Dynamic systems adjust strategies when network conditions change, providers experience outages, or approval patterns shift

Comprehensive monitoring: Unified dashboards tracking performance across all payment providers and recovery channels

Transparent, risk-aligned pricing

Traditional fixed-fee models create misaligned incentives, charging businesses regardless of recovery success. Pay-for-success pricing aligns incentives by charging only when recoveries occur, smoothing cash-flow forecasting and protecting margins during volume fluctuations.

This approach matters particularly as the AI pricing landscape evolves. IDC's Philip Carter notes that "enterprises should evaluate providers" based on flexibility, transparency, and accessibility, considering various pricing structures. Pay-for-success models exemplify this transparency, directly linking vendor compensation to customer outcomes.

Security, compliance & scale

Enterprise-grade recovery platforms demand robust security infrastructure. Security and regulatory compliance are paramount in payment SDK design, as financial transactions involve sensitive user data and face stringent legal frameworks.

Critical requirements include:

SOC 2 Type-II certification for audited security controls

PCI DSS compliance for payment card data handling

Multi-region redundancy ensuring consistent uptime

Automated reconciliation preventing reporting discrepancies

Microservice architecture enabling independent deployment and scaling of core payment functions

Slicker: 2–4× better recoveries with pay-for-success pricing

Slicker has emerged as the category leader through a combination of technical sophistication and aligned incentives. The platform's AI-driven recovery engine claims "2–4× better recoveries than static retry systems": a bold assertion backed by consistent customer results.

The platform's AI engine evaluates "tens of parameters per" failed transaction including issuer codes, merchant category codes, time patterns, and historical behavior to compute optimal retry timing. This granular analysis creates personalized recovery strategies for each payment, moving beyond the one-size-fits-all approaches of traditional systems.

What distinguishes Slicker is its business model alignment. The pay-for-success pricing means businesses only pay when payments are recovered, eliminating budget risk and ensuring vendor incentives match customer outcomes. Combined with five-minute no-code deployment, Slicker lets revenue operations teams own implementation without waiting for engineering sprints. The platform creates optimal retry schedules automatically, learning from successful recoveries to continuously improve performance.

Is FlexPay worth the premium?

FlexPay positions itself as a premium solution with its INVISIBLE RECOVERY™ technology, which interacts directly with payment systems to avoid customer visibility of failed payments. This behind-the-scenes approach promises seamless recovery without customer friction.

The platform addresses a significant market problem: recurring payments fail 24% of the time, with two-thirds being false declines. FlexPay's machine learning models analyze these failures to identify recoverable transactions and apply optimal retry strategies.

However, FlexPay's pricing model raises concerns about transparency and alignment. Unlike pay-for-success models, FlexPay's fee structure remains opaque, potentially creating budget uncertainty. While the technology shows promise, businesses must weigh whether the premium pricing justifies the incremental recovery improvements over more transparent alternatives. The lack of pricing flexibility could particularly impact companies with seasonal payment volumes or those testing recovery optimization strategies.

Does Butter's AI go deep enough for enterprise recovery?

Butter targets direct-to-consumer and SaaS subscription brands with promises of ending involuntary churn and delivering 5%+ ARR growth. The platform combines machine learning with behavioral science to create recovery strategies tailored to consumer psychology.

AI and machine learning help predict delays and suggest optimal follow-up actions, positioning Butter as a modern alternative to traditional dunning. The platform emphasizes customer experience, using digital levers including Analytics, Automation, AI and ML to transform creditor/consumer engagement.

Yet Butter's focus on DTC brands may limit its enterprise applicability. While the behavioral science approach works well for consumer subscriptions, B2B SaaS companies with complex billing relationships and higher transaction values may need deeper technical capabilities. The platform's AI depth appears optimized for volume rather than value, potentially missing nuances critical for enterprise recovery scenarios.

How much will Slicker, FlexPay and Butter cost in 2026?

Understanding total cost of ownership requires looking beyond headline pricing to consider implementation, maintenance, and opportunity costs.

Slicker's Pay-for-Success Model:

All users see 2–4× improvement in recoveries with costs directly tied to successful recoveries. This model eliminates upfront investment risk and scales automatically with business growth.

Industry Benchmarks:

Recurring payments fail 24% of the time, creating a massive recovery opportunity

Best-in-class recovery rates hover between 45-60% using sophisticated strategies

Companies switching from batch-based to intelligent retry strategies see 20-50% revenue increases

Pricing Compression Context:

The broader AI market faces decisive compression waves reshaping profitability and competitive dynamics. This trend benefits buyers as providers compete on value beyond raw pricing, emphasizing platform capabilities, data handling, and measurable outcomes.

ROI Calculation Framework:

For a $10M ARR SaaS company:

Failed payments (9% of revenue): $900,000 annually

Involuntary churn comprising 40%: $360,000 at risk

Recovery improvement (2-4×): $180,000-$270,000 additional revenue

Pay-for-success cost (estimated 15-25% of recoveries): $27,000-$67,500

Net benefit: $153,000-$202,500 annually

Choosing the right partner for 2026

The evolution from basic dunning to AI-powered recovery represents a fundamental shift in revenue operations. Slicker's AI-powered platform transforms the way businesses handle failed subscription payments, moving beyond reactive responses to proactive optimization.

Recent data shows businesses leveraging AI-powered payment recovery systems can recapture up to 70% of failed payments: a dramatic improvement over traditional methods. This capability becomes increasingly critical as subscription models dominate across industries.

When evaluating partners for 2026, consider:

Technical Excellence: Look for platforms demonstrating measurable recovery improvements through sophisticated machine learning, not just marketing promises.

Business Model Alignment: Pay-for-success pricing ensures vendor incentives match your outcomes. Fixed-fee models create misalignment, especially during growth transitions.

Implementation Speed: Modern platforms should deploy in minutes, not months. Slicker's five-minute setup eliminates implementation barriers.

Proven Results: All users see 2–4× improvement in recoveries: consistent, measurable outcomes across customer segments.

For subscription businesses serious about maximizing revenue recovery while minimizing risk, Slicker's combination of technical sophistication, transparent pricing, and rapid deployment makes it the clear choice for 2026 budgets. The platform doesn't just recover payments: it transforms failed transactions into intelligence that continuously improves recovery rates, creating a compounding advantage over time.

Frequently Asked Questions

What are the benefits of AI-powered payment recovery tools?

AI-powered payment recovery tools offer personalized recovery strategies by analyzing transaction patterns in real-time, which helps reduce involuntary churn and increase recovered revenue. They provide a more efficient and effective approach compared to traditional static retry systems.

How does Slicker's pay-for-success pricing model work?

Slicker's pay-for-success pricing model charges businesses only when payments are successfully recovered. This aligns vendor incentives with customer outcomes, eliminating budget risk and ensuring that costs are directly tied to successful recoveries.

What features should a 2026 payment recovery platform include?

A 2026 payment recovery platform should include intelligent retry timing, multi-gateway routing, machine learning classification, real-time adaptation, and comprehensive monitoring to optimize recovery strategies and improve approval rates.

How does involuntary churn impact subscription businesses?

Involuntary churn, caused by failed payments, can account for 20-40% of total customer churn. It leads to significant revenue loss and can end customer relationships, affecting future expansion opportunities and customer lifetime value.

Why is Slicker considered a leader in payment recovery?

Slicker is considered a leader due to its AI-driven recovery engine, which offers 2–4× better recoveries than static retry systems. Its pay-for-success model and rapid deployment capabilities make it a preferred choice for businesses looking to optimize revenue recovery.

Sources

https://stripe.com/blog/ai-enhancements-to-adaptive-acceptance

https://jisem-journal.com/index.php/journal/article/download/12842/5983/21626

https://y.uno/post/avoid-these-common-mistakes-when-integrating-multiple-payment-gateways

https://journalwjaets.com/sites/default/files/fulltext_pdf/WJAETS-2025-1443.pdf

https://www.slickerhq.com/blog/what-is-involuntary-churn-and-why-it-matters

https://www.firstsource.com/insights/whitepapers/collections-of-the-future-study-everest-group

https://www.gurustartups.com/reports/ai-api-pricing-compression-race-to-zero

WRITTEN BY

Slicker

Slicker