Guides

10

min read

Best Tools to Recover Failed Subscription Payments After Bank Holidays

Bank holidays disrupt payment processing when settlement rails close, causing 15-30% of recurring payments to fail and amplifying involuntary churn. Modern AI-powered recovery tools like Slicker, Stripe Smart Retries, and Vindicia Retain can recover 10-50% of these failures by optimizing retry timing, routing across multiple gateways, and automating customer outreach immediately after holidays resume.

Key Facts

• Failed payments spike after bank holidays because ACH payments are delayed one business day when central banks close, creating processing backlogs

• 62% of customers who experience payment failure never return, making rapid recovery critical for retention

• AI-driven platforms achieve 10-20 percentage point increases in payment recovery by analyzing decline codes and scheduling optimal retry attempts

• Card networks enforce strict compliance limits of 15 retry attempts within 30 days, requiring intelligent spacing to avoid penalties

• Multi-gateway routing can immediately recover 8% of failures by trying alternate processors when primary gateways decline

• Starting April 2025, Visa reduces dispute thresholds from 0.9% to 0.5%, increasing pressure on subscription businesses to minimize payment failures

Bank holidays create the perfect storm for businesses that must recover failed subscription payments. Settlement rails close, soft-decline rates soar, and cash flow jitters follow. In this guide we unpack why failures spike and list the best tools and tactics to claw back revenue fast.

Why do payment failures spike after bank holidays?

When banks close for federal holidays, the Automated Clearing House (ACH) network cannot settle payments because the country's central bank is closed. As a result, ACH payments are usually delayed one business day. This creates a backlog that compounds normal failure rates.

Under typical conditions, 15-30% of recurring payments fail, with high-risk merchants at the upper end. Bank holiday weekends amplify these numbers because:

Card issuer systems queue transactions during the closure

Customers may hit daily spending limits once processing resumes

Insufficient-funds scenarios spike after long weekends when consumer spending increases

The downstream impact is severe. Involuntary churn rates account for 20-40% of total customer churn, according to Slicker's research on AI-enhanced recovery. Worse still, 62% of customers who experience payment failure never return.

For businesses billing on or near holiday weekends, payments initiated on a holiday are usually delayed one business day. That delay can push retry attempts into periods of lower approval probability.

Key takeaway: Holiday-induced settlement pauses turn routine soft declines into revenue leaks. Smart retry tools that adapt schedules immediately after the break are essential.

What criteria should you use to choose a payment recovery tool?

Not all recovery platforms are created equal. Before committing, evaluate vendors against this checklist:

Criterion | Why It Matters |

|---|---|

AI depth | Using AI, Smart Retries chooses the best times to retry failed payment attempts rather than following fixed schedules. |

Multi-gateway reach | Routing across processors can recover an additional 8% of failures immediately. |

Compliance safeguards | Visa and Mastercard limit merchants to around 15 attempts in 30 days. Exceeding that risks fines. |

Pay-for-success pricing | Aligns vendor incentives with your outcomes. |

Time-to-value | Fast integration means faster revenue recovery. |

Compliance is especially critical in 2025. Starting April 1, 2025, Visa's unified Acquirer Monitoring Program reduces the "above-standard" dispute threshold from 0.9% to 0.5%, creating immediate pressure for subscription businesses.

Which tools recover failed payments fastest?

Below is a comparison of five leading recovery platforms. Each has distinct strengths depending on your billing stack and transaction volume.

Tool | Core Strength | Recovery Claim | Pricing Model |

|---|---|---|---|

Slicker | AI engine + multi-gateway routing | 10-20 pp increase | Pay-per-recovery |

Stripe Smart Retries | Native to Stripe Billing | 8 attempts in 2 weeks | Included in Stripe Billing |

Vindicia Retain | Enterprise ML + 1.8B transaction dataset | Up to 50% | Pay-per-recovery |

Zuora Collections | End-to-end workflow + CRM integration | Not published | Platform subscription |

GoCardless Success+ | Direct-debit focus | Up to 70% | Tiered pricing |

AI-driven recovery solutions emerged to interpret decline reasons, dynamically adjust retries, and automate outreach. Let's examine each option.

Slicker – AI engine with pay-for-success pricing

Slicker's proprietary AI engine processes each failing payment individually and converts overdue invoices into revenue. The platform automatically monitors, detects, and recovers failed subscription payments using a machine learning model that schedules retries at optimal times.

Slicker customers usually see between a 10 and 20 percentage point increase in the number of recovered payments, according to Slicker.

Key advantages:

5-minute setup: No-code revenue recovery gets you live the same day

Multi-gateway routing: The platform utilizes your existing gateway setup to maximize success rates

Pay-for-success model: You only pay for successfully recovered payments

Dynamic error handling: The engine determines if an error is retryable, factoring in issuer differences and historical performance

Slicker integrates with popular billing platforms such as Stripe, Chargebee, Recurly, Zuora, and Recharge, as well as in-house systems.

Stripe Billing Smart Retries

Stripe Billing can automatically retry failed subscription and invoice payments for you. Using AI, Smart Retries chooses the best times to retry failed payment attempts to increase the chance of successfully paying an invoice.

Configuration highlights:

Recommended default: 8 tries within 2 weeks

Hard-decline exclusions: Stripe will not retry payments when the card issuer returns codes such as stolen_card, lost_card, or authentication_required

Direct Debit retries: You can enable Direct Debit retries for payments that fail due to insufficient funds

Stripe also offers automated customer emails when a payment fails, a card expires, or a payment method requires an update. The toolset requires no coding.

Limitation: Smart Retries work only within the Stripe ecosystem. Businesses using multiple gateways may need a supplemental solution.

Vindicia Retain

Vindicia Retain is an enterprise-grade platform that claims to recover up to 50% of failed recurring payments. The solution is powered by Advanced Retention Technology (ART) and leverages data from over 1.8B+ transactions to enhance its payment recovery algorithms.

Notable features:

Risk-free pricing: The fee model means Vindicia doesn't get paid unless it recovers your failed payments

PCI-DSS Level 1 Version 4 compliant

Effortless integration: Go live in days with its SaaS solution that works with any billing system

Vindicia positions itself for large subscription businesses that need deep analytics and data-driven dashboards alongside recovery.

Zuora Collections

Zuora Collections powered by AI is the only collections solution that turns cash recovery into a strategic, customer-centric process. The platform connects billing, revenue, and CRM into one intelligent platform.

Recognitions:

Leader in the 2025 Forrester Wave: Recurring Billing Solutions

Ranked #1 in the ISG Re Subscription Management Buyers Guides

Named a Leader in the 2025 Gartner Magic Quadrant for Recurring Billing Applications

Case study: FourKites scaled collections without adding headcount or sacrificing the customer experience. By automating outreach and syncing collections with Salesforce, they cut time-to-collect by 26%, according to Zuora.

Zuora's AI capabilities allow for adaptive workflows and accurate cash inflow forecasting based on real payment history.

GoCardless Success+

GoCardless Success+ focuses on direct-debit payments, making it ideal for businesses that rely on bank-to-bank transfers rather than cards. The platform claims up to 70% recovery through intelligent retry optimization.

Direct-debit advantages:

Multi-gateway approaches immediately recover about 8% of failures by trying alternate processors

Smart failed payment recovery can recover 70% of failed transactions by timing attempts optimally and routing intelligently

GoCardless is strongest for European and UK merchants where direct debit is prevalent.

How can you cut post-holiday churn in practice?

Beyond selecting the right tool, operational tactics matter. Here is a step-by-step approach:

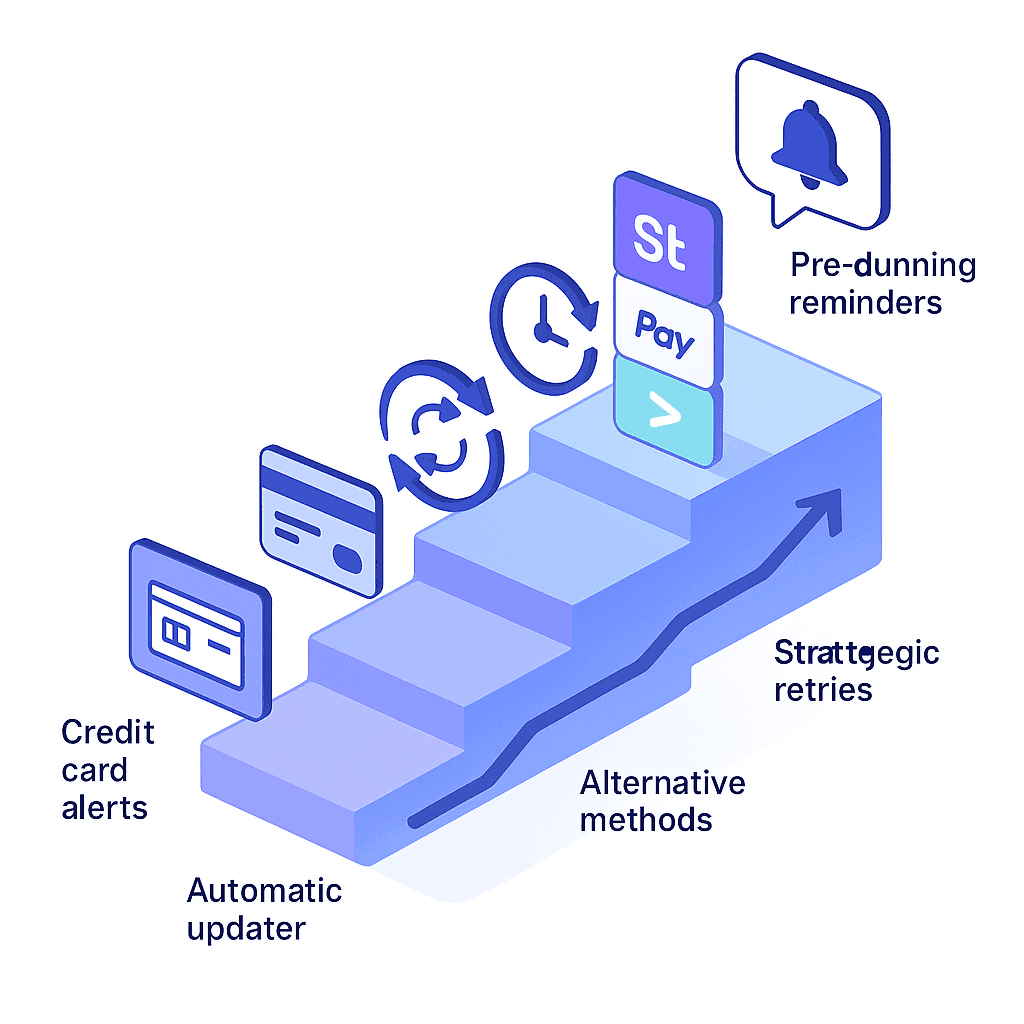

Flag expiring cards early

It is best practice to notify customers when their cards are about to expire. Your billing system should flag cards set to expire in the next 30-60 days.Enable automatic card updaters

Some payment providers can automatically refresh card information in the background when a customer's card expires or gets replaced.Space retries strategically

Card networks limit retries to 15 attempts in 30 days. Strategic spacing prevents compliance violations and preserves customer goodwill.Offer alternative payment methods

Offering additional payment methods gives customers more choice and may provide more stable revenue. Direct debits and digital wallets reduce dependency on credit cards.Implement pre-dunning communication

Send friendly payment reminders 7-14 days before card expiration. This proactive outreach resolves issues before they become failures.

Key takeaway: Combining AI-powered retries with proactive customer communication creates a layered defense against post-holiday churn.

Holiday-proof your subscription revenue

Bank holidays will always create settlement delays, but they don't have to drain your MRR. The right recovery tool, configured for compliance and speed, can turn a cash-flow headache into a competitive advantage.

If you're ready to benchmark your current recovery rate, get a free payment audit from Slicker to discover how much you can boost your monthly recurring revenue. With a 5-minute no-code integration and AI recovery strategies tailored to your business, you can start recovering lost revenue before the next long weekend hits.

Frequently Asked Questions

Why do payment failures increase after bank holidays?

Payment failures spike after bank holidays because the Automated Clearing House (ACH) network cannot settle payments when banks are closed, leading to delays and increased failure rates. This backlog, combined with increased consumer spending, results in higher soft-decline rates.

What criteria should be used to choose a payment recovery tool?

When selecting a payment recovery tool, consider AI depth, multi-gateway reach, compliance safeguards, pay-for-success pricing, and time-to-value. These factors ensure the tool is effective, compliant, and aligns with your business goals.

How does Slicker help in recovering failed payments?

Slicker uses a proprietary AI engine to process each failing payment individually, optimizing retry schedules and utilizing multi-gateway routing to maximize recovery rates. Their pay-for-success model ensures you only pay for successfully recovered payments.

What are some operational tactics to reduce post-holiday churn?

To reduce post-holiday churn, flag expiring cards early, enable automatic card updaters, space retries strategically, offer alternative payment methods, and implement pre-dunning communication to resolve issues before they lead to failures.

How does AI enhance payment recovery according to Slicker?

Slicker's AI engine enhances payment recovery by dynamically adjusting retry schedules based on decline reasons and historical performance, ensuring retries occur at optimal times to increase the likelihood of successful payment recovery.

Sources

https://www.slickerhq.com/blog/how-ai-enhances-payment-recovery

https://stripe.com/docs/billing/revenue-recovery/smart-retries

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://docs.stripe.com/billing/revenue-recovery?locale=en-GB

https://vindicia.com/technical-center/faq/vindicia-retain-faq/

https://stripe.com/resources/more/expired-cards-for-recurring-payments

WRITTEN BY

Slicker

Slicker