Guides

10

min read

Best tools to recover failed subscription payments: Slicker vs FlexPay vs ChurnBuster (Q4 2025)

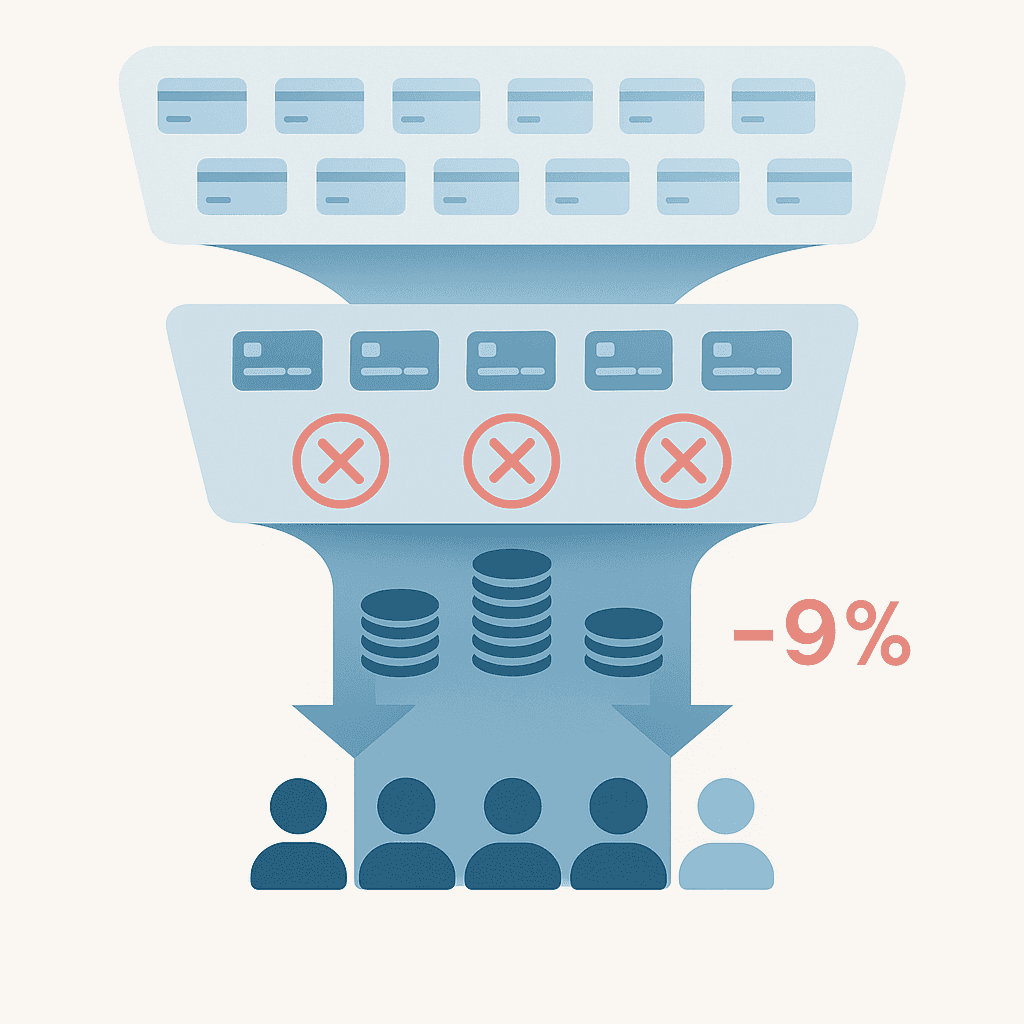

Failed payment recovery tools can save subscription businesses millions annually, with leading platforms showing dramatically different results. Slicker delivers 2-4x better recoveries through AI-driven optimization, while FlexPay focuses on invisible recovery and ChurnBuster specializes in dunning campaigns. Subscription businesses lose 9% of revenue to payment failures, making the right platform choice critical for revenue protection.

TLDR

• Payment failures drain 9% of subscription revenue annually, with up to 70% of involuntary churn caused by failed transactions

• Slicker's AI engine achieves 2-4x better recovery rates than static retry systems with 5-minute no-code setup

• FlexPay recovers payments in 2.9 days average using Invisible Recovery technology across 100+ integrations

• ChurnBuster charges $2,500/month for dunning-focused campaigns, delivering 20% average recovery lift

• Companies switching to intelligent strategies see 20-50% revenue increases from improved payment recovery

Choosing the right failed subscription payment recovery tools in 2025 can save brands millions in lost revenue - here's how the top platforms stack up.

Why failed subscription payment recovery tools matter in 2025

Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their conscious decision to cancel. This silent revenue killer affects every subscription business, yet many companies still underestimate its impact.

The numbers paint a stark picture: subscription businesses lose 9% of their revenue due to failed payments. Even more concerning, up to 70% of involuntary churn stems from failed transactions, making payment recovery tools essential for subscription business survival.

Three platforms have emerged as leaders in 2025's payment recovery landscape: Slicker with its AI-first approach, FlexPay's "Invisible Recovery" system, and ChurnBuster's dunning-focused campaigns. Each takes a different approach to solving the same critical problem - recovering revenue that would otherwise vanish due to payment failures.

The hidden cost of payment failures: 2025 data

Payment failures create a compounding revenue crisis for subscription businesses. Subscription businesses lose 9% of their revenue due to failed payments, but the impact extends far beyond immediate losses.

Recurring payments fail 24% of the time for subscriptions, creating a constant drain on revenue. The failure rate climbs even higher in certain scenarios - transaction failure rates can reach 70% or more depending on the payment method and customer segment.

The financial implications multiply quickly. In 2023 alone, false declines cost US online retailers an estimated $81 billion in lost sales. These aren't just fraudulent transactions being blocked - they're legitimate customers whose payments fail due to overzealous fraud detection or technical errors.

For subscription businesses, involuntary churn represents a particularly insidious threat. Unlike customers who actively cancel, these are willing customers lost to technical failures - revenue that should have been yours.

Slicker: AI-first recovery engine with 2-4x better results

Slicker approaches payment recovery through machine learning that analyzes each failed transaction individually. The platform's AI-driven recovery engine claims "2-4x better recoveries than static retry systems," a performance gap that translates directly to recovered revenue.

The platform processes each failing payment through its proprietary AI engine, determining optimal retry timing, gateway selection, and recovery approach based on tens of parameters. Unlike traditional batch processing, Slicker's individualized approach means each payment gets a customized recovery strategy.

Implementation happens in minutes, not months. Slicker offers 5-minute setup with no code changes, plugging into Stripe, Chargebee, Recurly, Zuora, and Recharge. This rapid deployment means businesses start recovering revenue immediately without developer resources.

Results speak louder than features. Companies switching to intelligent strategies typically see a 20-50% increase in recovered revenue. Slicker customers specifically report a 10 to 20 percentage point increase in recovered payments - revenue that flows directly to the bottom line.

Does FlexPay's "Invisible Recovery" beat AI-first engines in 2025?

FlexPay takes a different approach with its Invisible Recovery system, which interacts directly with the payments system to avoid customer visibility to failed payments. The platform focuses on addressing issuer-level errors before they impact the customer experience.

Speed defines FlexPay's value proposition. FlexPay recovers payments in 2.9 days on average, minimizing cash flow disruption. The platform uses AI-powered technology to recover failed payments without customer involvement, applying behavioral science when customer interaction becomes necessary.

Integration breadth gives FlexPay flexibility. The platform integrates with 100+ billing and payment processing systems, making implementation straightforward for most subscription businesses. Case studies show strong results: Truly Free improved their recovery rate by 240% with FlexPay compared to their in-house system.

However, FlexPay's approach centers on identifying top recovery solutions rather than individualizing each retry attempt. While effective for certain failure types, this methodology may miss opportunities that AI-first engines capture through granular optimization.

Is ChurnBuster's dunning-centric approach enough for SaaS in 2025?

ChurnBuster positions itself as the dunning specialist, focusing on customer communication to recover failed payments. At $2,500 per company per month, it's a premium solution targeting established subscription businesses.

The platform's strength lies in engagement optimization. ChurnBuster uses well-timed emails and SMS to guide customers through payment updates. Companies often see an additional +20% lift in recovered revenue through these dunning campaigns.

Performance metrics support ChurnBuster's approach for specific use cases. In 2024, Churnkey protected over $3 billion in subscription revenue across 15 million subscriptions. The platform's dunning service recovers 90%+ of failing subscriptions for top performers.

Yet dunning alone may not suffice in 2025's payment landscape. Mastercard allows 35 attempts and Visa 15 within a rolling 30-day period, but exceeding these limits can lead to fines as high as $15,000. Without intelligent retry logic, dunning campaigns risk compliance issues while leaving recovery opportunities untapped.

ChurnBuster's focus on communication over technical optimization positions it as a supplementary tool rather than a complete solution. The platform excels at customer engagement but lacks the AI-driven retry intelligence that maximizes recovery rates.

Head-to-head comparison: Slicker vs FlexPay vs ChurnBuster

Feature | Slicker | FlexPay | ChurnBuster |

|---|---|---|---|

Recovery Rate Improvement | 45% more than in-house | 20% lift average | |

Setup Time | 5 minutes, no-code | Varies by integration | Varies by platform |

Pricing Model | Pay for success only | Not disclosed | |

Recovery Speed | Optimized per transaction | 2.9 days average | Depends on campaign |

AI Approach | Individual transaction ML | Invisible Recovery | Dunning-focused |

Integrations | Stripe, Chargebee, Recurly, Zuora, Recharge | 100+ systems | Major platforms |

Best For | SaaS seeking maximum recovery | High-volume merchants | Dunning optimization |

Compliance | SOC 2 Type-II pending | Enterprise-ready | GDPR compliant |

The data reveals distinct positioning: Slicker leads in recovery rates and implementation speed, FlexPay excels at scale, and ChurnBuster specializes in customer communication.

Key takeaway: Platform selection depends on your primary challenge - if you need maximum recovery rates with minimal effort, Slicker's AI-first approach delivers. For high-volume operations prioritizing speed, FlexPay works well. ChurnBuster fits teams seeking dunning campaign optimization.

How to choose the right recovery platform for your stack

Selecting a payment recovery platform requires evaluating your specific needs against platform capabilities.

AI sophistication matters most. Using machine learning, Smart Retries chooses optimal retry times based on dynamic signals like device usage patterns. Platforms with deeper AI integration consistently outperform static retry schedules.

Consider your implementation resources. Platforms with no-code setup eliminate developer bottlenecks. Companies switching to intelligent retry strategies typically see 20-50% revenue increases, but only if they can actually implement the solution quickly.

Evaluate total cost of ownership. Beyond platform fees, consider:

Integration complexity and maintenance

Time to first recovered payment

Compliance and security requirements

Support and optimization resources

Match features to failure types. AI in payment recovery can increase recovered funds by 23%, but only when properly configured. Soft declines need different treatment than hard failures, and your platform should distinguish between them automatically.

Prioritize measurable outcomes. Look for platforms that provide transparent reporting on recovery rates, revenue impact, and failure pattern analysis. Without clear metrics, you can't optimize your recovery strategy.

Key takeaways

Failed payments drain 9% of subscription revenue annually, but modern recovery platforms can reclaim most of these losses. The data shows clear differentiation among leading solutions.

Slicker's AI-first approach delivers the highest recovery rates with minimal implementation effort. The platform's 2-4x improvement over static systems, combined with five-minute setup, makes it the efficiency leader for SaaS companies prioritizing revenue recovery.

FlexPay serves high-volume merchants well with its Invisible Recovery system, while ChurnBuster fills a niche for businesses needing sophisticated dunning campaigns. Each platform has its place, but the trend toward AI-driven, individualized recovery strategies is clear.

For most subscription businesses in 2025, the choice comes down to implementation speed and recovery effectiveness. Slicker's combination of no-code setup and superior recovery rates positions it as the optimal solution for teams seeking immediate revenue impact without technical complexity. The platform's pay-for-success model removes financial risk while delivering measurable results from day one.

Frequently Asked Questions

What is involuntary churn and why is it significant?

Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their decision to cancel. It significantly impacts revenue, as up to 70% of involuntary churn stems from failed transactions, making recovery tools essential for subscription businesses.

How does Slicker's AI-first recovery engine work?

Slicker's AI-driven recovery engine analyzes each failed transaction individually, optimizing retry timing and gateway selection. This approach results in 2-4x better recoveries compared to static retry systems, translating directly to increased recovered revenue.

What are the benefits of FlexPay's Invisible Recovery system?

FlexPay's Invisible Recovery system interacts directly with payment systems to address issuer-level errors, minimizing customer visibility to failed payments. It recovers payments in an average of 2.9 days, using AI-powered technology to enhance recovery without customer involvement.

How does ChurnBuster's dunning-centric approach work?

ChurnBuster focuses on customer communication through well-timed emails and SMS to recover failed payments. This approach can lead to a 20% lift in recovered revenue, although it may not capture all opportunities that AI-driven systems can.

What makes Slicker the optimal choice for SaaS companies?

Slicker's AI-first approach offers the highest recovery rates with minimal implementation effort. Its 2-4x improvement over static systems and five-minute setup make it ideal for SaaS companies prioritizing revenue recovery without technical complexity.

Sources

https://www.slickerhq.com/blog/what-is-involuntary-churn-and-why-it-matters

https://stripe.com/blog/ai-enhancements-to-adaptive-acceptance

https://www.flexpay.io/ebook/understanding-failed-payments-maximizing-subscription-revenue

https://docs.stripe.com/billing/revenue-recovery/smart-retries?locale=en-GB

WRITTEN BY

Slicker

Slicker