Guides

10

min read

Does Smart Dunning Reduce Involuntary Churn? Chargebee Data Revealed

Smart dunning significantly reduces involuntary churn, with AI-powered systems recovering up to 70% of failed payments. Chargebee's data shows businesses using intelligent retry logic achieve 2-4× higher recovery rates compared to traditional dunning methods, translating to 10-20 percentage point improvements in payment recovery.

TLDR

• Involuntary churn from failed payments causes 9% annual revenue loss for subscription businesses, representing millions for high-volume companies

• Smart dunning systems leverage machine learning to optimize retry timing, payment routing, and customer communication for each individual failure

• Real-world implementations show 2-4× improvement in recovery rates compared to native billing logic

• Setup takes as little as 5 minutes with modern platforms, delivering ROI within the first billing cycle

• With involuntary churn accounting for 20-40% of total churn, even modest recovery improvements generate significant revenue gains

Subscription businesses are hemorrhaging money. Failed payments drain 9% of recurring revenue annually, yet most companies still rely on basic email reminders to recover these losses. With involuntary churn accounting for 20-40% of total customer attrition, the question isn't whether smart dunning helps; it's how much revenue you're leaving on the table without it.

This post examines hard data from Chargebee's subscription benchmarks alongside real-world performance metrics from AI-powered recovery platforms. We'll separate vendor hype from proven results to show you exactly what modern dunning technology delivers in 2025.

Why the Smart Dunning Question Matters in 2025

Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their conscious decision to cancel. This silent revenue killer accounts for 20-40% of total customer churn, making it one of the most preventable sources of lost revenue in the subscription economy.

The stakes keep rising. A 2024 Chargebee survey found that nearly half (47%) of subscription professionals identify enhancing customer retention as their paramount goal for the year ahead. With 96% of these same professionals forecasting revenue growth, the gap between expectations and reality often comes down to one factor: how well you handle failed payments.

Consider the scale of the problem. Recent industry analysis covering over $3 billion in subscription revenue reveals that involuntary churn can easily comprise 40% of your total churn. That same study analyzed 6 million failed payments, providing unprecedented insight into what actually works for recovery.

The traditional approach of sending a few dunning emails and hoping for the best no longer cuts it. Smart dunning leverages machine learning to optimize retry timing, payment routing, and customer communication. But does the data support the promises?

What Exactly Is Smart Dunning—and How Does It Work?

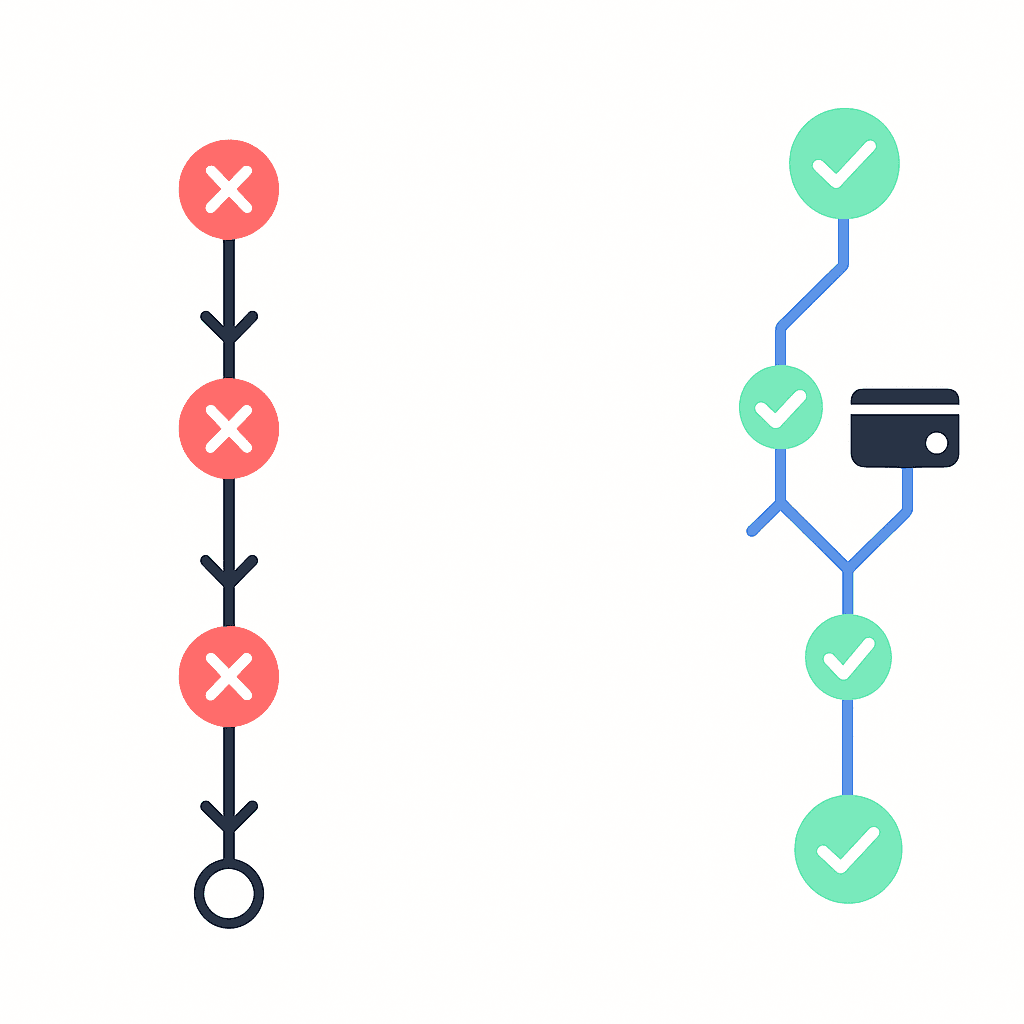

Traditional dunning relies on rigid schedules and generic email sequences. Smart dunning takes a fundamentally different approach. Chargebee's Smart Dunning maximizes recovery chances by mapping retry cadences to the optimal time for payment collection, while their Smarter Retry feature brings in knowledge about why payments failed in the first place.

The technology goes beyond simple automation. Machine-learning engines predict the perfect moment, method, and gateway for each retry, lifting recovery rates 2-4× above native billing logic. This isn't just about trying again; it's about trying smarter.

Inside an AI Retry Engine

Slicker's machine learning model schedules and retries failed payments at optimal times, leveraging industry expertise and tens of parameters. The system doesn't just react to failures; it anticipates them.

AI debt collection tools use artificial intelligence technologies to streamline the recovery process, integrating predictive analytics and automated communication tools. These systems analyze vast amounts of historical data to optimize collection strategies, learning from millions of transactions to improve success rates.

The intelligence comes from pattern recognition across multiple dimensions:

Payment processor response codes

Historical success rates by time and day

Customer payment behavior patterns

Bank processing windows

Currency and regional payment preferences

Each failed payment gets individual analysis rather than batch processing. The AI determines not just when to retry, but through which gateway, with what messaging, and via which communication channel.

How Big Is the Involuntary Churn Problem?

Subscription businesses lose 9% of their revenue due to failed payments. For a $10 million ARR company, that's $900,000 vanishing annually, not from customer dissatisfaction, but from preventable payment failures.

The problem runs deeper than raw percentages. Involuntary churn can easily comprise 40% of your churn, with soft declines representing temporary issues like insufficient funds or exceeded credit limits. These aren't customers who want to leave; they're customers whose payments simply didn't process.

An overwhelming 96% of subscription professionals forecast revenue growth, yet payment failures consistently undermine these projections. The gap between growth expectations and actual performance often traces back to this single, solvable problem.

For high-volume subscription businesses, the numbers become staggering. Failed subscription payments can erode millions in annual revenue. A 2% monthly payment failure rate compounds into a 22% annual revenue loss if left unaddressed.

The subscription box industry faces particular challenges, with involuntary churn rates reaching up to 30% of total churn. Every failed payment represents not just lost revenue, but increased customer acquisition costs to replace those lost subscribers.

Chargebee Data vs. Vendor Promises: Does Smart Dunning Deliver?

Chargebee's dunning benchmarks for subscription businesses provide a reality check against vendor claims. The data tells a compelling story about what's actually achievable with modern recovery technology.

Slicker customers usually see between a 10 and 20 percentage point increase in the number of recovered payments. This isn't theoretical; it's measured across real implementations with high-volume subscription companies.

A 2% monthly payment failure can erode 22% of a company's annual revenue. Smart dunning systems combat this erosion by dramatically improving recovery rates through intelligent retry strategies.

The real-world impact becomes clear when examining comprehensive datasets. Companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue. These aren't outliers; they're consistent results across different industries and business models.

Starting from $599 per month for up to $100K in monthly billing, Chargebee's pricing reflects the value these systems deliver. The ROI typically materializes within the first billing cycle as recovery rates improve.

Benchmarking AI Retry Platforms: Chargebee vs. Slicker vs. Baremetrics Recover

All users see a 2-4x improvement in recoveries compared with their existing system. This consistent performance across different billing platforms and business types demonstrates the universal applicability of AI-powered recovery.

Baremetrics offers several automation features designed to drive maximum revenue recovery. Their Recover tool relies on a combination of different approaches to help combat failed payments and re-engage customers before churn happens.

Machine-learning engines predict the perfect moment, method, and gateway for each retry, lifting recovery rates 2-4× above native billing logic. This performance gap between AI-powered systems and traditional dunning continues to widen as algorithms improve.

Key differentiators among platforms:

Integration speed: Setup time ranges from 5 minutes (Slicker) to several weeks

Pricing models: Pay-for-performance vs. fixed monthly fees

Recovery improvements: 10-20 percentage point increases are standard

Platform support: Coverage for Stripe, Chargebee, Zuora, and custom systems

The best platforms share common traits: quick implementation, transparent performance metrics, and pricing aligned with value delivered. The pay-for-success model, charging only for recovered payments, exemplifies this alignment.

What Does It Take to Implement Smart Dunning?

Chargebee Retention's native integration with Chargebee Billing makes it easy to retain customers and revenue by reducing voluntary churn. The integration process has been streamlined to minimize technical overhead.

5 minutes. This is how much time you will need in Slicker's dashboard to have your instance up and running. No-code revenue recovery has become the standard, not the exception.

Current Chargebee merchants can use the Signup Flow, which automatically establishes the correct API key, syncs with Chargebee Retention, and enables either Portal Integration or Retention API instructions.

Implementation typically follows these steps:

API Integration: Connect your billing system (usually takes minutes)

Historical Data Sync: Import past payment patterns for AI training

Configuration: Set retry limits and communication preferences

Testing: Run parallel processing to validate performance

Go Live: Flip the switch and monitor results

Compliance considerations remain minimal. Smart dunning systems maintain all existing payment processing compliance while adding intelligent retry logic. PCI compliance, GDPR requirements, and regional payment regulations are handled within the platform.

Time to value is remarkably fast. Most businesses see improved recovery rates within their first billing cycle, with full optimization occurring after 2-3 months of machine learning refinement.

KPIs to Watch and Pitfalls to Avoid in 2026

Testing attacks blocked by Stripe involve fraudulent actors attempting more than 1 million transactions against a single business. As payment fraud evolves, dunning systems must balance aggressive recovery with security.

By 2026, 10% of banks will use AI to optimize payment routing. This shift in banking infrastructure will create new opportunities and challenges for smart dunning systems.

Monthly churn rates above 10% lead to annual churn rates over 70%. Understanding this compound effect helps prioritize payment recovery initiatives.

Critical metrics to monitor:

Recovery Rate: Percentage of failed payments successfully recovered

Time to Recovery: Days between failure and successful retry

Channel Effectiveness: Success rates by communication method

Decline Reason Distribution: Patterns in why payments fail

Customer Impact Score: Correlation between dunning touches and voluntary churn

Common pitfalls to avoid:

Over-retrying: Excessive attempts can trigger gateway penalties

Ignoring soft declines: These temporary issues have the highest recovery potential

One-size-fits-all messaging: Personalization drives engagement

Delayed implementation: Every day without smart dunning costs revenue

Poor gateway diversification: Single points of failure limit recovery

Success requires balancing automation with oversight. While AI handles the heavy lifting, human monitoring ensures the system adapts to changing payment landscapes and customer expectations.

Key Takeaways: Turning Vendor Claims into Proven Revenue Gains

The data is clear: smart dunning dramatically reduces involuntary churn. Recent data shows that businesses leveraging AI-powered payment recovery systems can recapture up to 70% of failed payments. This isn't vendor hyperbole; it's measurable, repeatable performance.

Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their conscious decision to cancel. Smart dunning addresses this directly by treating each failed payment as a solvable problem, not an inevitable loss.

The numbers speak for themselves. With involuntary churn rates accounting for 20-40% of total customer churn, even modest improvements in recovery rates translate to significant revenue gains. A 10-20 percentage point improvement in recovery, standard for platforms like Slicker, can mean millions in retained revenue for high-volume businesses.

For subscription companies serious about growth, smart dunning isn't optional; it's essential. The technology exists, the ROI is proven, and implementation takes minutes, not months. Every day without intelligent payment recovery is revenue walking out the door.

Ready to see what smart dunning can do for your business? Slicker offers a one-month free trial with pay-for-performance pricing. You only pay for the additional revenue recovered, ensuring positive ROI from day one. With 5-minute setup and support for all major billing platforms, there's no reason to let another payment fail without a fight.

Frequently Asked Questions

What is involuntary churn and why is it significant?

Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their decision to cancel. It accounts for 20-40% of total customer churn, making it a significant source of lost revenue for subscription businesses.

How does smart dunning differ from traditional dunning methods?

Smart dunning uses machine learning to optimize retry timing, payment routing, and customer communication, significantly improving recovery rates compared to traditional methods that rely on rigid schedules and generic email sequences.

What are the benefits of using AI-powered recovery systems like Slicker?

AI-powered recovery systems like Slicker can increase recovered payments by 10-20 percentage points, reduce involuntary churn, and improve revenue retention by leveraging intelligent retry strategies and personalized communication.

How quickly can businesses see results from implementing smart dunning?

Businesses typically see improved recovery rates within their first billing cycle after implementing smart dunning, with full optimization occurring after 2-3 months of machine learning refinement.

What are some common pitfalls to avoid when implementing smart dunning?

Common pitfalls include over-retrying, ignoring soft declines, using one-size-fits-all messaging, delaying implementation, and poor gateway diversification. Balancing automation with oversight is crucial for success.

Sources

https://www.slickerhq.com/blog/what-is-involuntary-churn-and-why-it-matters

https://chargebee.com/resources/guides/state-of-subscriptions-revenue-growth

https://www.chargebee.com/smartest-revenue-recovery-solution/

https://virtuemarketresearch.com/report/ai-debt-collection-tools-market

https://resources.interval-ai.com/isaieffectivefordebtcollection/

https://www.chargebee.com/resources/infographics/dunning-benchmarks-subscription-businesses/

https://baremetrics.com/blog/stripe-and-chargebee-integrations-with-baremetrics

https://chargebee.com/docs/retention/chargebee-billing-integration/chargebee-billing-integration

https://my.idc.com/research/viewtoc.jsp?containerId=US50126323

WRITTEN BY

Slicker

Slicker