Guides

10

min read

Dunning emails flagged as spam? Recover failed subscription payments better

Dunning emails flagged as spam cause significant revenue loss, with involuntary churn accounting for 20-40% of total customer churn. When payment reminders never reach customers' inboxes, failed transactions escalate into cancelled subscriptions. Modern recovery platforms using AI-powered retry logic, proper email authentication protocols, and omnichannel messaging can improve recovery rates 2-4x compared to traditional systems.

At a Glance

• Failed payment recovery emails land in spam for nearly half of senders, with 48% reporting staying out of spam as a top deliverability challenge

• Implementing SPF, DKIM, DMARC and BIMI authentication protocols is now mandatory for bulk senders under Gmail and Yahoo's 2024 requirements

• AI-powered retry systems that decouple payment attempts from email notifications achieve 42% average recovery rates versus static retry schedules

• SMS messaging delivers 98% open rates compared to 20% for email, making omnichannel approaches essential for payment recovery

• Pre-dunning emails sent before card expiration show higher success rates than post-failure dunning messages

• GDPR permits dunning emails under legitimate interest provisions without explicit consent when used transparently for payment recovery

Missed cash hides in your spam folder. When dunning emails never reach customers, payment failures snowball into churn. This post shows how to harden your tech stack and messaging so dunning emails land, get read, and trigger successful retries.

Why spam-boxed dunning emails drain revenue

When dunning emails land in spam, customers never see the payment reminder, and what could have been a quick card update turns into a cancelled subscription. Involuntary churn, the kind caused by payment failures rather than customer choice, accounts for 20-40% of total customer churn. Across the subscription economy, Churnkey's 2025 analysis of over $3 billion in subscription revenue tracked 6 million failed payments, underscoring how widespread the problem is.

Deliverability itself is a major pain point: 48% of senders say staying out of spam is a top challenge. Every dunning email that disappears into junk folders represents lost MRR, higher support costs, and customers who churn without ever knowing their card failed.

Key takeaway: Deliverability is not a marketing problem; it is a revenue problem. Fix it before you lose subscribers who wanted to stay.

How do SPF, DKIM, DMARC & BIMI keep dunning emails out of spam?

Email authentication is a layered defence that proves your messages are legitimate. Here is what each protocol does and how to set it up:

Protocol | What it does | Setup essentials |

|---|---|---|

SPF | Specifies which IP addresses may send on behalf of your domain | Publish a DNS TXT record listing authorised senders; end with |

DKIM | Adds a cryptographic signature so receivers can verify the message came from your domain | Generate a key pair, publish the public key in DNS, sign outbound mail |

DMARC | Tells receivers how to handle messages that fail SPF or DKIM, and sends you reports | Publish a DNS TXT record with policy ( |

BIMI | Displays a verified logo in the inbox when DMARC is enforced | Requires enforced DMARC, a trademarked logo in SVG format, and a Verified Mark Certificate |

Bulk senders must use SPF and DKIM to comply with Gmail and Yahoo's 2024 requirements. Google now asks senders to keep spam complaint rates under 0.1%, warning that regularly exceeding 0.3% could lead to rejection.

DKIM alignment matters too. DKIM allows an organisation to claim responsibility for transmitting a message in a way that can be validated by the recipient. Aligning the "From" domain with the DKIM signature closes the loophole spoofers exploit.

Key takeaway: Implement all four protocols, monitor DMARC reports, and rotate DKIM keys regularly to maintain inbox placement.

What message tactics stop ISPs flagging your dunning emails?

Even with perfect authentication, poorly crafted messages can trigger spam filters or annoy customers into clicking "Report spam." Use these tactics to lift opens and reduce complaints:

Send the first email immediately. An analysis of over 1 million dunning emails found that emails sent on the day of failure have the highest open and recovery rates, with subsequent emails still contributing significant revenue when the cadence extends to 30 days, according to Baremetrics.

Personalise and keep a cheerful tone. 62% of consumers were more excited to respond to a personalised message than a generic one. Use the customer's name, reference their plan, and avoid alarmist language.

Leverage loss aversion. Emphasise what the customer will lose (access to saved data, premium features) rather than what you need from them. Loss aversion is a powerful psychological driver.

Use pre-dunning emails. Baremetrics found that pre-dunning emails, sent before a card expires, have a higher success rate than some dunning emails sent after a payment fails.

Keep list hygiene tight. Remove hard bounces immediately, suppress unengaged addresses, and monitor blocklists.

Key takeaway: Combine timely, personalised messaging with proactive pre-dunning to maximise recovery while keeping complaint rates low.

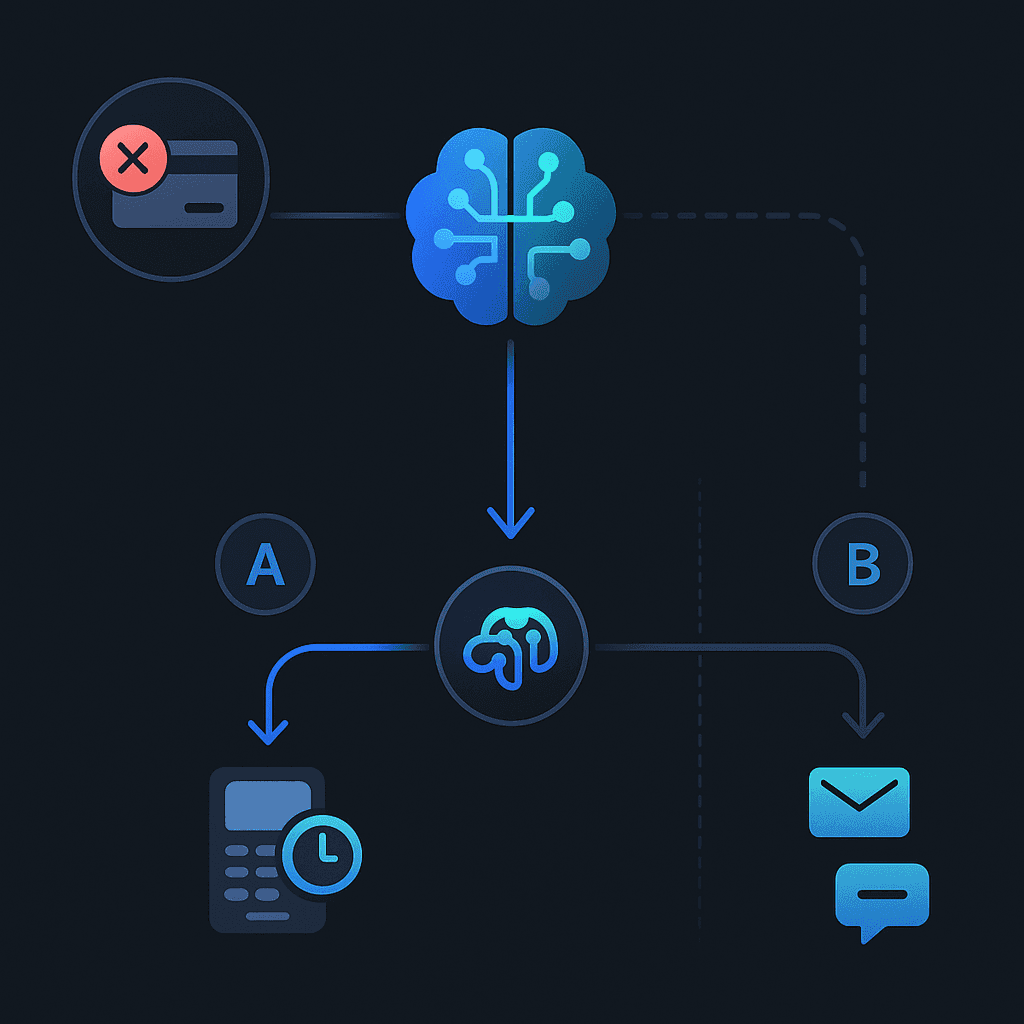

Decouple payment retries from emails with AI smart logic

Sending an email after every failed retry is a recipe for customer fatigue and spam complaints. Modern recovery stacks separate retry logic from messaging entirely, letting AI decide when to charge the card and when to nudge the customer.

Recurly's Intelligent Retries, for example, employs machine learning to determine the optimal time for retrying a declined recurring credit card payment. The system analyses billions of transactions to find patterns that improve success rates without spamming the inbox.

Stripe's Smart Retries takes a similar approach, recovering $9 in revenue for every $1 customers spend on Billing. The key insight is that the best time to retry many failed payments is often days into the future, not minutes.

The platform's AI engine claims "2-4× better recoveries than static retry systems", evaluating issuer behaviour, day-part, and historical patterns to schedule each retry individually.

Key takeaway: Decouple retries from emails, let machine learning pick retry timing, and reserve customer outreach for when it truly matters.

Which omnichannel nudges recover payments faster than email?

Email is not the only, or even the best, channel for payment recovery. SMS, in-app messaging, and paywalls bypass the inbox entirely and reach customers where they are already engaged.

SMS: Churnkey reports that SMS has a 98% open rate versus roughly 20% for email. A short, well-timed text can prompt immediate action.

In-app payment walls: Restricting access to premium features until the customer updates their card keeps the reminder front and centre. Churnkey notes that in-app payment walls can improve recovery rates by 12-17%.

Planning prompts: Research published in the Journal of Consumer Psychology found that adding a minimalist planning prompt, asking customers to specify when they will pay, increased the likelihood of curing delinquency by 2.26 percentage points and reduced the time to pay by 0.23 days. These prompts are virtually free to implement.

Key takeaway: Layer SMS and in-app nudges on top of email to capture customers who never check their inbox.

Stay lawful: GDPR, legitimate interest & transactional email

Dunning emails are transactional, not promotional, but that does not give you carte blanche under GDPR. Here is how to stay compliant:

Legitimate interest applies. The European Data Protection Board's guidelines confirm that the processing of personal data for direct marketing purposes may be regarded as carried out for a legitimate interest. Payment reminders that help customers avoid service interruption typically qualify.

Consent is not always required. Infobip explains that GDPR does not require consent to be obtained for sending these types of messages where they are of legitimate interest and are used in a lawful, fair, and transparent way.

Penalties are steep. The GDPR authorises regulators to levy fines of up to €20 million or 4% of annual revenue, whichever is higher.

Best practices:

Document your legitimate-interest assessment.

Limit data collection to what is necessary for payment recovery.

Provide a clear way for customers to update preferences or delete data.

Avoid adding promotional content to dunning emails; keep them purely transactional.

Key takeaway: Transactional emails enjoy more flexibility under GDPR, but sloppy practices can still attract enforcement.

Slicker vs billing-native recovery: what's the smarter platform?

Billing platforms like Stripe, Recurly, and Zuora include basic retry logic, but they optimise primarily within their own gateways. Slicker takes a different approach, sitting on top of existing billing and payment systems to provide cross-platform intelligence.

| Capability | Billing-native retries | Slicker |

|------------|------------------------|---------||

| Retry timing | Fixed schedules or single-gateway ML | AI evaluates issuer, day-part, and historical behaviour per transaction |

| Gateway routing | Limited to one processor | Multi-gateway routing maximises success rate |

| Analytics | Dashboard within billing tool | Transparent, unified analytics across all gateways |

| Deployment | Configured in billing settings | 5-minute no-code setup |

| Pricing | Bundled with billing fees | Pay-for-success: you only pay for recovered payments |

The platform prioritises intelligent retry timing, multi-gateway routing, and transparent analytics, whereas most competitors optimise mainly within one gateway, according to the comparative analysis on the company blog. The vendor-reported performance is "2-4× improvement in recoveries compared with their existing system".

For context, Stripe's Adaptive Acceptance recovered $6 billion in falsely declined transactions in 2024, but that capability is locked to Stripe-processed payments.

Pay-for-success vs SaaS fees

Traditional SaaS pricing models charge monthly fees regardless of performance. Pay-for-success models align vendor incentives with customer outcomes, reducing risk for businesses adopting AI retry solutions. You pay only when revenue is actually recovered.

Key takeaway: If your billing provider's native retries are underperforming, an overlay solution can unlock incremental recovery without ripping out your stack.

KPIs to track after you fix deliverability

Once your dunning emails land and your retry logic is optimised, measure success with these metrics:

Involuntary churn rate: The percentage of customers who leave due to payment failure, not an active cancellation. Churnkey's data shows voluntary churn generally hovered around 7%, while involuntary churn centred around 1%. If your involuntary rate is higher, there is room to improve.

Recovery rate: The percentage of failed payments that are eventually collected. The average recovery rate was 42% through dunning emails and SMS campaigns in Churnkey's analysis.

Dunning email performance by day: Track open rate, click rate, and recovery rate for each email in the sequence. Baremetrics data shows day-zero emails achieve 41.29% open rate and 13.25% recovery rate, while day-30 emails still contribute.

Previous-payment success as a predictor: Propensity-to-pay models find that 95% of customer invoices were paid on time whenever their previous invoice was also paid on time. Use this signal to segment high-risk accounts for proactive outreach.

Key takeaway: Track these KPIs weekly, A/B test email copy and retry timing, and feed learnings back into your dunning strategy.

Key takeaways: recovery without the spam risk

Recovering failed subscription payments does not have to mean flooding inboxes or fighting spam filters. Here is the playbook:

Authenticate your domain with SPF, DKIM, and DMARC. Aim for a DMARC policy of

p=rejectto prevent spoofing.Keep complaint rates low by personalising dunning emails, using a friendly tone, and extending the cadence to 30 days.

Decouple retries from emails. Let AI choose the best retry window; reserve customer outreach for moments that matter.

Go omnichannel. SMS and in-app walls reach customers who never open email.

Stay GDPR-compliant. Document legitimate interest, keep messages transactional, and respect data-subject rights.

Measure and iterate. Track involuntary churn rate, recovery rate, and per-email performance.

Slicker's AI-powered platform transforms the way businesses handle failed subscription payments. It integrates with existing payment rails and processes to reduce involuntary churn, increase recovered revenue, and boost business margins. If your current setup is leaving money in spam folders, schedule a demo to see the difference intelligent retries can make.

Frequently Asked Questions

What are dunning emails and why are they important?

Dunning emails are payment reminders sent to customers when a subscription payment fails. They are crucial for recovering failed payments and reducing involuntary churn, which can account for 20-40% of total customer churn.

How can I prevent dunning emails from being marked as spam?

To prevent dunning emails from being marked as spam, implement email authentication protocols like SPF, DKIM, DMARC, and BIMI. These protocols help verify the legitimacy of your emails and improve deliverability.

What are some effective strategies for improving dunning email performance?

Effective strategies include sending the first email immediately after a payment failure, personalizing messages, using a friendly tone, leveraging loss aversion, and employing pre-dunning emails to remind customers before their payment method expires.

How does AI improve payment recovery for failed subscriptions?

AI improves payment recovery by decoupling retry logic from emails, allowing machine learning to determine the optimal time for retrying payments. This approach reduces customer fatigue and increases recovery rates by analyzing transaction patterns.

What are the benefits of using omnichannel nudges for payment recovery?

Omnichannel nudges, such as SMS and in-app messaging, bypass email and reach customers directly. These channels have higher engagement rates, with SMS boasting a 98% open rate, and can significantly improve payment recovery rates.

How does Slicker enhance payment recovery compared to billing-native solutions?

Slicker enhances payment recovery by using AI to optimize retry timing, employing multi-gateway routing, and providing transparent analytics. This approach offers 2-4× better recoveries than static retry systems, integrating seamlessly with existing payment processes.

Sources

https://www.slickerhq.com/blog/what-is-involuntary-churn-and-why-it-matters

https://www.mailgun.com/wp-content/uploads/pdf/SI-State_of_Email-2024_-_v3_1.pdf

https://churnkey.co/feature/payment-recovery/dunning-campaigns

https://www.mailgun.com/resources/research/email-authentication-requirements/

https://www.spamresource.com/2025/04/2025-magy-sender-compliance-guide.html

https://myscp.onlinelibrary.wiley.com/doi/full/10.1002/jcpy.1031

https://www.edpb.europa.eu/system/files/2024-10/edpb_guidelines_202401_legitimateinterest_en.pdf

https://stripe.com/blog/ai-enhancements-to-adaptive-acceptance

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://pubsonline.informs.org/do/10.1287/LYTX.2024.03.06/full/

WRITTEN BY

Slicker

Slicker