Guides

10

min read

Fix Failed Payments Fast: Smart Dunning Setup in 5 Minutes

Modern smart dunning platforms enable payment recovery setup in under five minutes through no-code integrations with existing billing systems. Unlike legacy solutions requiring weeks of implementation, platforms like Slicker activate in minutes with pre-built connectors for major providers. This rapid deployment lets businesses immediately start recovering the 9% of revenue lost to failed payments while competitors remain stuck in lengthy rollouts.

At a Glance

• Smart dunning setup takes just 5 minutes with modern platforms versus weeks for legacy systems

• Failed payments cause 20-40% of total customer churn in subscription businesses

• Intelligent retry strategies deliver 20-50% increases in recovered revenue compared to batch processing

• Multi-gateway routing can recover up to 30% of initially failed payments through optimal processor selection

• Card networks allow 10-35 retry attempts within 30 days before penalties apply

• Slicker customers see 10-20 percentage point improvements in payment recovery rates

When a payment fails, every second counts. While your competitors spend weeks implementing complex recovery systems, you could be recovering revenue today. Smart dunning transforms the way businesses handle failed payments, and the best part? You can launch it in just five minutes.

Why every minute matters when a payment fails

Failed payments create a massive revenue hemorrhage for subscription businesses. Recent data shows that subscription businesses lose 9% of their revenue due to failed payments. Even more alarming, involuntary churn rates account for 20-40% of total customer churn in the subscription economy.

Smart dunning represents a fundamental shift from traditional batch processing to intelligent, data-driven recovery. Unlike conventional approaches that apply identical retry logic to all failures, smart dunning uses real-time signals to customize each recovery attempt. Payment retries are when a business attempts to process a payment after a failed first attempt - but the intelligence behind those retries makes all the difference.

The traditional batch approach treats every failed payment identically, regardless of why it failed or who the customer is. This one-size-fits-all strategy misses critical recovery opportunities. Smart dunning, by contrast, analyzes decline codes, customer payment history, and even payday patterns to determine the optimal retry strategy for each individual transaction.

What does a slow dunning rollout really cost?

Delaying your dunning implementation bleeds money from multiple wounds. Processing fees pile up with inefficient retry attempts - each retry has a cost, typically $0.05 to $0.15 per attempt. Without intelligent timing, you're essentially throwing money at the problem.

The numbers paint a stark picture. Failed payments cause nearly 20-30% of all lost online sales. For subscription businesses facing economic headwinds, 59% citing economic downturn as their biggest challenge, every recovered payment matters more than ever.

Beyond direct costs, slow implementation compounds customer churn. While you're waiting weeks or months to deploy a solution, customers with failed payments slip away. The cascading effect on lifetime value can be devastating - especially when modern platforms like Zuora's Cascading Payment Method feature could already be working to save those relationships.

How do you set up smart dunning in five minutes?

The era of lengthy implementation sprints is over. Modern smart dunning platforms have eliminated the technical barriers that once made payment recovery a complex undertaking. Here's your five-minute roadmap:

5 minutes. This is how much time you will need in Slicker's dashboard to have your instance up and running. No-code revenue recovery.

Step 1: Connect your billing provider (1 minute)

Whether you're using Stripe, Chargebee, Recurly, or another platform, modern dunning solutions offer 5-minute no-code integration. Simply authorize the connection through your existing dashboard.

Step 2: Enable intelligent retries (30 seconds)

Toggle on AI-powered retry logic. The system immediately begins analyzing your historical payment data to optimize retry timing.

Step 3: Configure multi-gateway routing (2 minutes)

If you have multiple payment processors, enable routing to maximize success rates across different gateways.

Step 4: Set compliance parameters (1 minute)

Ensure your retry limits align with card network rules to avoid penalties.

Step 5: Launch and monitor (30 seconds)

Activate the system and watch your dashboard populate with real-time recovery metrics.

Stripe's automated retry logic is designed to optimize the timing and frequency of payment retries, and platforms take this concept even further with machine learning that adapts to your specific customer base.

What makes intelligent retry logic outperform batch rules?

Intelligent retry logic represents a quantum leap beyond static batch processing. The hybrid retry model proved to be the most effective, offering both flexibility and efficiency in real-world testing.

The cost-benefit equation fundamentally changes with AI-driven retries. While each retry has a cost, typically $0.05 to $0.15 per attempt, intelligent systems maximize the ROI of each attempt by timing them strategically. This isn't just theory - companies that switch from batch-based to intelligent, individualized retry strategies typically see: 20-50% increase in recovered revenue.

The intelligence comes from analyzing multiple data points simultaneously:

Decline reason codes that indicate temporary versus permanent failures

Customer payment history showing successful transaction patterns

Bank processing schedules and payday cycles

Real-time processor performance metrics

This multifaceted analysis happens in milliseconds, ensuring each retry has the maximum probability of success while minimizing unnecessary attempts that frustrate customers and incur fees.

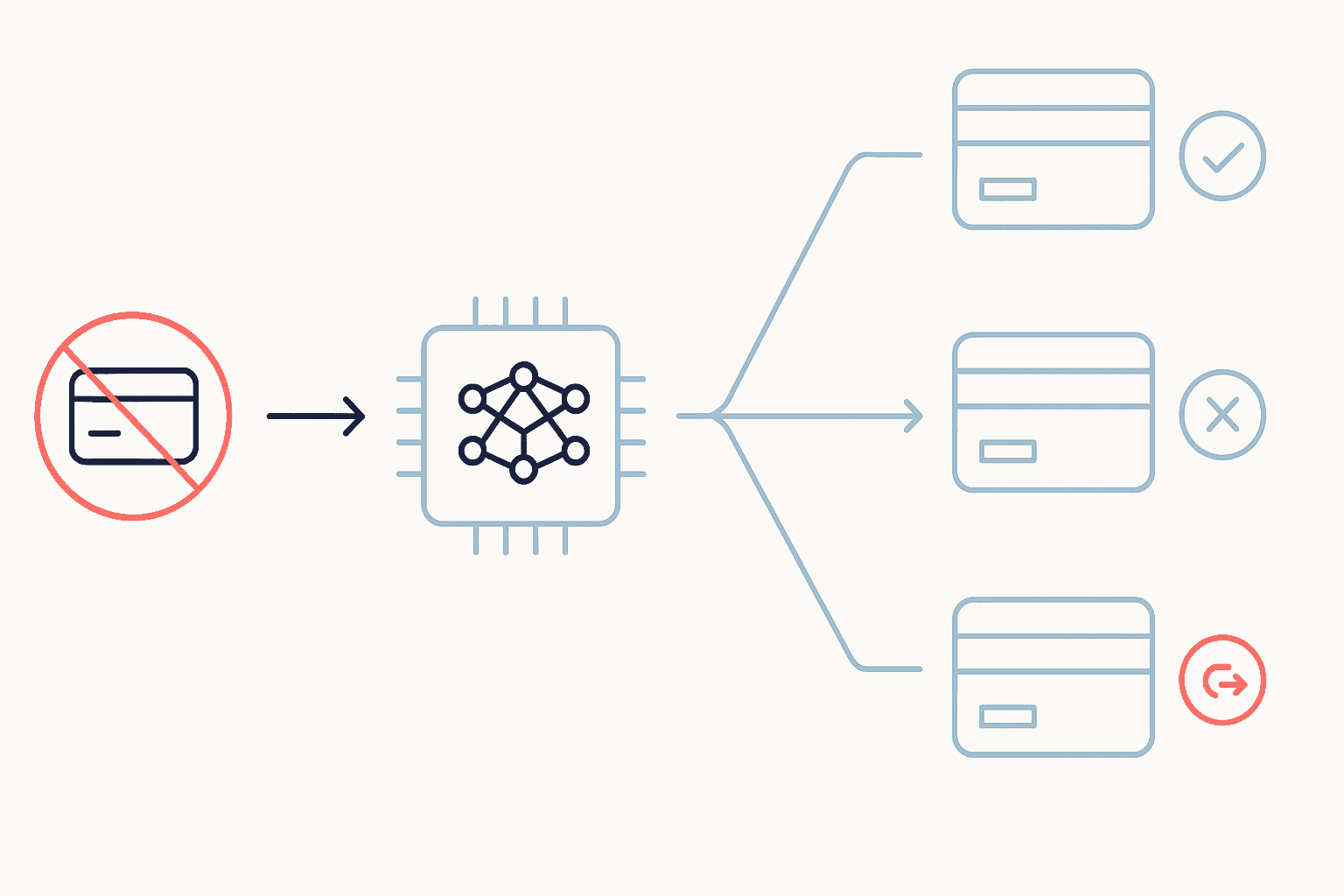

How does AI multi-gateway routing boost recovery?

Multi-gateway routing transforms payment recovery by intelligently directing each transaction through the optimal processor. This comprehensive analysis examines how machine-learning routing algorithms can deliver 7-13 percentage point approval lifts compared to single-processor setups.

Smart Retry is an intelligent payment optimization feature that automatically retries failed transactions using fallback acquirers or modified transaction parameters. When your primary processor declines a transaction, the AI instantly evaluates alternative routes.

The impact on recovery rates is dramatic. By optimizing transaction paths, reducing false declines, and lowering processing costs, merchants can increase approval rates by 10-15% and recover up to 30% of initially failed payments.

Key takeaway: Multi-gateway routing isn't just about having backup options - it's about intelligently selecting the best path for each unique transaction based on real-time success probability.

Slicker vs. legacy platforms: who gets you live faster?

The speed gap between modern and legacy platforms has become a chasm. The Buyers Guide for Billing in 2025 finds BillingPlatform first on the list, followed by Oracle and Zuora - but implementation timelines tell a different story.

Dunning workflow optimizes the collection of failed or delinquent payments, yet traditional platforms require extensive customization. Consider implementation realities:

Legacy platforms:

Weeks of scoping and planning sessions

Custom API development requiring engineering resources

Extended testing cycles

Gradual rollout phases

Modern solutions like Slicker:

Go live in an average of six weeks for complex custom integrations

Standard integrations in minutes, not months

Pre-built connectors for major billing platforms

Immediate access to AI optimization

If you're using a CRM we're already integrated with - such as Stripe or Chargify - we can configure your account in just a few hours. Even custom implementations pale in comparison to legacy timelines.

The difference isn't just speed - it's opportunity cost. Every day spent implementing is a day not recovering revenue.

What card-network rules limit retries - and how do you stay compliant?

Compliance isn't optional - it's essential for sustainable payment recovery. Card networks impose strict limits and hefty penalties for excessive retry attempts.

Visa allows up to 15 retry attempts in 30 days for the same transaction (same card and amount); every attempt past that incurs approximately $0.10 in penalties per retry domestically and $0.15 per retry cross-border.

Mastercard caps retries at 10 in 24 hours, and 35 in 30 days; after that, each extra attempt can cost around $0.30 in the US or €0.50 in Europe.

Smart dunning platforms automatically track and enforce these limits, ensuring you maximize recovery opportunities without triggering penalties. Slicker is actively pursuing SOC 2 Type II compliance to validate its controls, ensuring enterprise-grade security for sensitive payment data.

Beyond retry limits, consider:

PCI DSS requirements for handling card data

Regional regulations like PSD2 in Europe

Industry-specific compliance standards

Data residency requirements

Modern platforms handle these complexities automatically, building compliance into every retry decision.

Launch today, recover revenue tomorrow

Companies that switch from batch-based to intelligent, individualized retry strategies typically see: 20-50% increase in recovered revenue - and with modern platforms, that transformation happens in minutes, not months.

Slicker customers usually see between a 10 and 20 percentage point increase in the number of recovered payments. The platform's AI engine processes each failing payment individually, converting past due invoices into revenue while you focus on growing your business.

Every minute you wait is money left on the table. While competitors wrestle with lengthy implementations, you could already be recovering failed payments. The technology is proven, the integration is instant, and the results speak for themselves.

Don't let another payment failure become permanent churn. Smart dunning isn't just faster to implement than legacy solutions - it's fundamentally more effective at recovering revenue. With Slicker's five-minute setup and pay-for-success model, there's no reason to wait. Start recovering revenue today.

Frequently Asked Questions

What is smart dunning?

Smart dunning is an advanced payment recovery system that uses real-time data and AI to customize retry attempts for failed payments, optimizing recovery rates and reducing churn.

How does smart dunning differ from traditional methods?

Unlike traditional batch processing, smart dunning analyzes decline codes, customer payment history, and payday patterns to tailor retry strategies, increasing the likelihood of successful payment recovery.

What are the costs associated with retrying failed payments?

Retrying failed payments typically incurs costs of $0.05 to $0.15 per attempt. Smart dunning maximizes the ROI of each retry by strategically timing them to increase success rates.

How quickly can Slicker's smart dunning be implemented?

Slicker's smart dunning can be set up in just five minutes with a no-code integration, allowing businesses to start recovering failed payments almost immediately.

What compliance measures are necessary for payment retries?

Compliance with card network rules is crucial, such as Visa's limit of 15 retries in 30 days. Smart dunning platforms like Slicker automatically enforce these limits to avoid penalties.

Sources

https://www.slickerhq.com/blog/one-size-fails-all-the-case-against-batch-payment-retries

https://pagos.ai/blog/retrying-failures-finding-the-roi-sweet-spot

https://knowledgecenter.zuora.com/Zuora_Billing/Billing/Payments/Cascading_Payment_Method

https://www.gartner.com/reviews/market/recurring-billing-applications

WRITTEN BY

Slicker

Slicker