Guides

10

min read

High-volume smart dunning for Chargebee: Enterprise recovery at scale

Smart dunning for Chargebee processes failed payments individually using AI-powered retry logic, recovering 2-4× more revenue than basic dunning tools. Enterprise teams implementing intelligent recovery systems see 20-50% increases in recovered revenue by optimizing retry timing, gateway routing, and payment methods at scale.

Key Facts

• Failed payments cause subscription businesses to lose 9% of revenue annually, with involuntary churn accounting for 20-40% of total customer churn

• Native Chargebee dunning offers up to 12 retries but lacks the machine learning sophistication needed for complex, high-volume scenarios

• AI-powered retry logic analyzes individual payment patterns and global data to determine optimal retry timing for each transaction

• Enterprise solutions like Slicker integrate with Chargebee in 5 minutes with no-code setup, processing thousands of transactions simultaneously

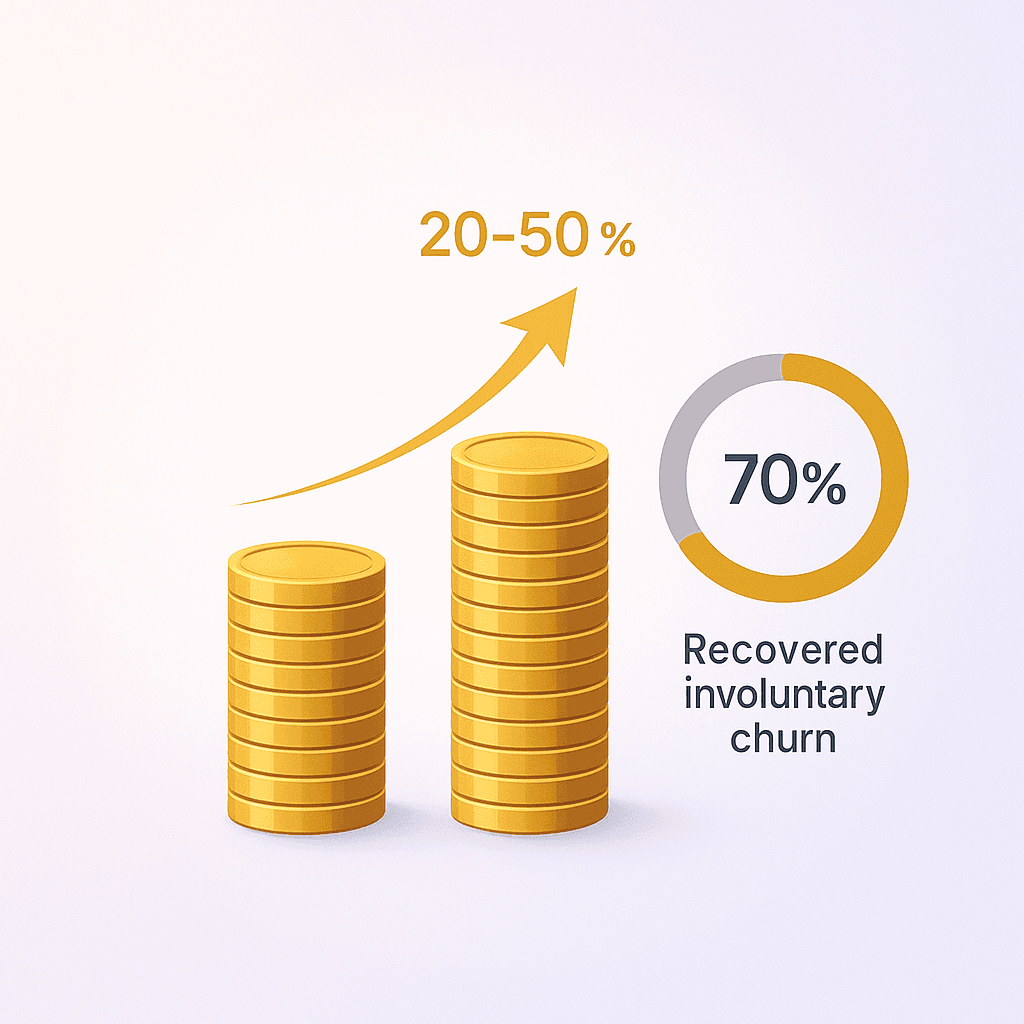

• Companies switching from basic to intelligent dunning typically recover 70% of involuntary churn versus 35-45% with traditional methods

• Multi-gateway routing and payment method optimization further increase recovery rates by leveraging regional processing advantages

High-volume subscription companies bleed revenue on failed charges. Smart dunning for Chargebee can curb that loss through AI-timed, card-network-aware retries--something basic tools can't match.

Why Do High-Volume Teams Need Smarter Dunning--Fast?

The numbers paint a stark picture: subscription businesses lose 9% of their revenue due to failed payments. For high-volume enterprises processing thousands of transactions daily, that translates to millions in lost revenue annually.

Involuntary churn rates account for 20-40% of total customer churn in the subscription economy, with up to 70% of involuntary churn stemming from failed transactions. These aren't customers who want to leave--they're revenue casualties of inadequate payment recovery systems.

Consider this: involuntary churn can easily comprise 40% of your churn, if not more, depending on your business nature. The scale of this problem demands an AI-powered approach that can analyze patterns across millions of data points and make split-second recovery decisions.

The average churn rate for B2B SaaS companies in 2025 is 3.5%, but voluntary and involuntary churn require completely different strategies to manage effectively. While voluntary churn requires customer success initiatives, involuntary churn is a technical problem with a technical solution: intelligent, automated retry logic.

Where Does Native Chargebee Dunning Hit a Ceiling?

Chargebee's built-in dunning capabilities work well for smaller operations, but they face significant limitations as transaction volumes and complexity increase. Chargebee will retry up to 12 times to collect payment, yet this feature is available only for Performance plan and above.

The real challenge emerges when you're dealing with multiple geographies, various card networks, and thousands of unique error codes. Smart retry logic retries payments at dynamic intervals based on gateway transaction errors, distinguishing between hard and soft declines. However, native solutions lack the machine learning sophistication to truly optimize retry timing across diverse payment scenarios.

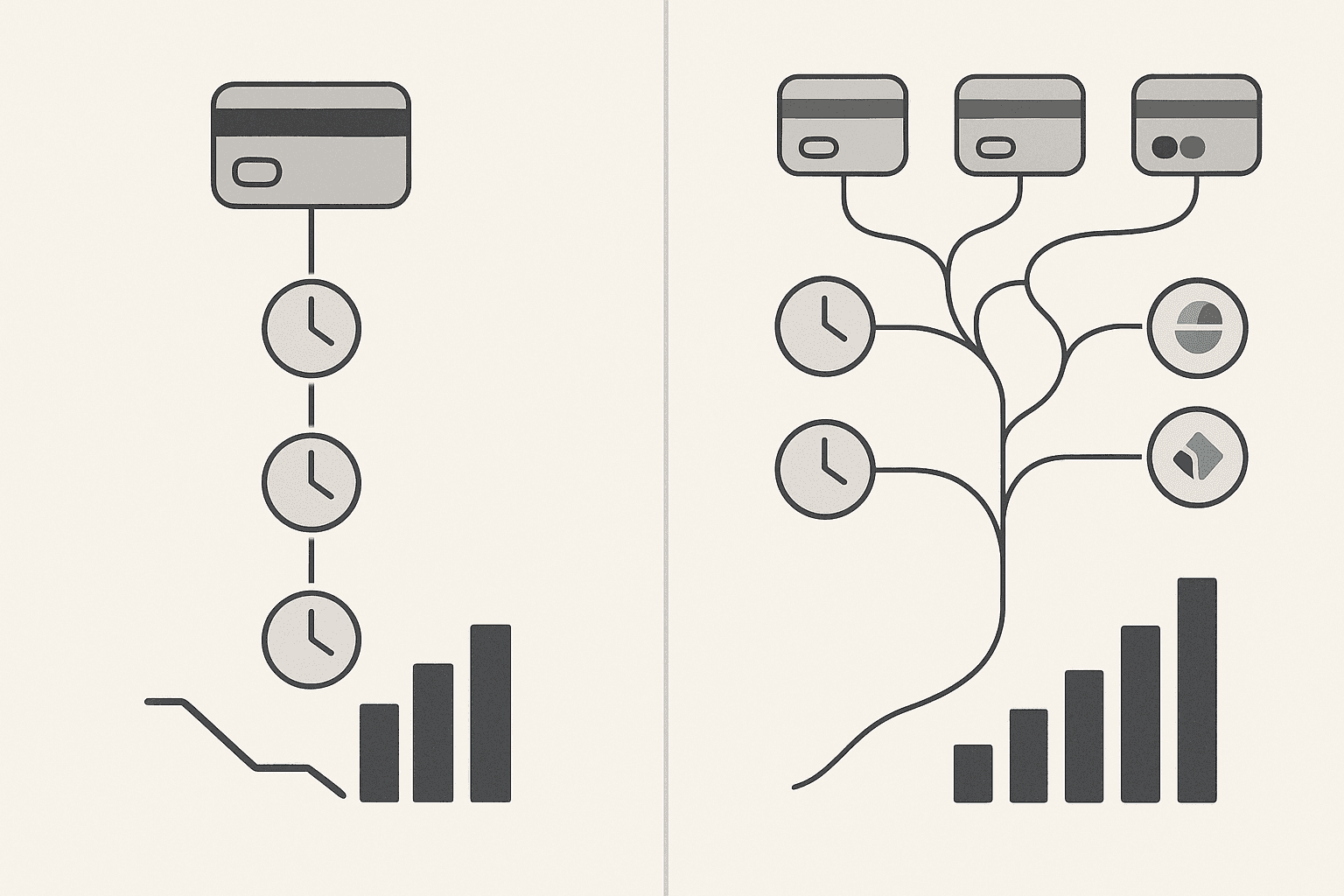

Companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue. This gap between basic and advanced dunning represents a massive opportunity for enterprise teams willing to upgrade their recovery infrastructure.

What Does 'Enterprise-Grade' Dunning Look Like?

Enterprise-grade dunning transcends simple retry schedules. The recommended default setting is 8 tries within 2 weeks for most platforms, but true enterprise solutions go far beyond static rules.

Retries will cease after 7 transaction declines, 20 total transaction attempts, or 60 days since invoice creation in advanced systems. This multi-dimensional approach prevents merchant account flagging while maximizing recovery opportunities.

By intelligently timing retries, "smart retry", models reduce costs associated with retries while also increasing the amount of money collected. The difference lies in the sophistication of the underlying technology and its ability to learn from vast datasets.

Individualized, AI-Timed Retries

AI-Driven Intelligent Retry Timing eliminates guesswork by analyzing patterns from vast datasets--your own transaction history combined with anonymized global payment data. Instead of rigid, fixed schedules, AI determines the optimal retry moment for each individual transaction.

Multi-Gateway Routing & Global Signals

Slicker utilizes your multi-gateway setup, routing payments to maximize success rate. This approach leverages local acquirer relationships and regional processing advantages that single-gateway solutions miss entirely.

How Slicker Supercharges Chargebee at Scale

Slicker's machine learning model schedules and retries failed payments at optimal times, leveraging industry expertise and tens of parameters. This isn't just another retry tool--it's a comprehensive recovery engine built for enterprise scale.

5 minutes. This is how much time you will need in Slicker's dashboard to have your instance up and running. No-code revenue recovery means your team can focus on strategy rather than implementation.

Machine-learning engines predict the perfect moment, method, and gateway for each retry, lifting recovery rates 2-4× above native billing logic. This dramatic improvement comes from processing each payment individually rather than applying blanket rules.

Slicker vs. Other Recovery Platforms

Platform | Retry Capability | ML/AI Features | Setup Time | Enterprise Scale |

|---|---|---|---|---|

Slicker | Unlimited custom | Advanced ML with global data | 5 minutes | Built for high-volume |

Up to 12 retries | Basic pattern analysis | Native | Performance plan+ only | |

8 retries default | AI-powered timing | Native | Good for mid-market | |

7 declines/20 attempts | Machine learning | Integration required | Limited by attempt caps | |

Up to 50% recovery | AI/ML driven | Days | Enterprise-focused | |

Customizable | ML-optimized | Complex setup | Enterprise-ready |

Chargebee scores 4.2 in user ratings, making it a solid base platform. However, when enhanced with Slicker's capabilities, the combined solution delivers enterprise-grade recovery that standalone platforms can't match.

Where Chargebee Smart Retry Falls Short

This feature is available only for Performance plan and above, immediately excluding many growing businesses. Even with access, the retry logic lacks the sophistication needed for complex, high-volume scenarios.

Stripe & Recurly: Good but Not Built for Enterprise Volume

Stripe can't automatically retry a payment if the card issuer returns hard decline codes like incorrect_number, lost_card, or stolen_card. These limitations compound at scale, leaving significant revenue unrecovered.

How Do You Deploy Slicker with Chargebee in One Day?

Implementation speed matters when you're losing revenue daily. 5 minutes. This is how much time you will need in Slicker's dashboard to have your instance up and running.

The deployment process follows these straightforward steps:

Connect your Chargebee account through secure API integration

Map your existing payment data and retry configurations

Configure AI parameters based on your business model

Test with a subset of failed payments

Scale to full production volume

Chargebee's Smart retry logic retries payments at dynamic intervals, but Slicker enhances this with machine learning that learns from your specific customer base and payment patterns.

Chargebee will retry up to 12 times to collect payment, while Slicker's intelligent system determines the optimal number of retries based on success probability, preventing unnecessary attempts that could flag your merchant account.

What ROI Can Enterprise Teams Expect from Smart Dunning?

The financial impact of intelligent dunning is immediate and substantial. Since last year's report, we analyzed over $3 billion in subscription revenue, revealing clear patterns in recovery potential.

Metric | Traditional Dunning | AI-Powered Recovery |

|---|---|---|

Recovery Rate | 35-45% | 70% of involuntary churn recovered |

Revenue Impact | Baseline | 20-50% increase in recovered revenue |

Profit Improvement | Standard margins | 25%+ increase from 5% retention improvement |

Implementation Time | Weeks to months | 5 minutes to 1 day |

Consider that companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue. For a company processing $10 million monthly, that's an additional $2-5 million annually.

Key Takeaways for Finance & RevOps Leaders

The shift from basic dunning to intelligent recovery represents one of the highest-ROI improvements available to subscription businesses. With failed payments causing 9% revenue loss industry-wide, the opportunity for recovery is massive.

Slicker transforms Chargebee from a capable billing platform into an enterprise-grade revenue recovery system. The combination delivers:

AI-powered retry timing that adapts to individual payment patterns

Multi-gateway routing for optimal approval rates

5-minute setup with no code requirements

2-4× better recovery than native billing logic

Pay-for-success pricing that aligns incentives

For high-volume teams serious about maximizing subscription revenue, the question isn't whether to upgrade their dunning capabilities--it's how quickly they can implement a solution that turns payment failures into recovered revenue at scale.

Frequently Asked Questions

What is smart dunning for Chargebee?

Smart dunning for Chargebee involves using AI-timed, card-network-aware retries to recover failed payments, reducing involuntary churn and increasing revenue recovery for high-volume subscription businesses.

Why do high-volume teams need smarter dunning?

High-volume teams need smarter dunning because traditional methods result in significant revenue loss due to failed payments. AI-powered dunning can analyze patterns and optimize retry timing, significantly improving recovery rates.

How does Slicker enhance Chargebee's dunning capabilities?

Slicker enhances Chargebee's dunning by using machine learning to schedule retries at optimal times, leveraging multi-gateway routing, and providing a no-code setup that boosts recovery rates 2-4× above native billing logic.

What are the limitations of Chargebee's native dunning?

Chargebee's native dunning is limited by its retry capabilities, which are capped at 12 attempts and lack the machine learning sophistication needed to optimize retry timing across diverse payment scenarios.

What ROI can enterprises expect from using smart dunning?

Enterprises can expect a 20-50% increase in recovered revenue and a 25%+ profit improvement from using smart dunning, as it significantly reduces involuntary churn and optimizes payment recovery processes.

Sources

https://www.slickerhq.com/blog/saas-churn-rate-benchmarks-2025

https://www.chargebee.com/docs/payments/2.0/kb/payments/what-is-smart-dunning

https://stripe.com/docs/billing/revenue-recovery/smart-retries

https://developer.zuora.com/blogs/2025-3-18-turningfailureintogold

https://vindicia.com/technical-center/faq/vindicia-retain-faq/

WRITTEN BY

Slicker

Slicker