Guides

10

min read

How to Recover Failed Subscription Payments Across Multiple Gateways

To recover failed subscription payments across multiple gateways, businesses must implement intelligent payment orchestration with automatic failover, ML-powered retry logic, and dynamic routing. Single-gateway systems lose 9% of subscription revenue to failed payments, while multi-gateway orchestration with smart routing reduces declines by optimizing each transaction path based on real-time performance data.

Key Facts

• Failed payments cause subscription businesses to lose 9% of revenue annually, with 27% of users likely canceling after payment interruptions

• Multi-gateway orchestration enables 20-50% increases in recovered revenue through intelligent retry strategies versus batch processing

• Gateway outages averaging just one minute cost businesses $10,000 in lost sales, making automatic failover essential for payment continuity

• ML-powered retry systems achieve 25-35% success rates on first retry attempts while reducing unnecessary retries by 35%

• Companies tracking failed payment metrics recover 61% of declined transactions versus 49% for those without monitoring

• Implementation requires tokenization across gateways, PCI DSS 4.0 compliance, and real-time performance monitoring with sub-200ms latency thresholds

Failed payments quietly bleed subscription revenue. To truly recover failed subscription payments, brands must orchestrate multiple gateways, not just fix their primary processor.

The real cost of failed payments—and why a single gateway isn't enough

Subscription businesses lose 9% of their revenue due to failed payments; a critical revenue leak that companies can't afford to ignore. Beyond the immediate financial impact, 27% of users are likely to cancel their subscriptions if they experience any service interruption due to failed payments.

The problem runs deeper than simple payment failures. Companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue. Yet most businesses remain locked into single-gateway architectures that fundamentally limit their recovery potential.

Where do single payment gateways fall short for subscriptions?

Traditional payment gateways weren't built for the unique demands of recurring revenue. As Payway CEO Dan Nadeau explains, "Not all payment gateways are built to handle the complex demands of recurring revenue."

The limitations become clear when examining specific failure points. Single gateways create dangerous vulnerabilities; even a one-minute outage can cost an average of $10,000 in lost sales. Meanwhile, Gateway Failover is a feature designed to provide a safety net for merchants by automatically routing transactions to a backup gateway whenever there's a detected outage.

Single-gateway systems struggle with critical limitations:

No automatic retry capabilities for different decline types

Lack of account updater tools to prevent involuntary churn

Inability to support modern billing models like freemium or metered usage

Limited visibility into payment performance and failure reasons

Zero redundancy when gateway outages strike

What are the building blocks of multi-gateway recovery?

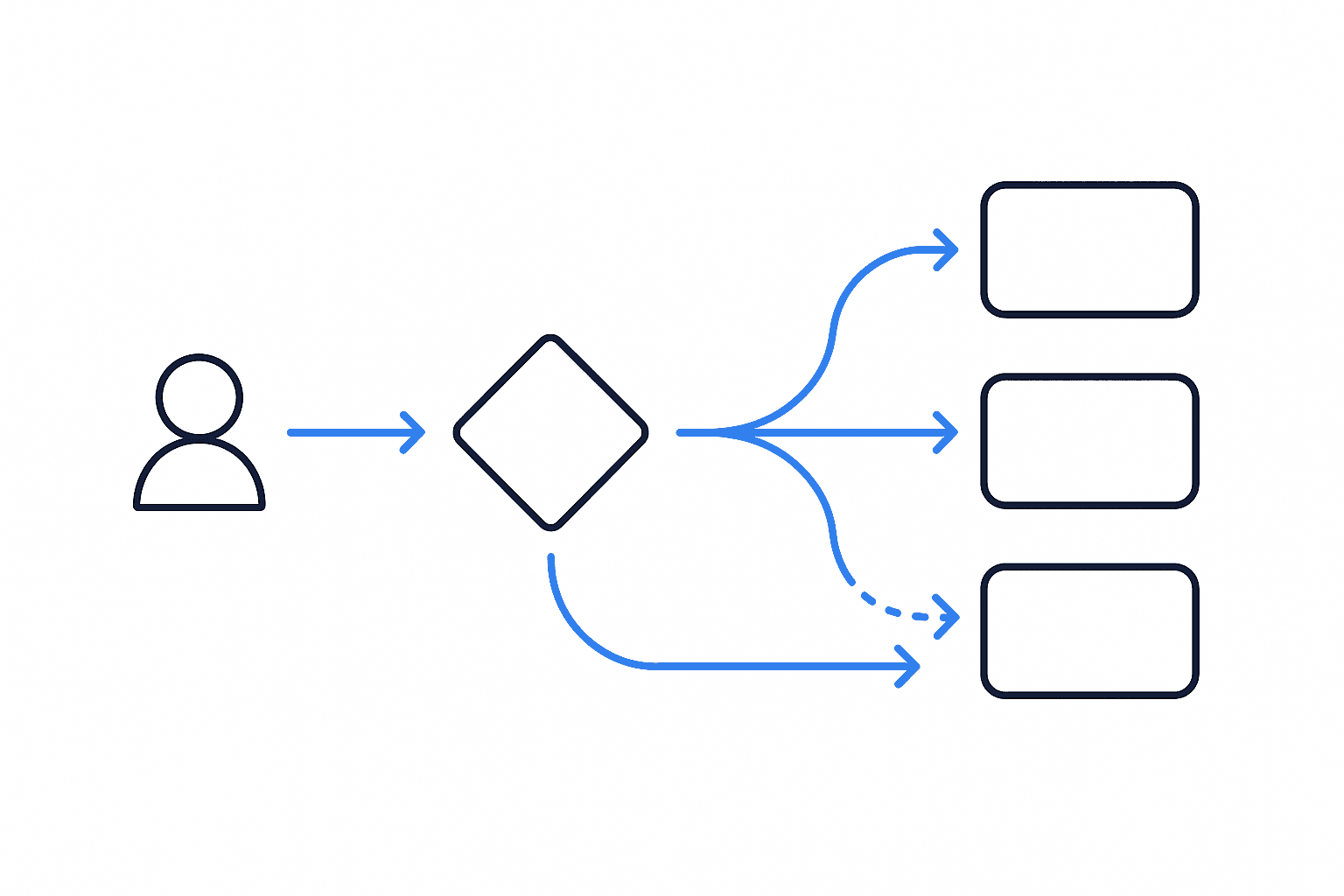

Multi-gateway orchestration transforms payment recovery through three core capabilities that single gateways can't match. Routing is about which channel the transaction enters; the foundation for intelligent payment flow.

Payment routing is the logic behind how a transaction gets from the checkout page to approval. It determines which processor, acquiring bank, or payment network handles each transaction based on real-time conditions.

Continuity in transactions processing ensures transactions are processed without interruption even during primary gateway outages. This capability alone can minimize financial losses and maintain customer trust when systems fail.

Intelligent payment routing

Dynamic routing setups can minimize failed payments, improve authorization rates, and protect against downtime. The system evaluates each transaction in milliseconds, selecting the optimal path based on historical performance data.

Failover and retry logic automatically retries transactions with another gateway when primary processors decline or fail. This intelligent rerouting happens seamlessly without customer awareness.

Merchants using orchestration can benefit from improved conversion rates and reduced declines through smart routing that optimizes for both cost and approval rates.

Automatic gateway failover

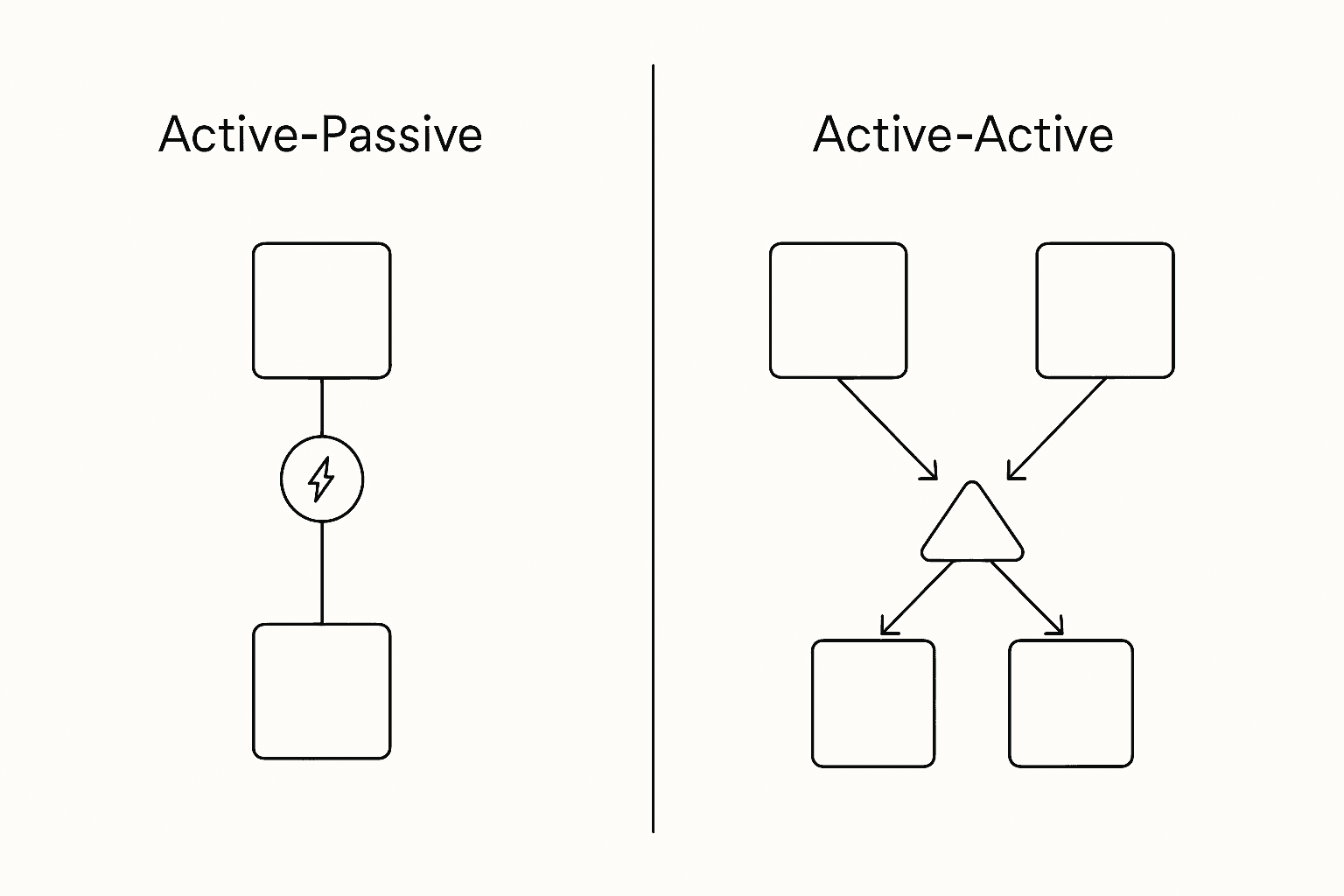

Downtime in payment processing can devastate e-commerce operations, with even a one-minute outage costing an average of $10,000 in lost sales. Active-passive configurations keep secondary gateways on standby, while active-active setups distribute load across multiple processors simultaneously.

When gateway errors are detected and reach a certain velocity, systems automatically failover to backup gateways, routing transactions seamlessly. The transition happens in milliseconds, invisible to customers.

Outages cost businesses over $400 billion in revenue each year globally. Multi-gateway failover can slash downtime-related losses by up to 80%.

Smart retries & decline-code logic

Smart Retries predicts the optimal time to retry a failed payment using machine learning algorithms trained on billions of data points. On average, the first retry after a decline succeeds 25-35% of the time.

Retries will cease after 7 transaction declines, 20 total transaction attempts, or 60 days since invoice creation; preventing excessive retry penalties while maximizing recovery chances.

How do you implement ML-powered retries across gateways?

Machine learning transforms retry logic from guesswork to science. Dynamic Retries leverage machine learning to determine optimal retry timing after initial payment declines.

Adaptive Acceptance's new AI model achieves 70% greater precision in identifying legitimate transactions that have been falsely declined, while reducing retry attempts by 35%. This precision matters; businesses recover more revenue with fewer retry attempts.

Visa allows 15 retries over a rolling 30-day period for soft declines, while Mastercard enforces different limits. Smart retry systems navigate these complex rules automatically, preventing costly penalty fees.

Implementation requires careful orchestration:

Configure retry rules based on decline codes across gateways

Set up ML models to predict optimal retry windows

Monitor retry performance metrics in real-time

Adjust algorithms based on gateway-specific success patterns

How do you design failover for 'five-nines' payment availability?

Vulnerabilities such as API downtimes, cyber attacks, or regional network outages can spike cart abandonment rates by 25-35%. Building resilient failover requires multiple layers of redundancy.

Testing Gateway Failover in sandbox mode isn't supported; the feature functions only in production. This limitation makes careful planning essential before going live.

Real-world resilience demands comprehensive monitoring. Companies that monitor the full Internet Stack lose 54% less to disruptions annually compared to those without full visibility. Meanwhile, 83% of respondents estimated their company lost over $100,000 per month due to Internet disruptions.

Key architectural decisions include:

Active-passive vs. active-active gateway configurations

Real-time health monitoring with sub-200ms latency thresholds

Automated failover triggers based on error velocity

Geographic distribution of backup processors

Regular failover testing protocols

Security & compliance across multiple gateways: tokenization and PCI DSS 4.0

Tokenization helps by reducing how many systems ever touch PAN data, concentrating sensitive activity in one hardened place, and producing clean logs that make continuous monitoring easier.

Spreedly's "Universal Tokens" allow you to transact with virtually any payment service while keeping data protected. The vault remains portable, letting businesses shift between gateways without re-tokenizing cards.

Compliance complexity multiplies with each gateway added. PCI-DSS has 12 main requirements and more than 300 sub-requirements. Multi-gateway architectures must maintain consistent security standards across all processors.

Best practices for multi-gateway security:

Implement universal tokenization across all gateways

Maintain centralized PCI compliance monitoring

Use network tokens for card-on-file transactions

Deploy consistent encryption standards

Regular security audits across all payment channels

Which KPIs prove your multi-gateway strategy works?

Success metrics reveal the true impact of multi-gateway orchestration. Companies that track failed payments are able to recoup, on average, 61% of failed payments versus 49% for those that don't track.

55.4% of Recurly merchants decreased their overall churn rates using intelligent retry features. The authorization rate can be 10% lower for online transactions compared to in-person; making every percentage point of improvement valuable.

Critical KPIs to monitor include:

Recovery rate by gateway and decline type

Average retry attempts before successful recovery

Involuntary churn reduction percentage

Gateway uptime and failover frequency

Cost per recovered transaction

Customer lifetime value impact

Key takeaway: Effective multi-gateway orchestration typically drives 20-50% improvements in payment recovery rates while reducing processing costs through intelligent routing.

Choosing a payment orchestration partner: Stripe vs. Recurly vs. Slicker

Deliveroo recovered more than £100 million using Smart Retries in coordination with other Stripe revenue recovery tools. Different platforms offer varying strengths in multi-gateway orchestration.

Recurly's intelligent retry logic uses data from billions of transactions to increase the chances of successful payments. Their machine learning models customize retry logic for each transaction type.

At Slicker, we've built our revenue recovery platform around the principle that every failed payment deserves a customized recovery approach. The platform sits on top of existing billing systems, adding intelligent retry capabilities without requiring infrastructure changes.

When evaluating orchestration partners, consider:

Integration complexity with existing systems

Machine learning sophistication

Gateway compatibility breadth

Real-time monitoring capabilities

Performance-based pricing models

Implementation timeline

Conclusion: future-proof your subscription revenue with Slicker

The era of single-gateway payment processing has ended. Modern subscription businesses need intelligent orchestration across multiple processors to maximize revenue recovery and minimize involuntary churn.

At Slicker, we've built our revenue recovery platform to address exactly these challenges. Our AI engine integrates seamlessly with your existing billing infrastructure, adding multi-gateway intelligence without complex migrations.

The path forward is clear: implement intelligent payment routing, enable automatic failover between processors, and deploy ML-powered retry logic that learns from every transaction. Companies making this transition see dramatic improvements; typically 20-50% increases in recovered revenue with significantly reduced involuntary churn.

Don't let single-gateway limitations continue bleeding your subscription revenue. The tools and strategies exist today to build resilient, intelligent payment systems that recover more failed payments while delivering better customer experiences.

Start with assessing your current recovery rates, then systematically add orchestration capabilities that address your specific failure patterns. Your subscription business deserves payment infrastructure as sophisticated as your product.

Make 2025 the year you move beyond single-gateway constraints to truly maximize recovered revenue across multiple processors.

Frequently Asked Questions

Why is a single payment gateway insufficient for subscription businesses?

Single payment gateways often lack the flexibility and redundancy needed for subscription businesses, leading to vulnerabilities like downtime and limited retry capabilities. Multi-gateway systems offer better recovery potential by providing automatic failover and intelligent retry strategies.

What are the benefits of multi-gateway orchestration?

Multi-gateway orchestration enhances payment recovery by enabling intelligent routing, automatic failover, and smart retries. This approach minimizes downtime, improves authorization rates, and reduces involuntary churn, ultimately increasing recovered revenue by 20-50%.

How does intelligent payment routing work?

Intelligent payment routing evaluates each transaction in real-time, selecting the optimal path based on historical performance data. This dynamic setup minimizes failed payments and improves authorization rates by choosing the best processor for each transaction.

What role does machine learning play in payment retries?

Machine learning optimizes retry logic by predicting the best time to retry failed payments. This approach increases the success rate of retries, reduces unnecessary attempts, and helps navigate complex rules across different gateways, enhancing overall recovery rates.

How does Slicker improve subscription revenue recovery?

Slicker's platform integrates with existing billing systems to add intelligent retry capabilities and multi-gateway orchestration. This approach customizes recovery strategies for each failed payment, significantly boosting recovered revenue and reducing involuntary churn.

Sources

https://www.slickerhq.com/blog/one-size-fails-all-the-case-against-batch-payment-retries

https://topmostlabs.com/failover-logic-payment-gateways-high-availability-strategies-2025/

https://payway.com/news/why-payment-gateways-fail-at-subscription-billing-and-what-to-do-about-it

https://br-dge.to/blogs/payment-gateway-versus-orchestration/

https://grow.cleverbridge.com/blog/failed-payment-recovery-dynamic-retries

https://stripe.com/blog/ai-enhancements-to-adaptive-acceptance

https://www.paypal.com/us/brc/article/retry-payment-or-not-retry

https://www.payrails.com/blog/pci-dss-4-0-compliance-whats-new

WRITTEN BY

Slicker

Slicker