Guides

10

min read

Smart payment retries API: Integrate AI recovery in your billing flow

Smart payment retries APIs use machine learning to determine optimal retry timing, processor routing, and transaction parameters for failed payments, recovering 50-70% of declined transactions versus 20-30% with dashboard-only tools. Unlike static retry schedules, these systems analyze billions of data points including issuer response codes and spending patterns to maximize recovery rates while maintaining compliance with network limits.

TLDR

Failed payments create a 9% revenue hole for subscription businesses, with 25% of lapsed subscriptions stemming from payment failures alone

Smart retries APIs analyze decline codes in real-time to distinguish between recoverable soft declines and permanent hard declines, optimizing retry strategies accordingly

Cross-processor retries automatically re-attempt failed payments through different processors, recovering revenue even during network outages

API integration costs 60-80% less than building in-house over three years while delivering implementation in weeks rather than months

Payment networks enforce strict retry limits, with Mastercard allowing 35 attempts and Visa capping at 15 within 30-day periods

Subscription businesses face a 9% revenue hole from failed payments, a silent killer that compounds annually. A smart payment retries API plugs this leak by using machine learning signals to determine when, how, and where to re-attempt declined transactions, moving beyond the rigid schedules of dashboard-only tools.

Why failed payments still leak revenue—and how a smart payment retries API flips the script

Failed payments create a massive revenue drain for subscription businesses. Payment retries occur when a business attempts to process a payment after an initial failure, a critical function since 25% of lapsed subscriptions stem purely from payment failures. The scale is staggering: up to 30% of online payments fail due to card declines, fraud checks, and inefficient processing routes.

This isn't just about lost transactions. When payment failures go unaddressed, they trigger involuntary churn that destroys customer lifetime value. The good news? Smart payment retries powered by AI can recover these losses at scale.

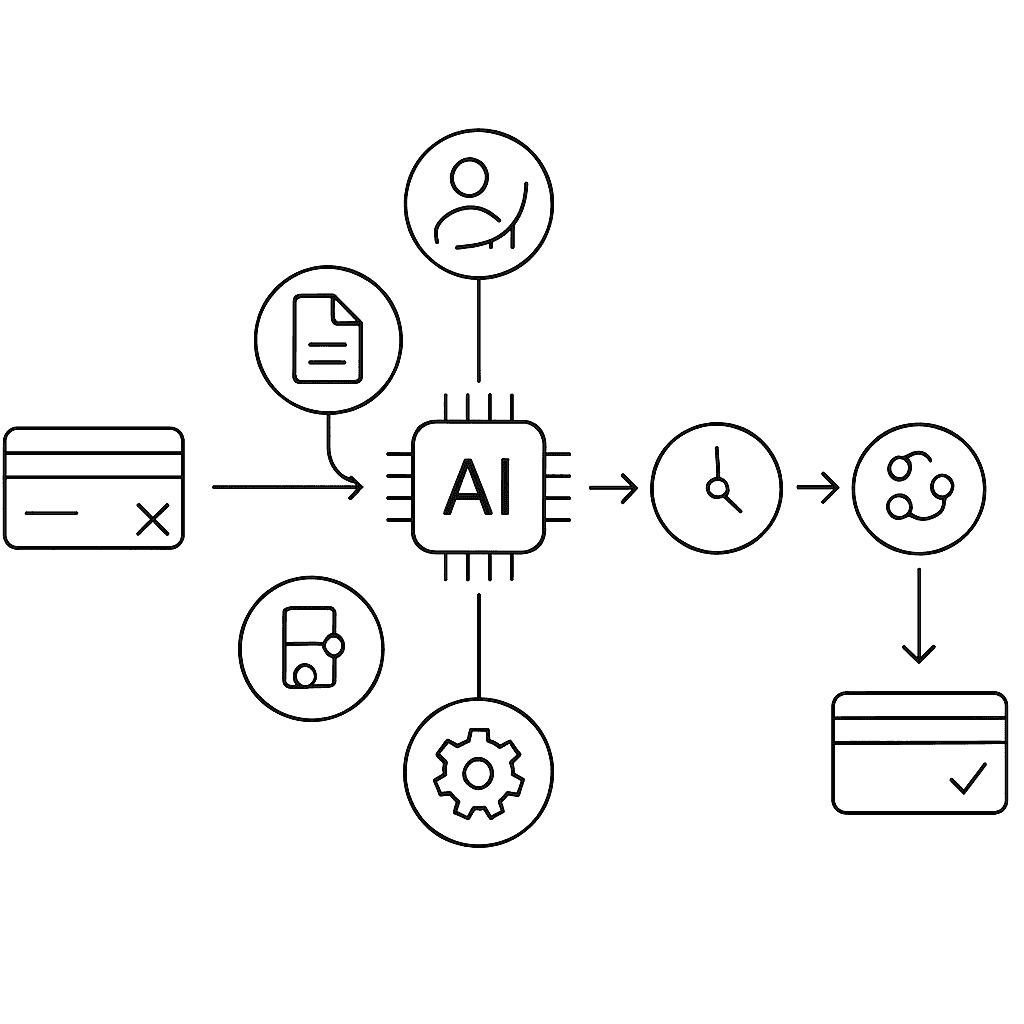

A smart payment retries API represents a fundamental shift in how businesses handle failed transactions. Unlike static retry schedules that blindly re-attempt payments at fixed intervals, these systems analyze billions of data points to predict optimal retry windows. They consider issuer response codes, local spending patterns, gateway uptime, and customer behavior to maximize recovery rates.

The difference is dramatic. While traditional methods often leave significant revenue unrecovered, AI-driven approaches can push recovery rates above 70% by intelligently timing attempts and routing through alternative processors.

Inside the machine: how does AI schedule the perfect retry?

The core of smart payment retries lies in distinguishing between recoverable and permanent failures. Soft declines like insufficient funds or temporary holds aren't final and often succeed on retry. Hard declines from stolen cards or closed accounts require new payment methods entirely.

Modern AI systems analyze these decline codes in real-time, learning from billions of transactions to identify patterns humans would miss. Stripe's Smart Retries uses AI to choose optimal retry times, continuously learning from new purchaser behaviors and transactions for a more targeted approach than traditional rules-based logic.

The technology goes beyond simple timing. Cross-processor retries automatically re-attempt failed payments using different processors than the original attempt. When network issues, processor outages, or temporary declines cause failures, switching processors can recover revenue that would otherwise be lost.

This multi-layered approach combines several strategies:

Timing optimization: ML models predict when cardholders are most likely to have funds available

Processor switching: Failed attempts route through alternative payment rails

Parameter modification: Adjusting transaction details like authentication levels

Geographic routing: Selecting processors based on regional performance

Dashboard-only settings vs API-first flexibility: what you can (and can't) control

The gap between dashboard configuration and API control defines whether you're optimizing or truly orchestrating payment recovery. Dashboard tools offer basic retry settings, typically a number of attempts and a time window. Stripe recommends "The recommended default setting is 8 tries within 2 weeks" as their default, which users can adjust through their interface.

But dashboards hide critical limitations. They operate within single-processor ecosystems, blind to opportunities across payment networks. When API uptime dropped from 99.66% to 99.46% between Q1 2024 and Q1 2025, adding 60% more downtime, single-processor dependence became a serious liability.

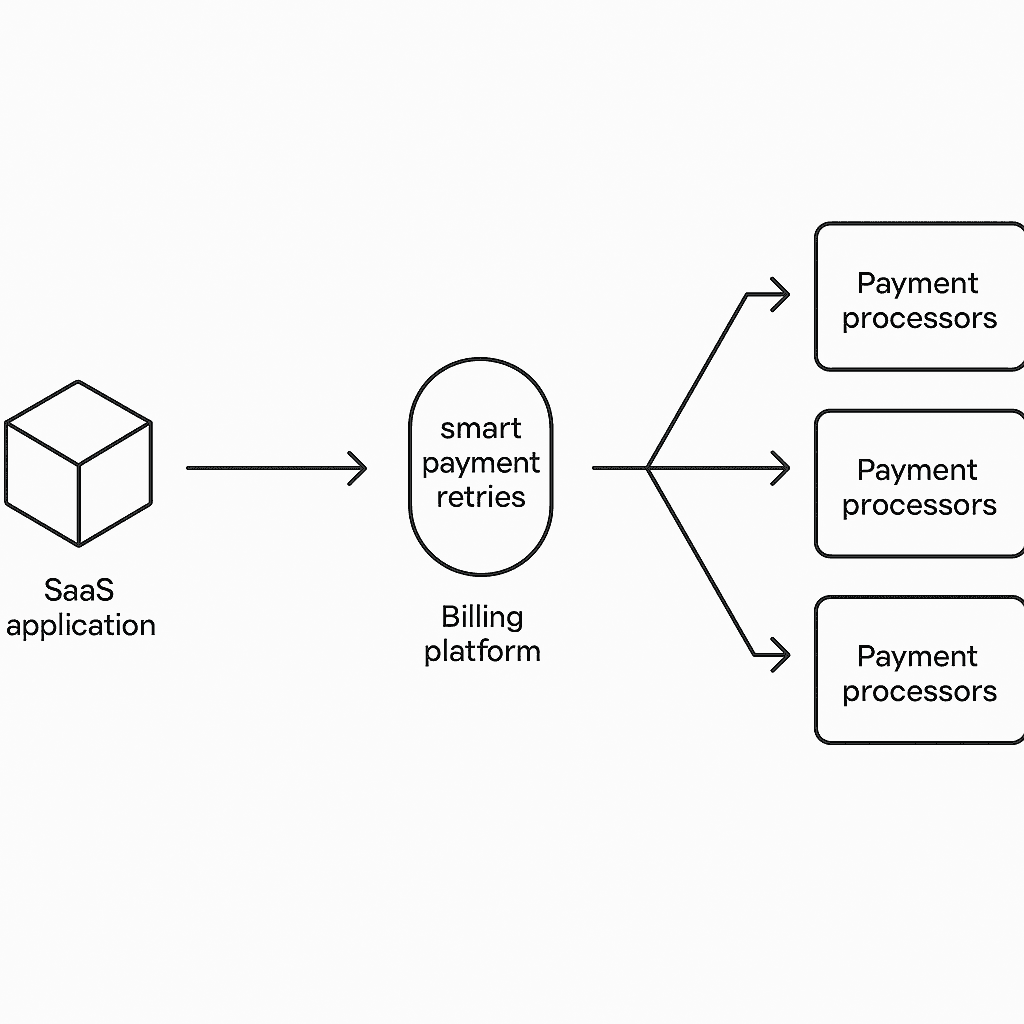

API-first solutions break these constraints. Multi-acquiring strategies intelligently route, dispatch, and recover transactions across multiple acquirers. They analyze decline reasons, apply fallback logic, and modify parameters in real-time, capabilities impossible through dashboard toggles alone.

What you give up with dashboard toggles

Dashboard-only approaches create invisible ceilings on recovery potential:

Retry caps: Mastercard allows "Mastercard allows 35 attempts and Visa 15 within a rolling 30 day period." Dashboard tools rarely optimize within these limits.

Single-processor lock-in: When your primary processor fails, dashboard-only systems have no fallback

Static routing: Can't dynamically switch based on card type, amount, or geography

Limited decline analysis: Stripe can't retry certain hard decline codes like stolen_card or authentication_required, but dashboards won't route these to alternative solutions

Where APIs unlock revenue

API integration transforms payment recovery from reactive to predictive:

Cross-processor orchestration: Automatically retry failed payments through different processors, recovering revenue even during outages

Dynamic retry strategies: Adjust timing based on real-time signals rather than fixed schedules

Smart routing intelligence: Route payments differently based on card type, country, and historical performance data

Custom ML models: Build recovery logic specific to your customer base and payment patterns

Which metrics prove a smart retries API beats DIY?

The economics of build-versus-buy tilt overwhelmingly toward API solutions. Creating a bare-bones MVP for real-time financial systems costs $345,000-$540,000 and requires 8-14 months of development. Meanwhile, API solutions typically cost 60-80% less over three years while delivering faster time-to-market.

Here's what to evaluate when comparing solutions:

Metric | Dashboard-Only | API-First Smart Retries |

|---|---|---|

Recovery Rate | 20-30% | 50-70%+ |

Implementation Time | Days | Hours |

Processor Flexibility | Single | Multiple |

Compliance Overhead | SOC 2 audits cost $15,000-$50,000/year | Included |

Custom ML Models | No | Yes |

ROI | 2-3x |

Companies switching from batch-based to intelligent retry strategies see 20-50% increases in recovered revenue. The compound effect is even more dramatic: subscriptions recovered by smart retries continue for an average of seven additional months.

How to weave smart retries into Chargebee, Zuora, or an in-house stack

Integration complexity depends on your existing infrastructure, but modern APIs make implementation surprisingly straightforward. Most teams embed "Most teams embed the API with < 50 lines of code and ship in two weeks".

For orchestration-based retries, the setup follows this pattern:

Zuora's Cascading Payment Method feature demonstrates platform-specific implementation: it dynamically retries failed payments using alternative methods from a priority list. The system supports both immediate cascading and retry-cycle cascading modes.

For custom implementations, Stripe recommends these core components:

Exponential backoff with jitter: Prevents server overload during retries

Idempotency keys: Ensures charges process only once despite network failures

Retry wrapper: Safely executes business logic with reasonable attempt limits

The key is starting small. Begin with soft decline handling, then expand to cross-processor routing as you validate recovery rates.

Staying compliant: brand-mandated retry limits and data standards

Payment networks enforce strict retry limits that vary by brand. Mastercard allows 35 attempts within rolling 30-day periods, while Visa caps at 15. Exceeding these limits "Exceeding these limits can lead to fines as high as $15,000."

Compliance extends beyond attempt counts:

Authentication requirements: 3D Secure failures typically block retry attempts

Data residency: Payment data must comply with regional regulations

Security standards: SOC 2 Type II audits alone cost $15,000-$50,000 annually

Smart retry APIs handle these requirements programmatically. They track attempt counts across processors, respect authentication outcomes, and maintain compliance logs, complexity that would overwhelm dashboard-based systems.

Putting it together: smarter retries, stronger margins

The math is compelling: subscription businesses hemorrhage 9% of revenue through payment failures, but smart payment retries can recover 70% or more of those losses. The difference between dashboard configuration and API orchestration isn't incremental; it's transformational.

API-first platforms unlock capabilities dashboards can't touch: cross-processor retries that automatically switch payment rails during failures, machine learning models trained on billions of transactions, and dynamic routing based on real-time performance data. While dashboard tools offer basic scheduling, APIs deliver true payment intelligence.

The five nines for API uptime may be gone, but that makes multi-processor strategies more critical than ever. When primary processors fail, API-orchestrated retries keep revenue flowing through alternative channels.

For high-volume subscription businesses using Chargebee, Zuora, or custom billing systems, the path forward is clear. Smart payment retries through API integration offer faster implementation, higher recovery rates, and lower total cost than any alternative. Slicker's AI engine exemplifies this approach, sitting atop existing billing infrastructure to maximize recovery without disrupting current operations.

The question isn't whether to implement smart retries, but how quickly you can plug your 9% revenue leak before competitors do.

Frequently Asked Questions

What is a smart payment retries API?

A smart payment retries API uses AI to optimize the timing and routing of retry attempts for failed transactions, significantly improving recovery rates compared to traditional methods.

How do smart payment retries differ from traditional methods?

Unlike traditional methods that use fixed schedules, smart payment retries analyze data to predict optimal retry windows and routes, increasing recovery rates by over 70%.

What are the benefits of using an API-first approach for payment retries?

An API-first approach allows for cross-processor orchestration, dynamic retry strategies, and smart routing intelligence, which are not possible with dashboard-only tools.

How does Slicker's AI engine enhance payment recovery?

Slicker's AI engine integrates with existing billing systems to reduce involuntary churn and increase recovered revenue by intelligently managing payment retries.

What compliance considerations are there for payment retries?

Payment retries must adhere to brand-mandated limits and data standards, such as authentication requirements and data residency laws, which smart retry APIs manage programmatically.

Sources

WRITTEN BY

Slicker

Slicker