Guides

10

min read

Smart payment retries error code 05: Fix soft declines automatically

Error code 05 "Do Not Honor" soft declines can be successfully recovered through AI-powered retry systems that analyze transaction patterns, optimize timing, and route through multiple gateways. Unlike generic retry schedules that treat all failures identically, smart retries achieve recovery rates up to 89% by evaluating each declined payment individually and determining the optimal retry strategy based on historical success patterns.

TLDR

• Error code 05 represents temporary soft declines that Visa allows up to 15 re-attempts within a 30-day window, making them prime candidates for intelligent retry strategies

• Generic retry systems lose 9% of subscription revenue by applying identical logic to all failures, while AI-powered systems deliver 7-13 percentage point approval lifts

• Smart retry engines analyze dozens of variables including transaction histories, time zones, and issuer behaviors to predict optimal retry timing and gateway routing

• First retry success rates jump from 10-15% with generic scheduling to 25-35% with intelligent timing

• Implementation requires respecting network retry limits, distinguishing soft from hard declines, and enabling multi-gateway routing for maximum recovery

• Modern AI systems reduce retry attempts by 40-60% while achieving 3-4x better overall recovery rates compared to fixed schedules

Error-code 05 soft declines drain revenue, but smart payment retries turn them into approvals. By combining AI timing, routing and issuer-specific rules, companies can recover more payments automatically, cutting involuntary churn at scale.

Why does error code 05 matter, and how do smart payment retries beat brute-force schedules?

Soft declines are the silent killers of SaaS cash flow. While hard declines signal definitive payment failures, soft declines represent temporary issues, insufficient funds, expired cards, or processing hiccups, that can often be resolved with the right retry strategy.

Error code 05, commonly known as "Do Not Honor," falls squarely into the soft decline category. Unlike hard declines that indicate permanent failures like stolen cards or closed accounts, Code 05 represents temporary refusals that merchants can retry. In fact, Visa allows up to 15 re-attempts for these temporary issues within a 30-day window.

The challenge lies in how error codes mask the real issues. As one payment recovery expert notes, "Error codes are inconsistent across banks and payment gateways, often mask multiple underlying issues, and ignore crucial context like customer history." Consider this reality: Amex uses identical codes for about 85% of their declines.

This inconsistency creates chaos for retry strategies. Gateway A might return "insufficient_funds," Gateway B prefers "NSF," while Bank C just sends "51", and they might all mean slightly different things. With modern payments potentially failing for roughly 160 different reasons, relying on error codes alone is like using a horoscope to make financial decisions.

The smart alternative? Build payment behavior profiles that track how specific banks and gateways actually behave. If Bank X historically approves 80% of retries after a specific error, that pattern matters more than the error code itself. This is where AI-powered smart retries fundamentally change the game.

Where does generic retry logic fall short?

Generic retry systems operate on a dangerous assumption: all failed payments deserve identical treatment. Batch systems typically apply identical retry logic to every declined transaction, missing critical nuances that determine success or failure.

The numbers tell a sobering story. Subscription businesses lose 9% of their revenue due to failed payments. Yet most companies still rely on fixed retry schedules that treat a Fortune 500 company's expired card the same as a startup's insufficient funds error.

This one-size-fits-all approach creates multiple problems:

Excessive retry fees: Blindly retrying payments that will never succeed wastes money on processing fees. Each failed attempt costs money, and those fees compound quickly when you're retrying thousands of transactions.

Network blacklisting risks: Card networks limit retries to 15 attempts in 30 days. Exceed these limits and you risk compliance violations, fines, or being flagged as a problematic merchant.

Customer friction: Generic retries often happen at inconvenient times, triggering multiple decline notifications that frustrate customers and damage trust.

Lost recovery opportunities: Fixed schedules miss optimal retry windows. Involuntary churn reduces revenue unnecessarily when payments that could succeed with proper timing fail repeatedly.

The hidden cost compounds over time. When generic retry logic fails to recover soft declines, those customers often disappear permanently. The relationship ends not because of dissatisfaction with the product, but because of payment infrastructure limitations.

How does an AI retry engine optimize timing, routing and messaging?

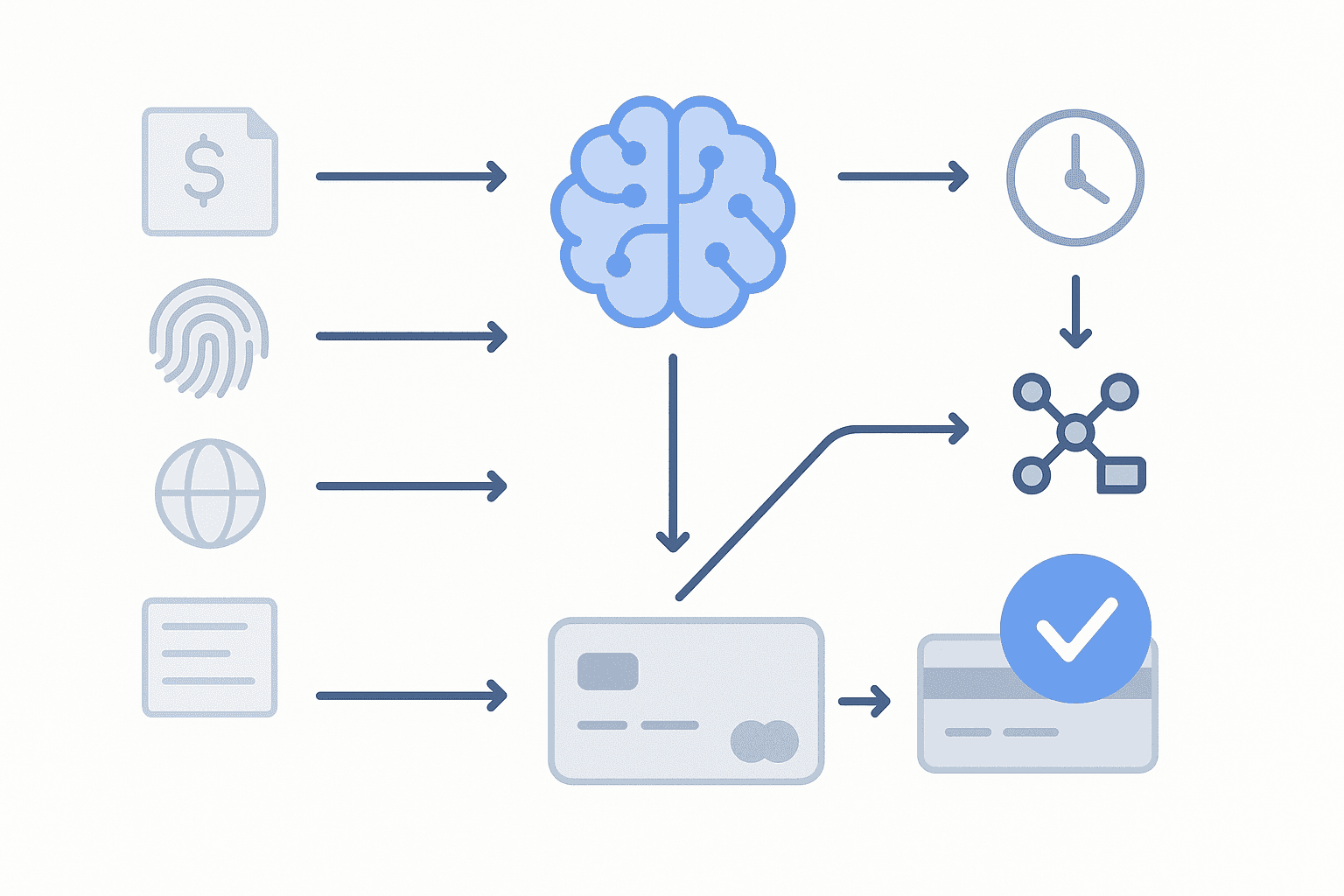

AI picks best retry times for failed payment attempts by analyzing patterns humans would never detect. Instead of following rigid schedules, machine learning models evaluate each transaction individually, considering dozens of variables simultaneously.

The core components work in concert:

Data inputs: AI engines ingest transaction histories, device fingerprints, time zones, spending patterns, and issuer behaviors. AI-powered multi-gateway routing evaluates each failed transaction individually, building comprehensive profiles that predict success probability.

Model outputs: The system generates three critical decisions for each failed payment:

Optimal retry timing (when the account likely has funds)

Best gateway routing (which processor has highest approval rates for this scenario)

Message optimization (how to frame the retry request to the issuer)

Real-time decision loops: Data-driven decision-making leverages machine learning to create adaptive retry schedules. The model continuously learns from each attempt, updating its predictions based on success and failure patterns.

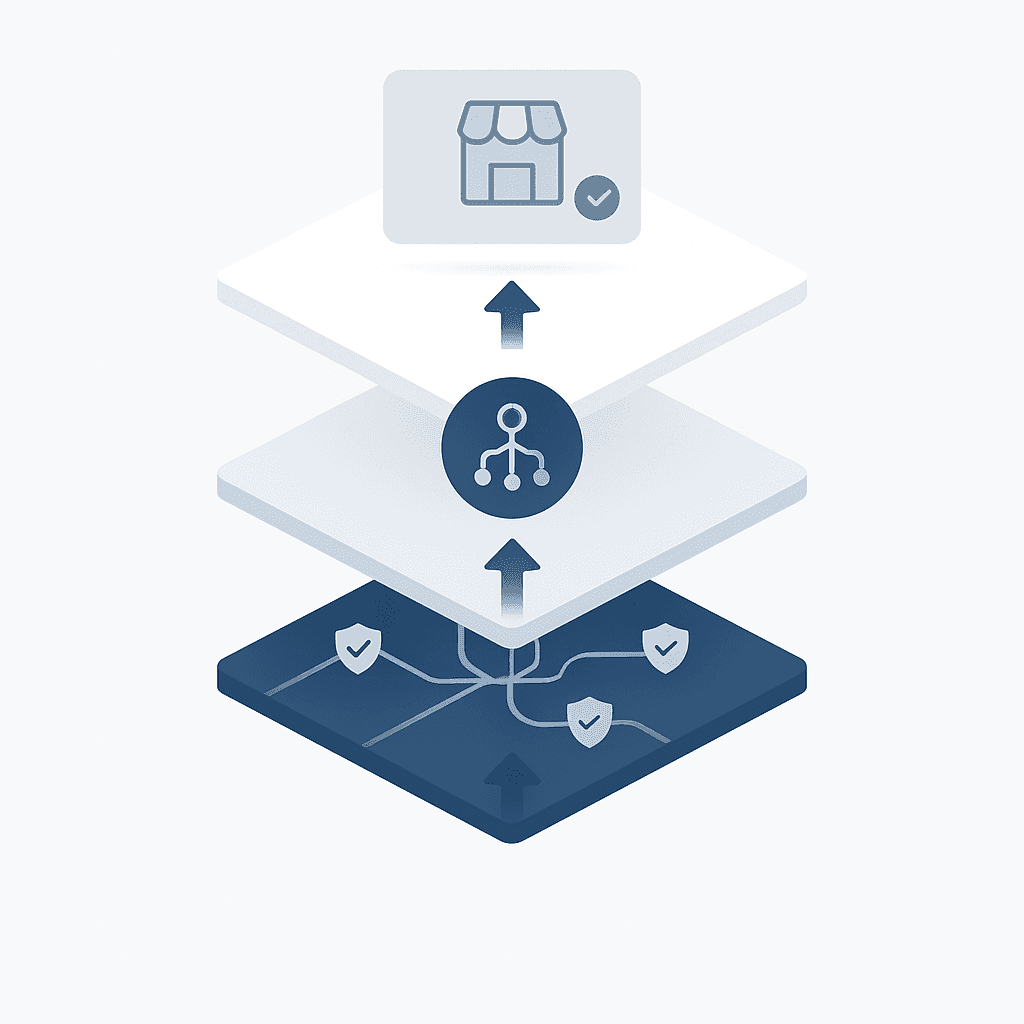

Routing intelligence: Modern AI engines don't just retry through the same gateway. They maintain relationships with multiple processors and route each retry through the path most likely to succeed. Adaptive Acceptance uses AI to optimize initial payment requests and automatically identify false declines in real time.

This orchestration happens invisibly. A payment fails at 3 PM on Friday. The AI knows this customer's employer deposits payroll on the 15th and 30th, their timezone is PST, and historically similar profiles succeed when retried at 6 AM on Monday through a specific gateway. The retry executes automatically at the optimal moment.

The sophistication extends beyond timing. AI models understand that "insufficient funds" from one bank might mean retry in 24 hours, while the same code from another bank suggests waiting until the next pay cycle. These nuanced decisions multiply recovery rates.

What do the numbers say? Benchmarks from Stripe, Recurly, Pagos & Slicker

The data from payment processors reveals the dramatic impact of intelligent retry systems compared to generic approaches:

Metric | Generic Retry | Smart Retry | Improvement |

|---|---|---|---|

First retry success rate | 10-15% | 2-3.5x | |

Overall recovery rate | 20-30% | 3-4x | |

Retry attempts needed | 3-5 optimized attempts | 40-60% reduction | |

Revenue impact | Baseline | Millions in ARR |

Platform-specific results demonstrate consistent patterns:

Stripe Smart Retries: The recommended default setting is 8 tries within 2 weeks, but their AI optimizes each attempt individually rather than following fixed intervals.

Recurly Intelligent Retries: Uses billions of transaction data points to predict optimal retry windows, particularly effective for soft declines.

Pagos optimization: First retry attempts after initial declines succeed 25-35% of the time when properly timed, compared to 10-15% for generic scheduling.

Slicker's multi-gateway routing: Machine-learning routing algorithms deliver 7-13 percentage point approval lifts versus single-processor setups. One merchant improved their success rate from 86% to 93%, transforming their unit economics overnight.

The compounding effect is remarkable. Failed payments represent 6 million transactions in recent analysis, yet smart retry systems recovered up to 89% of those failures. That recovery rate translates directly to retained revenue and reduced customer acquisition costs.

How do you implement smart payment retries without breaking compliance?

Implementing intelligent retry logic requires careful orchestration of technology, compliance, and customer experience:

1. Respect network retry limits

Visa allows up to 15 re-attempts within 30 days for soft declines. Mastercard permits 35 attempts. Your retry engine must track attempts across all gateways to avoid violations that trigger fines or merchant account issues.

2. Distinguish soft from hard declines

Card networks limit retries based on decline types. Hard decline codes like stolen_card or account_closed should never trigger retries. Your system needs real-time decline code interpretation to route appropriately.

3. Enable multi-gateway routing

Dynamic retries using alternative payment methods enhance success rates. Set up relationships with multiple processors and implement routing logic that selects the optimal gateway for each retry attempt.

4. Configure retry timing windows

Avoid retrying during typical insufficient funds periods (late in the month before payday). Instead, leverage data on payroll cycles, time zones, and historical success patterns.

5. Implement retry decay logic

First retries should happen quickly (within 24-48 hours) for technical failures. Subsequent attempts should space out progressively, with final attempts concentrated around likely funding events.

6. Monitor retry performance metrics

Track success rates by decline code, gateway, timing, and customer segment. AI continuously processes streaming data to identify patterns and optimize future attempts.

7. Maintain transparency with customers

Send a single, clear notification about payment issues rather than bombarding customers with failure alerts. Provide self-service options for updating payment methods.

8. Document your retry strategy

Maintain clear documentation of retry rules, timing logic, and compliance measures for audits and regulatory reviews.

Stop guessing, let AI fix soft declines before revenue leaks out

Error code 05 and other soft declines no longer need to drain your revenue. The technology exists today to transform these temporary failures into successful payments through intelligent retry orchestration.

The math is compelling: Amex uses identical codes for 85% of their declines, yet AI-powered systems achieve recovery rates approaching 90%. That gap between error code ambiguity and recovery success represents millions in retained revenue.

Smart payment retries aren't just about technology, they're about recognizing that each failed payment has unique characteristics that determine the optimal recovery path. Generic retry schedules treat symptoms. Building payment behaviour profiles for each bank and gateway combination addresses root causes.

For subscription businesses watching involuntary churn erode their growth, the choice is clear. Fixed retry schedules belong in the past alongside batch processing and manual dunning. Modern AI retry engines deliver measurable improvements in recovery rates, reduced processing costs, and customer retention.

Slicker's intelligent payment recovery platform exemplifies this evolution. By evaluating each failed transaction individually, scheduling optimal retries, and routing through the best gateway, Slicker helps subscription companies transform payment failures into recovered revenue. The platform's machine-learning engine continuously adapts to changing payment patterns, ensuring your recovery rates improve over time rather than stagnating with fixed rules.

The future of payment recovery isn't about trying harder, it's about trying smarter. Let AI handle the complexity of soft decline recovery while you focus on growing your business.

Frequently Asked Questions

What is error code 05 in payment processing?

Error code 05, also known as "Do Not Honor," is a soft decline indicating a temporary refusal of a payment transaction. It often results from issues like insufficient funds or expired cards, which can be resolved with strategic retry attempts.

How do smart payment retries differ from generic retry logic?

Smart payment retries use AI to analyze transaction patterns and optimize retry timing, routing, and messaging. Unlike generic retries that apply the same logic to all transactions, smart retries consider individual transaction histories and issuer behaviors to improve success rates.

Why are soft declines significant for subscription businesses?

Soft declines, such as error code 05, can lead to involuntary churn if not managed properly. Subscription businesses risk losing up to 9% of their revenue due to failed payments, making effective retry strategies crucial for revenue recovery.

How does AI improve payment retry success rates?

AI enhances payment retry success by evaluating each transaction individually, considering factors like transaction history, time zones, and issuer behaviors. This allows for optimized retry timing and routing, significantly increasing recovery rates compared to generic methods.

What compliance measures are necessary for implementing smart retries?

To implement smart retries, businesses must respect network retry limits, distinguish between soft and hard declines, enable multi-gateway routing, and configure retry timing windows. Monitoring performance metrics and maintaining transparency with customers are also essential for compliance.

Sources

WRITTEN BY

Slicker

Slicker