Guides

10

min read

Smart payment retries for LATAM cards: Recover failed Brazil payments

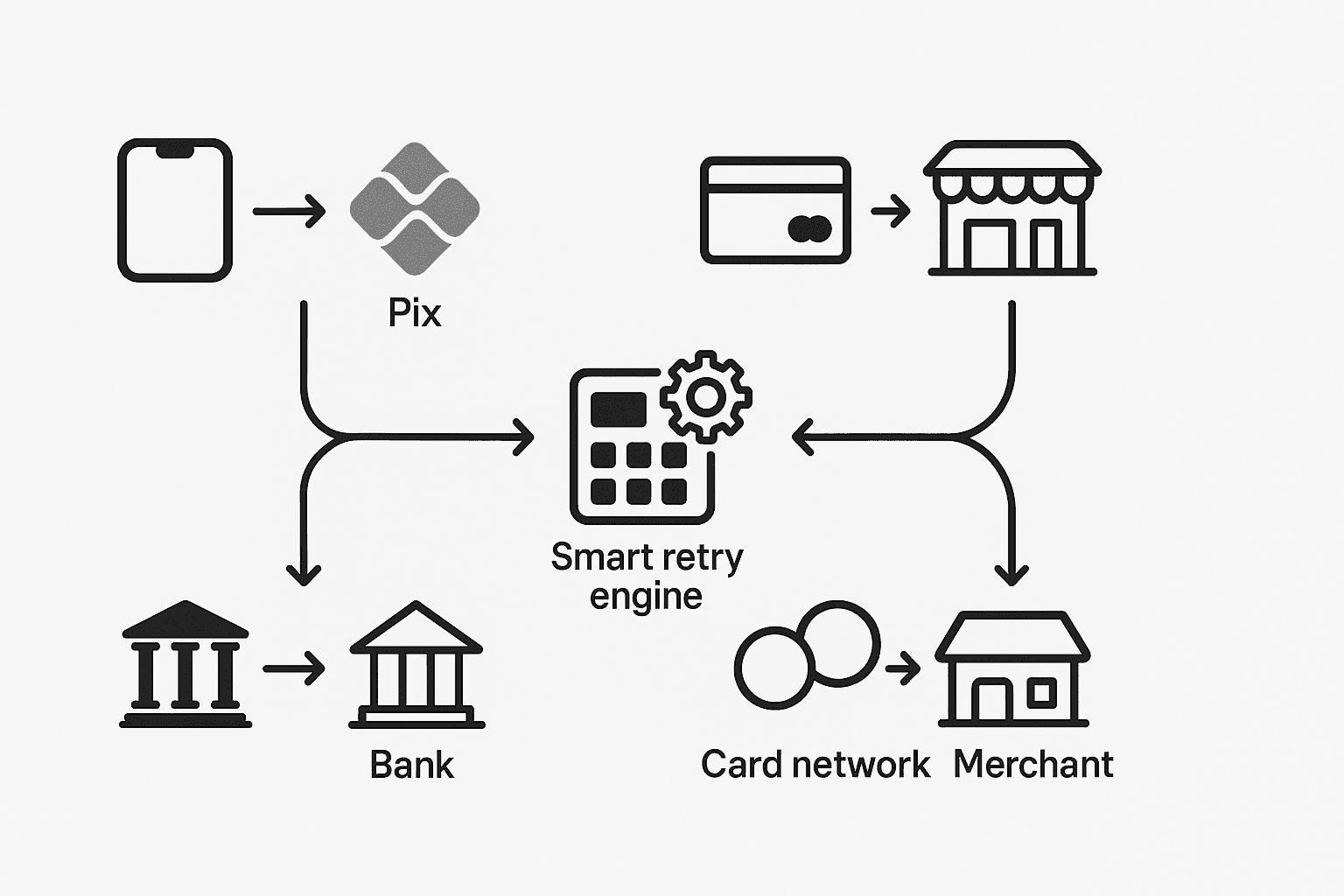

Smart payment retries for Brazil use AI to analyze Pix transaction limits, device signals, and funding cycles to optimize recovery timing. Unlike generic batch processing, region-specific engines achieve 25-35% success rates on first retry by adapting to Brazil's dual payment rails where Pix moves 20% of transactional volume alongside traditional cards.

Key Facts

• Brazil's Pix system serves 75% of the population with strict retry limits of three attempts within seven days

• Smart retry engines deliver 20-50% increases in recovered revenue compared to generic batch processing

• Failed payments cause 9% revenue loss for subscription businesses, with involuntary churn accounting for 20-40% of total churn

• LATAM's subscription economy will reach $39 billion by 2026, nearly doubling from current $20 billion valuation

• Region-aware retry systems analyze decline reasons, customer payment history, and optimal timing windows to maximize authorization rates

• Brazil's upcoming Pix Parcelado feature will introduce installment payments, requiring even more sophisticated retry logic adaptation

Why 'smart payment retries' matter in LATAM

In the subscription economy, failed payments represent a critical revenue leak that businesses can't afford to ignore. With subscription businesses losing 9% of revenue due to failed payments, the need for intelligent recovery strategies has never been more urgent.

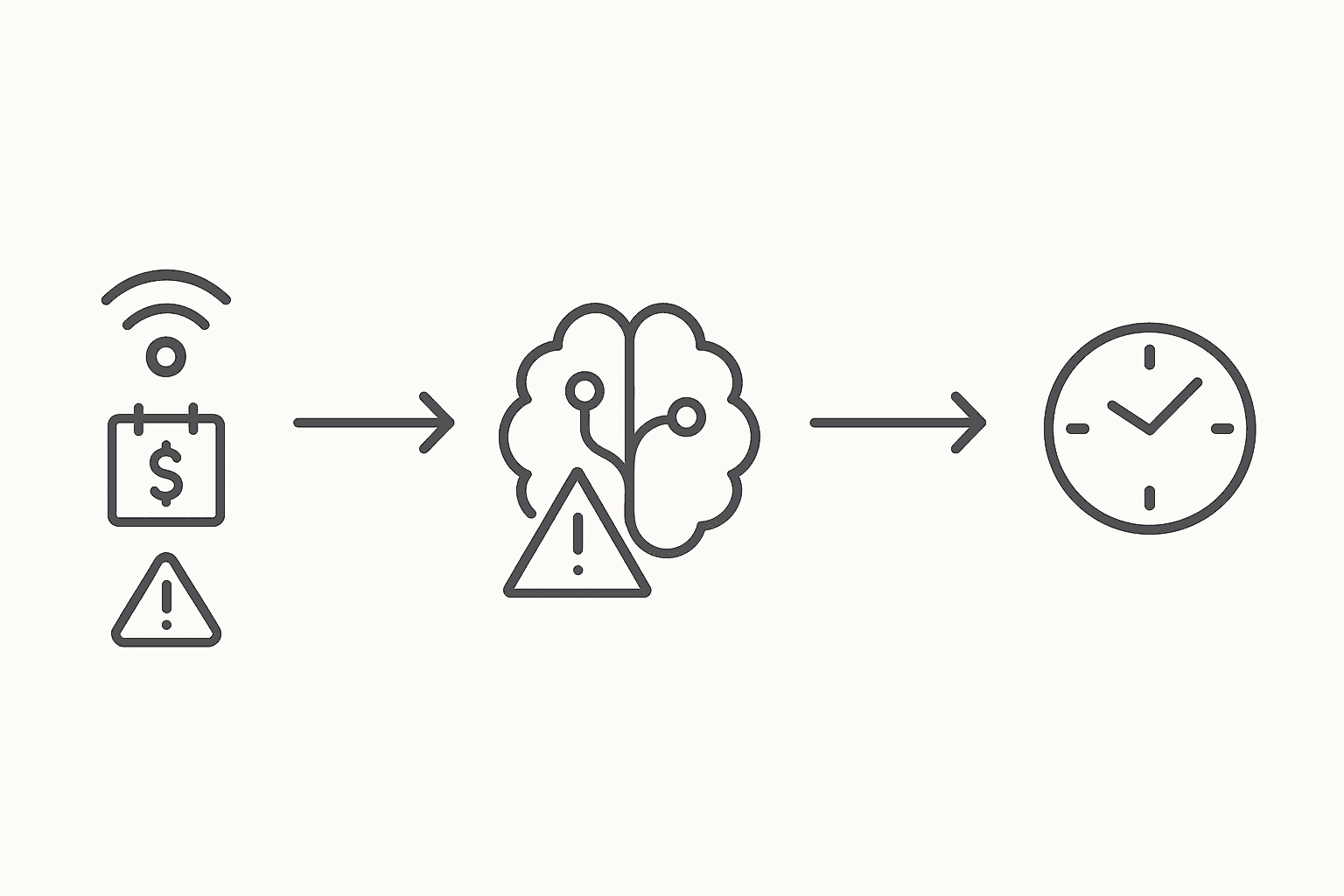

Smart payment retries use machine learning to re-process failed transactions at the moment they have the highest chance of success. Unlike batch systems that blindly re-run every decline, smart engines analyze issuer response codes, customer funding cycles, and device signals to craft an optimal schedule. The results speak for themselves: involuntary churn accounts for 20-40% of total customer churn in the subscription economy, with up to 70% of that stemming from failed transactions. Stripe's recovery tools help businesses recover 57% of failed recurring payments on average.

Traditional batch processing is the equivalent of fishing with dynamite when precision angling tools are readily available. Smart retries represent a fundamental shift in how businesses approach payment recovery, moving from generic, one-size-fits-all strategies to individualized, data-driven approaches that maximize recovery while minimizing costs.

How big is the LATAM subscription boom—and why do Brazil's payment rails demand special treatment?

The LATAM subscription economy is experiencing explosive growth, currently valued at $20 billion and expected to nearly double to $39 billion by 2026. With 80% of users accessing subscription services via smartphones, the region presents unique opportunities and challenges for payment recovery.

Brazil's payment infrastructure stands apart from the rest of LATAM. The Pix system has transformed the Brazilian payments landscape since its 2020 launch, achieving adoption by more than 150 million users. Today, Pix is used by more than 75% of Brazilians and over 15 million businesses, moving 20% of the country's total transactional volume.

This unique payment ecosystem demands specialized retry intelligence. Generic retry logic developed for card-centric markets fails to account for Brazil's dual payment rails, where instant payments via Pix coexist with traditional card networks. The result is a complex retry landscape that requires region-specific AI adaptation to maximize recovery rates.

Generic retry logic vs AI-driven strategies: what's the real uplift?

The difference between generic and AI-driven retry strategies is stark. As one industry expert notes, "Batch processing is the equivalent of fishing with dynamite when precision angling tools are readily available."

Companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue. AI-powered systems analyze payment failure patterns, customer behavior, and optimal timing to maximize recovery success rates. Stripe's recovery tools help businesses recover 57% of failed recurring payments on average, while Pagos highlights impressive results: "On average, Pagos customers find the first retry after a decline succeeds 25-35% of the time!"

The key differentiator lies in the intelligence layer. While generic systems apply identical retry logic to all failed payments, AI-driven strategies consider multiple variables including decline reasons, customer payment history, and even the day of the month. This granular approach transforms payment recovery from a blunt instrument into a precision tool.

What do Pix caps and card rules mean for retry engines in Brazil?

Brazil's payment regulations create unique constraints that retry engines must navigate carefully. According to Pix Automático rules, merchants can submit up to three retries within a seven-day window, limited to one retry per day. These strict limits mean every retry attempt must be optimized for success.

The complexity extends beyond simple retry limits. It is possible to request up to three retries within a seven-day window, with a maximum of one retry per day, but timing matters immensely. Brazil's Central Bank is implementing limits for PIX transactions made from unrecognized devices, adding another layer of complexity to retry strategies.

Furthermore, Brazil is set to launch Pix Parcelado, a buy now, pay later feature that will introduce installment payments to the Pix ecosystem. This development will further complicate retry strategies, requiring engines to differentiate between immediate payments and installment-based transactions.

Which smart-retry tactics lift authorization rates?

Successful smart retry implementation requires a multi-faceted approach that combines technology with strategic timing. Using AI, Smart Retries chooses the best times to retry failed payment attempts to increase the chance of successfully paying an invoice.

Key tactics that lift authorization rates include:

Device signal analysis: With Pagos' Real-Time and Batch Account Updater APIs, merchants can request updates on failing cards before attempting another retry

Optimal timing windows: Yuno's Smart Retries use advanced machine learning techniques to determine the best timing for retrying declined recurring credit card payments

Multi-channel orchestration: AI software solutions can analyze patterns in historical data and predict which strategies will yield the best results for various customer segments across different regions

The data speaks volumes about effectiveness. One notable success story: Banxa recovered over US$7 million in revenue in the first half of 2024 by implementing automated payment retry strategies.

How Slicker stacks up against Stripe, Yuno & Primer

The payment retry landscape features several major players, each with distinct approaches to recovery optimization.

Provider | Key Strength | Recovery Rate | Regional Focus |

|---|---|---|---|

Stripe | Global with limited LATAM specificity | ||

Yuno | NOVA recovered up to 75% on answered calls | 8% lift in recovery rates for Rappi | Strong LATAM presence |

Primer | AI-powered fallbacks | US$7 million recovered (Banxa case) | Global orchestration |

Slicker | Customized per transaction | LATAM-specific optimization |

What sets these platforms apart goes beyond raw numbers. ACI supports over 20 real-time domestic schemes around the world, demonstrating the importance of scheme-specific optimization. Meanwhile, the payment orchestration market will be worth over US$15 billion by 2026, highlighting the growing recognition of specialized retry solutions.

How do fraud and compliance shape retry strategy in LATAM?

Fraud and compliance considerations fundamentally shape retry strategies in LATAM markets. First-party and third-party fraudulent chargebacks together account for approximately 45% of merchant chargeback volume, making intelligent retry timing critical to avoid triggering fraud flags.

Brazil's evolving regulatory landscape adds complexity. Mexico's new CNBV regulation requires financial institutions to implement fraud prevention plans and establishes individual transaction limits. In Brazil specifically, dispute windows extend to 120 days for local cards and 180 days for international cards, meaning retry strategies must balance aggressive recovery with chargeback risk.

The key takeaway: Every unnecessary retry attempt increases fraud scores and dispute likelihood, making precision essential for sustainable recovery programs.

Putting it all together

Region-aware smart retries represent the fastest path to lower churn in Brazil's complex payment landscape. The future of payment recovery isn't about retrying more - it's about retrying smarter.

Successful implementation requires understanding Brazil's unique payment ecosystem, from Pix retry limits to device-based fraud caps. Generic batch processing simply cannot adapt to these regional nuances. In the subscription economy, failed payments represent a critical revenue leak that businesses can't afford to ignore - and in Brazil, that leak demands specialized solutions.

For subscription businesses operating in LATAM, the choice is clear: adopt intelligent, region-specific retry strategies or continue losing revenue to preventable payment failures. Slicker's AI engine sits on top of existing billing and payment systems, delivering the precision needed to maximize recovery while respecting Brazil's unique regulatory and technical constraints. The result? Lower involuntary churn, increased recovered revenue, and stronger business margins in one of the world's most dynamic subscription markets.

Frequently Asked Questions

What are smart payment retries?

Smart payment retries use machine learning to re-process failed transactions at optimal times, increasing the chances of successful payment recovery by analyzing issuer response codes, customer funding cycles, and device signals.

Why is Brazil's payment infrastructure unique?

Brazil's payment infrastructure is unique due to the Pix system, which allows instant payments alongside traditional card networks. This dual system requires specialized retry intelligence to effectively recover failed payments.

How do AI-driven retry strategies differ from generic ones?

AI-driven retry strategies analyze multiple variables such as decline reasons and customer payment history to optimize recovery, unlike generic strategies that apply the same logic to all failed payments, often resulting in lower recovery rates.

What are the regulatory constraints for payment retries in Brazil?

In Brazil, Pix Automático rules allow up to three retries within a seven-day window, with a maximum of one retry per day. These constraints require precise timing to maximize recovery success while adhering to regulatory limits.

How does Slicker optimize payment recovery in LATAM?

Slicker uses AI to tailor retry strategies to the unique payment landscape of LATAM, particularly Brazil, by integrating with existing billing systems to reduce involuntary churn and increase recovered revenue.

Sources

https://www.ppro.com/insights/subscriptions-and-recurring-payments-the-latam-revolution/

https://www.jpmorgan.com/content/dam/jpmorgan/documents/payments/payments-without-borders.pdf

https://www.slickerhq.com/blog/one-size-fails-all-the-case-against-batch-payment-retries

https://www.pymnts.com/wp-content/uploads/2025/05/PYMNTS-Real-Time-Payments-World-Map-May-2025.pdf

https://stripe.com/docs/billing/revenue-recovery/smart-retries

https://www.slickerhq.com/blog/how-to-implement-ai-powered-payment-recovery-to-mi-00819b74

https://developers.payulatam.com/latam/en/docs/tools/disputes.html

WRITTEN BY

Slicker

Slicker