Guides

10

min read

Visa debit soft declines? How to recover failed subscription payments

Visa debit soft declines are temporary authorization failures that can be recovered through strategic retries within scheme limits. These declines, which make up 80-90% of all payment failures, occur due to insufficient funds, authentication requirements, or issuer system issues. Subscription businesses can recover up to 70% of these failed transactions using intelligent retry timing, multi-gateway routing, and AI-powered recovery engines that optimize attempts within Visa's 15-retry/30-day limit.

TLDR

Soft declines are temporary payment failures caused by insufficient funds, authentication issues, or technical problems, accounting for 80-90% of all declines

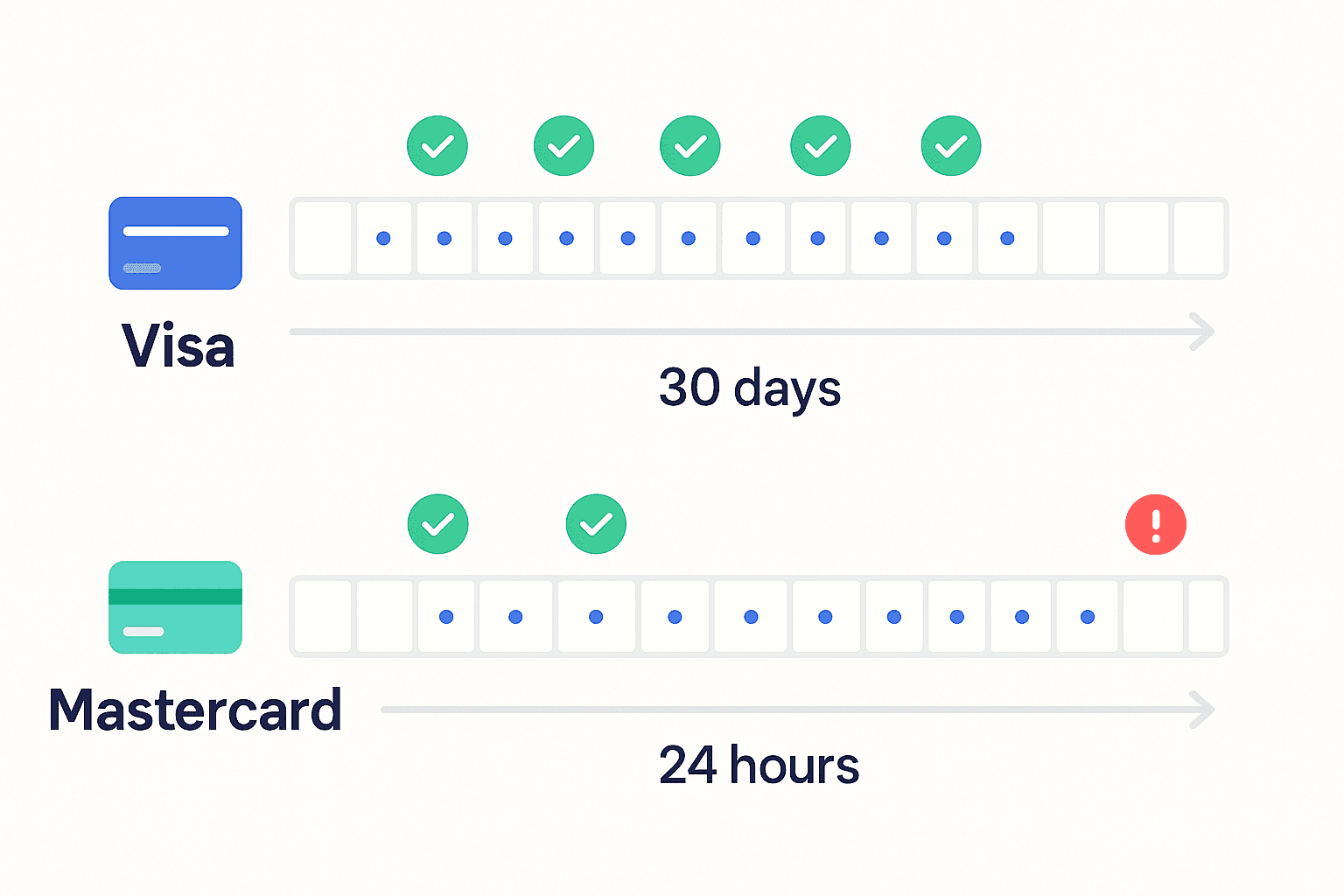

Visa permits up to 15 retry attempts within 30 days for soft declines, while Mastercard allows 9 attempts in 24 hours

Failed payments cost subscription businesses 10-15% of annual revenue, with involuntary churn representing 20-40% of total customer loss

Smart retry strategies can recover up to 70% of failed transactions through optimal timing and multi-gateway routing

AI-powered solutions like Slicker deliver 10-20 percentage point recovery increases compared to traditional dunning methods

Subscription merchants can't afford to ignore Visa debit soft declines. These temporary authorization failures quietly erode monthly recurring revenue (MRR), and left unaddressed, they compound into significant involuntary churn. This post unpacks why they happen, the real dollar impact, and a data-backed playbook to turn Visa debit soft declines into recovered cash.

Why Visa debit soft declines matter for subscription businesses

Every failed payment represents a subscriber who wanted to stay but couldn't. Unlike voluntary cancellations, these customers never chose to leave.

The scale of the problem is staggering. Soft declines are temporary failures, and they make up between 80% to 90% of all declines. That means the vast majority of payment failures hitting your billing system are recoverable if you act correctly.

Across the subscription economy, involuntary churn rates account for 20-40% of total customer churn. In high-growth subscription businesses, card declines, bank rejections, and soft errors collectively wipe out as much as 4% of MRR.

For a company processing $1 million in monthly subscriptions, that's $40,000 in potential revenue loss each month from payment failures alone.

Key takeaway: Most payment declines are soft declines, and most soft declines are recoverable with the right approach.

What exactly is a soft decline (and how does it differ from a hard decline)?

A soft decline is a temporary authorization failure where the issuer cannot approve the charge right now but has not permanently rejected the card.

Soft declines occur when a payment fails due to temporary or resolvable issues. Common causes include:

Insufficient funds

"Do Not Honor" responses

Authentication required (3-D Secure)

Issuer downtime or system glitches

Daily spending limits exceeded

Hard declines, by contrast, are permanent failures that cannot be resolved by retrying. Examples include:

Decline Type | Examples | Action Required |

|---|---|---|

Soft decline | Insufficient funds, network timeout, issuer outage | Retry at optimal time |

Hard decline | Stolen card, closed account, invalid card number | Request new payment method |

The critical distinction: soft declines are temporary and often recoverable, while hard declines signal the payment method is no longer valid.

Non-sufficient funds (NSF) declines alone account for around 44% of all card declines. Since these are almost always soft declines, a significant portion of your failed payments can be recovered with proper retry logic.

How much revenue do Visa debit soft declines really cost?

The financial impact of soft declines extends far beyond the initial failed transaction.

Consider these figures:

Approximately 11% of attempted online payments fail, and two-thirds of these failures result in permanent lost revenue

15-30% of recurring payments fail, with high-risk merchants experiencing rates at the upper end

10-15% of subscription revenue disappears annually due to payment failures like expired cards and insufficient funds

The cost extends beyond the immediate transaction. According to a Visa study, in-person transactions fail just 1.5% of the time, eCommerce transactions fail 15% of the time, and recurring transactions fail 24% of the time.

Perhaps most concerning: false declines, many of which are soft declines, cost merchants in the UK, US, France, and Germany as much as $20.3 billion a year.

Key takeaway: Recurring subscription payments have the highest failure rates of any transaction type, making soft decline recovery essential for subscription businesses.

Visa retry rules & card-scheme compliance: How many attempts are allowed?

Understanding scheme limits is critical. Exceed them, and you risk hefty fines and permanent issuer blocks.

Visa retry limits

Visa allows 15 attempts within a 30-day period for soft declines. This applies to temporary issues like insufficient funds or technical downtime.

Mastercard retry limits

Mastercard is stricter: only 9 attempts within a 24-hour period.

Decline code categories

Visa categorizes decline codes to guide retry behavior:

Category 1: Never retry (issuer will never approve)

Codes: 04, 07, 14, 41, 43, 46 (stolen/lost cards, closed accounts)

Category 2: Retry allowed (issuer cannot approve at this time)

Codes: 51 (insufficient funds), 61 (exceeds limit), 91 (issuer inoperative)

Category 3: Revalidate first (data quality issues)

Codes: 54 (expired card), 55 (incorrect PIN), 1A (authentication required)

Visa has introduced System Integrity Fees to enforce proper decline code management. Excessive retries on Category 1 codes or improper handling can trigger penalties.

Effective November 2021, Visa requires that no more than 5% of card-not-present declines use the generic "05" (do not honour) response code. This pushes issuers toward more descriptive codes, helping merchants optimize retry strategies.

What tactics convert Visa soft declines into successful payments?

Recovering soft declines requires a combination of smart timing, intelligent routing, and strategic communication.

"When a customer's payment fails, it's rarely a choice of their own volition," notes IXOPAY in their white paper on revenue recovery. "The silent profit killer of involuntary churn burdens your support team, frustrates otherwise happy customers, and decimates your bottom line."

The good news: smart failed payment recovery can recover 70% of failed transactions by timing attempts optimally and routing intelligently.

A proven framework for revenue recovery includes smart retry logic, dynamic routing, and network tokenization.

1. Smart payment retry schedules

Intelligent retries are the most effective strategy. Instead of immediately retrying or using fixed intervals, configure your payment system to retry at optimal times, such as:

Later in the day

The next morning

On common paydays (1st, 15th of the month)

Card networks limit retries to 15 attempts in 30 days. Strategic spacing prevents compliance violations while maximizing recovery odds.

Visa allows up to 15 re-attempts for temporary issues like insufficient funds or technical downtime within 30 days. Use this window wisely rather than burning through attempts immediately.

2. Multi-gateway & fallback routing

Sometimes a decline occurs because of processor-specific issues, not the card itself. Multi-gateway approaches immediately recover about 8% of failures by trying alternate processors.

Leading solutions automatically route retries through the processor with the highest real-time acceptance probability, rather than forcing merchants to orchestrate this themselves.

Ferryhopper provides a real-world example: by adopting Primer's Fallbacks feature, they automated rerouting declined transactions to secondary processors, recovering 1% of total bookings.

AI-powered recovery engines: Slicker vs. legacy dunning & other vendors

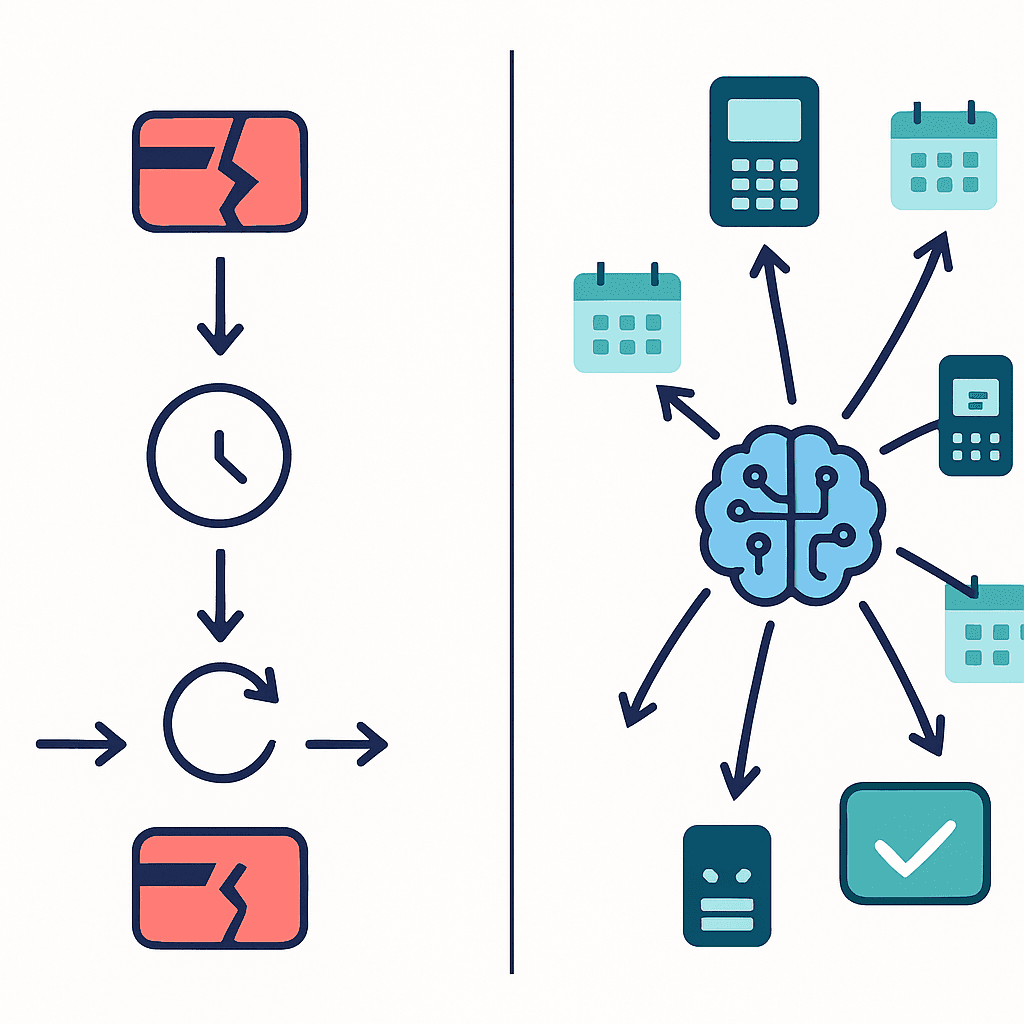

Traditional dunning systems use static retry schedules and generic decline-code rules. AI-driven recovery solutions take a fundamentally different approach.

The best AI recovery engines:

Interpret decline reasons dynamically

Adjust retry timing based on historical patterns

Route through optimal processors in real-time

Automate customer outreach when necessary

FlexPay claims clients can recover up to 70% of failed payments. Their "Invisible Recovery" approach works directly with payment systems to recover most failed payments without customers knowing their payment was declined.

Vindicia Retain uses AI and ML to automatically recapture up to 50% of failed transactions, including issues like expired cards, suspicious activity, and insufficient funds.

How Slicker compares

Slicker takes a different approach with its pay-for-success model and multi-gateway routing. The YC-backed platform processes each failed payment individually and schedules intelligent, data-backed retries rather than blindly following generic decline-code rules.

Customers typically see a 10-20 percentage point recovery increase and a 2-4x boost versus native billing logic.

Key differentiators:

Feature | Traditional Dunning | AI Recovery Engines |

|---|---|---|

Retry timing | Fixed schedules | Dynamic, data-driven |

Decline code handling | Generic rules | Individual analysis |

Processor routing | Single gateway | Multi-gateway optimization |

Pricing | Monthly SaaS fee | Pay-for-success (Slicker) |

Slicker's pay-for-success model means you only pay for successfully recovered payments, aligning vendor incentives with your outcomes.

Implementation checklist for subscription merchants

Follow this step-by-step guide to improve your soft decline recovery:

Map your decline codes

Configure your system to receive the

OriginalISOResponseCodefieldCategorize declines by Visa's Category 1, 2, and 3 classifications

Never retry Category 1 (permanent) declines

Set up intelligent retry schedules

Space retries to stay within Visa's 15-attempt/30-day limit

Prioritize paydays and morning hours for insufficient funds declines

Enable card account updaters

Automatically refresh expired or replaced card details using services from the card networks

Proactively update cards before renewal dates

Configure fallback processors

Add secondary payment gateways

Route failed transactions to alternate processors automatically

Handle permanent blocks correctly

If a transaction is rejected with a "Do not try again" error code, update your recurring agreement with a new card before trying again

Trigger customer outreach for hard declines

Detect failed payments instantly

Slicker's platform detects failed payments instantly and creates optimal retry schedules

Real-time detection enables faster recovery

Evaluate AI-powered recovery

Compare your current recovery rate against AI solutions

Consider pay-for-success models to minimize risk

Stop leaving Visa debit revenue on the table

Visa debit soft declines represent recoverable revenue, not permanent losses. With the right approach, subscription businesses can reclaim a significant portion of failed payments and reduce involuntary churn.

The key elements of an effective recovery strategy:

Understand the difference between soft and hard declines

Respect card scheme retry limits to avoid penalties

Implement intelligent retry timing based on decline reasons

Use multi-gateway routing to maximize approval rates

Consider AI-powered solutions for optimal recovery

Slicker customers typically see between a 10 and 20 percentage point increase in recovered payments. The platform's pay-for-success pricing means you only pay for results, with a one-month free trial to evaluate performance firsthand.

For subscription businesses looking to plug revenue leaks from Visa debit soft declines, Slicker offers a low-risk way to test AI-powered recovery against your current system.

Frequently Asked Questions

What are Visa debit soft declines?

Visa debit soft declines are temporary authorization failures where the issuer cannot approve the charge at the moment but has not permanently rejected the card. These declines are often due to issues like insufficient funds or network timeouts and are typically recoverable with the right approach.

How do soft declines differ from hard declines?

Soft declines are temporary and often recoverable, caused by issues like insufficient funds or issuer downtime. Hard declines, on the other hand, are permanent failures indicating the payment method is no longer valid, such as a stolen card or closed account.

What is the financial impact of Visa debit soft declines on subscription businesses?

Visa debit soft declines can significantly impact subscription businesses by contributing to involuntary churn and revenue loss. For instance, a company processing $1 million in monthly subscriptions could lose $40,000 monthly due to payment failures, highlighting the importance of effective recovery strategies.

How can subscription businesses recover from Visa debit soft declines?

Businesses can recover from Visa debit soft declines by implementing smart retry schedules, using multi-gateway routing, and leveraging AI-powered recovery engines. These strategies help optimize retry timing, route payments through the best processors, and automate customer outreach when necessary.

What are Visa's retry limits for soft declines?

Visa allows up to 15 retry attempts within a 30-day period for soft declines. It's crucial to space these attempts strategically to maximize recovery chances while staying compliant with card scheme rules.

How does Slicker help in recovering failed payments?

Slicker uses AI-driven recovery solutions to interpret decline reasons dynamically, adjust retry timing, and optimize processor routing. Their pay-for-success model ensures businesses only pay for successfully recovered payments, offering a low-risk way to improve recovery rates.

Sources

https://checkout.com/blog/when-should-merchants-prepare-for-soft-declines

https://developer.nexigroup.com/netaxept/en-EU/docs/managing-authorization-reattempts

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://www.slickerhq.com/blog/what-is-involuntary-churn-and-why-it-matters

https://developer.kalixa.com/docs/visa-system-integrity-fees

https://docs.thredd.com/pdf/Card_Status_Reponse_Codes_Changes_1.7.pdf

https://www.ixopay.com/whitepapers/turning-failed-subscription-payments-into-recovered-revenue

https://vindicia.com/technical-center/faq/vindicia-retain-faq/

WRITTEN BY

Slicker

Slicker