Guides

10

min read

What is AI payment error resolution? Beyond basic retry logic

AI payment error resolution uses machine learning to analyze hundreds of transaction signals—decline codes, customer history, issuer patterns—to predict optimal retry timing and routing for failed payments. Unlike static retry schedules that leave revenue on the table, AI models can increase recovery rates by up to 14% while simultaneously detecting fraud patterns that rules-based systems miss.

TLDR

Traditional retry logic follows rigid schedules regardless of decline reasons, while AI analyzes transaction patterns to determine optimal recovery timing

Machine learning models evaluate decline codes, customer tenure, issuer behavior, and network intelligence to predict when retries will succeed

AI-driven recovery can lift success rates by up to 14% compared to static schedules, with some solutions recovering up to 50% of terminally failed transactions

Modern systems combine predictive retry logic with fraud detection, achieving 38% average fraud reduction through anomaly detection

Since 70% of involuntary churn stems from failed payments, even modest recovery improvements significantly impact subscriber retention

Every failed subscription payment is a silent leak in your revenue bucket. When a card declines, most billing systems fire the same retry schedule they used a decade ago: wait 24 hours, try again, repeat. That rigid approach ignores why the payment failed in the first place. AI payment error resolution changes the equation by using machine learning to predict the best moment, method, and route to recover a transaction while simultaneously flagging suspicious activity.

This post unpacks how adaptive intelligence outperforms static rules, the measurable impact on churn and fraud, and what subscription businesses should consider when implementing an AI-first recovery strategy.

From static rules to adaptive intelligence: defining AI payment error resolution

Traditional retry logic is blunt. A billing system might retry every card decline at fixed intervals regardless of the decline reason, the customer's payment history, or the issuer's uptime. As one BIS working paper notes, routine cash-management tasks could be automated using general-purpose large language models, potentially reducing operational costs and improving intraday liquidity efficiency.

AI payment error resolution replaces that one-size-fits-all cadence with models trained on transaction patterns. Instead of a hard-coded "retry in 48 hours" rule, an ML engine evaluates hundreds of signals, including decline codes, customer tenure, day of week, and issuer behavior, to decide when a retry is most likely to succeed.

Accenture research underscores the shift already underway: "Leading banks are already investing significantly in AI and generative AI and have managed to automate 40% of manual tasks in their payments business." The same momentum is reaching subscription billing, where 70% of involuntary churn stems from failed payments that could have been recovered with smarter timing and routing.

Why do rules-based retries leave revenue on the table?

Hard-coded retry schedules fail because they lack context. Consider the following limitations:

Blind to issuer behavior. A rule that retries every decline after 24 hours cannot account for the fact that some issuers batch authorizations overnight while others clear in real time.

No customer segmentation. A long-tenured subscriber with a temporary insufficient-funds error deserves a different cadence than a new trial user whose card was declined for suspected fraud.

Static thresholds. Traditional fraud rules, such as blocking all cards used abroad, may block many good transactions.

Recurly discovered these pitfalls firsthand when exploring static retry models. The company found that "Dynamic models deliver stronger results than static models" because success depends on too many variables for a lookup table to capture.

Beyond missed recoveries, rigid rules create fraud exposure. A BIS machine-learning framework achieved a 93% detection rate, a significant improvement over commonly-used econometric models, marking a 44% gain in out-of-sample accuracy. Rules simply cannot keep pace with evolving attack vectors.

Key takeaway: Static retry logic treats every decline the same, sacrificing both recovered revenue and fraud protection.

How does AI resolve payment errors in real time?

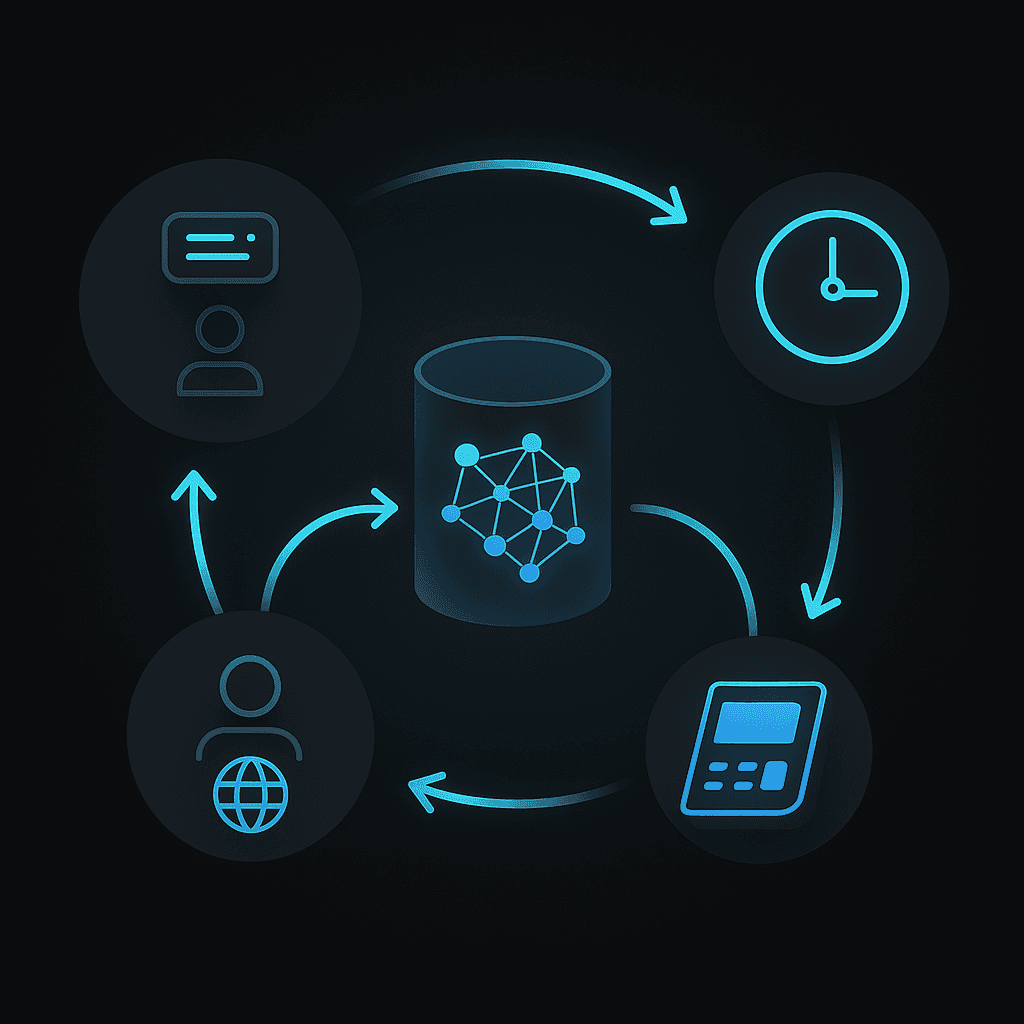

AI payment error resolution operates through a continuous feedback loop of data ingestion, prediction, action, and learning. Models ingest signals from multiple layers: transaction metadata (decline code, amount, currency, time of day), customer profile (tenure, lifetime value, prior retry outcomes), network intelligence (issuer uptime, card-network fraud alerts), and behavioral context (recent login activity, email engagement).

Stripe's Smart Retries, for instance, uses machine learning trained on the platform's vast dataset to predict the optimal time to retry a failed payment. Recurly's Intelligent Retries employs machine learning to determine the optimal time for retrying a declined recurring credit card payment. Rather than following a calendar, the model recalculates after each attempt, adjusting to new information such as a refreshed card-on-file or a cleared temporary hold.

Predictive smart retries

ML-timed card retries typically follow a pattern:

Initial assessment. The model scores the decline by recoverability.

Timing selection. It picks the next retry window based on predicted issuer availability and customer cash-flow patterns.

Outcome capture. Success or failure feeds back into the model for continuous improvement.

Stripe reports that Smart Retries can increase recovery rates by up to 14% compared to a static retry schedule. Recurly enforces guardrails: retries cease after 7 declines, 20 attempts, or 60 days since invoice creation to avoid network penalties.

Anomaly detection & fraud safeguards

Payment recovery and fraud prevention are two sides of the same coin. Modern systems layer supervised classifiers with unsupervised anomaly detectors.

A research framework combining Graph Neural Networks with online anomaly detectors models payment ecosystems as dynamic, heterogeneous graphs. Incoming transactions update a temporal multi-relational graph, and lightweight GNNs produce embeddings that feed both a cost-sensitive classifier for known fraud and unsupervised detectors to surface novel attacks.

Visa's TREASURE foundation model, a transformer-based encoder trained on over 300 billion transactions annually, illustrates the scale advantage. The model features dedicated sub-modules for static and dynamic attributes, enabling efficient training and inference while increasing abnormal-behavior detection performance by 111% over production systems.

A layered machine-learning approach, using supervised algorithms in the first layer followed by unsupervised isolation-forest models in the second, marks manipulated transactions as nearly twice as suspicious as their original counterparts.

What measurable impact does AI payment error resolution deliver?

Quantifying ROI requires tracking three levers: recovered revenue, churn reduction, and fraud savings.

Metric | Benchmark | Source |

|---|---|---|

Recovery-rate lift | Up to 14% vs. static schedules | |

Failed-payment recovery | Up to 50% of terminally failed transactions | |

Fraud reduction | 38% average decrease |

Because 70% of involuntary churn traces back to failed payments, even modest recovery improvements compound into material subscriber retention gains.

Fraud cost reduction case study

Stripe Radar's AI scans every payment using hundreds of signals from across the Stripe network, reducing fraud by 38% on average. Globally, fraud costs businesses more than an estimated $20 billion annually, making even incremental detection improvements significant at scale.

Key takeaway: AI-driven recovery and fraud prevention can shift a subscription business from reactive firefighting to proactive revenue protection.

Slicker vs rules-based vendors: which recovers more revenue?

Subscription businesses typically evaluate three categories of retry solutions:

Vendor Type | Approach | Considerations |

|---|---|---|

Native billing retries (Stripe, Recurly) | ML-timed retries built into the billing platform | Effective within their ecosystem; limited cross-platform visibility |

Standalone recovery tools (Vindicia Retain) | AI/ML models trained on decades of payment data; claims up to 50% recovery of terminally failed transactions | Requires integration; success-based pricing common |

AI overlay solutions (Slicker) | Sits on top of existing billing and payment systems to reduce involuntary churn and boost margins | Integrates with existing rails; pay-for-success model; best-in-class evaluation platform |

Stripe's Smart Retries can increase recovery rates by up to 14%, while Recurly's Intelligent Retries caps attempts at 7 declines or 60 days. Vindicia Retain has analyzed 1.8 billion+ transactions to power its recovery algorithms.

Slicker differentiates by layering an AI engine on top of whichever billing and payment systems a company already uses, whether Chargebee, Zuora, or an in-house stack. The pay-for-success pricing model means Slicker only earns when it recovers revenue, aligning incentives directly with outcomes.

How to implement AI payment error resolution: a practical checklist

Rolling out machine-learning recovery involves more than flipping a switch. Use the following checklist to guide your implementation:

Audit current retry logic. Document existing schedules, decline-code handling, and dunning workflows.

Map data sources. Identify which signals (transaction metadata, customer profiles, issuer responses) are accessible and in what latency.

Evaluate integration paths. Zuora's Cascading Payment Method, for example, allows dynamic retries using alternative payment methods based on a priority list.

Segment customers into cohorts. Chargebee Receivables recommends a three-step process: identify the cohort, engage with the cohort, and recover from the cohort.

Establish human oversight. As the BIS notes, integrating AI needs to be approached with a strong emphasis on transparency, accountability, and human oversight to mitigate associated risks.

Define success metrics. Track recovery rate, time-to-recovery, false-positive rate, and customer satisfaction.

Plan for continuous learning. Ensure the model retrains on fresh outcomes to adapt to issuer policy changes and seasonal patterns.

High-volume subscription companies using Chargebee, Zuora, or in-house billing systems should prioritize solutions that integrate with existing payment rails without requiring a full platform migration.

What's next: foundation models and agentic AI in payments

The frontier of AI payment error resolution is moving toward foundation models and agentic architectures.

Visa's TREASURE model processes over 300 billion transactions annually, capturing cardholder behaviors and payment-network signals at massive scale. Foundation models like TREASURE can identify suspicious patterns that traditional models might miss, increasing performance by 111%.

Agentic AI represents a significant evolution, characterized by its ability to autonomously make decisions and execute complex end-to-end processes, unlike generative AI, which primarily provides advisory support. McKinsey estimates that AI enablement of revenue-cycle tasks could cut cost-to-collect by 30 to 60 percent.

Multirail innovation is also accelerating. Visa is embracing stablecoin integration and AI-enabled agent tools to offer faster, flexible payments across corridors where traditional settlement still lags. For subscription businesses, these developments hint at a future where recovery logic spans card rails, ACH, and tokenized assets, all orchestrated by autonomous agents.

Key takeaways

Rules-based retries are insufficient. Static schedules ignore context and leave recoverable revenue on the table.

AI payment error resolution combines smart retries with fraud detection. Models ingest hundreds of signals to predict the optimal recovery path while flagging anomalies.

Measurable impact is substantial. Recovery-rate lifts of up to 14%, fraud reductions averaging 38%, and recovery of up to 50% of terminally failed payments are documented benchmarks.

Implementation requires data, integration, and oversight. Segment customers, map data sources, and maintain human accountability.

Foundation models and agentic AI are the next frontier. Expect autonomous, multirail recovery engines to become standard for high-volume subscription businesses.

For subscription companies running on Chargebee, Zuora, or in-house billing systems, Slicker offers an AI engine that sits on top of existing payment rails to reduce involuntary churn and boost margins, with a pay-for-success model that aligns cost with recovered revenue. Learn more at the Slicker comparative analysis.

Frequently Asked Questions

What is AI payment error resolution?

AI payment error resolution uses machine learning to predict the best time, method, and route to recover failed transactions, improving recovery rates and reducing fraud.

How does AI improve payment recovery compared to traditional methods?

AI improves payment recovery by analyzing multiple signals such as decline codes and customer behavior to optimize retry timing, unlike static rules that apply a one-size-fits-all approach.

What are the benefits of using AI for payment error resolution?

AI offers benefits like increased recovery rates, reduced fraud, and decreased involuntary churn by using adaptive intelligence to tailor retry strategies to each transaction's context.

How does Slicker's AI engine differ from other payment recovery solutions?

Slicker's AI engine integrates with existing billing systems, offering a pay-for-success model that aligns costs with recovered revenue, unlike static or standalone solutions.

What measurable impacts can AI payment error resolution deliver?

AI payment error resolution can increase recovery rates by up to 14%, reduce fraud by 38%, and recover up to 50% of terminally failed transactions, significantly boosting revenue.

Sources

https://recurly.com/blog/predicting-recurring-transaction-success/

https://docs.stripe.com/billing/revenue-recovery/smart-retries?locale=en-GB

https://bankingblog.accenture.com/unlocking-gen-ai-commercial-payments

https://www.scilit.com/publications/83a0d3146eff68771cddb91eff4e1278

https://knowledgecenter.zuora.com/Zuora_Payments/Configure_payment_orchestration/Retry_payments

https://chargebee.com/docs/receivables/payment-failure-recovery/payment-failure-management

WRITTEN BY

Slicker

Slicker