Guides

10

min read

Best smart dunning for Zuora: Slicker vs FlexPay vs native (Q4 2025)

For Zuora merchants seeking to optimize payment recovery, Slicker delivers 10-20 percentage point increases in recovered payments through AI-powered retry logic, while FlexPay offers enterprise-scale ML models with custom pricing, and Zuora's native Collections provides AI-powered workflows within the existing platform. The choice depends on deployment speed requirements, pricing preferences, and desired recovery lift above baseline performance.

Key Facts

• Involuntary churn causes 10-15% of subscription revenue to disappear annually through payment failures

• Slicker achieves 2-4× better recovery than native billing provider logic with just 5 minutes setup time

• FlexPay leverages a dataset equaling 7% of all US annual transactions for its proprietary ML models

• Zuora Collections earned Leader status in the 2025 Forrester Wave for Recurring Billing Solutions

• Pay-for-success models like Slicker's ensure positive ROI by only charging for recovered payments

• Every 1% lift in recovery translates to tens of thousands in annual revenue for mid-market businesses

Smart dunning for Zuora is no longer a nice-to-have; in 2025 it is a board-level lever for protecting recurring revenue. This post benchmarks Zuora's own Collections tools against FlexPay and Slicker, showing where AI-driven retries deliver the biggest lift.

Why smart dunning for Zuora matters more than ever in 2025

Involuntary churn silently drains subscription revenue. Industry research shows that 10-15% of subscription revenue disappears annually due to payment failures such as expired cards and insufficient funds. The numbers are staggering: subscription companies could lose an estimated $129 billion in 2025 due to involuntary churn alone.

The cost imbalance makes this problem even more acute. Acquiring new customers costs five to 25 times more than keeping the ones you have. With 20-40% of total churn attributed to involuntary churn, Zuora merchants cannot afford to rely on basic retry logic.

Key takeaway: For high-volume subscription businesses, every percentage point of improved recovery translates directly to protected revenue and reduced customer acquisition pressure.

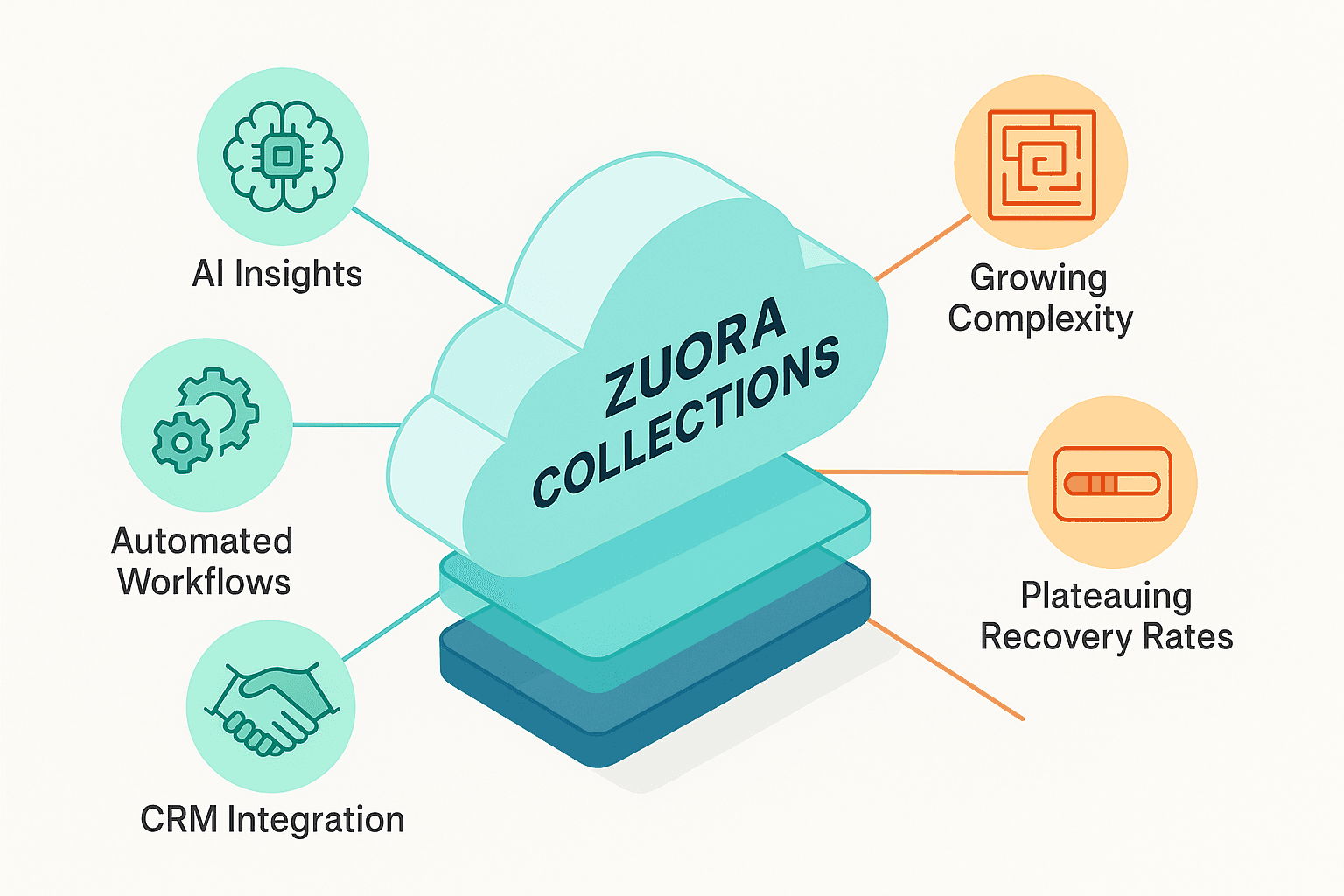

What do Zuora Collections & Optimizer deliver out-of-the-box?

Zuora Collections powered by AI positions itself as "the only collections solution that turns cash recovery into a strategic, customer-centric process." The platform connects billing, revenue, and CRM into one intelligent system.

Native capabilities include:

AI-generated insights for prioritization and forecasting

Automated workflows that adapt to customer payment behavior

Task and team management with CRM integrations

Automatic payment matching to keep Collections, Billing, and Accounting on the same source of truth

Cascading Payment Method feature for dynamic retries using alternative payment methods

Zuora has earned recognition as a Leader in the 2025 Forrester Wave for Recurring Billing Solutions and the 2025 Gartner Magic Quadrant for Recurring Billing Applications.

Known gaps:

Despite these strengths, enterprise finance teams face growing complexity. A Zuora-commissioned study found that 76% of respondents report growing complexity in their company's go-to-market models, products, and pricing. Additionally, 68% report not having the right technology to address growing demands from the business.

The native tools provide solid foundations, but recovery rates often plateau without purpose-built AI optimization layered on top.

FlexPay on Zuora: enterprise ML power—plus enterprise trade-offs

FlexPay positions itself as an enterprise-grade solution with machine learning models trained on a dataset "equaling 7% of all US annual transactions." The platform focuses on recovering failed credit card payments on recurring transactions.

Strengths:

Large transaction dataset for ML model training

Proprietary machine learning models

INVISIBLE RECOVERY feature that interacts directly with the payments system to avoid customer visibility to the failed payment

Account Updater functionality that supports a broader range of payment gateways, automatically updating expired or replaced card details

New Invoice Reconciliation report for visibility into FlexPay fees connected to recovered transactions

Trade-offs for Zuora users:

Custom pricing model requiring direct negotiation

Heavier integration requirements compared to native solutions

Integration complexity varies by platform configuration

FlexPay serves enterprises processing high transaction volumes, but the custom pricing and integration overhead may not suit all Zuora merchants.

Slicker: AI-powered, pay-for-success smart dunning built for Zuora

Slicker takes a different approach to smart dunning for Zuora. The YC-backed platform combines AI-powered retries with a pay-for-success model and rapid deployment.

How it works:

Slicker's proprietary AI engine processes each failed payment individually and schedules intelligent, data-backed retries rather than following generic decline-code rules. The machine learning model schedules retries at optimal times, leveraging industry expertise and tens of parameters. The engine dynamically determines if an error is retryable, accounting for differences between issuers and historical performance.

Recovery performance:

"Slicker customers usually see between a 10 and 20 percentage point increase in the number of recovered payments."

— Slicker

The platform claims 2-4× better recovery than native billing provider logic.

Deployment speed:

"5 minutes. This is how much time you will need in Slicker's dashboard to have your instance up and running. No-code revenue recovery."

— Slicker

Multi-gateway optimization:

Slicker utilizes existing multi-gateway setups, routing payments to maximize success rate. This approach works alongside Zuora's infrastructure without requiring platform changes.

Pricing model:

Slicker's pay-for-success pricing means charges only apply to successfully recovered payments. The first month is free, allowing finance teams to validate results before committing.

For more details on Slicker's approach compared to alternatives, see how Slicker outperforms FlexPay and the Zuora integration documentation.

Side-by-side comparison: Slicker vs FlexPay vs Zuora native (Q4 2025)

Criteria | Zuora Native | FlexPay | Slicker |

|---|---|---|---|

Recovery vs. baseline | Baseline | Proprietary ML models | |

AI/ML approach | AI-powered workflows | Large dataset training | Per-payment individualized analysis |

Integration time | Already integrated | Custom implementation | |

Pricing model | Platform subscription | Custom pricing | |

Multi-gateway support | Cascading Payment Method | Multiple gateways | Multi-gateway routing |

Trial period | N/A | Negotiated | 1 month free |

Best for | Existing Zuora-centric stacks | Enterprise scale | Mid-market to enterprise Zuora merchants |

How vendors compare on key differentiators:

Intelligent processing: Zuora Collections uses AI to adapt workflows to payment behavior. FlexPay leverages its transaction dataset for ML training. Slicker processes each payment individually with data-backed retry scheduling.

Time-to-value: Native tools require no additional setup. FlexPay requires custom integration work. Slicker's no-code approach minimizes engineering involvement.

Cost alignment: Native costs are bundled with Zuora. FlexPay requires custom pricing discussions. Slicker's performance-based model guarantees positive ROI by only charging for recovered payments.

For a broader comparison of AI retry engines, see the top 7 AI retry engines for 2025.

Decision framework: estimating ROI from smarter retries

Building a CFO-ready business case for smart dunning requires concrete numbers. Here's how to model the revenue lift.

Step 1: Quantify your failed payment exposure

Calculate your monthly failed payment volume and multiply by average transaction value. Industry benchmarks show that best-in-class recovery rates hover between 45-60%.

Step 2: Apply recovery rate improvements

Companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue. Machine learning engines can lift recovery rates 2-4× above native billing logic.

Step 3: Calculate incremental revenue

As the data shows, every 1% lift in recovery can translate into tens of thousands of annual revenue for mid-market subscription businesses.

Step 4: Factor in downstream effects

Recurly reports that 55.4% of merchants decreased their overall churn rates using intelligent retry features. Reduced churn compounds over time through improved customer lifetime value.

Sample calculation:

Metric | Value |

|---|---|

Monthly failed payments | $500,000 |

Current recovery rate | 30% |

Improved recovery rate | 50% |

Monthly revenue lift | $100,000 |

Annual impact | $1,200,000 |

Evaluation approach:

With pay-for-success models like Slicker's, the evaluation risk is minimal. Run a pilot, measure incremental recoveries against baseline, and only pay for demonstrated results.

Key takeaways for Zuora operators

Zuora's native Collections tools provide a solid foundation with AI-powered workflows, CRM integration, and industry recognition. However, recovery rates often plateau without specialized optimization.

FlexPay offers enterprise-scale ML capabilities but requires custom pricing negotiations and heavier integration work.

Slicker delivers a distinct combination for Zuora merchants:

Performance: 10-20 percentage point increase in recovered payments

Speed: 5-minute setup with no engineering resources required

Alignment: Pay-for-success pricing ensures positive ROI by design

For Zuora merchants seeking to maximize payment recovery without platform migration or lengthy implementations, Slicker's approach offers the fastest path to validated results. The free first month allows finance teams to see results firsthand before committing.

To explore how Slicker compares in more depth, read the detailed FlexPay comparison.

Frequently Asked Questions

What is smart dunning and why is it important for Zuora users in 2025?

Smart dunning refers to advanced techniques for managing failed subscription payments, crucial for Zuora users to minimize involuntary churn and protect recurring revenue. In 2025, it's a strategic necessity due to the high cost of customer acquisition and the significant revenue loss from payment failures.

How does Zuora's native Collections tool compare to FlexPay and Slicker?

Zuora's native Collections tool offers AI-powered workflows and CRM integration but may plateau in recovery rates. FlexPay provides enterprise-scale ML capabilities with custom pricing and integration needs, while Slicker offers AI-driven retries with a pay-for-success model and rapid deployment, often achieving higher recovery rates.

What are the key benefits of using Slicker for smart dunning on Zuora?

Slicker offers a 10-20 percentage point increase in recovered payments, a 5-minute setup with no engineering resources required, and a pay-for-success pricing model that ensures positive ROI. It integrates seamlessly with existing Zuora infrastructure, optimizing payment recovery without platform changes.

How does FlexPay's approach to smart dunning differ from Slicker's?

FlexPay uses proprietary ML models trained on a large transaction dataset, focusing on recovering failed credit card payments. It requires custom pricing and integration, whereas Slicker uses individualized AI-driven retries with a pay-for-success model, offering faster deployment and potentially higher recovery rates.

What is the potential revenue impact of improving recovery rates with smart dunning?

Improving recovery rates with smart dunning can significantly boost revenue. For example, a 20% increase in recovery rates can translate into substantial annual revenue gains, as demonstrated by Slicker's ability to lift recovery rates 2-4× above native billing logic.

Sources

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://www.slickerhq.com/blog/soft-decline-retry-strategies-saas-cfos-q3-2025-guide

https://knowledgecenter.zuora.com/Zuora_Payments/Payment_Runs/AQ_Cascading_Payment_Method

https://pages.zuora.com/2025-accounting-in-the-dark-report.html

WRITTEN BY

Slicker

Slicker