Guides

10

min read

Bulk Migration to Smart Dunning: Zero-Downtime Strategy

Smart dunning migration involves transitioning from batch-based payment recovery to AI-driven systems that process failed transactions individually. Modern platforms using intelligent retry logic recover 2-4× more revenue than legacy systems, addressing the 9% revenue loss from failed payments that plagues subscription businesses. Zero-downtime migration achieves this through parallel running, selective routing, and gradual cutover strategies.

TLDR

Legacy dunning systems using batch processing miss optimal retry windows, while AI-powered platforms achieve 45-60% recovery rates versus 15-25% for basic systems

Zero-downtime migration uses parallel operations where both systems run simultaneously during validation, eliminating service interruption risks

Multi-gateway routing provides 7% authorization rate uplift by instantly rerouting declined transactions through alternative processors

Regulatory compliance requires dual frameworks during migration to avoid gaps that could trigger penalties

Most businesses achieve full ROI within 60-90 days through incremental recovery value

5-minute setup with no code changes makes migration accessible for teams without extensive technical resources

Why Does Smart Dunning Migration Matter in 2025?

Subscription businesses face a critical inflection point. With 9% of revenue lost to failed payments annually, the cost of maintaining legacy dunning systems has become unsustainable. Even more concerning, involuntary churn accounts for 20-40% of total customer churn in the subscription economy.

Smart dunning migration represents the shift from batch-based payment recovery to AI-driven engines that process each failed transaction individually. This isn't just an incremental improvement—platforms using intelligent retry logic report lifting recovery rates 2-4× above native billing logic. For a subscription business processing $10 million annually, that difference translates to recovering an additional $360,000 to $720,000 in revenue that would otherwise vanish.

The urgency intensifies when you consider customer behavior patterns. Research shows that 62% of users who encounter a payment error never return to the site. Every day spent on outdated dunning systems means permanently lost customers who could have been saved with intelligent retry orchestration.

What Are the Hidden Costs of Legacy Dunning & Competitor Lock-In?

Legacy dunning systems operate like fishing with dynamite when precision tools are readily available. As one industry expert puts it, "Batch processing is the equivalent of fishing with dynamite when precision angling tools are readily available."

The fundamental flaw lies in timing rigidity. Traditional systems bundle all failed payments together for weekly batch retries, ignoring that optimal retry timing varies dramatically based on decline reason, customer payment history, and even the day of the month. A soft decline from insufficient funds requires different handling than an expired card, yet batch systems treat them identically.

Beyond timing, the financial impact compounds quickly. Companies switching from batch-based to intelligent retry strategies typically see a 20-50% increase in recovered revenue. This isn't theoretical—it's measurable revenue sitting in your failed payments queue right now.

The vendor lock-in problem adds another layer of complexity. Many competitors bundle dunning with their broader billing platforms, making migration feel impossible without disrupting your entire payment infrastructure. This artificial barrier keeps businesses trapped in underperforming systems, watching revenue slip away month after month.

How Do You Achieve Zero-Downtime Migration? A 5-Step Framework

Zero-downtime migration isn't wishful thinking—it's an established practice backed by proven methodologies. Organizations are investing heavily in this approach, with 46% increasing spend on application modernization in 2023.

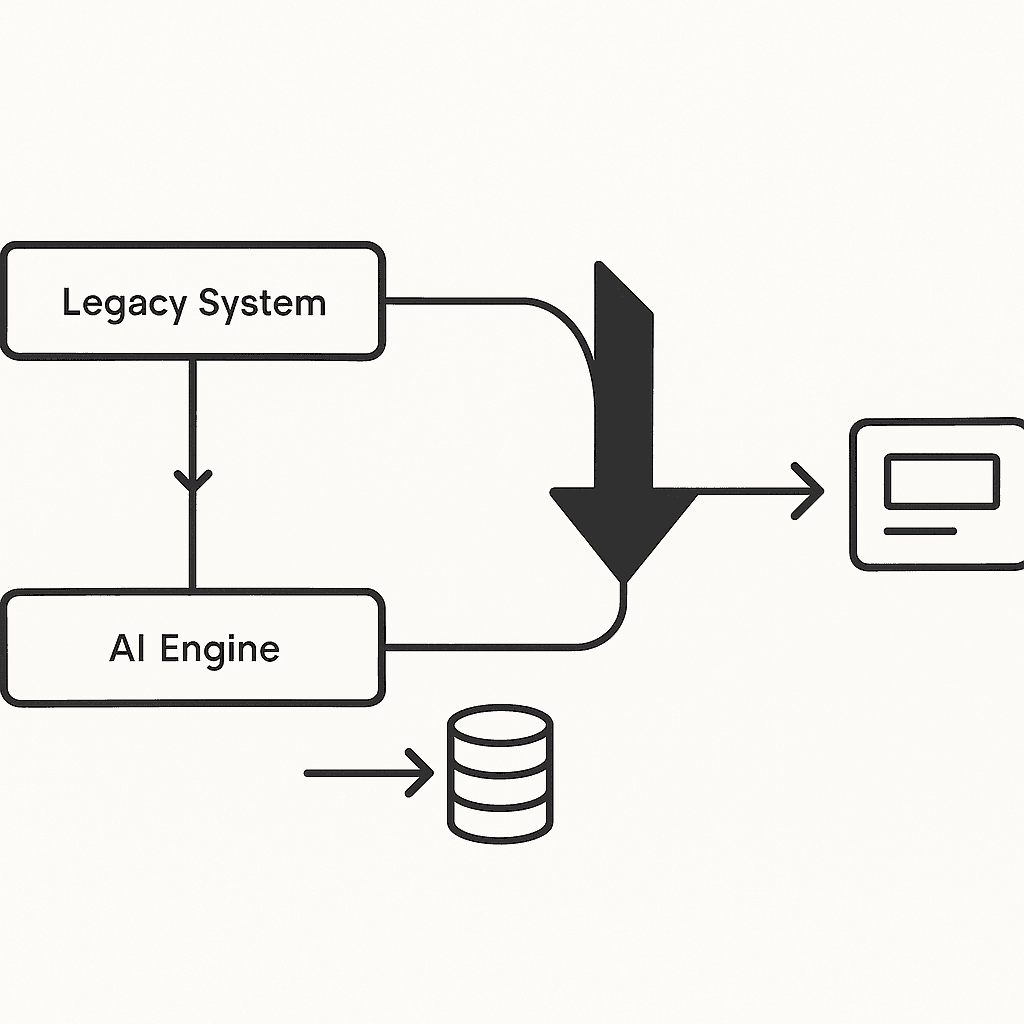

The framework begins with parallel operations. Rather than a risky cutover, you run your new intelligent dunning system alongside the incumbent platform. This shadow-running phase allows you to validate recovery metrics before committing to the switch.

Step two involves selective routing. Start by directing a small percentage of failed payments to the new system—perhaps 5% in week one, expanding gradually as confidence builds. This approach mirrors enterprise database migration strategies where automatic failback prevents data loss if issues arise.

The third phase focuses on data synchronization. Your historical payment failure patterns become training data for the AI engine. Export decline codes, retry histories, and recovery outcomes from your legacy system. Modern platforms process this data to establish baseline performance metrics.

Step four accelerates the transition. Once the new system matches or exceeds legacy recovery rates, flip the routing rules to send majority traffic through the intelligent engine. Keep the old system running as a fallback for another billing cycle.

Finally, complete the cutover with comprehensive monitoring. Track recovery rates, processing times, and customer impact metrics hourly during the first week post-migration.

Run Parallel & Validate

Parallel running eliminates the biggest migration risk: service interruption. Modern platforms like Slicker offer 5-minute setup with no code changes, connecting through SDKs to Stripe, Chargebee, Recurly, Zuora, Recharge, or custom gateways.

During parallel validation, both systems process copies of the same failed transactions. The legacy system continues recovering payments normally while the new platform runs in observation mode. This dual-track approach provides real performance comparisons without risking revenue.

Key validation metrics include recovery rate parity, processing speed benchmarks, and successful gateway communications. Most businesses achieve validation confidence within 2-3 billing cycles.

Activating AI-Powered Retry & Multi-Gateway Routing

Once migration completes, the real transformation begins. AI-driven recovery engines claim "2-4× better recoveries than static retry systems" by prioritizing intelligent retry timing, multi-gateway routing, and transparent analytics.

The intelligence layer evaluates each transaction across hundreds of variables. Smart routing evaluates multiple factors—historical conversion rates, card type, transaction amount, issuer country, and currency—to determine the optimal processing path.

Machine learning applications in multi-provider payment routing represent a significant advancement in transaction processing technology. Rather than predetermined rules, these systems continuously learn from outcomes, refining their decision models with each processed payment.

Route Around Failures in Real Time

Multi-gateway routing transforms recovery economics through redundancy and optimization. When one processor declines a transaction, intelligent systems instantly reroute through alternative gateways. 7% authorization rate uplift becomes standard, not exceptional.

The technology adapts dynamically to processor performance variations. Built with AI/ML algorithms, routing engines calculate success probabilities based on historical patterns, card intelligence, and real-time network conditions.

Real-world impact proves the concept. One merchant using multi-gateway routing saw payment success rates increase from 86% to 93%—a 7 percentage point improvement that translated directly to bottom-line revenue.

How Do You Stay Compliant & Customer-Friendly During Migration?

Regulatory compliance during migration isn't optional—it's existential. The FTC's "Click to Cancel" rule fundamentally changes how subscription businesses handle payment processing and cancellations.

In the UK, the Digital Markets, Competition and Consumers Act targets "subscription traps" costing consumers £1.6 billion annually. The new regime mandates clear pre-contract information, regular subscription reminders, and a 14-day cooling-off period for auto-renewals.

During migration, maintain dual compliance frameworks. Your legacy system continues following existing protocols while the new platform implements enhanced safeguards. This redundancy prevents regulatory gaps that could trigger penalties—the FTC estimates 109,000 organizations face costs exceeding $5.7 million annually for non-compliance.

Customer communication becomes critical. Notify subscribers about system improvements without creating payment anxiety. Frame the migration as an enhancement to payment security and reliability, not a disruption to their service.

Which KPIs Prove ROI After Cut-Over?

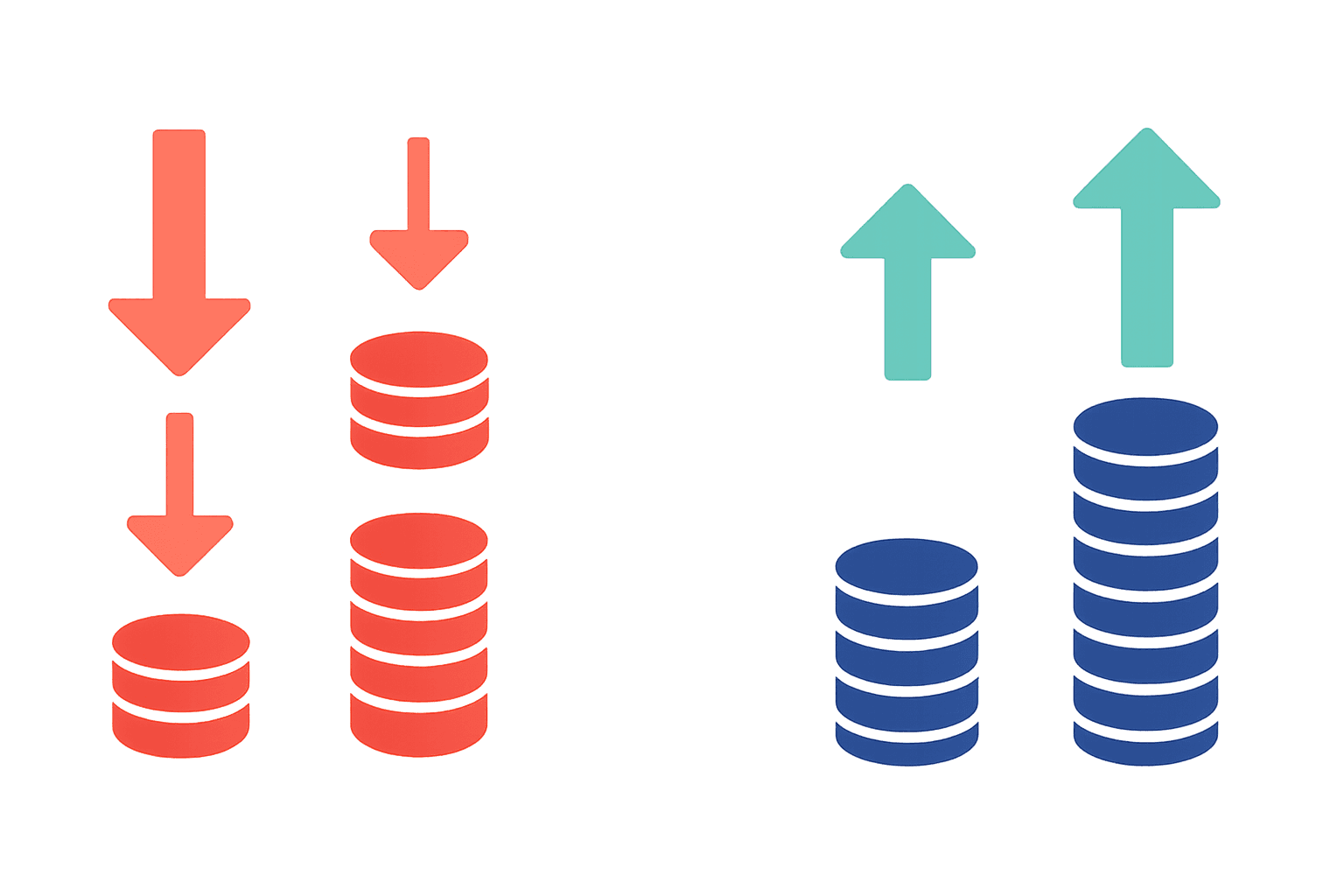

Post-migration metrics tell the real story. Recovery rate improvements typically range from 2-4× above native billing logic, but the compound effects matter more.

Track involuntary churn reduction as your north star metric. Best-in-class recovery rates hover between 45-60%, significantly above the 15-25% achieved by basic dunning emails. Each percentage point improvement in recovery rate directly reduces involuntary churn.

Revenue retention provides the clearest ROI signal. Studies suggest businesses implementing advanced churn prediction techniques improve retention rates by 5-10%, leading to profit increases of 25-95%. For a $10 million ARR business, that's $2.5 to $9.5 million in additional profit.

Measure payback period through incremental recovery value. If migration costs $50,000 but recovers an additional $20,000 monthly, you achieve full ROI in under three months. Most businesses report payback within 60-90 days of cutover.

Key takeaway: Focus on sustainable metrics like customer lifetime value extension and reduced payment processing costs, not just immediate recovery rates.

Ready to Migrate? Let's Talk

Smart dunning migration represents more than a technical upgrade—it's a strategic imperative for subscription businesses serious about revenue optimization. The data is unambiguous: intelligent retry logic recovers 2-4× more failed payments than legacy systems, directly addressing the 9% revenue leak plaguing the subscription economy.

The migration path is clearer than ever. Zero-downtime frameworks eliminate cutover risk. Parallel validation ensures performance parity before committing. Multi-gateway routing and AI-powered retry logic deliver immediate, measurable improvements in recovery rates.

Slicker's intelligent payment recovery platform exemplifies this new paradigm. With 5-minute setup, no-code integration, and proven recovery rate improvements, the platform removes traditional migration barriers. Our AI engine processes each failed payment individually, learning from millions of transactions to optimize retry timing, routing decisions, and recovery strategies.

The question isn't whether to migrate—it's how quickly you can capture the revenue currently slipping through your legacy dunning system. Every month of delay means thousands in unrecovered revenue and customers lost to preventable involuntary churn.

Connect with Slicker's migration experts to map your zero-downtime transition strategy. We'll analyze your current recovery rates, project improvement potential, and design a parallel validation approach tailored to your payment infrastructure. The path to 2-4× better recovery starts with a conversation.

Frequently Asked Questions

What is smart dunning migration?

Smart dunning migration involves transitioning from traditional batch-based payment recovery systems to AI-driven engines that process each failed transaction individually, significantly improving recovery rates.

How does smart dunning improve revenue recovery?

Smart dunning uses intelligent retry logic to optimize the timing and method of payment retries, resulting in a 2-4× increase in recovery rates compared to legacy systems.

What are the steps for zero-downtime migration?

Zero-downtime migration involves running the new system in parallel with the old, gradually routing more transactions to the new system, synchronizing data, and monitoring performance to ensure a smooth transition.

Why is parallel running important in migration?

Parallel running allows businesses to validate the performance of the new system against the old without risking service interruption, ensuring that recovery rates and processing speeds meet expectations before full migration.

How does multi-gateway routing enhance payment recovery?

Multi-gateway routing improves recovery by rerouting failed transactions through alternative gateways, increasing authorization rates and optimizing transaction success based on real-time conditions.

What compliance measures are necessary during migration?

During migration, maintaining dual compliance frameworks is crucial to prevent regulatory gaps, ensuring both legacy and new systems adhere to existing and enhanced protocols to avoid penalties.

Sources

https://www.slickerhq.com/blog/soft-decline-retry-strategies-saas-cfos-q3-2025-guide

https://jisem-journal.com/index.php/journal/article/download/12842/5983/21626

https://blog.ottu.com/posts/adaptive-payment-intelligence-ottu-ai-routing-engine

https://www.ftstrategies.com/en-gb/insights/regulatory-pressure-on-media-subscription-businesses

https://pinsentmasons.com/out-law/news/uk-subscription-contracts-regime-consultation

WRITTEN BY

Slicker

Slicker