Guides

10

min read

Emergency AI payment error resolution: Same-day recovery setup

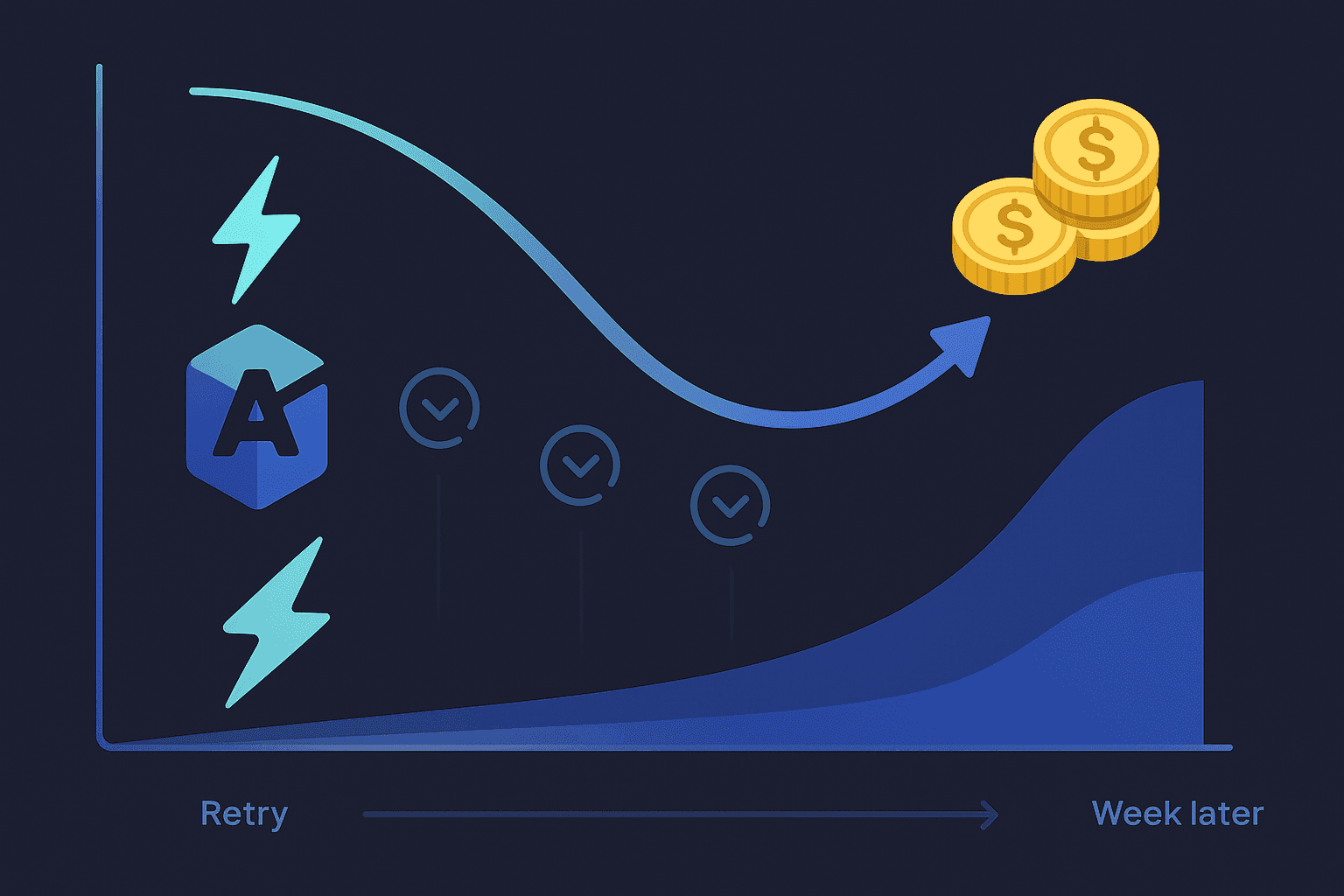

AI payment error resolution enables same-day recovery by automatically detecting failures, analyzing decline reasons, and triggering intelligent retries within hours. Companies using AI-driven smart retries recover significantly more revenue than static systems, with the first retry capturing the majority of recoverable payments before success rates diminish.

At a Glance

Failed payments cost subscription businesses 10-15% of annual revenue, with soft declines accounting for up to 4% of MRR

AI systems achieve 45-60% recovery rates for best-in-class performance, with 70% potential recoverability using sophisticated strategies

Smart retry engines analyze transaction data individually rather than following fixed schedules, improving recovery by 2-4x over static systems

Implementation takes as little as 5 minutes with no-code solutions that connect to existing billing platforms

Real-time fraud detection achieves up to 99.2% accuracy while maintaining high approval rates

Every hour a failed transaction sits unrecovered, subscription revenue silently drains away. With the global subscription industry projected to reach $1.5 trillion by 2025, subscription companies could lose an estimated $129 billion in 2025 due to involuntary churn alone. Same-day AI payment error resolution is no longer a nice-to-have; it is table stakes for any SaaS or subscription business serious about protecting margins.

This guide walks through what emergency AI payment error resolution actually means, why delayed retries cost you more than you think, and how to launch a same-day recovery stack in five actionable steps.

Why must AI payment error resolution happen the same day?

AI payment error resolution is the immediate answer. It detects failed transactions, analyzes the exact decline reason, and triggers data-driven recovery actions within seconds.

Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their conscious decision to cancel. This is not a minor operational hiccup. Failed payments could cost subscription companies more than $129 billion in 2025, and involuntary churn already costs companies more than $440 billion a year. That figure could climb to nearly $650 billion within five years at current growth rates, dwarfing revenue lost to fraud by 10 times.

Day-one recovery matters because the first retry captures the majority of recoverable revenue, with diminishing returns on subsequent attempts. When errors linger beyond 24 hours, you lose the window where soft declines are most likely to succeed, and you risk the subscriber blaming your company rather than their card issuer.

Key takeaway: Waiting even a single day to act on a failed payment can mean the difference between a recovered subscriber and permanent churn.

The hidden cost of delayed retries & the upside of instant recovery

Delayed retries quietly erode MRR, inflate churn, and amplify fraud risk. Here is what the numbers actually look like:

10-15% of subscription revenue disappears annually due to payment failures such as expired cards and insufficient funds.

Involuntary churn can easily comprise 40% of total business churn, with soft and hard credit card declines as primary contributors.

Card declines, bank rejections, and soft errors collectively wipe out as much as 4% of MRR in high-growth subscription businesses.

Kayo, the sports streaming platform, demonstrates the upside of moving fast. After four years building an AI decisioning system, the company now forecasts quarterly churn and reactivation with 98-99% accuracy. Reactivation offers work at 90% efficiency, meaning 90% of churned users who reactivate off the back of an automated action would not have done so otherwise.

Soft declines drain up to 4 % of MRR

Soft declines are temporary rejections, often caused by insufficient funds or temporary holds. Unlike hard declines, they are not final and represent your best opportunity for same-day recovery.

Metric | Value |

|---|---|

MRR impact from soft errors | |

Best-in-class recovery rates | |

Potential recoverability with sophisticated retries |

Industry benchmarks show that best-in-class recovery rates hover between 45-60%, yet overall recoverability can reach 70% with sophisticated retry strategies. The gap between average and best-in-class is pure margin left on the table.

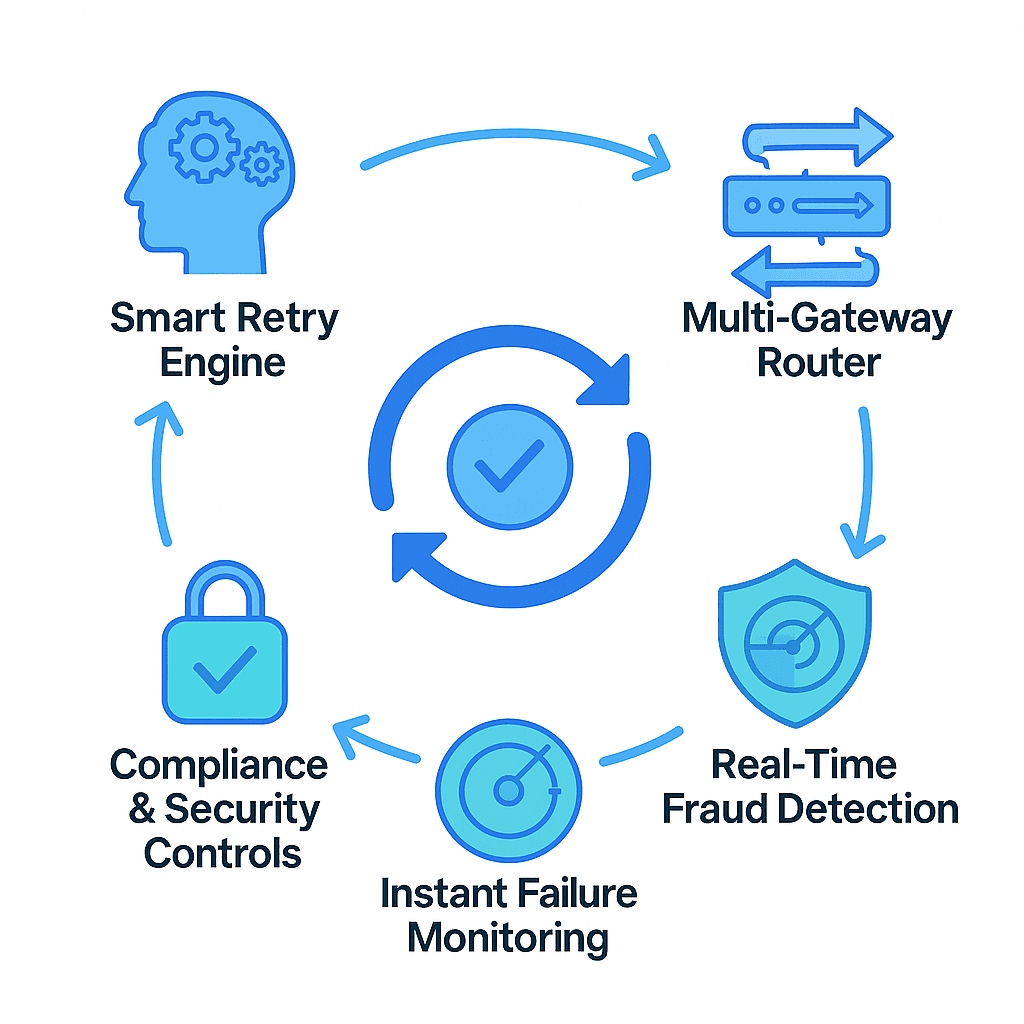

Core building blocks of a same-day AI recovery stack

A same-day recovery stack is not a single tool; it is an integrated set of components that work together in less than 24 hours. Here are the essential pieces:

Smart retry engine: Uses AI to choose optimal retry times based on transaction history and decline codes.

Multi-gateway routing: Routes retries through the processor with the highest real-time acceptance probability.

Real-time fraud and dispute automation: Embeds ML-based fraud detection to secure retries and automate dispute evidence packets.

Instant payment detection: Monitors failed payments the moment they occur, not in overnight batches.

Compliance and security controls: SOC 2 Type II compliance and enterprise-grade security for handling sensitive payment data.

Using AI, Smart Retries chooses the best times to retry failed payment attempts to increase the chance of successfully paying an invoice. Slicker's engine utilizes multi-gateway setups, routing payments to maximize success rate, while AI-driven fraud detection systems leverage real-time analytics and anomaly detection to identify suspicious activities with up to 99.2% accuracy.

AI-driven smart retries

Smart retries are the backbone of same-day recovery. Rather than blindly following a fixed schedule, AI-driven systems analyze transaction data to determine the optimal moment for each retry.

Stripe recommends a default setting of 8 tries within 2 weeks. As Stripe notes, "The recommended default setting is 8 tries within 2 weeks." Recurly's Intelligent Retries employs machine learning to determine optimal retry times for declined recurring credit card payments, analyzing billions of transactions to improve success rates. Smart Retries use data points to find the best time to retry and are more effective than scheduled retries.

The key advantage: AI processes each failing payment individually, considering issuer differences and historical performance, rather than treating all declines the same way.

Real-time fraud & dispute automation

Recovery is only valuable if the retried payments are legitimate. Embedded ML fraud detection ensures you are not re-attempting transactions that will trigger chargebacks or compliance flags.

AI-driven fraud detection systems leverage real-time analytics to identify suspicious activities with up to 99.2% accuracy, reducing false positives by 60% while maintaining high transaction approval rates. For disputes that do arise, Stripe's Smart Disputes uses an AI rules engine to extract evidence from transaction data, Stripe internal data, historical win performances, and cardholder data.

A streaming framework that models payment ecosystems as dynamic, heterogeneous graphs and detects anomalies by fusing Graph Neural Networks with online anomaly detectors represents the leading edge of fraud detection. These systems update temporal graphs with incoming transactions and produce embeddings on the fly, exposing local explanations to support analyst review and regulatory needs.

How to launch same-day recovery in five steps

You do not need a multi-month implementation project to start recovering payments today. Here is a roadmap your team can execute in 24 hours:

Connect your billing platform. Link your existing system (Stripe, Chargebee, Zuora, Recurly, or in-house) to an AI recovery engine. Slicker's setup takes 5 minutes of no-code configuration.

Enable smart retry schedules. Configure AI-driven retries that fire up to 8 attempts in two weeks rather than relying on static schedules.

Activate multi-gateway routing. If you use multiple payment processors, enable routing that automatically selects the gateway with the highest acceptance probability for each retry.

Integrate automated dispute packets. Turn on AI-powered dispute evidence compilation so you are prepared when chargebacks occur.

Set up real-time alerts. Configure notifications for failed payments, successful recoveries, and any anomalies that require manual review.

Smart Retries recover $9 in revenue for every $1 customers spend on Billing, demonstrating the ROI available even in the first month.

Slicker vs Stripe, Recurly & Zuora: who wins emergency recovery?

When evaluating AI recovery solutions, the differences come down to integration depth, retry intelligence, and pricing alignment.

Feature | Slicker | Stripe Smart Retries | Recurly | Zuora |

|---|---|---|---|---|

Retry approach | AI-driven, per-transaction analysis | AI-optimized timing | ML-based, decline-code specific | Configurable ML retries |

Multi-gateway routing | Yes, automatic | Within Stripe ecosystem | No | Limited |

Setup time | Native integration | Account setup required | Configuration required | |

Pricing model | Pay-for-success | Bundled with Billing | Platform subscription | Platform subscription |

Recovery claim | Significant lift | AI-powered workflows |

Stripe's Smart Retries leverage billions of data points across the Stripe network but operate within the Stripe ecosystem. Recurly's Intelligent Retries cease after 7 transaction declines, 20 total transaction attempts, or 60 days since invoice creation. Zuora's Configurable Payments Retry analyzes customer and payment data to determine optimal retry timing.

Where Slicker wins

Slicker customers typically see between a 10 and 20 percentage point increase in the number of recovered payments. The company's AI-driven recovery engine claims "2-4x better recoveries than static retry systems," as noted in comparative analysis.

Three factors differentiate Slicker:

Pay-for-success pricing: You only pay for successfully recovered payments, aligning incentives perfectly.

Multi-gateway routing: Automatic routing through the processor with the highest real-time acceptance probability.

Speed to value: No-code setup means RevOps can own deployment without waiting for engineering sprint cycles.

Slicker brings Silicon Valley innovation to payment recovery with a proprietary AI engine that processes each failed payment individually and schedules intelligent, data-backed retries rather than blindly following generic decline-code rules.

What pitfalls & compliance checks matter when you move fast?

Moving quickly on recovery does not mean cutting corners on security or compliance. Here are the risks to watch:

Data quality: AI models are highly data dependent. Poor historical data leads to poor retry timing. Ensure your billing system exports clean, complete transaction histories before enabling AI retries.

Regulatory compliance: Interpretability of ML models is essential for regulatory compliance (e.g., PSD2, GDPR), resolved through explainable AI methods such as SHAP and LIME. Your recovery vendor should be able to explain why specific retry decisions were made.

Fallback architecture: High-risk machine learning applications require hierarchical fallback architectures to handle stress and failure scenarios. Ask your vendor how their system behaves when external data dependencies fail.

Fraud exposure: Global losses from payment card fraud are projected to reach $400 billion over the next ten years. Ensure your recovery stack includes real-time fraud screening, not just retry logic.

Security certifications: SOC 2 Type II compliance and enterprise-grade security controls are essential for handling sensitive payment data and maintaining customer trust.

Key takeaway: Fast implementation is possible, but only with vendors that have built compliance and security into their architecture from day one.

Proof in numbers: real-world recovery wins

The impact of AI-driven recovery is measurable and substantial across different business types:

Slicker customers: Typically see between a 10 and 20 percentage point increase in the number of recovered payments.

FourKites: Scaled collections without adding headcount or sacrificing customer experience. By automating outreach and syncing collections with Salesforce, they cut time-to-collect by 26%.

Industry-wide: The global subscription industry could lose an estimated $129 billion in 2025 due to involuntary churn, yet 10-15% of subscription revenue disappears annually due to payment failures. The companies recovering this revenue are gaining a material competitive advantage.

These results demonstrate that same-day recovery is not theoretical; it is already delivering measurable ROI for subscription businesses across industries.

Moving to zero-delay recovery with Slicker

Same-day AI payment error resolution is now the baseline expectation for subscription businesses serious about protecting revenue. The technology exists to detect failures instantly, analyze decline reasons intelligently, and retry at optimal times, all without manual intervention.

The key takeaways:

Every hour of delay costs recoverable revenue

Soft declines represent your best same-day recovery opportunity

AI-driven smart retries outperform static schedules by 2-4x

Multi-gateway routing maximizes acceptance probability

Pay-for-success pricing eliminates risk from your recovery investment

Slicker offers a solution built specifically for high-volume subscription companies using Chargebee, Zuora, Stripe, or in-house billing systems. With 5-minute no-code setup, multi-gateway routing, and pay-for-success pricing, you can start recovering failed payments today.

To see how much revenue you are leaving on the table, explore how Slicker's AI engine enhances payment recovery for subscription businesses.

Frequently Asked Questions

What is same-day AI payment error resolution?

Same-day AI payment error resolution involves using AI to detect failed transactions, analyze decline reasons, and trigger recovery actions within seconds, ensuring minimal revenue loss from payment failures.

Why is it important to resolve payment errors on the same day?

Resolving payment errors on the same day is crucial because it captures the majority of recoverable revenue. Delays beyond 24 hours can lead to permanent churn and missed opportunities for recovery, especially with soft declines.

How does Slicker's AI engine enhance payment recovery?

Slicker's AI engine enhances payment recovery by using smart retries, multi-gateway routing, and real-time fraud detection. This approach increases recovery rates by 2-4x compared to static retry systems, aligning with pay-for-success pricing.

What are the core components of a same-day AI recovery stack?

A same-day AI recovery stack includes a smart retry engine, multi-gateway routing, real-time fraud and dispute automation, instant payment detection, and compliance and security controls to ensure efficient and secure payment recovery.

How does involuntary churn impact subscription businesses?

Involuntary churn, caused by payment failures, can significantly impact subscription businesses by eroding MRR and increasing churn rates. It is estimated to cost companies over $129 billion in 2025, highlighting the need for effective recovery strategies.

Sources

https://stripe.com/docs/billing/revenue-recovery/smart-retries

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://www.slickerhq.com/blog/soft-decline-retry-strategies-saas-cfos-q3-2025-guide

https://journalwjarr.com/sites/default/files/fulltext_pdf/WJARR-2025-1273.pdf

https://www.slickerhq.com/blog/what-is-involuntary-churn-and-why-it-matters

https://www.scilit.com/publications/83a0d3146eff68771cddb91eff4e1278

https://www.slickerhq.com/blog/how-ai-enhances-payment-recovery

WRITTEN BY

Slicker

Slicker