Guides

10

min read

Enterprise Guide: Recover Failed Subscription Payments at 1M+ Subscribers

Enterprise-scale subscription businesses can recover 45-60% of failed payments using AI-powered smart retries that optimize timing and routing based on machine learning models. Modern platforms achieve this by analyzing decline patterns across billions of transactions, determining optimal retry windows, and routing payments through multiple gateways to maximize approval rates.

Key Facts

• Failed subscription payments cost businesses approximately 9% of annual revenue, with involuntary churn comprising up to 40% of total customer churn

• Smart retry systems use machine learning to predict optimal retry timing, recovering 7.8% more purchases compared to static retry schedules

• The standard retry cadence involves 8 attempts within 2 weeks, with timing intervals escalating from 5 minutes to 96 hours

• Multi-gateway orchestration routes failed payments through alternate processors, significantly improving approval odds for cross-border and high-value transactions

• Enterprise recovery platforms like Slicker deliver 10-20 percentage point increases in payment recovery rates through AI optimization

• SOC 2 Type II certification has become essential for payment recovery vendors, with compliant organizations experiencing 57% fewer data breaches

When a subscription payment fails at million-subscriber scale, the instinct is to shrug it off. "We lost $50, that's unfortunate," teams often think. But that $50 monthly subscription, multiplied across the average 24-month customer lifespan, actually represents $1,200 in expected revenue. At enterprise scale, involuntary churn becomes a silent drain that could cost subscription companies an estimated $129 billion in 2025 alone.

The path forward is clear: AI-powered smart retries have emerged as the proven way to recover failed subscription payments. Industry benchmarks show that best-in-class recovery rates reach 45-60 %, but achieving these numbers requires strategic thinking about retry cadences, timing windows, and intelligent routing.

The Silent Revenue Leak Hiding in Your Million-Subscriber Base

Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their conscious decision to cancel. Unlike voluntary churn, where customers actively choose to leave, involuntary churn happens silently in the background, often without the customer even realizing their service has lapsed.

The scale of this problem is staggering. According to Churnkey's analysis of 6 million failed payments across $3 billion in subscription revenue, involuntary churn can easily comprise 40 % of a business's total churn. For subscription services specifically, failed payments cost businesses approximately 9 % of their annual revenue.

At one million subscribers, even a modest 5 % failure rate translates to 50,000 at-risk accounts each billing cycle. When you factor in customer acquisition costs averaging $205 per customer and the lifetime value implications, the true cost of a single $50 failed payment balloons to $1,727.50 when accounting for lost LTV, wasted acquisition spend, and operational overhead.

Key takeaway: Involuntary churn represents 20-40 % of total customer churn, and at enterprise scale, addressing it directly protects millions in annual recurring revenue.

Why Payments Fail: Soft vs. Hard Declines and 2,000+ Error Codes

Understanding why payments fail is the first step toward recovering them effectively. There are over 2,000 things that can go wrong when a credit card is processed for a transaction, but they generally fall into two categories:

Soft Declines are temporary issues that can often be resolved through retries:

Insufficient funds

Credit limit exceeded

Temporary authorization holds

Processor timeouts

Hard Declines are permanent issues requiring customer intervention:

Stolen or lost cards

Closed accounts

Fraud blocks

Expired cards without updates

According to Churnkey's State of Retention 2025 report, soft declines are temporary issues that can be resolved primarily with card retries, requesting a backup card, in-app payment collection walls, and dunning recovery campaigns. Insufficient funds represented nearly half of all declines in their analysis.

The complexity multiplies across payment networks. Juspay notes there are over 70 error codes across card networks, each requiring different handling strategies. Category 1 errors, for instance, can never be retried, with penalties of $0.10 to $0.15 per retry attempt if merchants attempt them anyway.

Decline Type | Examples | Recovery Approach |

|---|---|---|

Soft decline | Insufficient funds, credit limit exceeded | Automated smart retries |

Hard decline | Lost/stolen card, account closed | Customer outreach + payment update |

Gateway error | Processor unavailable, timeout | Immediate retry or alternate routing |

Deploy AI-Powered Smart Retries for 45-60 % Recovery Rates

The shift from static retry schedules to AI-powered payment recovery represents a fundamental evolution in how enterprises handle failed payments. Smart Retries choose the best times to retry failed payment attempts, using machine learning to increase the chance of successfully paying an invoice rather than following generic decline-code rules.

The impact is substantial. Research shows that 62 % of customers who experience payment failures will not return to the website. However, clients leveraging dynamic retries recover 7.8 % more purchases, representing a 36 % relative improvement compared to static retries.

How does AI-powered recovery work in practice?

Instant detection of failed payments across all billing channels

Failure classification to determine soft vs. hard declines

Optimal timing prediction based on historical patterns and real-time signals

Dynamic routing to the gateway with highest acceptance probability

Continuous learning from each recovery attempt

Companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50 % increase in recovered revenue.

Designing Optimal Retry Cadence & Windows

Timing is everything in payment recovery. The recommended default setting is 8 tries within 2 weeks, but optimal cadence varies based on decline type and customer behavior patterns.

Yuno's Smart Retries documentation provides a sample retry schedule that illustrates how timing escalates:

Retry Attempt | Time After Initial Failure |

|---|---|

Second try | 5 minutes |

Third try | 60 minutes |

Fourth try | 5 hours |

Fifth try | 24 hours |

Sixth try | 48 hours |

Seventh try | 96 hours |

The logic behind this escalation is straightforward: early retries catch transient issues like processor timeouts, while later retries align with paycheck cycles and account balance replenishment.

For gateway-specific errors, Recurly recommends different intervals:

Try Again/Gateway Error: Every 2 days

Issuer or Processor Unavailable: Every 3 days

Communication/Configuration Error: Initial retries up to 2 times, 4 hours apart, then daily

Multi-Gateway Orchestration to Boost Approval Odds

When a payment fails at one processor, routing it to another can dramatically improve approval odds. Leading solutions automatically route retries through the processor with the highest real-time acceptance probability, rather than forcing merchants to orchestrate this themselves.

Slicker utilizes multi-gateway setups, routing payments to maximize success rate. This approach is particularly effective for:

Cross-border transactions where local processors have higher approval rates

Specific card networks that perform better with certain acquirers

High-value transactions that may trigger fraud rules at some processors

How Do Proactive Dunning Campaigns Amplify Recovery Results?

Proactive dunning campaigns work in tandem with automated retries to maximize recovery. Dunning is the process of communicating with customers to collect payments that are due or past due.

Effective dunning management involves multiple tactics working together:

Communication strategy: Clear, timely messages across email and SMS

Automation with personalization: Tailored messaging based on customer segment and failure reason

Multi-channel approach: Meeting customers where they are

Compliance and sensitivity: Maintaining positive relationships while pursuing payment

Stripe's dunning management includes sophisticated algorithms that analyze the best times to attempt payment retries, based on industry data and individual customer payment patterns.

Every dunning message should include key components:

Clear sender identification

Specific details of the payment issue

Simple call to action with payment link

Due date for resolution

Polite, respectful tone

The combination of automated retries and proactive communication is powerful. Failed payments cost the global economy more than $118 billion in 2020, with 80 % of businesses experiencing substantial daily failed payments reporting customer loss.

Which KPIs Matter Most for Subscription Revenue Recovery?

CFOs need a clear scorecard to track payment recovery performance. Zuora measures improvements using Document Success Rate (DSR), defined as the number of billing documents collected divided by the number attempted.

KPI | Benchmark | What It Tells You |

|---|---|---|

Document Success Rate | 85-95 % | Overall billing health |

Net Revenue Retention | Expansion vs. contraction balance | |

Gross Revenue Retention | Revenue retention before expansion | |

Recovery Rate | 45-60 % | Failed payment capture efficiency |

Involuntary Churn Rate | Target <1 % | Payment failure impact |

Gainsight's Customer Success Index 2025 reports that 74 % of respondents say most of their company's revenue comes from existing customers, making retention metrics increasingly critical.

For SaaS companies specifically, the 2025 SaaS benchmarks show that Net Revenue Retention at 101 % highlights that retaining and expanding existing customers is becoming more challenging. Companies with strong recovery systems protect this metric directly.

Slicker vs. FlexPay, Recurly & DIY: Should You Build or Buy?

Enterprise teams face a fundamental choice: build payment recovery in-house or partner with a specialized platform. Here's how the options compare:

Solution | Approach | Best For |

|---|---|---|

Slicker | YC-backed, pay-for-success model + multi-gateway routing | Companies wanting 2-4× better recovery than native billing |

FlexPay | Enterprise ML trained on 7 % of all US annual transactions | Large-scale B2C subscription businesses |

Recurly | Built-in intelligent retries with billing platform | Companies already on Recurly seeking integrated solution |

DIY | Custom-built retry logic | Teams with significant engineering resources and unique requirements |

Recurly's case studies demonstrate concrete results: after implementation, Output saw an astounding 45 % decrease in card declines.

Slicker differentiates through its pay-for-success pricing model, charging only for successfully recovered payments with no upfront SaaS fees. The platform integrates with existing billing systems like Stripe, Chargebee, and Zuora, enabling rapid deployment without disrupting established workflows.

For enterprises evaluating options, key considerations include:

Integration complexity: How quickly can you go live?

Recovery rate improvement: What's the incremental lift over current performance?

Pricing alignment: Does the vendor's incentive match your outcomes?

Compliance readiness: Is SOC 2 Type II certification in place or in progress?

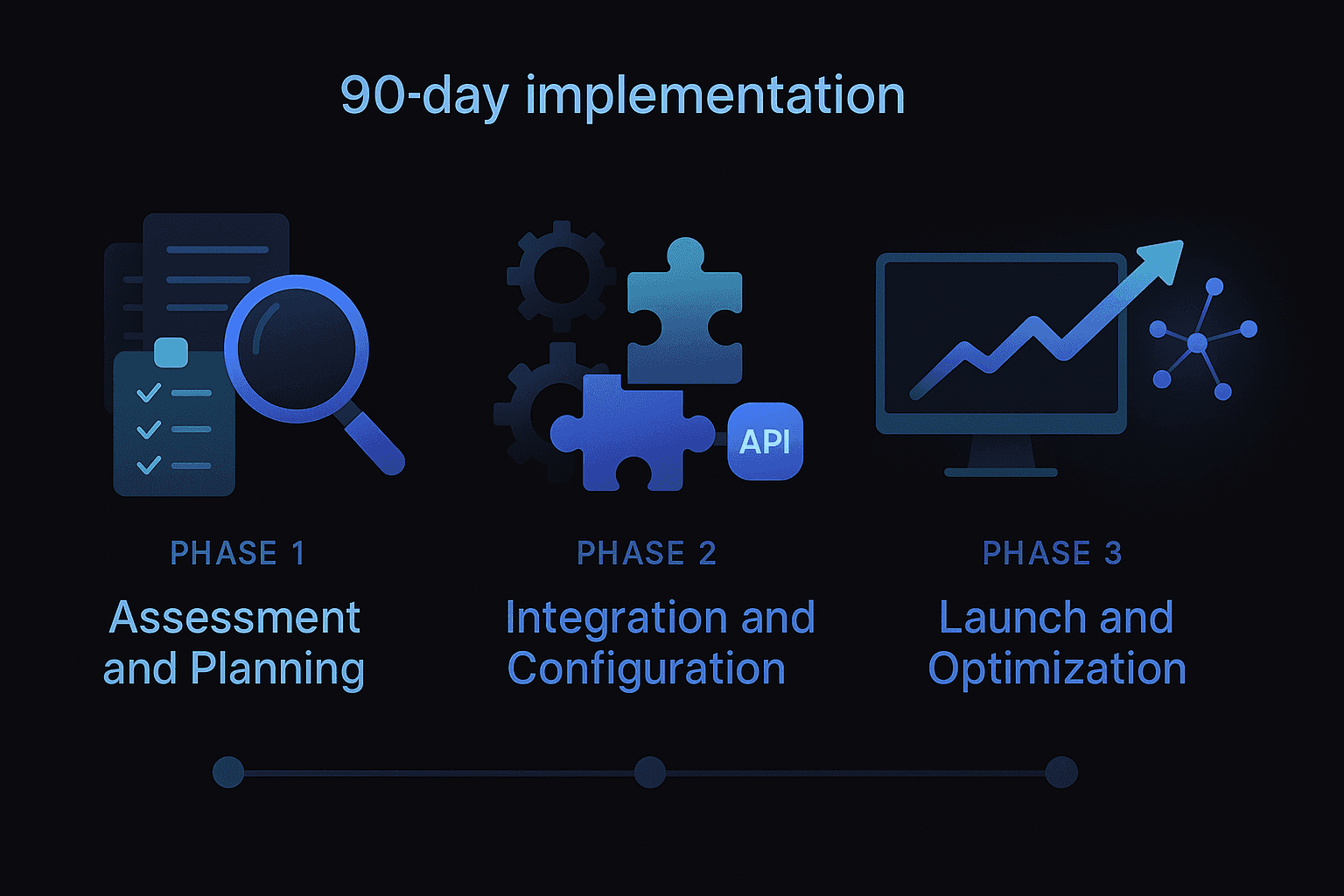

What Does a 90-Day Enterprise Implementation Roadmap Look Like?

Deploying AI-powered payment recovery at enterprise scale requires careful planning. Here's a phased approach that addresses both technical integration and compliance requirements:

Phase 1: Assessment & Planning (Days 1-30)

Audit current recovery rates and failure patterns

Map existing billing and payment infrastructure

Identify SOC 2 requirements (large enterprise buyers often ask specifically for Type 2 reports)

Select recovery platform and finalize integration scope

Phase 2: Integration & Configuration (Days 31-60)

Connect billing platform APIs (Stripe, Chargebee, Zuora)

Configure retry rules and gateway routing preferences

Set up dunning communication workflows

Establish monitoring dashboards and alerting

Phase 3: Launch & Optimization (Days 61-90)

Go live with shadow mode to validate recovery decisions

Enable full automated recovery

Tune retry timing based on initial performance data

Document processes for SOC 2 compliance evidence

SOC 2 Type II compliance has become table stakes for payment recovery platforms handling sensitive financial data. Organizations with SOC 2 Type II certification experience 57 % fewer data breaches and reduce client onboarding time by 30 %, according to recent industry studies.

For enterprises with PCI DSS requirements, ensure your recovery platform supports outsourced account data functions appropriately, maintaining compliance without adding scope to your own assessment.

Turning Failed Payments Into Sustainable Growth

Failed subscription payments represent one of the largest addressable revenue opportunities for enterprise subscription businesses. The data is clear: AI-powered recovery systems can recapture up to 70 % of failed payments, transforming what was once written off as unavoidable loss into recovered revenue.

The path forward involves three core elements:

Intelligent retries that optimize timing and routing for each individual transaction

Proactive dunning that complements automated recovery with human-centered communication

Continuous measurement using metrics like DSR and recovery rate to drive ongoing improvement

Slicker customers typically see between a 10 and 20 percentage point increase in the number of recovered payments. With a pay-for-success model that charges only for recovered revenue, the economics align directly with outcomes.

For enterprises managing million-subscriber bases, the question isn't whether to invest in payment recovery. It's how quickly you can deploy a solution that turns failed payments from a silent drain into a competitive advantage. Contact Slicker to see how AI-powered recovery can protect your subscription revenue.

Frequently Asked Questions

What is involuntary churn and why is it significant?

Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their decision to cancel. It is significant because it can silently drain revenue, comprising up to 40% of a business's total churn, and can cost subscription companies billions annually.

How do AI-powered smart retries improve payment recovery?

AI-powered smart retries optimize the timing and routing of payment attempts, increasing the likelihood of successful transactions. This approach can lead to a 20-50% increase in recovered revenue by using machine learning to predict the best times to retry failed payments.

What are the differences between soft and hard declines in payment processing?

Soft declines are temporary issues like insufficient funds or processor timeouts that can often be resolved with retries. Hard declines are permanent issues such as stolen cards or closed accounts, requiring customer intervention to resolve.

How can proactive dunning campaigns enhance payment recovery?

Proactive dunning campaigns involve communicating with customers to collect due payments. Effective campaigns use clear, timely messages across multiple channels and personalize communication based on customer segments and failure reasons, complementing automated retries to maximize recovery.

What KPIs are crucial for tracking subscription revenue recovery?

Key performance indicators for tracking subscription revenue recovery include Document Success Rate (DSR), Net Revenue Retention, Gross Revenue Retention, Recovery Rate, and Involuntary Churn Rate. These metrics help assess billing health and the efficiency of payment recovery efforts.

How does Slicker differentiate itself in the payment recovery market?

Slicker differentiates itself with a pay-for-success pricing model, charging only for successfully recovered payments. It integrates seamlessly with existing billing systems and offers multi-gateway routing to maximize payment success rates, providing a significant lift over native billing solutions.

Sources

https://www.slickerhq.com/blog/soft-decline-retry-strategies-saas-cfos-q3-2025-guide

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://stripe.com/en-ch/resources/more/dunning-what-subscription-based-businesses-need-to-know

https://www.cleverbridge.com/resources/cleverbridge-smart-retries

https://stripe.com/docs/billing/revenue-recovery/smart-retries

https://www.slickerhq.com/blog/the-hidden-cost-of-failed-payments-beyond-the-lost-revenue

https://juspay.io/blog/juspay-aiops-solution-to-reduce-passive-churn

https://developer.zuora.com/blogs/2025-3-18-turningfailureintogold/

https://www.sapphireventures.com/insights/saas-benchmarks-report-2025/

https://www.trustcommunity.io/resources/soc-2-type-2-checklist

https://docs-prv.pcisecuritystandards.org/SAQ%20(Assessments

WRITTEN BY

Slicker

Slicker