Guides

10

min read

How to recover failed subscription payments from 50K+ backlogs

Recovering 50K+ failed subscription payments requires systematic segmentation, AI-powered smart retries, and multi-gateway routing. Best-in-class platforms achieve 45-60% recovery rates by implementing intelligent retry cadences that analyze billions of transactions to optimize timing, while automated payment reminders make recovery 90% faster.

At a Glance

• Failed payment backlogs cost far more than face value—each failed $50 subscription can represent $1,727.50 in total losses including lost lifetime value and acquisition costs

• Average transaction failure rates reach 35%, but can climb as high as 70% for subscription businesses

• Smart retry systems using AI can recover up to 50% of terminally failed transactions by optimizing retry timing based on customer behavior patterns

• Multi-gateway routing immediately recovers an additional 8% of failures by leveraging alternate payment processors

• Payment orchestration platforms market is growing at 23.7% CAGR, projected to reach $6.1 billion by 2030

• Leading recovery platforms like Slicker integrate with existing billing infrastructure using pay-for-success models, eliminating upfront risk

High-volume subscription brands lose millions when they fail to recover failed subscription payments. The global subscription industry is projected to reach a market value of $1.5 trillion by 2025, yet subscription companies could lose an estimated $129 billion in 2025 due to involuntary churn alone.

This post unpacks why a 50K invoice backlog forms and shows exactly how to eliminate it, boost approval rates, and stop involuntary churn from silently draining your revenue.

50K failed payments isn't a queue - it's a silent revenue leak

When finance teams see a backlog of 50,000 failed invoices, they often underestimate the scale of the problem. Failed payments are not new nor rare in subscription businesses. "While the average transaction failure rate is 35%, it can be as high as 70% or more," according to Recover Payments.

The customer retention impact is equally stark. When customers get locked out over a failed payment, 62% simply never come back. Each of those 50,000 invoices represents a subscriber who wanted to stay but couldn't complete their payment through no fault of their own.

This subscription payment backlog feeds directly into involuntary churn, the silent killer of recurring revenue businesses. Unlike voluntary churn, where customers actively choose to leave, involuntary churn happens when payment hurdles get in the way of subscription renewals. The result is a compounding revenue leak that grows larger with every billing cycle.

Key takeaway: A 50K invoice backlog isn't an administrative inconvenience; it's an active drain on customer lifetime value that compounds monthly.

Why do subscription payment backlogs balloon? 5 root causes to tackle first

Understanding why backlogs form is the first step toward eliminating them. Here are the five primary drivers:

Involuntary churn mechanics. Payment failures often result in involuntary churn when customers unintentionally drop out of subscription services not because they chose to leave, but because payment hurdles got in the way of their subscription renewal.

Static retry logic. The concept of "smart retries" or "dynamic collections" is now well established, yet many companies still rely on fixed schedules. Modern billing solutions leverage years of transaction data to optimize when failed payments are retried, improving cash flow while decreasing involuntary churn.

Hard decline mismanagement. Stripe can't automatically retry a payment if the card issuer returns hard decline codes such as incorrect_number, lost_card, stolen_card, or authentication_required. Attempting retries on these transactions wastes resources and risks compliance violations.

Lack of gateway redundancy. When a single payment processor experiences downtime or declines transactions at higher rates, companies without backup gateways see their backlogs grow rapidly.

Delayed customer communication. Without proactive outreach when payments fail, customers remain unaware of issues with their payment methods until their service is interrupted.

What's the hidden cost of a 50K-invoice backlog - why every failed $50 bill can bleed $1,727.50

The visible cost of a failed $50 payment is obvious. The hidden costs are what destroy margins.

Lost Customer Lifetime Value

The most significant hidden cost lies in the lost customer lifetime value. In subscription businesses, the average customer stays for 24 months, meaning that $50 monthly subscription actually represents $1,200 in expected revenue.

The Involuntary Churn Multiplier

Involuntary churn can represent up to 30% of total customer churn for subscription businesses. For a company with a 50K invoice backlog, even modest churn rates translate to thousands of permanently lost customers.

Wasted Acquisition Spend

86% of businesses reported that up to 30% of their monthly invoiced sales were overdue. When those customers churn, you've not only lost future revenue but also the marketing investment that acquired them.

Cost Category | Per Failed $50 Payment |

|---|---|

Lost LTV (24 months) | $1,200 |

Customer acquisition cost | $205 |

Operational costs | $72.50 |

Lost expansion revenue | $200 |

Brand/trust impact | $50 |

Total real cost | $1,727.50 |

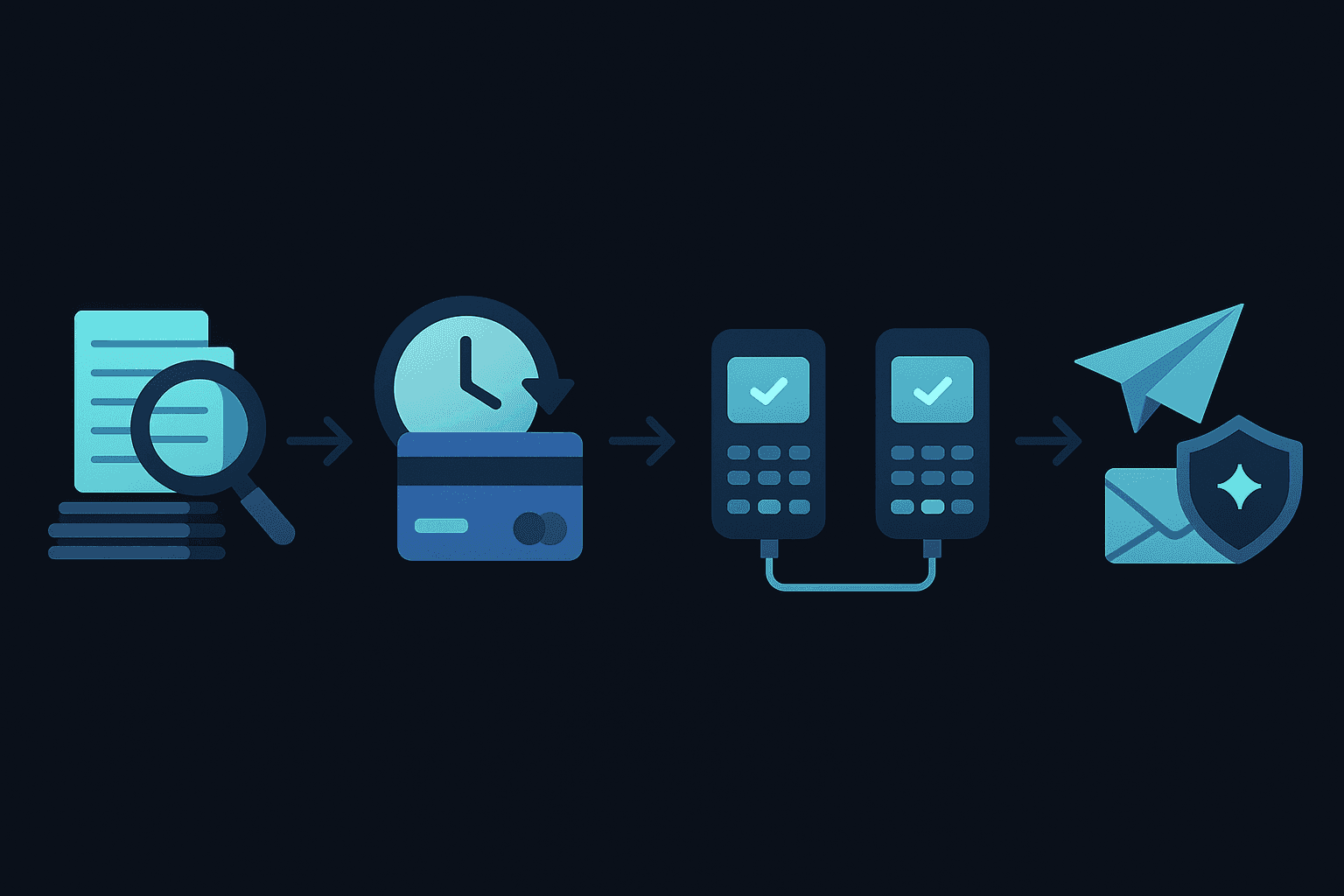

How can you clear a 50K backlog in four steps?

Clearing a massive backlog requires a systematic approach. A proven framework for revenue recovery includes smart retry logic, dynamic routing, and network tokenization.

Here's the four-step process:

Audit and segment the backlog by decline type

Apply smart retries to soft declines first

Escalate with dynamic routing for persistent failures

Orchestrate proactive outreach and tokenization for prevention

Automated systems for payment reminders and follow-ups make the entire process of getting paid 90% faster. AI platforms built on adaptive engines analyze debtor behavior in real time to continuously optimize collections outreach.

Audit & segment the backlog: which decline types matter most?

Before retrying anything, classify every failed transaction by decline type. This determines your recovery strategy.

Soft declines are temporary issues worth retrying:

Insufficient funds

Daily limit exceeded

Network timeout

Issuer system glitch

Hard declines are permanent failures for that payment method:

Stolen card

Account closed

Invalid card number

Soft declines should enter your smart retry queue. Hard declines require customer outreach to collect updated payment information. Mixing these two categories wastes retry attempts on transactions that will never succeed.

2. Apply data-driven smart retries first

Smart Retries chooses the best times to retry failed payment attempts to increase the chance of success. Unlike fixed schedules, machine learning models analyze dynamic signals such as device usage and local time zones.

Recurly's Intelligent Retries employs machine learning to determine the optimal time for retrying a declined recurring credit card payment. This approach is data-driven, analyzing billions of transactions to enhance the likelihood of successful payments.

Steps to implement smart retries:

Enable AI-powered retry logic in your billing platform

Set appropriate retry limits (Stripe recommends 8 tries within 2 weeks)

Monitor recovery rates by decline code

Adjust timing based on customer time zones and payment patterns

Dynamic routing & multi-gateway: when should you escalate?

When smart retries on your primary gateway don't succeed, escalate to alternate processors.

Multi-gateway approaches immediately recover about 8% of failures by trying alternate processors. This additional uplift comes from differences in issuer relationships, regional coverage, and processing capabilities across gateways.

Escalate to dynamic routing when:

Soft declines persist after 3 to 5 retry attempts

Decline codes suggest processor-specific issues

Customer geography differs from your primary gateway's strength

Transaction volume spikes beyond single-gateway capacity

AI can analyze a customer's usage patterns, payment history, and account value to suggest personalized payment plans and route transactions through the optimal processor.

How do you design smart retry cadences that beat the 45-60 % benchmark?

Industry benchmarks show that best-in-class recovery rates hover between 45-60 %, but the path to achieving these numbers requires strategic thinking about retry cadences, timing windows, and intelligent routing.

Compliance Constraints

Card networks limit retries to 15 attempts in 30 days. Strategic spacing prevents compliance violations and potential fines from Visa and Mastercard.

Recommended Cadence Structure

The recommended default setting from Stripe is 8 tries within 2 weeks. However, optimal cadences vary by decline type:

Decline Scenario | Retry Schedule |

|---|---|

Gateway error | Every 2 days |

Issuer unavailable | Every 3 days |

Insufficient funds | AI-optimized timing |

Communication error | 4 hours apart initially, then daily |

The first retry captures the majority of recoverable revenue, with diminishing returns on subsequent attempts. AI-powered systems achieve higher recovery rates by learning from each transaction and adjusting timing based on individual customer payment patterns rather than applying blanket rules.

Key takeaway: Beat the 45-60 % benchmark by combining compliant retry limits with AI-optimized timing that adapts to each customer's behavior.

Payment orchestration & dynamic routing: how do you squeeze the last 10 %?

After smart retries and multi-gateway routing, payment orchestration extracts the remaining recoverable revenue.

The global market for Payment Orchestration Platforms was estimated at US$1.7 billion in 2024 and is projected to reach US$6.1 billion by 2030, growing at a CAGR of 23.7%.

What Orchestration Delivers

AI-powered transaction routing enables businesses to automatically select the most cost-effective and high-performing payment providers, reducing transaction fees and improving authorization rates.

Key orchestration capabilities:

Intelligent routing: Automatically direct transactions to the gateway with the highest approval probability

Failover automation: Instantly switch to backup processors when primary gateways decline

Tokenization: Maintain valid payment credentials even when cards are reissued

Adaptive acceptance: Processors retry declined transactions in real-time when likely to succeed

Using multiple payment gateways should be on the list of planned payments infrastructure improvements for any company with plans to expand. Merchants and marketplaces that need to transact in new geographies or currencies may find their current gateway limits their expansion.

Which recovery platform delivers the best ROI? Slicker vs Stripe, Recurly & Vindicia

Selecting the right recovery platform depends on your billing infrastructure, transaction volume, and integration requirements.

Platform | AI/ML Recovery | Recovery Rate | Integration Model | Pricing Model |

|---|---|---|---|---|

Slicker | Proprietary ML engine | Best-in-class | Sits on existing billing/payment rails | Pay-for-success |

Stripe | Smart Retries | Up to 70% with optimization | Native to Stripe Billing | Included with Billing |

Recurly | Intelligent Retries | Billions of transactions analyzed | Native dunning + retries | Platform subscription |

Vindicia | AI/ML for terminal failures | Up to 50% of terminal failures | API or interface submission | Enterprise pricing |

Vindicia Retain is described as the #1 payment recovery solution, utilizing AI and ML to automatically recapture up to 50% of failed transactions, including issues like expired cards, suspicious activity, and insufficient funds.

Recurly's intelligent retry logic uses data from billions of transactions to increase the chances of successful payments. Retries cease after 7 declines, 20 total attempts, or 60 days post-invoice creation.

Stripe Billing can automatically retry failed subscription and invoice payments. The platform recommends using Smart Retries but also allows custom retry schedules.

Why Slicker Stands Out

For companies using Chargebee, Zuora, or in-house billing systems, Slicker offers a distinct advantage. Rather than replacing existing infrastructure, Slicker's AI engine sits on top of current billing and payment systems. The pay-for-success pricing model means you only pay when payments are actually recovered, eliminating upfront risk.

Turn backlog into growth momentum - next steps

A 50K invoice backlog doesn't have to remain a permanent fixture on your balance sheet. With the right approach, you can convert it into recovered revenue within weeks.

Summary of key actions:

Audit your backlog immediately, separating soft declines from hard declines

Implement AI-powered smart retries for soft declines

Add multi-gateway routing to capture an additional 8-10% of failures

Deploy payment orchestration to maximize approval rates across all transactions

Establish proactive customer outreach for hard declines requiring updated payment methods

Companies like Slicker are leading this evolution, using AI-powered recovery systems that integrate seamlessly with existing billing platforms to turn potential losses into sustained revenue.

The difference between treating a backlog as an administrative burden versus a revenue opportunity determines whether involuntary churn continues draining your growth or becomes a problem you've permanently solved.

Frequently Asked Questions

What causes a 50K subscription payment backlog?

A 50K subscription payment backlog can be caused by involuntary churn, static retry logic, hard decline mismanagement, lack of gateway redundancy, and delayed customer communication.

How can companies clear a 50K invoice backlog?

Companies can clear a 50K invoice backlog by auditing and segmenting the backlog, applying smart retries, escalating with dynamic routing, and orchestrating proactive outreach and tokenization.

What is the hidden cost of a failed $50 payment?

The hidden cost of a failed $50 payment includes lost customer lifetime value, wasted acquisition spend, and operational costs, totaling approximately $1,727.50 per failed payment.

How does Slicker help in recovering failed payments?

Slicker uses an AI engine that integrates with existing billing systems to recover failed payments, offering a pay-for-success pricing model that eliminates upfront risk.

What are smart retries and how do they work?

Smart retries use AI to determine the best times to retry failed payments, increasing the chance of success by analyzing dynamic signals like device usage and local time zones.

Why is payment orchestration important for subscription businesses?

Payment orchestration is important as it enables businesses to select the most cost-effective and high-performing payment providers, reducing transaction fees and improving authorization rates.

Sources

https://www.slickerhq.com/blog/soft-decline-retry-strategies-saas-cfos-q3-2025-guide

https://vindicia.com/technical-center/faq/vindicia-retain-faq/

https://stripe.com/docs/billing/revenue-recovery/smart-retries

https://www.slickerhq.com/blog/the-hidden-cost-of-failed-payments-beyond-the-lost-revenue

https://creditsafe.com/us/en/resources/research/cost-of-late-payments.html

https://www.ixopay.com/whitepapers/turning-failed-subscription-payments-into-recovered-revenue

https://ai.respaid.com/ai-learns-debtor-behavior-collections

https://www.researchandmarkets.com/reports/5765995/payment-orchestration-platform-global-strategic

https://spreedly.com/blog/using-multiple-payment-gateways-key-business-advantages

WRITTEN BY

Slicker

Slicker