Guides

10

min read

No-code AI payment error resolution: 5-minute setup guide

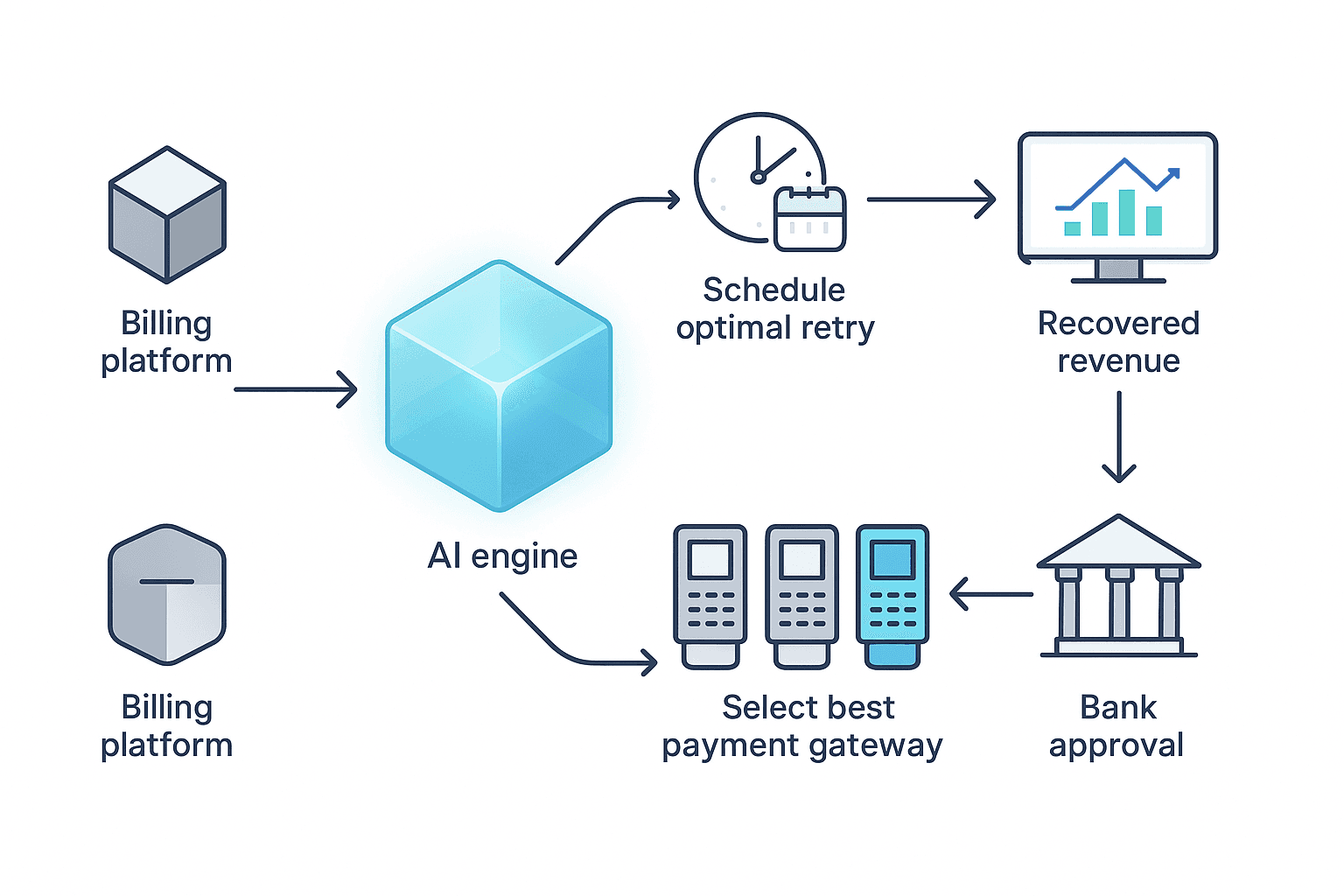

No-code AI payment error resolution tools connect directly to billing platforms like Stripe or Chargebee through OAuth, enabling 5-minute setup without engineering resources. These systems use machine learning to analyze failed payments individually, schedule optimal retry times, and route transactions through multiple gateways, typically achieving 2-4x better recovery rates than native billing platform retry logic.

At a Glance

Payment failures cause 10-15% annual revenue loss for subscription businesses, with involuntary churn potentially costing the industry $129 billion in 2025

AI-powered retry engines analyze each failed payment individually rather than using fixed schedules, resulting in 20-50% higher recovery rates

Multi-gateway routing prevents 20-30% of lost sales by automatically redirecting payments when a provider fails

No-code integration takes 5 minutes through app marketplaces or OAuth connections

Modern platforms provide full audit trails for every AI decision, ensuring compliance with VAMP requirements starting April 2025

Pay-for-success pricing models charge only for recovered payments, eliminating implementation risk

Payment failures can bleed revenue long before finance teams notice. No-code AI payment error resolution lets SaaS operators plug an ML-powered retry engine into Stripe, Chargebee or Zuora in minutes -- no developers required.

Why do payment failures need an AI-first, no-code fix?

Payment failures are the silent killers of SaaS cash flow. Industry research shows that 10-15% of subscription revenue disappears annually due to payment failures such as expired cards and insufficient funds. Even more alarming, subscription companies could lose an estimated $129 billion in 2025 due to involuntary churn.

The problem lies in complexity. There are over 2,000 things that can go wrong when a credit card is processed for a transaction. Traditional retry logic simply cannot keep pace with this variability.

No-code AI payment error resolution addresses this by:

Automatically detecting and classifying payment errors

Scheduling retries at optimal times based on ML analysis

Routing transactions through gateways with the highest success probability

Requiring zero engineering resources for deployment

"5 minutes. This is how much time you will need in Slicker's dashboard to have your instance up and running. No-code revenue recovery."

-- Slicker

How much revenue do failed payments really cost SaaS companies?

The financial impact of payment failures extends far beyond the obvious missed transaction.

Metric | Impact |

|---|---|

Annual revenue loss from involuntary churn | |

MRR lost to card declines and soft errors | |

Involuntary churn as percentage of total churn | |

Average B2B SaaS involuntary churn rate |

Churnkey's analysis of over $3 billion in subscription revenue reveals that insufficient funds represent nearly half of all declines. The good news? 70% of all involuntary churn detected was recovered through intelligent retry strategies.

A 5% improvement in retention can drive 25%+ increase in profits over time. Every failed payment that leads to involuntary churn forces you to spend that premium again.

Key takeaway: Failed payments represent recoverable revenue, not lost customers -- if you have the right tools in place.

How does a modern AI retry engine work -- and why is no code enough?

A modern AI retry engine combines three core capabilities: intelligent error detection, optimized retry scheduling, and dynamic gateway routing. The no-code approach works because these systems connect directly to your existing billing infrastructure through pre-built integrations.

Smart retries vs. batch logic

Traditional batch processing treats all payment failures identically -- scheduling retries at fixed intervals regardless of the failure reason. This approach, as one industry analysis puts it, is "the equivalent of fishing with dynamite when precision angling tools are readily available."

The data supports individualized approaches: companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue.

Smart retries analyze:

Error codes and their true recoverability

Issuer-specific behavior patterns

Historical success rates by time of day

Customer payment history

Multi-gateway routing for higher approvals

Relying on a single payment gateway creates unnecessary risk. Failed payments cause nearly 20-30% of all lost online sales, with single-gateway dependency being the primary culprit.

Having multiple payment gateways ensures uninterrupted transaction processing, automatically redirecting payments to an active gateway if one goes down. With smart payment routing, businesses can increase success rates, lower transaction costs, and offer seamless payments worldwide.

How to integrate in 5 minutes -- install to first recovered dollar

The setup process eliminates traditional integration complexity. Here's how to go from zero to recovering payments:

Connect your billing platform in two clicks

Slicker supports popular billing and payment platforms, such as Stripe, Chargebee, Recurly, Zuora, and Recharge, as well as in-house systems.

For Stripe users:

Head to Stripe's App Marketplace

Click "Install" and connect your Stripe account

Grant read/write payment permissions

"Slicker is now live on Stripe's App Marketplace! This means you can now leverage our 5-minute integration directly through Stripe, making it easier than ever to recover failed recurring payments and boost your revenue."

For Chargebee, Zuora, and other platforms, the OAuth connection flow works similarly -- authorize access and the onboarding wizard imports your decline history automatically.

Audit and monitor every AI decision

Machine learning does not mean a black box. You can inspect, audit and review every future or historical action in the dashboard. This transparency lets finance teams:

Verify retry logic matches business rules

Review which errors are being classified as retryable

Track recovery rates by error type and gateway

Export data for compliance documentation

What best-practice levers maximise recovered revenue?

Optimizing payment recovery requires attention to retry windows, fraud prevention, and regulatory compliance.

Retry window optimization:

Intelligent systems analyze each failed payment individually rather than applying blanket rules. This means considering issuer differences, historical performance data, and real-time approval probabilities.

VAMP compliance requirements:

Visa's payment landscape is undergoing significant transformation. Starting April 1, 2025, Visa is consolidating its monitoring programs into a unified Visa Acquirer Monitoring Program with dramatically tighter dispute thresholds.

An acquirer's portfolio is identified as Above Standard if its VAMP ratio is ≥50bps and as Excessive if ≥70bps. This makes strategic retry behavior essential -- aggressive, unintelligent retries can trigger compliance issues.

Fraud check integration:

Effective April 1, 2025, VAMP will integrate the Visa Fraud Monitoring Program and the Visa Dispute Monitoring Program into a unified framework with stricter thresholds. Your recovery platform needs to factor fraud signals into retry decisions to maintain compliance.

Key takeaway: Recovery optimization must balance maximizing successful retries against compliance risk from excessive retry attempts.

Slicker vs. legacy collections tools: where does AI win?

Legacy collection tools typically rely on rule-based logic and manual workflows. Here's how AI-powered solutions compare:

Capability | Legacy Tools | AI-Powered (Slicker) |

|---|---|---|

Retry logic | Fixed schedules | |

Gateway routing | Single provider | |

Setup time | Days to weeks | |

Engineering required | Yes | No |

Recovery improvement | Baseline |

Zuora Collections positions itself as turning cash recovery into a strategic, customer-centric process by connecting billing, revenue, and CRM into one platform. However, this approach requires significant platform commitment.

PayStorm claims to reduce late payments by 40% and save 5+ hours weekly, focusing primarily on invoice-based collections for SMEs rather than subscription payment recovery.

Slicker differentiates through its pay-for-success model and focus specifically on subscription payment failures. All users see a 2-4x improvement in recoveries compared with their existing system, with customers typically experiencing between a 10 and 20 percentage point increase in recovered payments.

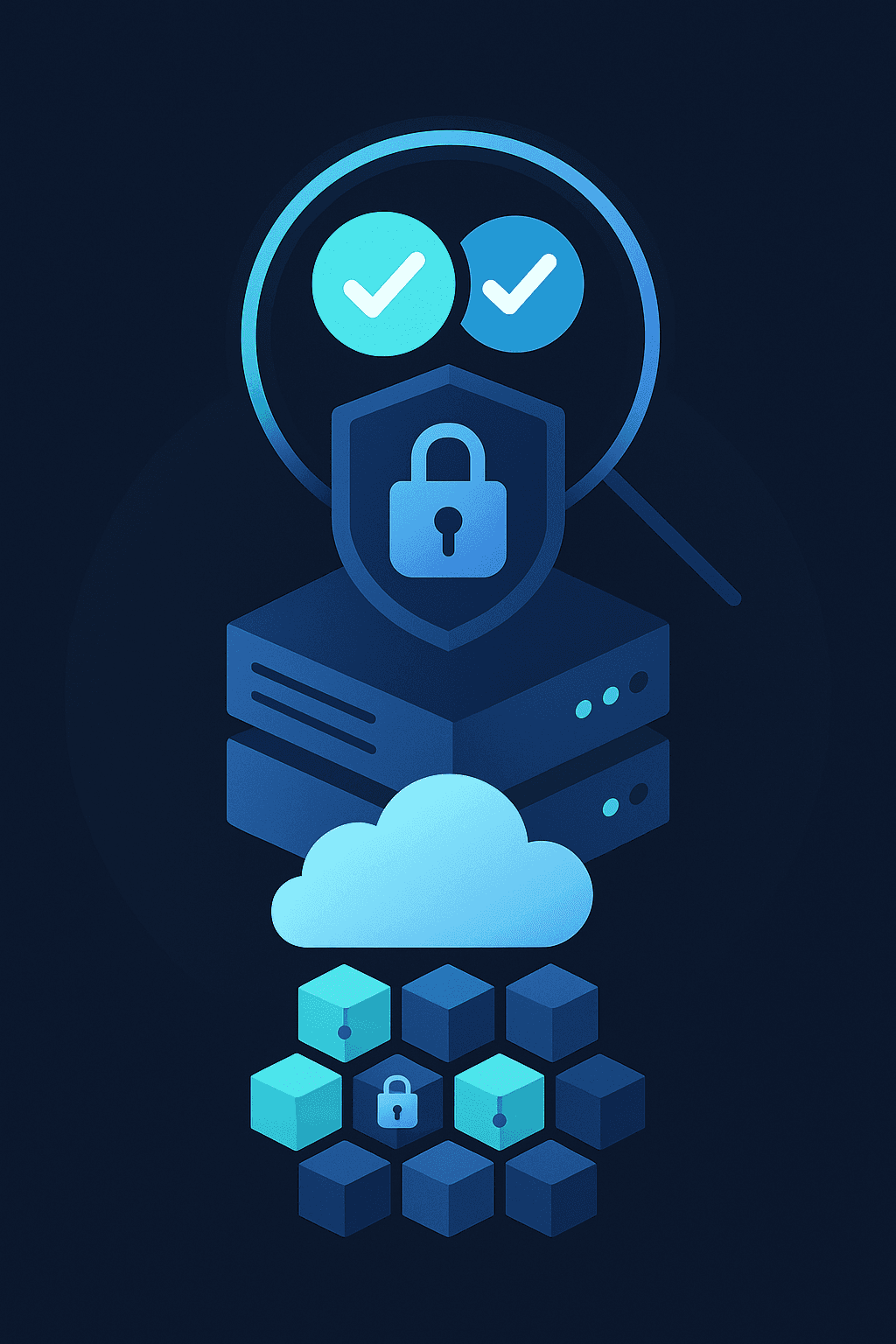

Is your recovery platform SOC-ready? Security & compliance essentials

Enterprise subscription businesses require recovery platforms that meet rigorous security standards.

SOC2 is considered to be a gold standard for data security and is specifically designed for service providers storing customer data in the cloud. When evaluating platforms, verify:

Encryption: Data encrypted both in transit and at rest

Access controls: Principle of least privilege enforcement

Monitoring: 24/7 security coverage of cloud services

Compliance certifications: ISO 27001:2013 and SOC 2 Type 2 represent industry standards

Slicker follows the best cloud security practices and is in the process of obtaining SOC2 Type-II compliance. The leadership team has launched products processing more than $1B in payments, banking and asset management.

For AI-powered financial tools specifically, ensure the provider has:

Clear data retention policies

Incident response procedures

Employee vetting processes

Regular third-party security audits

Next steps: start recovering revenue before your coffee gets cold

No-code AI payment error resolution removes the traditional barriers between recognizing a payment recovery problem and solving it. The technology has matured to the point where sophisticated ML-powered retry logic, multi-gateway routing, and comprehensive audit capabilities are accessible without writing code or engaging engineering teams.

Slicker's machine learning model schedules and retries failed payments at optimal times, leveraging industry expertise and tens of parameters. Machine learning does not mean a black box -- you can inspect, audit and review every action in the dashboard for complete transparency.

To get started:

Get a free payment audit to discover how much Slicker can boost your MRR

Connect your billing platform through the 5-minute integration

Review the AI-generated recovery strategy

Launch and monitor results in real-time

With a pay-for-success pricing model and a one-month free trial, there's no risk in testing whether AI-powered payment recovery can improve your retention rates.

Frequently Asked Questions

What is no-code AI payment error resolution?

No-code AI payment error resolution allows SaaS operators to integrate an ML-powered retry engine into billing systems like Stripe or Chargebee without needing developers. It automates error detection, retry scheduling, and transaction routing to optimize payment success.

How much revenue do failed payments cost SaaS companies?

Failed payments can lead to significant revenue loss, with up to 15% of subscription revenue disappearing annually due to involuntary churn. Intelligent retry strategies can recover up to 70% of this lost revenue.

How does a modern AI retry engine work?

A modern AI retry engine uses intelligent error detection, optimized retry scheduling, and dynamic gateway routing. It connects to existing billing systems through pre-built integrations, requiring no coding for setup.

What are the benefits of using multiple payment gateways?

Using multiple payment gateways reduces the risk of transaction failures by redirecting payments to an active gateway if one fails. This approach increases success rates, lowers transaction costs, and ensures seamless global payments.

How does Slicker ensure compliance with payment regulations?

Slicker adheres to best practices in cloud security and is working towards SOC2 Type-II compliance. It integrates fraud checks and strategic retry behavior to comply with Visa's Acquirer Monitoring Program and other regulatory requirements.

Sources

WRITTEN BY

Slicker

Slicker