Guides

10

min read

Setup smart retries to recover failed payments (50K+ subscribers)

Smart payment retries use AI-driven engines to automatically re-process failed subscription charges at optimal times, recovering up to 70% of failed payments. For businesses with 50,000+ subscribers, implementing intelligent retry strategies instead of batch processing can increase recovered revenue by 20-50%, translating to millions in saved annual revenue.

At a Glance

• Failed payments cost subscription businesses 9% of total revenue annually, approximately $129 billion industry-wide in 2025

• DIY implementations with Stripe, Recurly, or Zuora require extensive engineering overhead including webhook configuration, decline code monitoring, and custom retry logic

• AI-powered engines analyze decline codes, customer history, and cash flow patterns to schedule individualized retries rather than batch processing

• Slicker's platform deploys in 5 minutes with no code required and uses pay-for-success pricing

• Multi-gateway routing increases recovery rates by 10-20 percentage points by automatically retrying through alternative processors

• For a company with 50,000 subscribers at $50/month, smart retries can recover approximately $2.7 million in at-risk revenue annually

Failed payments silently drain subscription revenue. For businesses with 50,000 or more subscribers, smart payment retries offer a proven path to recover lost transactions, reduce involuntary churn, and protect margins without overwhelming your engineering team.

This guide breaks down why smart retries matter at scale, what makes DIY implementations with Stripe, Recurly, or Zuora so complex, and how to deploy an AI-powered retry engine in minutes.

Why smart payment retries matter for 50K-plus subscriber businesses

Smart payment retries are automated, data-driven attempts to re-process a failed subscription charge at the moment it is most likely to succeed. Rather than batch-retrying every decline on the same schedule, an AI engine analyzes decline codes, customer history, and cash-flow patterns to schedule each retry individually.

"Involuntary churn occurs when a customer's subscription is terminated due to payment failures rather than their conscious decision to cancel." This silent revenue leak accounts for 20-40% of total customer churn, with subscription box companies reporting rates as high as 30%.

Failed payments cost subscription businesses 9% of total revenue annually, approximately $129 billion industry-wide in 2025. For a company with 50,000 subscribers paying $50 per month, that translates to $2.7 million at risk every year.

Businesses leveraging AI-powered payment recovery systems can recapture up to 70% of failed payments, turning a preventable loss into recovered MRR.

The hidden revenue leak: quantifying payment failure and churn

Industry research shows that 10-15% of subscription revenue disappears annually due to payment failures such as expired cards and insufficient funds. Card declines, bank rejections, and soft errors collectively wipe out as much as 4% of MRR in high-growth subscription businesses.

Every 1% lift in recovery can translate into tens of thousands of annual revenue. For businesses operating at scale, the math is straightforward: improving your payment retry strategy delivers an outsized return with minimal incremental cost.

Companies that switch from batch-based to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue. That lift compounds month over month, making smart retries one of the highest-leverage investments a subscription finance team can make.

Key takeaway: At 50K+ subscribers, even a modest improvement in recovery rate can add six figures to your annual bottom line.

Why do DIY setups with Stripe, Recurly or Zuora become engineering quagmires?

Stripe Smart Retries, Recurly Intelligent Retries, and Zuora Cascading Payment all promise automated recovery, yet each introduces significant engineering overhead.

Stripe Smart Retries requires configuring webhooks, monitoring decline codes, and building custom logic to interpret processor responses. While Stripe offers tools to optimize retry strategies, teams must still maintain the integration as APIs evolve.

Recurly Intelligent Retries uses machine learning to determine optimal retry timing, but enforces hard limits: retries cease after 7 declines, 20 attempts, or 60 days. Customizing schedules beyond those constraints demands additional development.

Zuora Cascading Payment enables dynamic retries using alternative payment methods. However, the feature remains in Early Adopter phase and is not compatible with Advanced Payment Manager, limiting flexibility for enterprises with complex billing stacks.

Building your own retry engine also means implementing exponential backoff with jitter, capping maximum attempts, and handling edge cases across multiple gateways. AWS Well-Architected guidance warns that failing to control and limit retry calls exposes systems to high risk of cascading failures.

Effective payment retry strategies can increase revenue by up to 15%, but realizing that gain in-house requires dedicated engineering cycles that most subscription teams cannot spare.

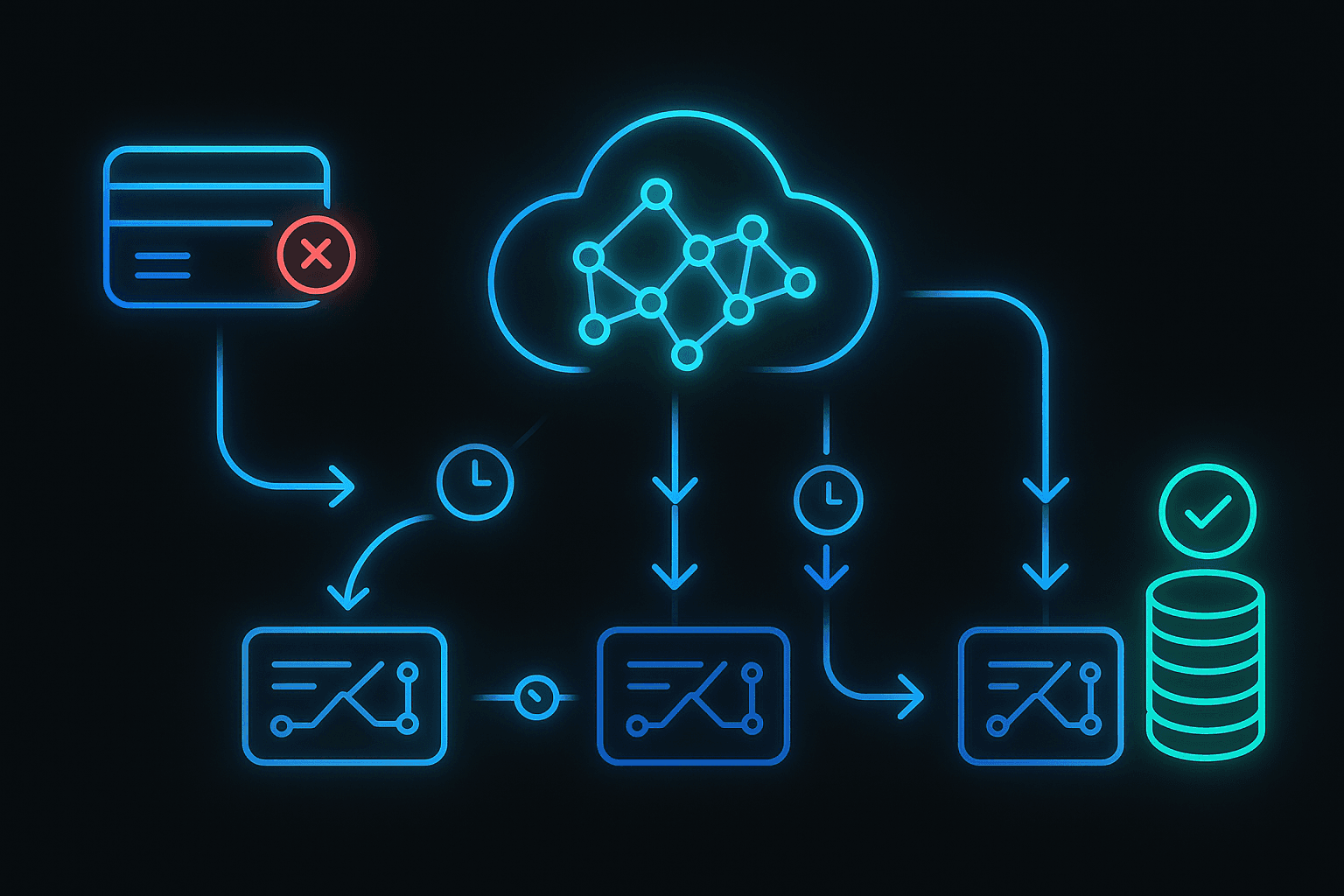

What are the key components of an AI-driven smart retry engine?

A high-performance retry engine combines three core capabilities: a machine-learning decision layer, multi-gateway routing, and automatic fallback logic.

When a payment fails or a processor goes down, the system should automatically retry through a different processor without manual intervention. Controlled retries using exponential backoff and jitter prevent overwhelming gateways while maximizing success windows.

Slicker's AI engine analyzes vast amounts of payment data to identify patterns in failed transactions, creating personalized retry strategies for each decline rather than applying generic rules.

Machine-learning decision layer

Machine learning models process dynamic signals and purchaser behaviors, learning from millions of transactions to predict when funds will be available. By distinguishing soft declines (temporary issues like insufficient funds) from hard declines (permanent blocks), the model tailors timing and routing for each case.

Multi-gateway routing & fallback

If the payment fails through the primary processor due to specific reasons, the system retries with an alternative processor to increase the chances of success. This multi-processor approach ensures that a single gateway outage or regional decline pattern does not block recovery.

How to deploy smart payment retries with Slicker in 5 minutes

Slicker's platform takes just 5 minutes to set up, no code required. The following steps walk you through deployment:

Connect your billing system. Slicker integrates with Chargebee, Zuora, and in-house billing stacks via pre-built connectors.

Authorize payment access. Grant read/write permissions so the AI engine can detect failed payments instantly, analyze failure reasons, and execute automated recovery attempts.

Configure retry rules (optional). Accept Slicker's ML-optimized defaults or customize retry windows to match your business logic.

Enable multi-gateway routing. If you process through multiple gateways, activate fallback routing. Customers typically see 10-20 percentage point increases in recovered payments when implementing multi-gateway routing.

Monitor recoveries in the dashboard. Track recovered revenue, retry success rates, and churn impact in real time.

Slicker's pay-for-success pricing aligns incentives: you only pay for successfully recovered payments, eliminating upfront risk.

Scorecard: Slicker vs FlexPay, GoCardless Success+, Paddle & more

The table below compares leading AI payment recovery platforms across key dimensions.

Platform | Recovery Approach | Integration Complexity | Pricing Model | Notable Limitation |

|---|---|---|---|---|

Slicker | Proprietary AI engine; 2-4x better recoveries than static systems | 5-minute setup; no code | Pay-for-success | Pursuing SOC 2 Type-II (SOC-2-grade controls in place) |

FlexPay | ML trained on dataset equaling 7% of US annual transactions | Enterprise integration required | Custom | Enterprise-focused; longer onboarding |

GoCardless Success+ | Claims up to 70% recovery for certain failure types | Moderate | Percentage of recovered | Best suited for direct debit markets |

Paddle Retain | Part of comprehensive billing solution | Bundled with Paddle billing | Included in platform fee | Requires full Paddle adoption |

Churn Buster | Combines retry logic with customer communication workflows | Moderate | Tiered subscription | Less focus on AI-driven timing |

Butter | Real-time checkout optimization via ML routing | Checkout-level integration | Custom | Focused on initial authorization, not recurring retries |

The platform brings Silicon Valley innovation to payment recovery with a proprietary AI engine that delivers 2-4x better recoveries than static retry systems. Its pay-for-success model means you pay only when revenue is actually recovered, aligning platform incentives with merchant outcomes.

Stop revenue leakage -- start smart retries today

Every failed payment left unrecovered chips away at your MRR and customer lifetime value. At Slicker, the platform is built around the principle that every failed payment deserves a customized recovery approach.

For high-volume subscription companies ready to move beyond batch retries and DIY complexity, Slicker's AI-powered engine integrates with existing payment rails, deploys in minutes, and charges only for results. Visit slickerhq.com to see how much revenue you can recover.

Frequently Asked Questions

What are smart payment retries?

Smart payment retries are automated, data-driven attempts to re-process failed subscription charges at optimal times, using AI to analyze decline codes and customer history for personalized retry strategies.

Why are smart retries important for businesses with 50K+ subscribers?

For businesses with over 50,000 subscribers, smart retries help recover lost transactions, reduce involuntary churn, and protect margins by optimizing the timing and method of retry attempts.

How do smart retries differ from traditional retry methods?

Unlike traditional batch retries, smart retries use AI to schedule retries based on individual transaction data, improving success rates and reducing the risk of overwhelming payment gateways.

What challenges do DIY setups with Stripe, Recurly, or Zuora present?

DIY setups with platforms like Stripe, Recurly, or Zuora often require significant engineering resources to configure and maintain, including managing webhooks, custom logic, and API updates.

How does Slicker's AI-powered retry engine work?

Slicker's engine uses machine learning to analyze payment data, creating personalized retry strategies. It integrates with existing billing systems and offers multi-gateway routing to maximize recovery rates.

What is the benefit of Slicker's pay-for-success pricing model?

Slicker's pay-for-success model means businesses only pay for successfully recovered payments, aligning incentives and eliminating upfront risk.

Sources

https://www.slickerhq.com/blog/what-is-involuntary-churn-and-why-it-matters

https://www.slickerhq.com/blog/one-size-fails-all-the-case-against-batch-payment-retries

https://www.slickerhq.com/blog/smart-payment-retries-vs-dunning-which-recovers-more-in-2025

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://www.slickerhq.com/blog/top-7-ai-payment-recovery-platforms-2025-comparison-success-rates

https://docs.stripe.com/billing/revenue-recovery/smart-retries

https://docs.recurly.com/recurly-subscriptions/docs/retry-logic

https://knowledgecenter.zuora.com/Zuora_Payments/Configure_payment_orchestration/Retry_payments

https://docs.hyperswitch.io/explore-hyperswitch/payment-orchestration/smart-router

https://docs.hyperswitch.io/explore-hyperswitch/payment-orchestration/smart-retries

WRITTEN BY

Slicker

Slicker