Guides

10

min read

Smart payment retries vs dunning: Which recovers more in 2025?

Smart payment retries recover up to 70% of failed transactions through AI-powered timing and multi-gateway routing, while traditional dunning email campaigns typically capture only 30%. With subscription businesses losing 9% of revenue to payment failures, companies implementing intelligent retry strategies see 20-50% increases in recovered revenue compared to dunning-only approaches.

Key Facts

• Recovery rates: Smart retries capture up to 70% of failed transactions vs 30% for traditional dunning

• Revenue impact: Failed payments cost subscription businesses 9% of total revenue annually—approximately $129 billion industry-wide in 2025

• Churn reduction: Up to 70% of involuntary churn stems from payment failures that could be automatically recovered

• Compliance limits: Card networks restrict retry attempts to 15 within 30 days to prevent merchant violations

• Implementation speed: Modern AI-powered systems like Slicker deploy in 5 minutes without code requirements

• Performance gains: Companies switching to intelligent retry see 20-50% revenue increases over email-only dunning

Failed payments still siphon 9% of subscription revenue in 2025. By contrasting smart payment retries with old-school dunning, we show which method patches that leak fastest.

The 9 % revenue leak: why failed payments still hurt in 2025

The numbers paint a stark picture. With the global subscription industry reaching $1.5 trillion in 2025, businesses lose 9% of their revenue to failed payments. That translates to an estimated $129 billion vanishing from subscription companies' bottom lines this year alone.

The real damage extends beyond immediate revenue loss. As recent data shows, "involuntary churn can represent up to 30% of total customer churn for subscription businesses." When you factor in customer acquisition costs, support time, and lost expansion revenue, the true impact multiplies exponentially.

This isn't just about missed payments. It's about customers who wanted to stay but got disconnected due to technical failures. The good news? Most of these losses are entirely preventable with the right recovery approach.

How does legacy dunning work--and where does it stall?

Dunning is the process of communicating with customers to resolve payment issues promptly. Traditional dunning relies almost exclusively on email sequences, sending increasingly urgent messages asking customers to update their payment information.

Here's the typical flow: A payment fails, triggering an automated email. If no response, another email follows in a few days. The process repeats until either the customer updates their card or the subscription expires. Some companies extend dunning windows or adjust communication frequency, but the core mechanism remains unchanged.

The limitations become obvious quickly. Dunning requires customer action--they must open the email, click through, and manually update their payment details. Many legitimate customers never see these emails due to spam filters or inbox overload. Even when messages get through, the friction of updating payment information leads to drop-offs.

Recurly found that dunning done right can lift subscription revenue by 12%. That's significant, but it still leaves substantial money on the table. The passive nature of email-only approaches means you're essentially hoping customers will rescue themselves.

While dunning plays a role in payment recovery, relying on it alone ignores technological advances that can automatically retry payments without any customer involvement. Companies switching to intelligent retry strategies typically see 20-50% increases in recovered revenue compared to dunning-only approaches.

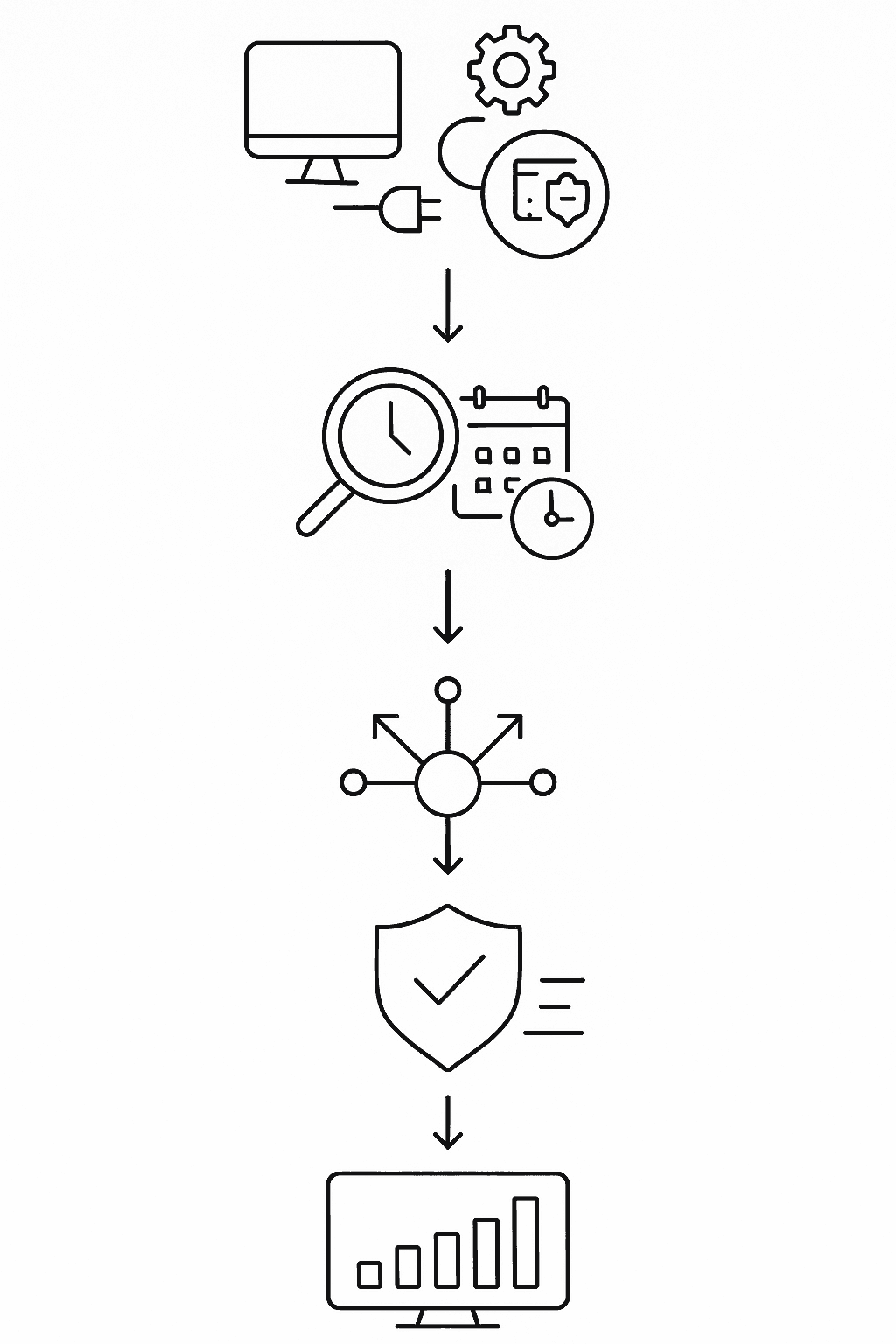

Inside smart payment retries: AI timing, routing & compliance

Smart retries choose optimal times to retry failed payments, dramatically increasing success rates. Unlike fixed schedules that treat all failures equally, AI-powered systems analyze each transaction individually to determine the perfect retry moment.

The technology goes deep. Machine learning models process dynamic signals and purchaser behaviors, learning from millions of transactions to predict when funds will be available. Stripe recommends 8 tries within 2 weeks as their default setting, but the system continuously adapts based on real-time data.

Recurly's intelligent retry logic takes this further by analyzing billions of transactions to create customized schedules for each payment type. The system differentiates between soft declines (temporary issues like insufficient funds) and hard declines (permanent failures like stolen cards), applying unique logic to maximize recovery potential.

Compliance adds another layer of sophistication. Card networks limit retries to 15 attempts in 30 days, and exceeding these limits risks fines or account suspension. Smart retry systems automatically track attempts across all processors, ensuring you stay within network rules while maximizing recovery opportunities.

Zuora's Smart Retry feature, trained on anonymized data from millions of payments, demonstrates the power of this approach. By predicting optimal retry moments rather than following fixed schedules, their system increases collections while reducing retry costs. The platform even retrains models every six months to adapt to economic changes and payment network updates.

Perhaps most importantly, Slicker's proprietary AI engine processes each failing payment individually. Rather than applying blanket retry logic, it considers transaction history, decline codes, issuer patterns, and dozens of other parameters to craft the perfect recovery strategy for each specific failure.

Smart retries vs dunning: which KPIs win in 2025?

The performance gap between approaches is striking. Companies switching to intelligent retry strategies typically see 20-50% increases in recovered revenue compared to traditional methods. Meanwhile, dunning alone delivers about 12% revenue lift--respectable, but nowhere near the potential of AI-powered recovery.

Recovery rates tell an even clearer story. Smart payment recovery captures up to 70% of failed transactions through optimal timing and routing. Traditional dunning struggles to break 30% recovery in most cases, limited by its dependence on customer action.

Involuntary churn metrics reveal the downstream impact. With up to 70% stemming from failed transactions that could have been recovered, the difference in churn prevention between approaches becomes massive. Smart retries attack this problem directly by fixing payments before customers even know there's an issue.

The efficiency gains compound these advantages. While dunning requires ongoing email optimization, template testing, and manual intervention for edge cases, AI-powered systems run autonomously. They process thousands of failures simultaneously, each with personalized retry logic based on real-time data.

Subscription companies could lose $129 billion to involuntary churn in 2025. The companies capturing the most of that lost revenue won't be sending more emails--they'll be using intelligent systems that fix payments automatically.

Key takeaway: Smart retries deliver 2-4× better recovery rates than dunning alone, with top systems recovering 70% of failed payments versus dunning's typical 30% ceiling.

Case studies: Slicker, Recurly & Primer in the wild

Slicker customers typically see 10-20 percentage point increases in recovered payments when implementing multi-gateway routing. One merchant saw their payment success rate jump from 86% to 93%--a 7 percentage point improvement that translated directly to bottom-line revenue.

These results come from Slicker's approach of processing each failed payment individually rather than applying batch logic. The system's AI-driven recovery engine delivers 2-4× better recoveries than static retry systems by prioritizing intelligent timing, multi-gateway routing, and transparent analytics.

Primer's Fallbacks helped Banxa recover over $7 million in revenue in just the first half of 2024. By automating their payment retry strategy and implementing intelligent routing across processors, Banxa transformed what would have been lost revenue into recovered subscriptions.

The success stems from Primer's data-driven approach. Rather than guessing at retry schedules, their system analyzes transaction patterns to identify optimal retry windows. For U.S. merchants, this might mean targeting the 1st and 15th when paychecks typically arrive.

Recurly's dunning workshops delivered a 12% revenue lift across 20 participating merchants. Companies like SmallPDF, Overleaf, and Kahoot! achieved these results by extending dunning windows and optimizing email frequency--but this represents the ceiling of what email-only approaches can achieve.

The contrast is telling. While Recurly's dunning optimization requires extensive testing and manual configuration, Slicker and Primer's AI-driven systems deliver superior results automatically. The gap widens further when you consider implementation time: Slicker's platform takes just 5 minutes to set up, while comprehensive dunning optimization can take months.

Implementation guide: hitting 70 %+ recovery without compliance headaches

Card networks limit merchants to around 15 retry attempts in 30 days. Exceed this, and you risk fines or being flagged as a bad actor. Smart retry systems track attempts across all processors, automatically staying within limits while maximizing recovery opportunities.

Start with intelligent spacing. In the US, many people receive pay fortnightly, making the 1st and 15th optimal retry dates. But don't apply this blindly--AI systems detect patterns specific to your customer base and adjust accordingly.

Multi-gateway routing amplifies recovery rates. By connecting multiple payment processors, you create fallback options when one gateway experiences issues. Each processor has different relationships with banks and card networks, so a payment that fails on one might succeed on another.

Research shows 5 retries represent the sweet spot for most SaaS companies, balancing recovery potential with operational complexity. The first retry captures the majority of recoverable revenue, with diminishing returns on subsequent attempts.

Implementation doesn't require massive technical resources. Slicker's platform takes just 5 minutes to set up--no code required. The system automatically integrates with your existing billing platform, immediately applying AI-powered recovery logic to all failed payments.

For compliance peace of mind, ensure your system differentiates between soft and hard declines. Soft declines (insufficient funds, temporary holds) are worth retrying. Hard declines (stolen card, account closed) should trigger dunning emails instead of automated retries.

Key takeaway: Focus on intelligent timing, multi-gateway routing, and strict compliance tracking to achieve 70%+ recovery rates without risking network violations.

Key takeaways: turn failed payments into growth fuel

The evidence is overwhelming. Smart payment retries outperform traditional dunning by every meaningful metric--recovery rates, revenue impact, and operational efficiency. While dunning emails still have their place, relying on them alone in 2025 is like bringing a knife to a gunfight.

The exciting news is that most failed payment costs can be transformed into recovered revenue. Modern AI-powered systems don't just patch the leak--they turn payment failures into data that continuously improves recovery rates.

For subscription businesses serious about growth, the choice is clear. Implement smart retry technology that processes each failure individually, routes through multiple gateways, and learns from every transaction. Combine this with strategic dunning for hard declines, and you've built a recovery system that captures the maximum possible revenue.

The companies winning in 2025 won't be those sending cleverer emails. They'll be using intelligent systems like Slicker that automatically fix payments before customers even notice there's a problem. With failed payments representing a 9% revenue leak industry-wide, the opportunity for businesses willing to modernize their approach has never been greater.

Frequently Asked Questions

What is the main difference between smart payment retries and dunning?

Smart payment retries use AI to determine optimal times for retrying failed payments, increasing success rates without customer involvement. Dunning relies on email sequences to prompt customers to update payment information, requiring their action.

How much revenue do businesses lose to failed payments in 2025?

In 2025, businesses lose approximately 9% of their subscription revenue to failed payments, translating to an estimated $129 billion industry-wide.

What are the recovery rates for smart payment retries compared to dunning?

Smart payment retries can recover up to 70% of failed transactions, while traditional dunning typically recovers around 30%, as it depends on customer action.

How does Slicker's AI engine improve payment recovery?

Slicker's AI engine processes each failed payment individually, using transaction history and decline codes to craft personalized recovery strategies, leading to 2-4× better recovery rates than static retry systems.

What compliance considerations are there for payment retries?

Card networks limit retry attempts to 15 in 30 days to avoid fines or account suspension. Smart retry systems track attempts to ensure compliance while maximizing recovery opportunities.

Sources

https://www.slickerhq.com/blog/soft-decline-retry-strategies-saas-cfos-q3-2025-guide

https://recurly.com/content/subscription-case-study-dunning-workshop-to-reduce-customer-churn/

https://www.slickerhq.com/blog/how-to-implement-ai-powered-payment-recovery-to-mi-00819b74

https://stripe.com/docs/billing/revenue-recovery/smart-retries

https://developer.zuora.com/blogs/2025-3-18-turningfailureintogold

WRITTEN BY

Slicker

Slicker