Guides

10

min read

Smart dunning for custom billing systems: API integration in 5 minutes

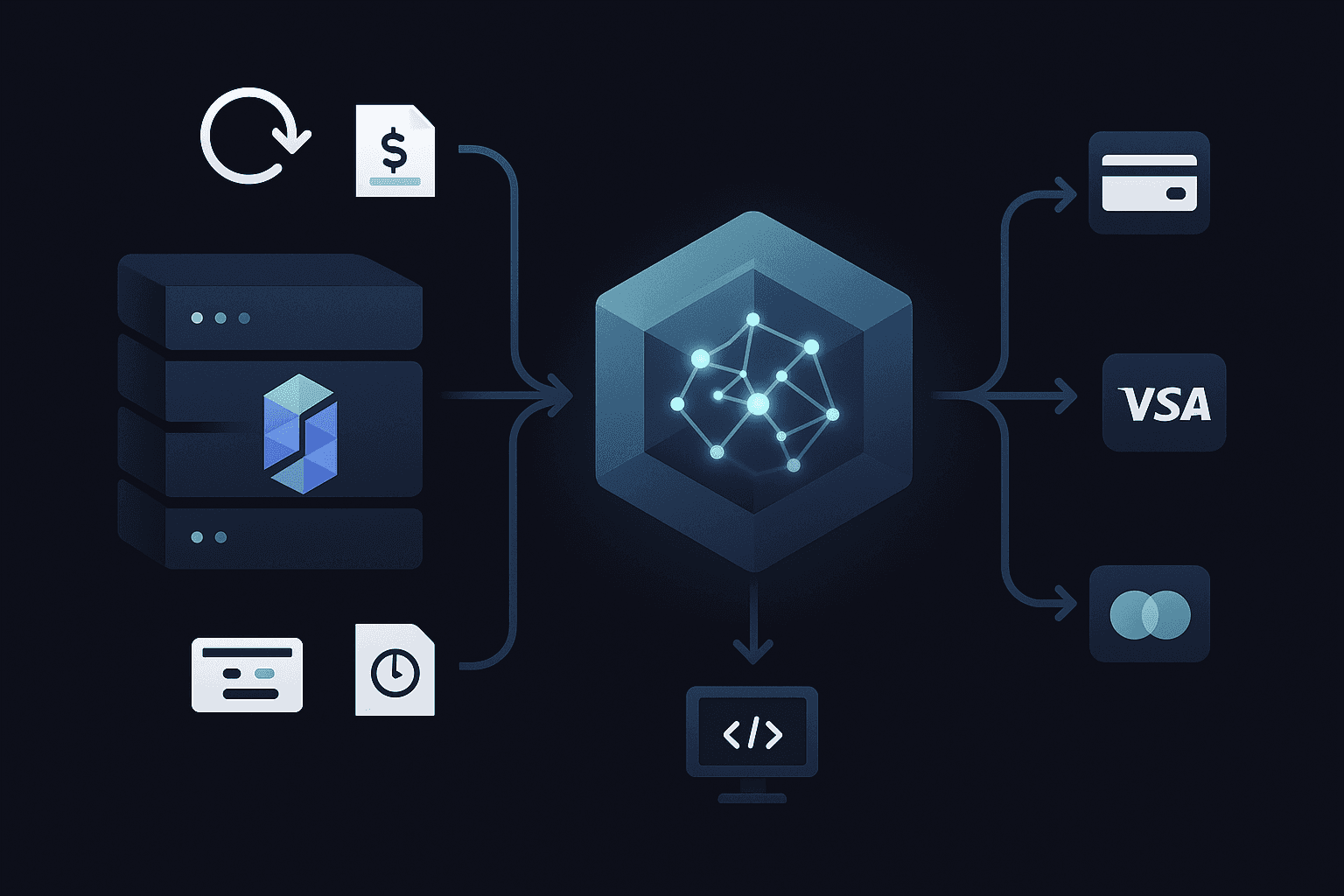

Smart dunning APIs integrate with custom billing systems in approximately five minutes through webhook-based architecture. Systems send transaction data to the dunning engine, which analyzes payment failures and returns optimal retry timing via webhooks. This approach allows businesses to recover 45-60% of failed payments without replacing existing billing infrastructure.

At a Glance

• Failed payments cause 10-15% annual revenue loss in subscription businesses, with 25% of lapses due to technical payment failures rather than customer decisions

• Smart dunning uses AI to predict decline types, calculate retry timing, and route payments through optimal gateways for 2-4x better recovery rates versus static retry schedules

• Integration requires four steps: connecting data sources, mapping fields, setting up webhooks, and syncing historical data to train ML models

• Security compliance includes PCI DSS 4.0.1 requirements and card network retry limits of 15 attempts in 30 days for Visa

• Key metrics to track include recovery rate (45-60% target), involuntary churn reduction, and retry efficiency per recovered payment

• Pay-for-success pricing models align costs directly with recovered revenue, eliminating upfront integration risk

Failed payments silently erode margins, but smart dunning can reverse the leak in minutes. By plugging Slicker's API into any custom stack, teams tame involuntary churn and start measuring recovered revenue within days.

Why custom billing needs smart dunning now

Involuntary churn silently drains subscription revenue. Industry research shows that 10-15% of subscription revenue disappears annually due to payment failures such as expired cards and insufficient funds. Card declines, bank rejections, and soft errors collectively wipe out as much as 4% of MRR in high-growth subscription businesses.

The impact extends beyond immediate revenue loss. Twenty-five percent of lapsed subscriptions are purely due to payment failures, not customer decisions to leave. These are subscribers who want to stay but are forced out by technical glitches in the payment chain.

Smart dunning solves this problem through intelligent automation. Unlike static retry schedules that blindly attempt payments at fixed intervals, smart dunning uses machine learning to:

Predict whether a decline is temporary or permanent

Calculate the optimal retry timing for each transaction

Route payments through the best-performing gateway

Tailor recovery actions based on decline type

Slicker's AI-driven recovery engine claims "2-4x better recoveries than static retry systems", making the difference between losing a customer and retaining them for months longer.

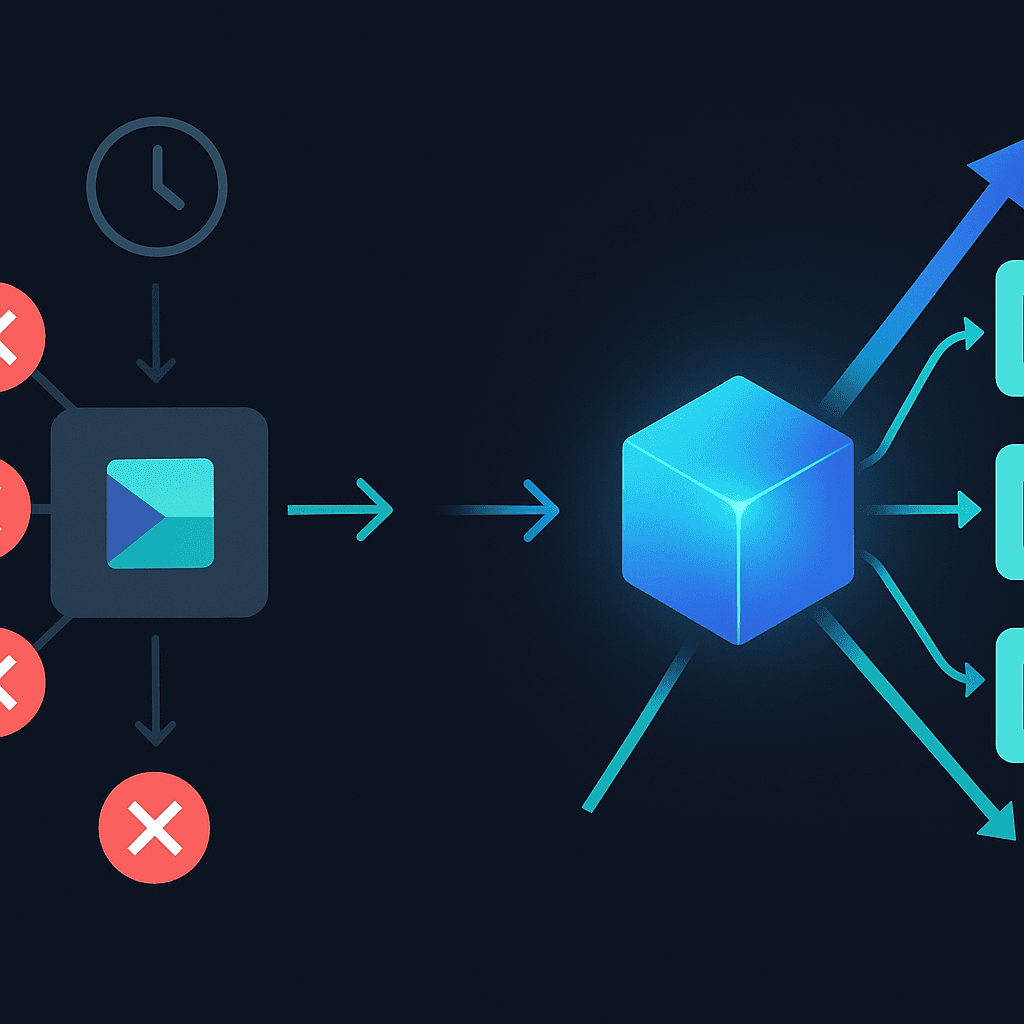

For teams running custom in-house billing, the challenge has historically been integration complexity. Off-the-shelf solutions often require ripping out existing infrastructure. Slicker changes that equation by acting as a decision engine that sits alongside your current stack.

How to integrate Slicker in five minutes

Slicker provides a flexible API-based integration for custom in-house billing systems, allowing businesses with proprietary or unique billing solutions to benefit from advanced retry optimization and revenue recovery capabilities.

The integration follows a straightforward pattern:

Step 1: Connect your data sources

Your system sends subscription, invoice, and transaction event data to the API endpoints. This establishes the information flow that powers intelligent retry decisions.

Step 2: Map your fields

Map your system's data fields to the expected format. The documentation provides clear schema requirements and code samples to accelerate this process.

Step 3: Set up your webhook endpoint

Create an endpoint to receive retry instructions. When the AI engine determines optimal timing, it sends a webhook notification with specific retry parameters.

Step 4: Sync historical data

Syncing historical data significantly improves effectiveness of recovery strategies from day one. The algorithms can immediately analyze past payment patterns and failures to calibrate retry timing.

Five minutes is the time you need in the dashboard to have your instance up and running, with no-code revenue recovery ready to deploy.

The platform acts as a decision engine for your billing system, determining the optimal timing and strategy for payment retries while your existing infrastructure handles the actual transaction processing.

Data Slicker needs

The quality of recovery strategies improves with the richness of data provided. Here's what to send:

Data Type | Required Fields | Purpose |

|---|---|---|

Subscriptions | ID, status, plan, customer ID | Segment retry strategies by subscription type |

Invoices | Amount, currency, due date, status | Prioritize recovery by value and urgency |

Transactions | Payment method, decline code, timestamp | Train ML models on failure patterns |

For subscription events, include:

Subscription creation and cancellation timestamps

Plan identifiers and pricing tiers

Customer account information

For invoice events, capture:

Invoice amounts and currencies

Due dates and billing cycles

Associated subscription references

For transaction events, log:

Payment method details (tokenized)

Decline codes and error messages

Gateway identifiers for multi-gateway setups

Implement API calls to send subscription, invoice, and transaction events as they occur in your system. Real-time data ensures the AI engine has current information for retry decisions.

Webhook & idempotency best practices

Building reliable webhook handlers is critical for smart dunning to function correctly. Poor implementation leads to missed retries or duplicate charges.

Validate incoming requests

Prioritize validation of incoming notifications to ensure authenticity. Validate the source by using the signature verification feature provided by the payment processor. Security protocols are foundational for protecting your payment infrastructure.

Return responses quickly

Your webhook endpoint must:

Accept POST requests with JSON payloads

Return HTTP 200 status code quickly (under 10 seconds)

Handle requests asynchronously for complex processing

Be accessible via HTTPS (required for production)

Implement idempotency

Idempotency keys ensure a request is processed only once, even if retried multiple times. Payment platforms often resend notifications due to network issues or processing errors. Without idempotency handling, you risk double charges or missed retries.

Store idempotency keys with an in-memory database on the server side. Remove them after 24 hours to manage storage costs while allowing reasonable retry windows.

Log everything

Log all incoming notifications for auditing and troubleshooting purposes. Detailed logs provide crucial insights during abnormal occurrences. Research shows 45% of developers experience difficulties diagnosing webhook-related issues without adequate logging.

Statistics indicate that 5-10% of webhook events may fail, often due to network issues or endpoint misconfigurations. Build retry mechanisms into your handler to catch these failures.

What security and compliance rules matter for payment data?

Developers integrating smart dunning must respect several compliance frameworks to avoid fines and protect customer data.

PCI DSS 4.0.1

As of March 31, 2024, PCI DSS 4.0.1 is now in effect, replacing the older 3.2.1 standard. This global security standard applies to all entities that store, process, or transmit cardholder data.

For smart dunning integrations, the key requirement is minimizing your Cardholder Data Environment (CDE). By using tokenized payment methods and letting payment processors handle sensitive card data, you can dramatically reduce compliance scope.

Non-compliance penalties escalate quickly:

First 3 months: $5,000-$10,000 per month

Months 4-6: $25,000-$50,000 per month

Beyond 6 months: Up to $100,000 per month

SOC 2 Type II

SOC 2 encompasses five key criteria: Security, Availability, Processing Integrity, Confidentiality, and Privacy. When selecting a smart dunning provider, verify they maintain current SOC 2 Type II certification.

Data breaches involving multiple environments cost an average of $5.05 million, while data breached on premises cost an average of $4.01 million. The investment in compliant infrastructure pays for itself many times over.

Card network retry limits

Visa and Mastercard impose strict limits on payment retries:

Visa allows 15 reattempts in 30 days for soft declines

Mastercard allows 10 retries in a 24-hour period

Exceeding these limits triggers fees and potential program enrollment. Smart dunning systems like Slicker automatically respect these constraints, optimizing within allowable retry windows rather than blindly maximizing attempts.

Key takeaway: The single most effective way to manage PCI compliance costs is to relentlessly minimize the size and complexity of your Cardholder Data Environment by using tokenized payments and certified third-party processors.

Slicker vs. native retry tools: where the gains come from

Native billing platform retry tools provide baseline recovery capabilities. Dedicated smart dunning solutions like Slicker deliver materially better results through deeper specialization.

Stripe Smart Retries

Stripe's Smart Retries uses machine learning trained on billions of data points across the Stripe network. The tool enables Stripe to recover $9 in revenue for every $1 customers spend on Billing. However, Stripe's solution operates only within the Stripe ecosystem and lacks multi-gateway routing capabilities.

Adyen Uplift

Adyen Uplift introduced AI-powered tooling that "improved payment conversion by 6%". Like Stripe, Adyen's solution is optimized for transactions processed through Adyen's gateway.

Recurly

Recurly's platform demonstrates effectiveness for mid-market SaaS, with customers able to recover 70% of failed transactions and cut involuntary churn to 1%. The platform works best when Recurly serves as the primary billing system.

Where Slicker differs

Slicker's architecture provides advantages for custom billing environments:

Capability | Native Tools | Slicker |

|---|---|---|

Multi-gateway routing | Single gateway | Routes across gateways |

Integration approach | Replace existing systems | Augments existing stack |

Setup time | Days to weeks | 5 minutes |

Pricing model | Platform fees | Pay for recovered payments only |

The pay-for-success pricing model aligns incentives directly with recovery outcomes. Businesses pay only when recoveries occur, eliminating upfront risk.

For companies running custom billing infrastructure across multiple payment gateways, Slicker's gateway-agnostic approach enables optimization that single-gateway solutions cannot match.

Which metrics prove smart dunning ROI?

Tracking the right KPIs ensures you can measure impact and optimize over time.

Core recovery metrics

Metric | Definition | Target Range |

|---|---|---|

Failed payments | Volume of subscription payments that failed on first attempt | Baseline measurement |

Percentage of failed volume successfully recovered | 45-60% best-in-class | |

Failure rate | Percentage of subscription payment volume failing on first attempt | Industry benchmark comparison |

Slicker customers usually see between a 10 and 20 percentage point increase in the number of recovered payments compared to previous systems.

Churn impact metrics

Involuntary churn rate directly measures how many customers you lose to payment failures versus active cancellations. Research from Churnkey shows that involuntary churn can easily comprise 40% of a business's total churn.

Companies that switch from batch-based to intelligent retry strategies typically see a 20-50% increase in recovered revenue. This uplift compounds over time as recovered subscribers continue generating lifetime value.

Operational metrics

Track retry efficiency to ensure you're not burning through card network limits unnecessarily:

Retries per recovered payment

Recovery by decline code category

Time to recovery (days from initial failure)

The Stripe Dashboard provides revenue recovery analytics showing recovered volume by method, helping identify which recovery tactics drive the most value for your specific business.

Key takeaway: Focus first on recovery rate and involuntary churn rate as your primary success metrics, then optimize retry efficiency once baseline recovery is established.

Next steps: switch on AI-powered recovery today

Smart dunning transforms payment failures from inevitable losses into recoverable revenue. The key benefits for custom billing teams:

Speed: Five-minute integration with existing infrastructure

Flexibility: API-first design works with any billing stack

Performance: AI-driven timing outperforms static retry schedules

Alignment: Pay-for-success pricing means paying only for results

Dedicated integration specialists are available to guide your team through setup. Documentation and code samples accelerate development, with most teams completing integration and running test recoveries within a single sprint.

For high-volume subscription companies using Chargebee, Zuora, or in-house billing systems, Slicker offers a path to reduced involuntary churn without replacing existing payment rails. The platform sits alongside your current infrastructure, enhancing recovery rates while you retain full control of the payment experience.

Learn more about how AI enhances payment recovery or explore how Slicker outperforms competing solutions in head-to-head comparisons.

Frequently Asked Questions

What is smart dunning and why is it important for custom billing systems?

Smart dunning uses machine learning to optimize payment retries, reducing involuntary churn and recovering lost revenue. It's crucial for custom billing systems to efficiently manage failed payments without overhauling existing infrastructure.

How does Slicker's API integration work for custom billing systems?

Slicker's API allows custom billing systems to integrate smart dunning by sending subscription, invoice, and transaction data to its endpoints. This enables intelligent retry decisions and improved revenue recovery without replacing existing systems.

What are the key steps to integrate Slicker's API in five minutes?

The integration involves connecting data sources, mapping fields, setting up a webhook endpoint, and syncing historical data. This process allows businesses to quickly deploy smart dunning capabilities and start recovering revenue.

How does Slicker ensure compliance with payment data security standards?

Slicker adheres to PCI DSS 4.0.1 and SOC 2 Type II standards, minimizing the Cardholder Data Environment by using tokenized payments and certified processors, thus reducing compliance scope and protecting customer data.

What metrics should be tracked to measure the ROI of smart dunning?

Key metrics include recovery rate, involuntary churn rate, retries per recovered payment, and time to recovery. These metrics help assess the effectiveness of smart dunning strategies and optimize recovery processes.

Sources

https://docs.stripe.com/billing/revenue-recovery/recovery-analytics

https://www.slickerhq.com/blog/top-7-ai-retry-engines-2025-yc-backed-slicker-flexpay-gocardless

https://www.paypal.com/us/brc/article/avoid-excessive-retries-penalties

https://www.hooklistener.com/learn/stripe-webhooks-implementation

https://www.slickerhq.com/blog/ai-data-governance-breach-prevention

https://www.slickerhq.com/blog/soft-decline-retry-strategies-saas-cfos-q3-2025-guide

https://www.slickerhq.com/blog/how-ai-enhances-payment-recovery

WRITTEN BY

Slicker

Slicker