Guides

10

min read

Smart payment retries aligned with paydays: How AI times recovery

AI-powered payment retry systems achieve recovery rates above 70% by analyzing customer payment patterns and timing retries around paydays, compared to 47.6% for static retry rules. This intelligent timing approach delivers 15-20+ percentage point improvements by aligning retry attempts with when customers actually have funds available.

At a Glance

Static retry rules waste limited attempts by ignoring consumer cash flow patterns, while AI systems time retries for payday periods when funds are available

Up to 12% of card-on-file transactions fail, with 62% of customers who hit payment errors never returning

AI recovery engines analyze dozens of variables including bank patterns, decline codes, payment history, and day-of-week timing to optimize retry success

Decline rates spike at night (midnight to 5am) and month-end periods before paydays

Retaining customers through smart retries costs 5-7x less than acquiring new ones

Modern platforms like Slicker enable 5-minute no-code deployment with pay-for-success pricing models

Static rules miss the human pay-cycle. Smart payment retries use AI to time recovery right after cash hits a customer's account, slashing involuntary churn and boosting revenue.

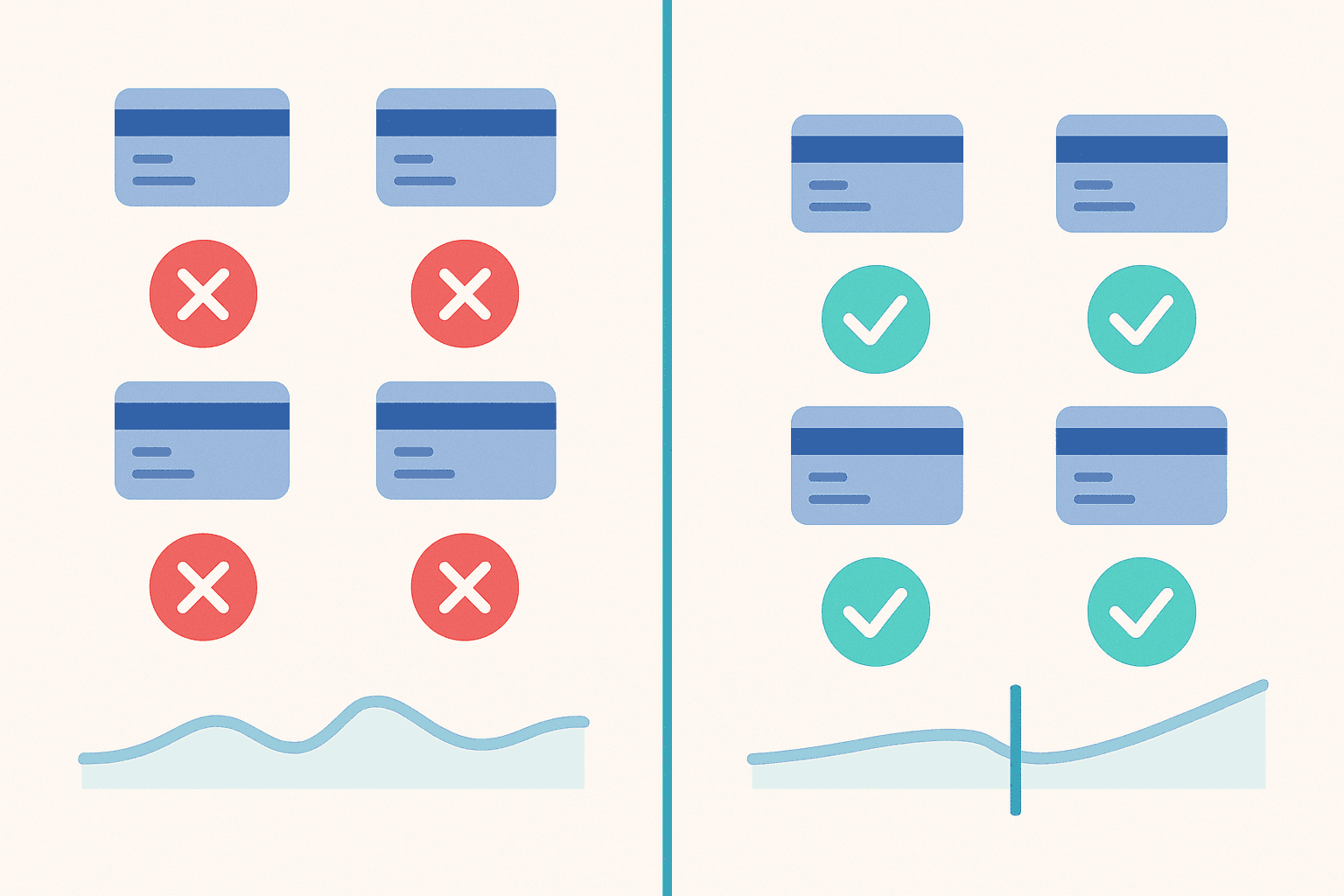

Static rules vs AI timing: why 'when' you retry matters

Subscription payment failures represent one of the most significant yet preventable sources of revenue loss. "Up to 12% of card-on-file transactions fail due to expirations, insufficient funds, or network glitches," according to industry research. The consequences extend beyond the immediate transaction: 62% of users who hit a payment error never return to the site.

Traditional billing systems attempt to address this through static retry rules. These systems retry failed payments at preset intervals, regardless of individual customer circumstances. The problem? They ignore a fundamental reality of consumer behavior: people's ability to pay fluctuates based on when they receive their income.

Smart payment retries take a fundamentally different approach. Rather than following rigid schedules, AI-powered systems analyze dozens of variables to identify the optimal moment for each retry attempt. This shift from "when the system is ready" to "when the customer is ready" transforms recovery rates dramatically.

The difference in outcomes is substantial. The industry average recovery rate hovers around 47.6%, while AI-powered solutions push recovery rates above 70%.

What is the hidden cost of static retry schedules?

Static retry schedules create problems that compound over time. "Most payment processors make authorization attempts at preset times and if it fails, retry next attempt in a fixed time window and for fixed number of times. This rule-based approach doesn't consider historical data and may cause redundant retry attempts," explains research on payment retry optimization.

The costs manifest in several ways:

Wasted retry attempts: Card networks like Visa and Mastercard limit merchants to around 15 retry attempts in 30 days. Static systems burn through these precious attempts without strategic timing.

Customer frustration: Multiple failed charges appearing on bank statements create confusion and erode trust.

Network penalties: Excessive retries can trigger monitoring programs from payment networks, potentially leading to increased fees or processing restrictions.

Timing blindness: Static systems retry when scheduled, not when customers have funds. "In the U.S., for example, refusal rates peak toward the end of the month just before people are paid," notes Chargebee's research.

Why declines spike at month-end & night hours

Payment success rates follow predictable patterns that static systems ignore:

Night-time declines: Decline rates are much higher from midnight to 5am, likely due to heightened fraud protection measures during these hours.

Day-of-week effects: Decline rates are much lower for debit cards on Fridays, correlating with typical payday schedules in many industries.

Month-end cash crunches: The final days before payday represent peak decline periods as consumer bank balances reach their lowest points.

These patterns are invisible to static retry logic but form the foundation of intelligent recovery strategies.

Key takeaway: Static retry schedules waste limited retry attempts by ignoring predictable patterns in consumer cash flow and bank behavior.

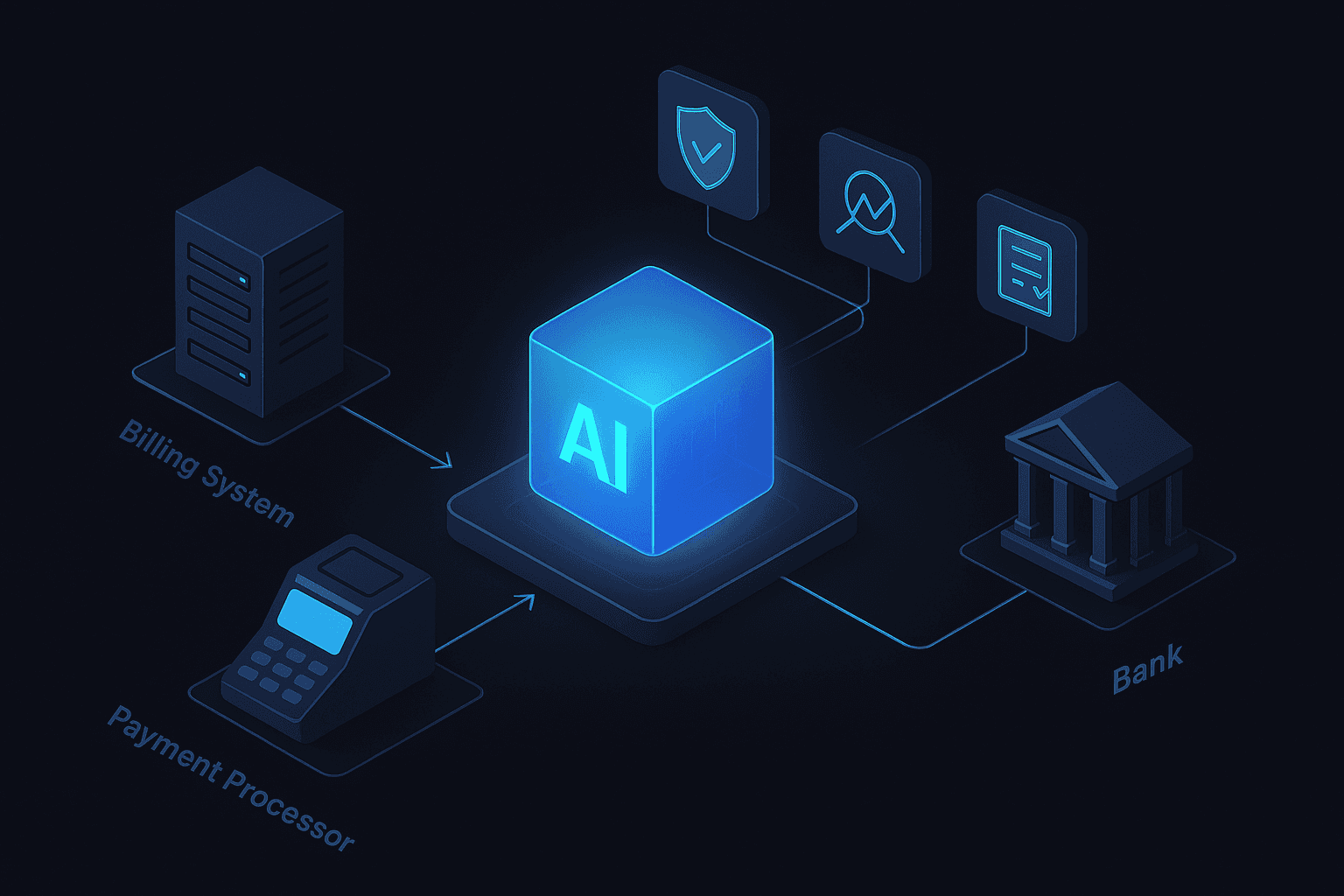

How AI predicts cash-flow and retries on payday

AI-powered payment recovery systems analyze multiple data streams to predict the optimal retry moment for each individual transaction. The core insight driving these systems is straightforward: "Aligning a borrower's loan payment schedule around their payroll has a huge impact on collections success," according to research on AI-driven collections.

The mechanics work as follows:

Historical pattern analysis: Machine learning models examine past payment behaviors, identifying when individual customers typically have funds available.

Decline code interpretation: Different decline codes indicate different underlying issues. AI systems route each failure type through appropriate recovery pathways.

Temporal optimization: Models factor in time of day, day of week, and day of month to maximize success probability.

Dynamic learning: Systems continuously refine predictions based on outcomes, improving accuracy over time.

The connection between pay frequency and financial behavior is well-documented. Research analyzing over 30,000 consumers found that higher payment frequencies lead to more distributed consumption patterns throughout the month. Understanding these patterns allows AI systems to time retries when customers are most likely to have available funds.

Propensity-to-pay modeling adds another dimension. 95% of customer invoices were paid on time whenever their previous invoice was also paid on time, demonstrating the predictive power of payment history.

Signals the model ingests: bank patterns, decline codes & more

AI recovery engines process numerous variables to determine optimal retry timing:

Error messages: "When a payment attempt fails, we receive a distinct error message from the payment provider with specific details on the nature of the error," explains Recharge's engineering team.

Days since first attempt: The elapsed time since initial failure provides crucial context for retry strategy.

Merchant-specific patterns: Individual merchants show unique characteristics that influence model decisions.

Payment method brand: Different card networks (Visa, Mastercard, Discover) exhibit varying decline and recovery patterns.

Day of week timing: The specific day a retry occurs significantly impacts success probability.

Slicker's engine exemplifies this approach, considering time of day, issuing bank patterns, merchant category codes, customer payment history, and seasonal trends for each retry decision.

How much uplift can payday-aligned retries deliver?

The performance gap between static and intelligent retry systems is substantial and well-documented across multiple implementations.

Slicker's AI-powered approach delivers a 15.7 percentage point uplift compared to traditional methods. This translates to 2-4x better recovery than native billing-provider logic.

Other platforms report similar gains:

Cleverbridge's Dynamic Retries recover up to 10% more declined transactions than static retries

Adyen's contextual multi-armed bandit approach showed a 6% improvement in order conversion over traditional methods in initial experiments

Approach | Typical Recovery Rate | Key Limitation |

|---|---|---|

Static retry rules | 47.6% industry average | Ignores customer cash flow patterns |

AI-powered retries | 60-70%+ | Requires integration and data access |

Dunning emails alone | ~30% | Relies on customer action |

The compound effect of improved recovery extends beyond immediate revenue. Each successfully recovered payment represents a customer retained, contributing to lifetime value rather than requiring replacement through expensive acquisition efforts.

Revenue saved vs new customer acquisition costs

The economic case for intelligent retry optimization becomes clear when comparing recovery costs to acquisition costs:

Metric | Value |

|---|---|

Cost to save existing customer vs acquire new | 5-7x cheaper to retain |

Monthly revenue at risk from credit card declines | |

Customer retention with effective decline management | More than 69% of lost customers recoverable |

"Acquiring a new customer is anywhere from 5 to 25 times more expensive than retaining an existing one," according to Recurly's benchmarking research. This cost differential makes intelligent payment recovery one of the highest-ROI investments available to subscription businesses.

How do you implement smart retries securely and compliantly?

Deploying AI-powered payment recovery requires attention to both technical integration and governance considerations.

Security requirements: SOC 2 compliance is crucial for AI payment recovery platforms because they handle sensitive customer payment data and financial information. Any platform handling payment retry logic needs robust security controls and audit capabilities.

Model explainability: Understanding why the AI makes specific decisions matters for compliance and optimization. SHAP (SHapley Additive exPlanations) values are commonly used to explain AI model outputs, allowing teams to understand which factors drive retry timing decisions.

Network compliance: Card networks impose specific rules around retry attempts. Intelligent systems must operate within these constraints while optimizing timing within allowed parameters.

Data privacy: Processing payment data for AI analysis requires appropriate consent frameworks and data handling procedures aligned with regional regulations.

5-minute no-code onboarding (Slicker example)

Modern AI recovery platforms have dramatically simplified implementation:

Rapid deployment: Slicker's dashboard requires just 5 minutes to have an instance up and running.

No-code integration: Platforms like Slicker offer 5-minute setup with no code changes required.

Broad platform support: Slicker supports popular billing and payment platforms including Stripe, Chargebee, Recurly, Zuora, and Recharge, as well as in-house systems.

Pay-for-success pricing: Slicker's pricing model aligns directly with business outcomes, meaning businesses only pay for successfully recovered payments.

Security compliance: Slicker follows best cloud security practices and is pursuing SOC 2 Type-II compliance.

This streamlined implementation approach removes the traditional barriers that prevented subscription businesses from adopting intelligent recovery strategies.

Key takeaways for subscription CFOs & growth leaders

Smart payment retries represent a fundamental shift from system-centric to customer-centric recovery timing. The evidence is clear:

Static retry rules leave significant revenue unrecovered by ignoring predictable patterns in consumer cash flow and bank behavior.

AI-powered timing optimization delivers measurable uplift, with documented improvements of 15-20+ percentage points over traditional approaches.

Implementation barriers have collapsed, with modern platforms enabling deployment in minutes rather than months.

The economics favor retention over acquisition, making intelligent payment recovery one of the highest-ROI investments available.

For high-volume subscription companies using Chargebee, Zuora, or in-house billing systems, the path forward is straightforward. Slicker collects failed subscription payments with smart retries, with an AI engine that integrates with existing payment rails and processes. The pay-for-success pricing model eliminates implementation risk, while the rapid deployment timeline means results can begin within days.

The question is no longer whether to implement intelligent payment recovery, but how quickly you can begin capturing the revenue that static retry rules are leaving behind.

Frequently Asked Questions

What are static retry rules in payment systems?

Static retry rules are preset intervals at which billing systems attempt to process failed payments, regardless of individual customer circumstances. These rules often ignore consumer cash flow patterns, leading to inefficient recovery attempts.

How does AI improve payment recovery rates?

AI improves payment recovery rates by analyzing multiple data streams to predict the optimal retry moment for each transaction. This approach aligns retries with customer paydays, significantly increasing the likelihood of successful payment recovery.

What are the benefits of AI-powered payment retries over static rules?

AI-powered payment retries offer higher recovery rates, reduced customer frustration, and lower network penalties. By timing retries when customers are most likely to have funds, AI systems can achieve recovery rates above 70%, compared to the industry average of 47.6% for static rules.

How does Slicker's AI engine enhance payment recovery?

Slicker's AI engine enhances payment recovery by integrating with existing billing systems and using smart retries aligned with customer paydays. This approach reduces involuntary churn and increases recovered revenue, offering a pay-for-success pricing model that aligns with business outcomes.

What security measures are necessary for AI payment recovery systems?

AI payment recovery systems must adhere to strict security measures, including SOC 2 compliance, to protect sensitive customer payment data. They should also ensure model explainability and operate within card network retry constraints to maintain compliance.

Sources

https://www.slickerhq.com/blog/slicker-vs-zuora-collect-2025-ml-retry-performance-pricing-setup

https://recurly.com/blog/how-data-science-work-reveals-hidden-trends-in-payment-success-rates/

https://www.slickerhq.com/blog/ai-driven-payment-recovery-stripe-subscriptions-2025-buyers-guide

https://www.slickerhq.com/blog/can-smart-payment-retries-reach-90-recovery-reality-check

https://www.chargebee.com/resources/guides/involuntary-churn-payment-failed/

https://pubsonline.informs.org/do/10.1287/LYTX.2024.03.06/full/

https://grow.cleverbridge.com/blog/failed-payment-recovery-dynamic-retries

WRITTEN BY

Slicker

Slicker