Guides

10

min read

What is AI payment error resolution? Complete guide for B2B SaaS

AI payment error resolution uses machine learning to analyze declined transactions, predict failure types, and optimize retry timing to recover failed subscription payments. Leading platforms achieve recovery rates above 70% compared to the industry baseline of 47.6%, preventing involuntary churn that accounts for 20-40% of total customer losses in B2B SaaS.

At a Glance

Failed payments cause up to 12% of card-on-file transactions to decline due to expirations, insufficient funds, or network issues

AI-powered recovery systems deliver 2-4× better recovery rates than traditional static retry logic

Machine learning engines analyze issuer codes, customer behavior, and gateway data to optimize retry timing and routing

Rescuing failed payments is 5-7× cheaper than acquiring new customers

Modern platforms like Slicker integrate in 5 minutes with pay-for-success pricing models

Recovered subscriptions continue for an average of seven additional months, compounding lifetime value

Failed subscription payments drain B2B SaaS revenue faster than most finance teams realize. AI payment error resolution offers a scalable fix: machine learning engines that analyze each declined transaction, predict whether the failure is temporary or permanent, and trigger precisely timed retries to recover revenue before customers churn.

This guide breaks down how AI payment error resolution works, what results it delivers, how leading platforms compare, and how to deploy an intelligent retry system in 30 days or less.

Why payment errors are a silent killer for B2B SaaS

The subscription economy is booming, with the global market projected to reach $1.5 trillion by 2025. Yet beneath headline growth lies a quieter crisis: involuntary churn driven by payment failures.

Subscription businesses lose 9% of their revenue due to failed payments. Worse, up to 12% of card-on-file transactions fail because of expirations, insufficient funds, or network glitches. When a charge declines, customers who never intended to leave are pushed toward cancellation, and many never return.

Involuntary churn accounts for 20-40% of total customer churn in the subscription economy, and up to 70% of that involuntary churn stems from failed transactions. For B2B SaaS companies running high-volume billing through Chargebee, Zuora, or in-house systems, these numbers translate directly into lost contracts and compressed margins.

AI payment error resolution addresses this problem at scale by analyzing each failure in real time, optimizing retry strategies, and routing charges through the gateway most likely to succeed.

What exactly is AI payment error resolution?

AI payment error resolution uses machine-learning models to interpret decline reasons, dynamically adjust retries, and automate outreach with unprecedented precision. Instead of generic "retry three times" logic, these systems ingest issuer codes, customer behavior, and gateway data to lift recovery rates well above industry baselines.

"Machine learning unlocks granular segmentation, predicting which failures are 'soft' (temporary) vs. 'hard' (permanent) and tailoring actions accordingly," notes Slicker.

Insufficient funds errors, for example, are classified as "soft errors," meaning they can often be recovered if retries are timed correctly. AI engines weigh country-specific paydays, card types, and historical success patterns to pick the optimal moment for each attempt.

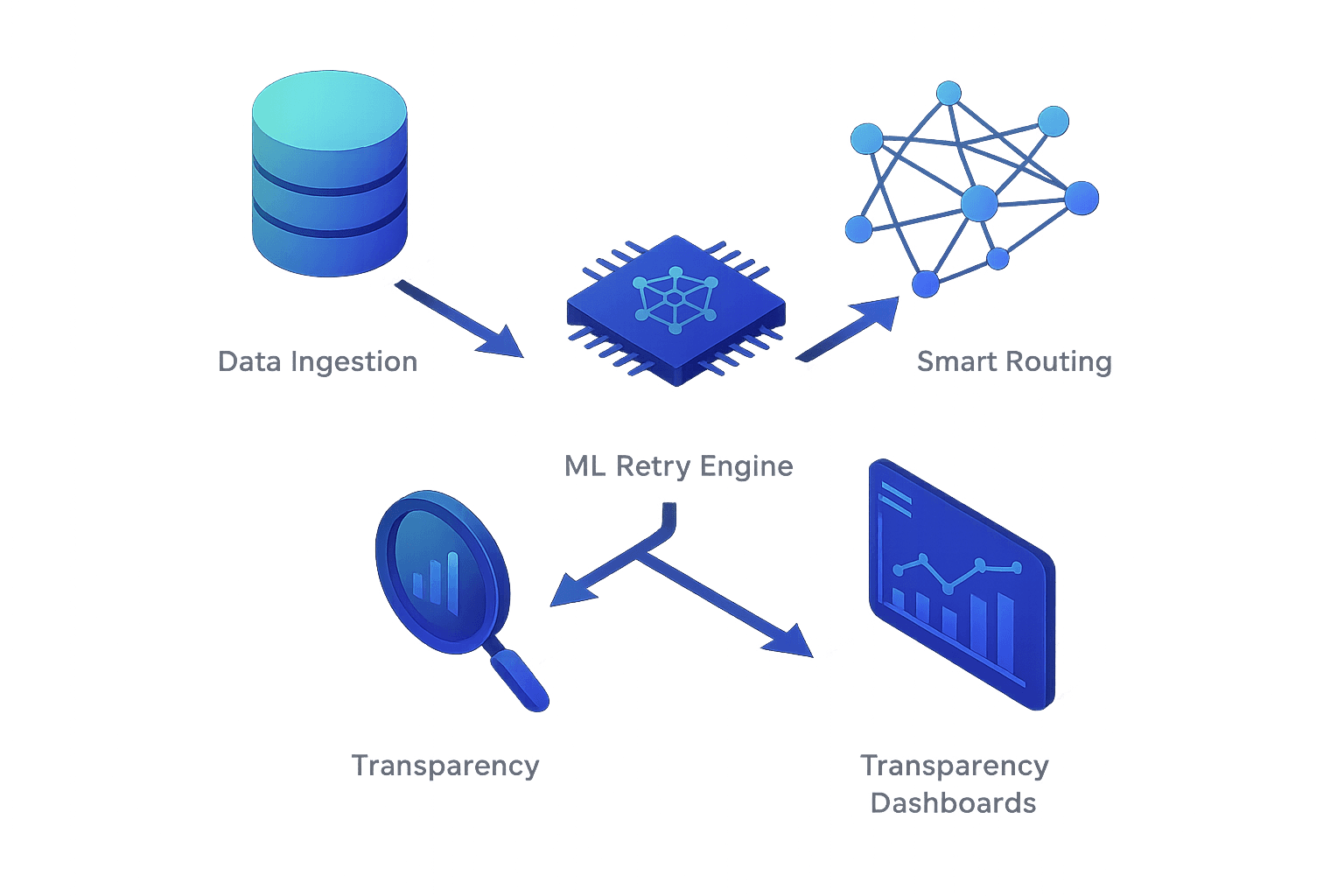

Key building blocks: data ingestion, ML retry engine, smart routing & analytics

AI payment error resolution platforms share four technical pillars:

Building Block | Function |

|---|---|

Data Ingestion | Collects payment error codes, issuer details, network messages, customer behavior, and subscription history. Stripe Radar, for instance, ingests data from every layer of the financial stack to assess risk and optimize decisions. |

ML Retry Engine | Predicts the best retry moment for each failed transaction. Adyen's experiments with contextual multi-armed bandits, using a variation on the classic random forest algorithm, achieved 6% higher order conversion than baseline methods. |

Smart Routing | Routes payments across multiple gateways in real time. Platforms like Slicker utilize multi-gateway setups to maximize success rates rather than repeatedly hitting the same processor that initially declined. |

Analytics & Transparency | Delivers click-through logs and dashboards so finance teams can inspect, audit, and review every action. |

Together, these components move payment recovery from reactive batch processing to intelligent, data-driven automation.

What recovery gains do AI-driven retries unlock?

The numbers tell a compelling story:

Industry baseline: The median recovery rate across the industry hovers around 47.6%.

AI-powered recovery: Platforms leveraging machine learning push recovery rates above 70%.

Revenue uplift: Companies switching from batch-based to intelligent retry strategies see 20-50% increases in recovered revenue.

Every 1% lift in recovery can translate into tens of thousands of dollars in annual revenue for mid-market SaaS companies.

How saving a payment adds months of lifetime value

Recovering a single failed payment does more than recapture that invoice. Subscriptions rescued from involuntary churn continue on average for seven more months, compounding lifetime value and improving CAC/LTV ratios.

Because it is 5-7 times cheaper to save an existing customer than acquire a new one, AI-powered recovery becomes a core lever for sustainable growth rather than a back-office afterthought.

Key takeaway: AI-driven retries shift payment recovery from a cost center to a growth driver by rescuing customers who never intended to leave.

AI platforms vs. legacy logic: Slicker, Zuora Collect, Stripe, Recurly

Not all retry systems are created equal. Below is a comparison of leading approaches:

Platform | Approach | Claimed Recovery Lift | Pricing Model |

|---|---|---|---|

Slicker | Proprietary ML engine processes each payment individually; multi-gateway smart routing | 2-4× better recovery than native billing logic; 15.7 percentage point uplift | Pay-for-success: charges only for recovered payments |

Zuora Collect | Configurable Payment Retry with machine learning; Cascading Payment Method for fallback | Bundled with Zuora subscriptions | |

Recurly | Intelligent Retries using Random Forest models trained on billions of transactions | Dynamic models deliver stronger results than static models | Platform subscription |

Stripe Smart Retries | Machine-learning retry timing built into Stripe Billing | Not publicly disclosed | Included in Stripe Billing |

The Forrester Wave provides side-by-side comparisons of top recurring billing providers, noting that "accuracy, flexibility, and automation in billing can go a long way in improving customer and partner experiences, reducing costs, capturing missed revenue opportunities, reducing revenue leakage, and driving compliance."

Where legacy tools fall short

Traditional dunning and batch retries struggle with several gaps:

Static schedules: The most common approach is to retry a certain number of times within a fixed window, ignoring customer-specific signals like paydays or card types.

Single-gateway dependency: Zuora's Cascading Payment Method is not supported in payment runs invoked by Advanced Payment Manager, limiting flexibility.

Limited learning: Static models cannot adapt to shifting fraud patterns or issuer behavior the way continuously trained ML systems can.

Smart dunning represents a fundamental shift from batch processing to intelligent, data-driven recovery.

How to deploy AI payment error resolution in 30 days

Implementing AI-powered payment recovery no longer requires months of engineering work. Modern platforms enable setup in minutes and measurable results within weeks.

Step-by-step roadmap:

Audit current recovery metrics. Identify baseline recovery rate, churn attributed to payment failures, and retry costs.

Choose a platform. Evaluate integration depth with your billing system (Stripe, Chargebee, Zuora, Recurly, or in-house). Slicker integrates in 5 minutes with no code changes required.

Configure gateways. If using multiple processors, enable smart routing to maximize success probability.

Set retry rules. Use ML-driven recommendations rather than fixed schedules. A propensity model trained on 3.5 million invoices demonstrated that key features like automated past-due notifications, payment methods, and previous success rates drive payment behavior.

Monitor and iterate. Review analytics dashboards weekly; most organizations achieve full deployment within 30-60 days, with initial results visible in the first month.

Compliance, SOC 2 & outcome-based pricing

Security and pricing structure matter as much as recovery performance.

SOC 2 compliance: Has become table stakes in 2025, with most platforms either certified or actively pursuing certification. Slicker follows best cloud security practices and is pursuing SOC 2 Type-II compliance.

Outcome-based pricing: Outcome-based pricing (OBP) ties the price to some tangible outcome the buyer seeks. AI advancements make it possible to achieve and measure these outcomes reliably. Slicker's pay-for-success model, where you only pay for successfully recovered payments, aligns platform incentives directly with merchant outcomes.

Data privacy: Emerging agentic AI is pushing companies to evolve pricing models toward outcome-driven strategies that align cost with delivered value, ensuring transparency and accountability.

Takeaways: Turn failed payments into predictable growth

Failed payments represent both a massive challenge and an unprecedented opportunity for subscription businesses. "Involuntary churn has become the silent killer of subscription revenue, with up to 70% of customer departures stemming from failed transactions rather than intentional cancellations," according to Slicker.

AI payment error resolution flips the equation. By analyzing each transaction individually, predicting optimal retry timing, and routing charges through the best available gateway, machine-learning engines deliver 2-4× better recovery than native billing logic.

Slicker customers typically see 10-20 percentage point increases in recovered payments, with a 5-minute setup and pay-for-success pricing that ensures you only pay when revenue is actually recovered.

For high-volume subscription companies running Chargebee, Zuora, or in-house billing systems, AI payment error resolution is no longer optional. It is the fastest path to converting past-due invoices into revenue and turning involuntary churn into predictable growth.

Learn how Slicker can boost your payment recovery →

Frequently Asked Questions

What is AI payment error resolution?

AI payment error resolution uses machine-learning models to analyze declined transactions, predict failure types, and optimize retry strategies to recover revenue and reduce involuntary churn.

How does AI payment error resolution benefit B2B SaaS companies?

AI payment error resolution helps B2B SaaS companies by reducing involuntary churn, increasing recovered revenue, and improving customer retention through intelligent retry systems and data-driven automation.

What are the key components of AI payment error resolution platforms?

Key components include data ingestion, machine learning retry engines, smart routing, and analytics, which together enable intelligent, data-driven payment recovery.

How does Slicker's AI payment error resolution compare to other platforms?

Slicker's AI payment error resolution offers 2-4× better recovery than native billing logic, with a pay-for-success pricing model and easy integration with existing systems.

What is the impact of AI-driven retries on revenue recovery?

AI-driven retries can increase recovery rates above 70%, leading to 20-50% increases in recovered revenue, significantly boosting a company's bottom line.

How quickly can AI payment error resolution be deployed?

AI payment error resolution can be deployed in 30 days or less, with platforms like Slicker offering integration in just 5 minutes and measurable results within weeks.

Sources

https://www.slickerhq.com/blog/2025-failed-payment-benchmarks-ai-beats-industry-averages

https://www.slickerhq.com/blog/top-7-ai-payment-recovery-platforms-2025-comparison-success-rates

https://www.slickerhq.com/blog/2025-failed-payment-benchmarks-b2c-subscription-ecommerce-ai-recovery

https://www.slickerhq.com/blog/slicker-vs-zuora-collect-2025-ml-retry-performance-pricing-setup

https://recurly.com/blog/predicting-recurring-transaction-success/

https://www.forrester.com/report/recurring-billing-solutions/

https://knowledgecenter.zuora.com/Zuora_Payments/Configure_payment_orchestration/Retry_payments

https://www.slickerhq.com/blog/fix-failed-payments-fast-smart-dunning-setup-in-5-minutes

https://pubsonline.informs.org/do/10.1287/LYTX.2024.03.06/full/

https://www.tesorio.com/blog/the-complete-guide-to-ai-powered-revenue-control-systems-in-2025

https://www.marketingweek.com/outcome-based-pricing-explained/

https://www.forrester.com/report/center-your-ai-pricing-strategy-on-customer-outcomes/RES186410

https://www.slickerhq.com/blog/how-ai-enhances-payment-recovery

WRITTEN BY

Slicker

Slicker