Guides

10

min read

What Is Smart Dunning and Why Does It Matter Now?

Smart dunning uses AI and machine learning to analyze payment patterns, issuer codes, and customer behavior to optimize retry timing and routing, while rules-based systems follow fixed schedules regardless of context. AI-powered recovery increases success rates 20-50% compared to traditional methods, with platforms like Slicker achieving 7 percentage point approval lifts through intelligent multi-gateway routing.

Key Facts

• Rules-based dunning relies on predetermined retry schedules (day 3, 7, 14) applied uniformly to all failed payments, ignoring individual transaction context

• Smart dunning analyzes thousands of signals including device data, gateway trends, and customer behavior patterns to predict optimal retry timing and processors

• AI systems adapt in real-time, learning from each transaction to improve future recovery attempts, while rules-based systems remain static

• Machine learning models outperform traditional logistic regression approaches across most payment recovery segments

• Smart dunning orchestrates recovery across multiple channels (email, SMS, in-app) based on individual customer engagement patterns

• Implementation typically takes 30 days with platforms like Slicker requiring just 5-minute setup and no code changes

What Is Smart Dunning and Why Does It Matter Now?

Smart dunning is an AI-driven approach to recovering failed subscription payments that uses data-driven insights and machine learning to optimize collection strategies. Unlike traditional dunning that relies on fixed email sequences and rigid retry schedules, smart dunning analyzes thousands of signals--from issuer codes and customer behavior to device data and gateway trends--to predict the optimal time, channel, and processor for each payment retry.

The urgency for smart dunning has never been greater. With subscription businesses losing 9% of their revenue due to failed payments, the limitations of rule-based systems are becoming increasingly costly. Traditional collection strategies that depend on rigid segmentation lead to operational inefficiencies and customer dissatisfaction, making them inadequate for today's dynamic payment landscape.

As PayOptify notes, "Old dunning is often ineffective: Basic emails, fixed retries that ignore context, and wrestling with multi-processor complexities. The usual result? Lost revenue and annoyed customers." This fundamental shift from static rules to adaptive AI represents a critical evolution in payment recovery technology.

How Much Revenue Do Failed Payments Really Cost?

The financial impact of failed payments extends far beyond individual transactions. Subscription businesses lose 9% of their revenue to payment failures, translating to billions in lost revenue across the industry. For a global subscription market projected to reach $1.5 trillion by 2025, this represents an estimated $129 billion in potential losses from involuntary churn alone.

The problem runs deeper than raw revenue loss. Involuntary churn accounts for 20-40% of total customer churn in the subscription economy, with up to 70% of that involuntary churn stemming directly from failed transactions. These aren't customers who chose to leave--they're revenue casualties of inadequate payment recovery systems.

Adding to the urgency, false declines cost US retailers an estimated $81 billion in 2023 alone. Meanwhile, chargeback volume continues to escalate, with global chargebacks expected to grow from $33.79 billion in 2025 to $41.69 billion in 2028--a 23% increase that further strains traditional recovery systems.

These statistics underscore a critical reality: payment failure isn't just a technical problem--it's a massive revenue leak that compounds over time. Every failed payment that goes unrecovered represents not just lost immediate revenue, but potentially years of future subscription value walking out the door.

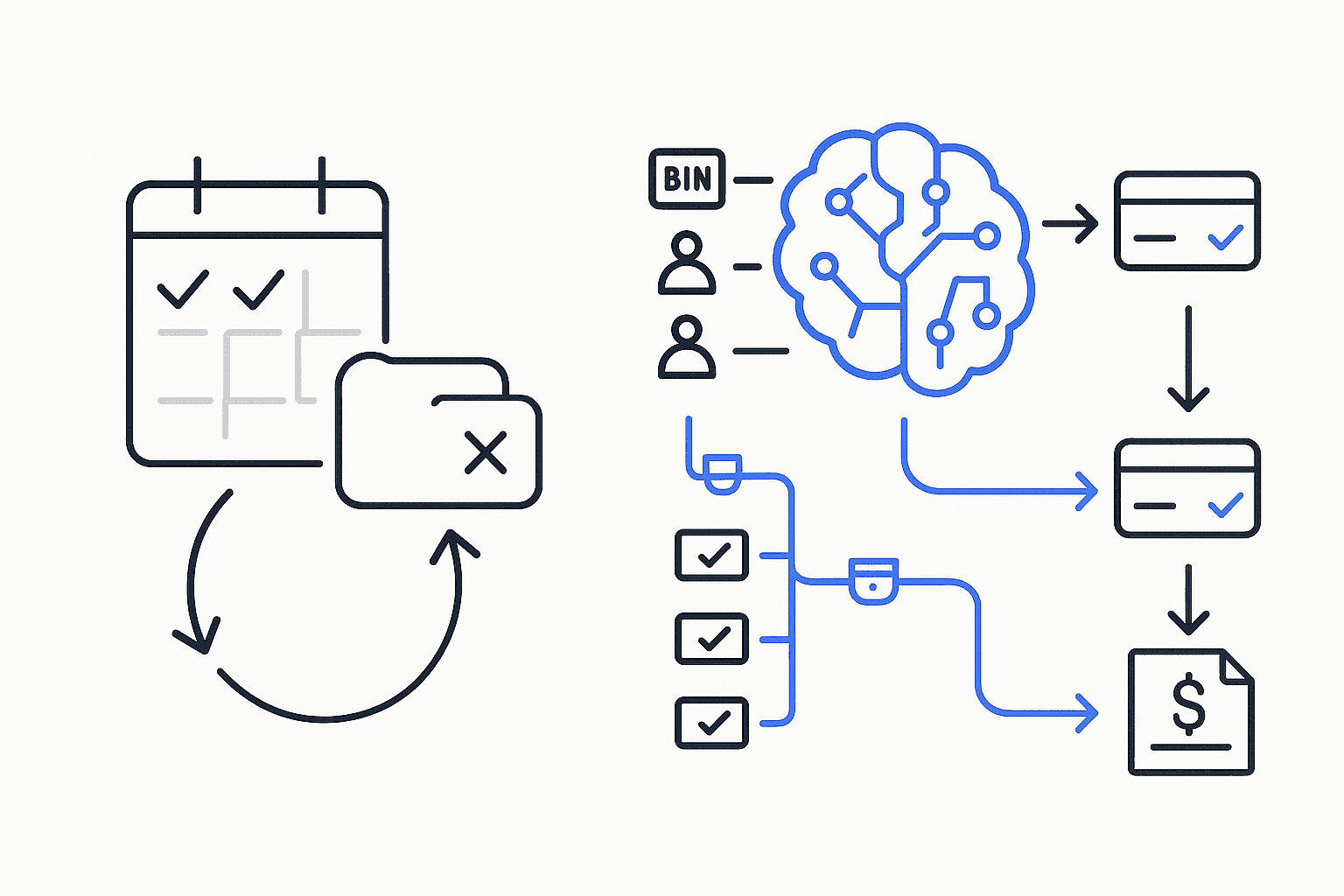

Rules-Based Dunning vs. AI Recovery: Where the Old Playbook Breaks

The fundamental difference between rules-based dunning and AI recovery lies in adaptability. Traditional systems operate on predetermined logic--retry on day 3, then day 7, then day 14--regardless of individual customer patterns or payment context. As PayOptify explains, these basic approaches result in "fixed retries that ignore context, and wrestling with multi-processor complexities."

In contrast, AI-powered recovery systems analyze vast datasets to make individualized decisions. Rather than following static rules, they evaluate each failed transaction individually, considering factors like issuer patterns, customer behavior history, and real-time gateway performance to determine optimal recovery strategies.

The performance gap is striking. While traditional approaches might achieve baseline recovery rates, machine learning models outperform logistic regression in most arrears segments, with neural networks showing particular strength in complex payment scenarios.

Why Static Retry Logic Can't Keep Up

Static retry logic fails because it treats all payment failures identically. As one SaaS CFO memorably put it, "Batch processing is the equivalent" of fishing with dynamite when precision angling tools are readily available.

The limitations are clear: fixed schedules ignore the nuances of why payments fail. A card declined for insufficient funds at 3 PM on a Thursday requires different handling than one declined due to a temporary gateway issue. Yet traditional systems apply the same retry schedule to both. Stripe acknowledges this limitation, noting that while they offer custom retry schedules, their AI-driven Smart Retries continuously learn from new purchaser behaviors to provide more targeted approaches.

How AI Learns and Adapts in Real Time

AI-powered dunning engines operate on continual learning principles. The RCE model demonstrates this capability, processing streaming data continuously to ensure adaptability in fast-changing environments. This real-time processing allows the system to respond immediately to emerging patterns and shifts in payment behavior.

Rather than waiting for periodic batch updates, AI systems analyze patterns from vast datasets--combining transaction history with anonymized global payment data. This enables them to identify subtle patterns humans might miss, like the correlation between specific decline codes and optimal retry windows, or the relationship between customer engagement patterns and payment success rates.

What AI Capabilities Power a Smart Dunning Engine?

Modern smart dunning engines leverage multiple AI capabilities working in concert. At the core, AI-powered multi-gateway routing evaluates each failed transaction individually, schedules intelligent retries, and routes payments through the processor with the highest real-time success probability.

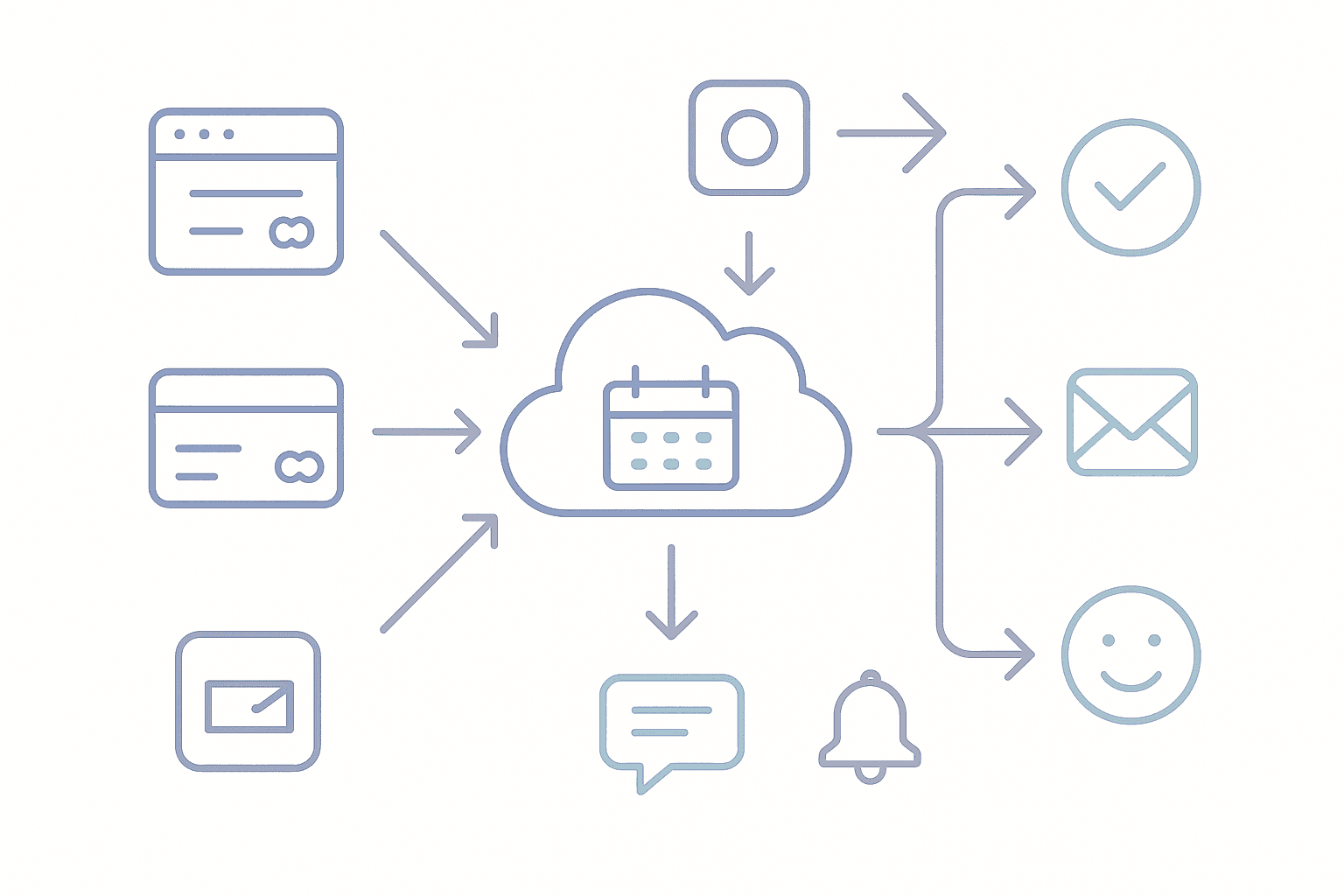

These systems go beyond simple retry logic. They orchestrate recovery attempts across channels--not just email, but also SMS and in-app notifications--meeting customers where they actually engage. This multi-channel approach recognizes that different customers respond to different communication methods at different times.

Additionally, Stripe's Smart Retries demonstrates how AI chooses optimal retry times by analyzing dynamic signals like device usage patterns and historical payment timing, continuously learning from new transactions to refine its approach.

Predictive Retry Timing

Predictive retry timing represents a quantum leap from fixed schedules. Machine-learning engines predict the perfect moment, method, and gateway for each retry, lifting recovery rates 2-4× above native billing logic. This isn't guesswork--it's data-driven optimization based on millions of successful recovery patterns.

The sophistication of these systems is remarkable. Stripe's Adaptive Acceptance recovered a record-high $6 billion in falsely declined transactions in 2024, reflecting a 60% year-over-year increase in retry success rate. This was achieved by transitioning to more advanced neural network models that can identify legitimate transactions with 70% greater precision.

Multi-Channel & Personalized Outreach

Smart dunning recognizes that payment recovery isn't just about timing--it's about communication strategy. AI can orchestrate recovery across email, SMS, and in-app notifications, choosing the channel most likely to succeed for each individual customer.

This personalization extends beyond channel selection. Research shows that reinforcement learning-driven personalized campaigns via electronic mail yield statistically significant reductions in customer attrition rates. The AI learns which message types, tones, and timing work best for different customer segments, continuously refining its approach based on response patterns.

Do Smart Dunning Systems Actually Work? Benchmarks & Case Studies

The evidence for smart dunning's effectiveness is compelling. Companies switching from batch-based strategies to intelligent, individualized retry strategies typically see a 20-50% increase in recovered revenue. These aren't marginal improvements--they represent transformative impacts on bottom-line performance.

Real-world implementations consistently demonstrate superior results. Billogram's Smart Dunning feature uses AI to continuously optimize workflows, training on real data from customer bases to improve recovery rates while reducing churn.

The sophistication of modern AI recovery is perhaps best illustrated by Stripe's Adaptive Acceptance, which achieved a 60% year-over-year increase in retry success rate, recovering $6 billion in previously lost transactions.

SaaS Merchant Boosts Approvals 7 pp with Slicker

One merchant using Slicker's multi-gateway routing saw their payment success rate increase from 86% to 93%--a 7 percentage point improvement that translated directly to bottom-line revenue. This wasn't achieved through more aggressive retry attempts, but through smarter routing and timing decisions powered by machine learning.

Telecom Cuts Collections 80 % with Billogram's ML

Billogram's work with Hallon, a mobile operator, demonstrates the transformative potential of smart dunning. Their experiment revealed that 80% of customers sent to debt collection would have paid without such friction-heavy actions. By implementing machine learning models to predict payment behavior, Hallon successfully reduced its collection cases by 80%, while simultaneously decreasing churn and reducing pressure on customer service.

How to Upgrade from Rules to Smart Dunning in 30 Days

The transition from rules-based to AI-powered dunning doesn't require a complete system overhaul. Modern platforms like Slicker offer 5-minute setup with no code changes required. This rapid deployment is possible because smart dunning systems are designed to integrate with existing billing infrastructure rather than replace it.

The implementation process typically follows a straightforward path. First, connect your existing payment processors and billing systems to the AI platform. Natural language helpers are becoming administrators' best friends, simplifying data queries, documentation queries, and configuration tasks.

Critically, many smart dunning providers operate on performance-based pricing models. Stripe can't automatically retry certain hard decline codes, but for the vast majority of soft declines, their AI systems can determine optimal retry strategies. This pay-for-performance approach means businesses only pay for successfully recovered payments, eliminating financial risk during the transition.

The key to successful implementation is starting with clear metrics. Track your current recovery rate, average time to recovery, and involuntary churn rate before implementation. This baseline allows you to measure the AI system's impact accurately and optimize its configuration for your specific business needs.

Why Smart Dunning Belongs on Your 2026 Roadmap

The case for smart dunning is no longer theoretical--it's an operational imperative. Slicker customers typically see between a 10 and 20 percentage point increase in recovered payments, translating to millions in recovered revenue for larger organizations.

The technology has reached a maturity point where implementation risk is minimal while potential returns are substantial. Strategic multi-channel outreach meets customers where they are, while AI-powered routing ensures each retry has the maximum chance of success.

Perhaps most importantly, AI-powered multi-gateway routing doesn't just recover more payments--it does so while improving customer experience. By reducing failed payment friction and eliminating unnecessary collection escalations, smart dunning preserves customer relationships while protecting revenue.

For subscription businesses serious about minimizing involuntary churn and maximizing revenue recovery, the question isn't whether to adopt smart dunning, but how quickly they can implement it. Slicker's AI-powered platform offers the fastest path to implementation, with proven results across industries and a risk-free, performance-based pricing model that ensures you only pay for success.

Key takeaway: Smart dunning represents a fundamental shift from reactive, rules-based recovery to proactive, AI-driven optimization that can increase recovery rates by 20-50% while improving customer relationships.

Frequently Asked Questions

What is smart dunning?

Smart dunning is an AI-driven approach to recovering failed subscription payments. It uses data-driven insights and machine learning to optimize collection strategies, unlike traditional methods that rely on fixed email sequences and retry schedules.

How does smart dunning differ from rules-based systems?

Smart dunning adapts to individual customer patterns and payment contexts using AI, while rules-based systems follow predetermined logic without considering specific transaction details. This adaptability leads to higher recovery rates and improved customer satisfaction.

What financial impact do failed payments have on subscription businesses?

Failed payments can cost subscription businesses up to 9% of their revenue, translating to billions in losses industry-wide. Involuntary churn from failed transactions accounts for a significant portion of total customer churn.

How does AI improve payment recovery rates?

AI improves recovery rates by analyzing vast datasets to make individualized decisions, optimizing retry timing, channel, and processor selection. This data-driven approach can increase recovery rates by 20-50% compared to traditional methods.

What are the benefits of implementing smart dunning?

Implementing smart dunning can significantly increase recovered revenue, reduce involuntary churn, and enhance customer relationships by minimizing payment friction and unnecessary collection actions. It offers a performance-based pricing model, reducing financial risk.

Sources

https://www.slickerhq.com/blog/soft-decline-retry-strategies-saas-cfos-q3-2025-guide

https://stripe.com/blog/ai-enhancements-to-adaptive-acceptance

https://stripe.com/docs/billing/revenue-recovery/smart-retries

https://thesai.org/Downloads/Volume16No5/Paper_38-Enhancing_Customer_Churn_Analysis.pdf

https://journalwjarr.com/sites/default/files/fulltext_pdf/WJARR-2025-1045.pdf

https://www.billogram.com/blog/smart-dunning-dunning-that-reduces-churn

WRITTEN BY

Slicker

Slicker