Guides

10

min read

Renewals failing after card updates? AI-powered recovery fixes

AI-powered payment recovery systems achieve 70% recovery rates compared to 30% for traditional dunning emails, recovering up to 70% of failed transactions through intelligent timing and multi-gateway routing. These systems analyze each decline individually to determine optimal retry timing, while basic retry logic uses fixed schedules that waste limited retry attempts on transactions unlikely to succeed.

Key Facts

• Failed payments cost subscription businesses 9% of total revenue annually—approximately $129 billion industry-wide in 2025

• Involuntary churn accounts for 20-40% of total customer churn in subscription businesses

• AI-powered platforms deliver 2-4x better recovery rates than the industry median of 47.6%

• Card networks limit merchants to 15 retry attempts within 30 days to prevent violations

• Companies switching to intelligent retry see 20-50% revenue increases over email-only dunning

• Modern AI recovery systems deploy in 5 minutes without code requirements

Card-update failures quietly drain recurring revenue, but AI-powered payment recovery can plug the leak and lift renewals in weeks.

Why card-update failures cost you more than you think

Failed renewals rarely announce themselves with flashing alarms. They slip through the cracks when a customer's card expires, when an issuer declines a charge for insufficient funds, or when a gateway hiccup goes unnoticed. Yet the cumulative damage is staggering.

"Subscription businesses lose 9% of their revenue due to failed payments," according to Slicker's 2025 analysis. That figure translates to roughly $129 billion industry-wide in 2025 alone.

Involuntary churn, the loss of customers due to payment failures rather than intentional cancellations, accounts for 20-40% of total customer churn in the subscription economy. Unlike voluntary churn, these customers never intended to leave. They simply hit a payment wall and were forced out.

The revenue at risk compounds quickly:

Metric | Impact |

|---|---|

Revenue lost to failed payments | 9% of total revenue |

Involuntary churn share | 20-40% of all churn |

Projected 2025 industry loss | $129 billion |

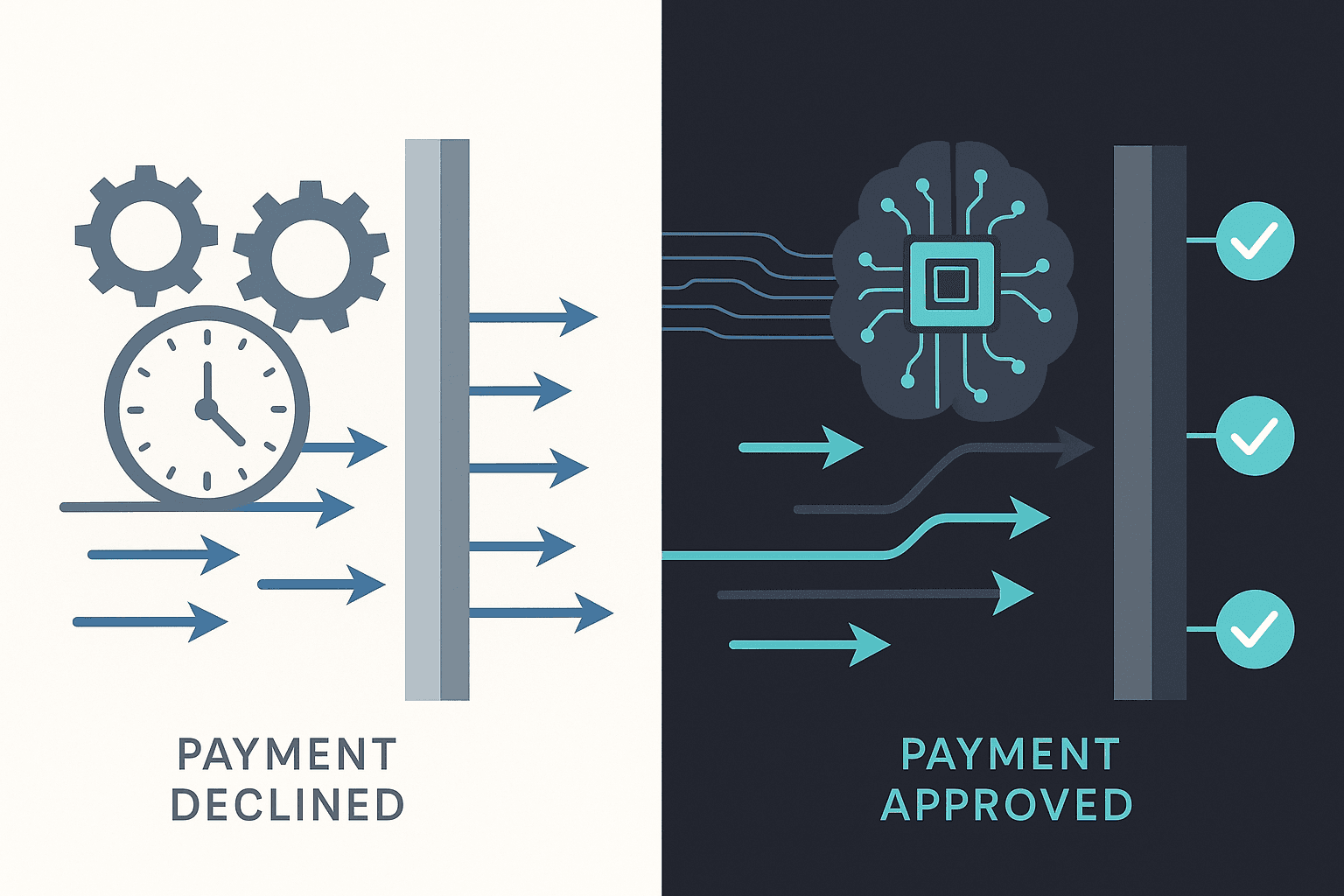

Basic retry logic often fails to recover these payments because it treats every decline the same way. AI-powered payment recovery changes that equation by analyzing each transaction individually and scheduling retries at the precise moment funds are most likely available.

Where does basic payment retry logic fall short?

Static retry schedules and dunning emails have been the default recovery tools for years. Unfortunately, they leave significant money on the table.

"Most of payment processors make authorization attempt at preset time and if it fails retry next attempt in a fixed time window and for fixed number of times. This rule based approach doesn't consider historical data and may cause redundant retry attempts," explains a GitHub analysis of payment retry practices.

The limitations are clear:

Generic timing: Basic systems retry at fixed intervals regardless of why the payment failed or when funds might actually be available.

No decline classification: They treat a temporary insufficient-funds decline the same as a permanently closed account.

Compliance risks: Aggressive retries can trigger card-network violations and damage your merchant standing.

Dunning emails compound the problem by depending entirely on customer action. Traditional dunning campaigns typically capture only 30% of failed transactions because they require the customer to log in, update their card, and complete the payment manually.

Card-network retry limits you can't ignore

Card networks have strict rules about how many times you can retry a declined transaction. Visa and Mastercard limit merchants to around 15 retry attempts in 30 days.

Exceed these limits and you face serious consequences:

High-risk merchant status: Gateways and payment processors flag accounts with excessive failed transactions.

Potential blacklisting: "Every unsuccessful retry attempt increases your chances to being marked a high-risk merchant, or worse, getting blacklisted," warns Chargebee's dunning documentation.

This creates a dilemma: you need multiple retry attempts to maximize recovery, but blind retries waste your limited attempts on transactions that will never succeed. Intelligent detection solves this by identifying which declines are worth retrying and when.

How do intelligent retry engines work, and why do they win?

Intelligent retry engines replace guesswork with data-driven precision. Instead of firing retries on a fixed schedule, they analyze each failed transaction to determine the optimal recovery strategy.

"Using AI, Smart Retries chooses the best times to retry failed payment attempts to increase the chance of successfully paying an invoice," explains Stripe's automatic collection documentation. The AI model uses time-dependent, dynamic signals such as device usage patterns and payment method activity to predict when a retry will succeed.

Recurly's Intelligent Retries employs machine learning to determine the optimal time for retrying a declined recurring credit card payment. Their system analyzes data from billions of transactions to increase success rates.

The recommended default for Stripe's Smart Retries is 8 tries within 2 weeks, but the AI determines the spacing based on each transaction's unique characteristics.

Machine-learning triage: soft vs hard declines

Not all declines are created equal. AI systems classify each failure to determine the appropriate response.

Soft declines are temporary issues that can often be resolved with retries:

Insufficient funds

Temporary holds

Gateway timeouts

Credit limit exceeded

"Four out of the five reasons contributing to high credit card decline rates are soft declines, which can be repaired by retrying the card at a later date," notes Recurly's payment decline research.

Hard declines are permanent issues requiring customer intervention:

Stolen or lost cards

Closed accounts

Fraud flags

"Fraud is a hard decline, meaning retries will not be effective," the same research confirms.

The Churnkey State of Retention 2025 report, analyzing over $3 billion in subscription revenue, found that soft declines can be resolved "primarily with card retries, requesting a backup card, in-app payment collection walls, and dunning recovery campaigns across email and SMS." Hard declines require different strategies entirely.

By distinguishing between decline types, AI engines avoid wasting retry attempts on unrecoverable transactions while maximizing success on soft declines.

Smart routing across gateways

Beyond timing optimization, AI systems can route payments across multiple gateways to find the processor most likely to approve each transaction.

AI systems can route payments across multiple gateways in real-time, selecting the optimal processor based on:

Historical success rates by card type and issuer

Geographic optimization

Real-time gateway performance

Cost optimization

Customers implementing multi-gateway routing typically see 10-20 percentage point increases in recovered payments.

This approach proves especially valuable when a primary gateway experiences issues or when certain card types perform better through specific processors.

What ROI can AI payment recovery deliver?

The performance gap between basic retry logic and intelligent systems is substantial.

"The median recovery rate across the industry hovers around 47.6%, but AI-powered platforms are consistently delivering 2-4x better results," reports Slicker's 2025 benchmark analysis.

Smart payment retries recover up to 70% of failed transactions through AI-powered timing and multi-gateway routing, while traditional dunning email campaigns typically capture only 30%.

Recovery Method | Typical Recovery Rate |

|---|---|

Traditional dunning emails | ~30% |

Industry median | 47.6% |

AI-powered platforms | 70-85% |

The financial impact extends beyond immediate recovery. Companies switching to intelligent retry see 20-50% revenue increases over email-only dunning.

Platforms using AI engines push recovery rates above 70%, effectively doubling the industry standard. For a company losing $200,000 annually to failed payments at the median recovery rate, this improvement could recover an additional $45,000 or more.

Key takeaway: AI-powered payment recovery delivers 2-4x better results than industry median rates, turning failed renewals from a cost center into a revenue opportunity.

Slicker vs native billing and AI rivals: what really stacks up?

Subscription businesses have several options for payment recovery, from native billing tools to specialized AI platforms. Understanding the differences helps identify the right fit.

Native billing retry logic (Stripe, Chargebee, Zuora, Recurly):

Built into existing billing platforms

Limited customization options

Typically achieve median industry recovery rates (~47%)

Zuora Collect customers reported a revenue recovery increase of 10-20%

Specialized AI recovery platforms:

Purpose-built for payment recovery

Deeper machine learning optimization

Multi-gateway routing capabilities

Higher recovery rates (70%+)

Involuntary churn can represent up to 30% of total customer churn for subscription businesses, making the choice of recovery solution a strategic decision.

Slicker's approach stands out in several ways:

Recovery performance: The platform delivers 2-4× better recovery than native billing-provider logic

Pay-for-success pricing: You only pay for successfully recovered payments, aligning incentives with your outcomes

Integration flexibility: Works with Stripe, Chargebee, Zuora, Recurly, Recharge, and in-house systems

Setup speed: Five-minute no-code deployment versus weeks of development time

Capability | Native Billing | Slicker |

|---|---|---|

Recovery rate improvement | 10-20% | 2-4x baseline |

Multi-gateway routing | Limited | Yes |

ML-optimized timing | Basic | Advanced |

No-code setup | Varies | 5 minutes |

Pay-for-success pricing | No | Yes |

How to implement AI-powered payment recovery in five steps

Rolling out an intelligent retry engine doesn't require a billing overhaul or lengthy development cycles. Here's how to get started:

Audit your current recovery performance

Calculate your baseline recovery rate and identify how much revenue you're losing to failed payments

Segment declines by type (soft vs hard) to understand where the opportunity lies

Choose your integration approach

Modern AI-powered systems like Slicker deploy in 5 minutes without code requirements

The platform connects to your existing billing system through standard APIs

Configure retry rules and thresholds

Set parameters that align with card-network limits (15 attempts in 30 days)

"You can override this behavior by disabling Smart Retries and defining your own custom retry rules," notes Stripe's documentation

Enable multi-gateway routing (if applicable)

Connect additional payment gateways to maximize approval rates

Let the AI engine determine optimal routing for each transaction

Monitor and optimize

Track recovery rates, retry success by decline type, and revenue recovered

Adjust strategies based on performance data

Plug-and-play integrations with Stripe, Chargebee, Zuora, Recurly

Platforms like Slicker offer 5-minute setup with no code changes, plugging into Stripe, Chargebee, Recurly, Zuora, and Recharge.

The data required for integration is typically limited to:

Failed invoice and payment details

Customer payment method information

Decline codes and error messages

Historical retry outcomes

Stripe provides automated revenue recovery features for one-off invoices to help collect payments that might have failed otherwise. These native tools can work alongside specialized platforms for comprehensive coverage.

Recurly currently does not implement intelligent payment retries for direct debit methods such as ACH and SEPA, so businesses using these payment types may need supplementary solutions.

Case study: 40% churn drop for a beauty-box subscription

Theory is helpful, but real-world results demonstrate what's actually achievable.

"A mid-sized beauty subscription box company was experiencing monthly churn rates of 14%, with involuntary churn representing 42% of total losses. Their existing billing platform's basic retry logic was only recovering 18% of failed payments, resulting in monthly revenue losses exceeding $12,000 for their 2,000-subscriber base," describes Slicker's B2C subscription benchmark report.

The company implemented an AI-powered recovery platform that evaluates each failed transaction individually, analyzing patterns in geography, currency, pay cycles, and error codes to choose optimal retry timing.

"Within three months of implementation, the company achieved: 40% reduction in overall churn rate (from 14% to 8.4%), 68% recovery rate on failed payments (up from 18%), $8,400 monthly revenue recovery, 96.2% renewal-invoice paid rate," the case study continues.

The transformation came from replacing generic retry schedules with intelligent, individualized strategies:

Soft declines were retried at optimal times based on customer payment patterns

Hard declines were flagged for dunning outreach rather than wasting retry attempts

Multi-gateway routing found alternative processors when the primary gateway declined

This example illustrates the gap between basic and intelligent recovery. An 18% recovery rate left the company bleeding revenue; a 68% rate turned payment failures into a manageable operational metric.

Turning failed renewals into strategic wins

Slicker's number one priority is increasing your retention rate. By only charging for successfully recovered payments, the pay-for-success model ensures that platform success directly correlates with your revenue recovery.

Failed payments don't have to be an accepted cost of doing business. AI-powered payment recovery transforms what was once inevitable churn into recoverable revenue, often doubling or tripling recovery rates compared to basic retry logic.

The opportunity is significant: subscription companies leave billions on the table each year due to inadequate recovery processes. Those that adopt intelligent retry strategies gain not just immediate revenue recovery but also the extended lifetime value of customers who would otherwise have churned involuntarily.

For high-volume subscription companies using Chargebee, Zuora, or in-house billing systems, Slicker offers a path to capture this opportunity with minimal integration effort and aligned incentives.

Frequently Asked Questions

What causes card-update failures in subscription renewals?

Card-update failures often occur due to expired cards, insufficient funds, or unnoticed gateway issues, leading to significant revenue loss.

How does AI-powered payment recovery improve renewal rates?

AI-powered recovery analyzes each transaction to optimize retry timing and routing, significantly increasing the success rate of payment recoveries.

What are the limitations of basic retry logic for payment recovery?

Basic retry logic uses fixed schedules and lacks decline classification, often leading to ineffective retries and potential compliance risks.

How does Slicker's AI platform differ from native billing tools?

Slicker's platform offers advanced machine learning, multi-gateway routing, and pay-for-success pricing, outperforming native billing tools in recovery rates.

What is the impact of AI-powered recovery on revenue?

AI-powered recovery can double or triple recovery rates, turning failed renewals into revenue opportunities and reducing involuntary churn.

Sources

https://www.slickerhq.com/blog/smart-payment-retries-vs-dunning-which-recovers-more-in-2025

https://www.slickerhq.com/blog/can-smart-payment-retries-reach-90-recovery-reality-check

https://www.slickerhq.com/blog/2025-failed-payment-benchmarks-ai-beats-industry-averages

https://www.chargebee.com/recurring-payments/dunning-management/

https://docs.recurly.com/recurly-subscriptions/docs/retry-logic

https://recurly.com/research/subscription-benchmarks-top-payment-decline-reasons/

https://www.slickerhq.com/blog/2025-failed-payment-benchmarks-b2c-subscription-ecommerce-ai-recovery

WRITTEN BY

Slicker

Slicker