Guides

10

min read

Manual dunning spreadsheets costing you? Smart dunning ROI calculator

Manual dunning spreadsheets cause businesses to lose up to 9% of revenue annually through failed payments and processing errors. AI-powered recovery systems recover up to 70% of failed transactions compared to 30% for traditional methods, while companies switching to intelligent retry see 20-50% revenue increases over spreadsheet-based dunning.

At a Glance

• Manual spreadsheets contribute to 9% annual revenue loss from failed payments, totaling $129 billion industry-wide in 2025

• 94% of business spreadsheets contain errors that impact payment recovery accuracy

• AI-powered systems achieve 70% recovery rates versus 30% for traditional dunning methods

• Involuntary churn accounts for 20-40% of total customer churn in subscription businesses

• Smart dunning ROI calculators factor in recovered revenue, preserved lifetime value, and reduced operational costs

• Implementation takes as little as 5 minutes with no-code platforms like Slicker

Manual dunning spreadsheets leak revenue and time. A smart dunning ROI calculator shows, in minutes, how much cash AI-driven recovery can put back in your pocket.

Why Do You Need a Smart Dunning ROI Calculator Fast?

How much revenue is slipping through the cracks of your spreadsheet-based dunning process right now?

The numbers paint a stark picture. Subscription businesses lose 9% of their total revenue annually to failed payments, which translates to approximately $129 billion industry-wide in 2025. Meanwhile, 15% of monthly revenue on average goes uncollected due to credit card declines.

The spreadsheet problem compounds these losses. Research shows that 94% of spreadsheets used in business decision-making contain errors, directly impacting your ability to recover failed payments accurately and consistently.

Involuntary churn, the silent revenue killer, accounts for 20-40% of total customer churn in the subscription economy. These are customers who never intended to leave but are forced out when payments fail. Traditional dunning recovers only about 30% of failed transactions, while AI-powered systems recover up to 70%.

A smart dunning ROI calculator quantifies exactly what you stand to gain by moving from error-prone spreadsheets to intelligent recovery systems.

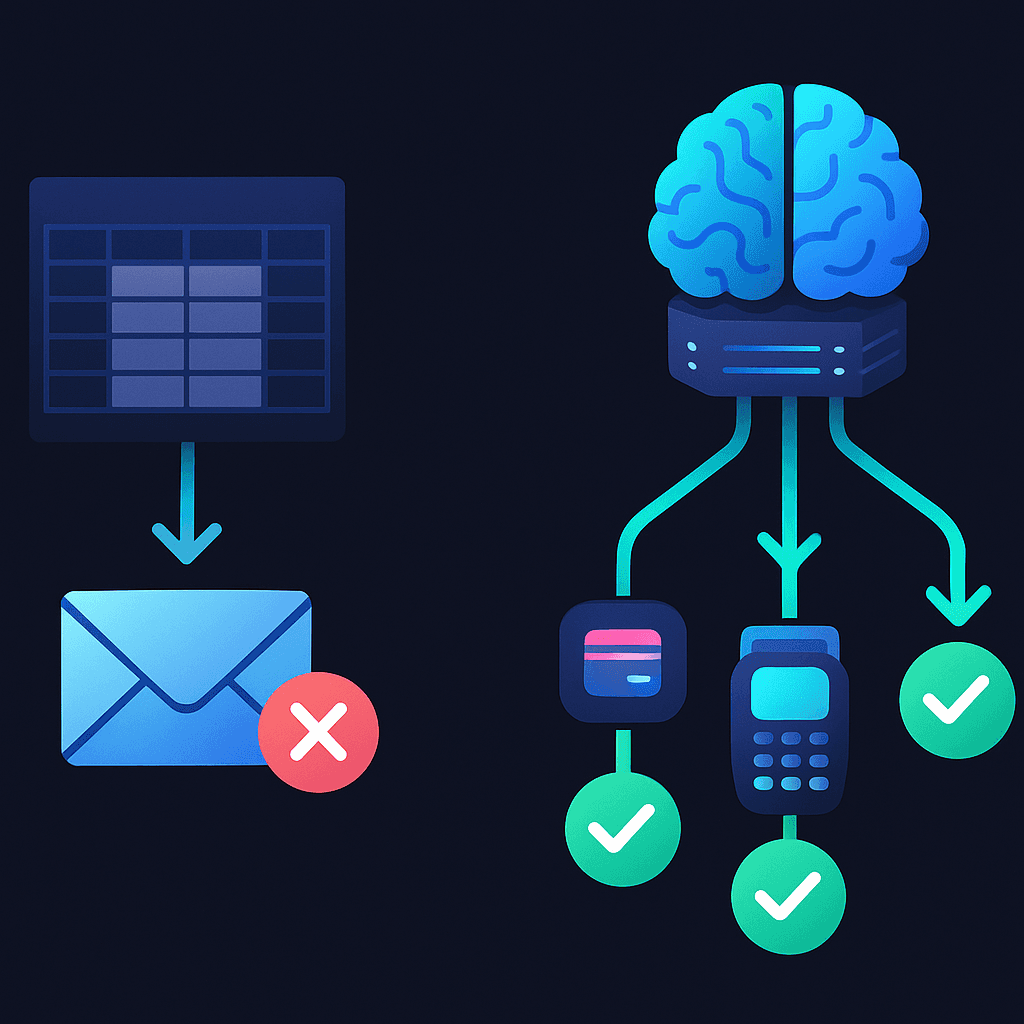

What Are the Hidden Costs of Manual Dunning Spreadsheets?

Manual dunning creates cascading costs that extend far beyond the obvious time drain.

Operational Burden

Failed payments trigger a cascade of operational costs:

Customer support tickets

Manual retry attempts

Account recovery processes

Dunning management

Reactivation campaigns

Subscription businesses risk losing 7.2% of subscribers each month due to involuntary churn from credit card declines and failed payments alone. Every failed payment requires manual intervention, consuming valuable finance team hours that could be spent on strategic work.

Financial Impact

The financial damage runs deeper than missed payments. 62% of users who hit a payment error never return to the site. That means a single failed payment doesn't just cost you one transaction; it potentially eliminates an entire customer lifetime value.

Consider the error rate problem. Research shows that 18% of accountants make financial errors at least daily, with over half making several errors per month. Companies that digitize with high technology acceptance see a 75% reduction in financial errors.

Customer Experience Degradation

Manual processes create friction at the worst possible moment. When customers experience payment failures, they need seamless resolution, not delayed email sequences from overwhelmed finance teams working through spreadsheet queues.

Key takeaway: Manual dunning costs you revenue, customers, and operational efficiency simultaneously.

How Do AI-Powered Dunning Engines Recover Up to 70% of Failed Payments?

AI-driven payment recovery transforms a reactive spreadsheet process into a proactive, intelligent system.

The difference comes down to precision. Traditional systems rely on email sequences triggered by payment failures and hope customers take action. AI systems analyze each failed transaction individually to determine the optimal recovery strategy.

AI systems route payments across multiple gateways in real-time, selecting the optimal processor based on historical success rates by card type and issuer, geographic optimization, real-time gateway performance, and cost optimization.

Intelligent Retry Timing

Timing determines everything in payment recovery. The first retry captures the majority of recoverable revenue, with diminishing returns on subsequent attempts.

AI optimization can push soft decline recovery toward 70%, but hard declines remain unrecoverable. Machine learning models process dynamic signals and purchaser behaviors, learning from millions of transactions to predict when funds will be available.

Slicker's engine analyzes patterns in geography, currency, pay cycles, and error codes to schedule intelligent retries at optimal times.

Smart Multi-Gateway Routing

Not all payment processors perform equally for every transaction type.

AI-powered platforms route payments across multiple gateways, selecting the processor most likely to approve each specific transaction. This approach considers historical success rates, real-time gateway performance, and cost optimization to maximize recovery probability.

The result: intelligent retry strategies deliver 20-50% revenue recovery increases over basic systems.

Inside the Smart Dunning ROI Calculator

Calculating your potential return requires understanding the key inputs and how they translate to recovered revenue.

Core Inputs

Input | What It Measures | Why It Matters |

|---|---|---|

Monthly Recurring Revenue | Total subscription revenue | Baseline for calculating recovery potential |

Current Failed Payment Rate | Percentage of payments failing | Identifies your exposure |

Current Recovery Rate | Percentage of failures recovered | Shows your improvement opportunity |

Average Customer Lifetime | How long customers stay | Determines LTV at stake |

The Formula

As noted by one ROI framework, the calculation follows this structure:

ROI % = [(Time Saved × Hourly Rate × Frequency) - Automation Cost] / Automation Cost × 100

For payment recovery specifically, you add recovered revenue to time savings.

Traditional ROI models fail to capture the full value of AI, which is why leading frameworks now evaluate ROI across dimensions including customer experience, time-to-market, and innovation.

Value Drivers

In subscription businesses, the average customer stays for 24 months, meaning that $50 monthly subscription actually represents $1,200 in expected revenue.

A failed payment doesn't just cost you $50; it potentially costs you the full customer lifetime value. This hidden revenue killer accounts for 20-40% of total customer churn across industries.

When you calculate ROI, factor in:

Direct recovered revenue from failed payments

Preserved customer lifetime value

Reduced operational costs from automation

Lower customer acquisition costs (retaining is 5-25 times cheaper than acquiring)

Manual data entry has a 1-4% error rate, while automation has near-zero errors. That error reduction compounds across thousands of transactions annually.

Can AI Dunning Really Slash Involuntary Churn? 3 Case Studies

Real-world results demonstrate what smart dunning delivers.

Case Study 1: Beauty Subscription Box

A mid-sized beauty subscription company was experiencing monthly churn rates of 14%, with involuntary churn representing 42% of total losses. Within three months of implementing AI-powered recovery, the company achieved:

40% reduction in overall churn rate (from 14% to 8.4%)

68% recovery rate on failed payments (up from 18%)

96.2% renewal-invoice paid rate

Case Study 2: SaaS Revenue Recovery

For a $5M ARR SaaS company, the difference between industry-average and AI-powered recovery translates to hundreds of thousands in recovered revenue annually. Moving from the 47.6% industry median to 70%+ recovery rates fundamentally changes the growth equation.

Case Study 3: Enterprise Collections Efficiency

FourKites scaled collections without adding headcount or sacrificing customer experience. By automating outreach and syncing collections with their CRM, they cut time-to-collect by 26%.

Across these cases, a consistent pattern emerges: AI-powered recovery delivers 2-4× better results than static retry systems.

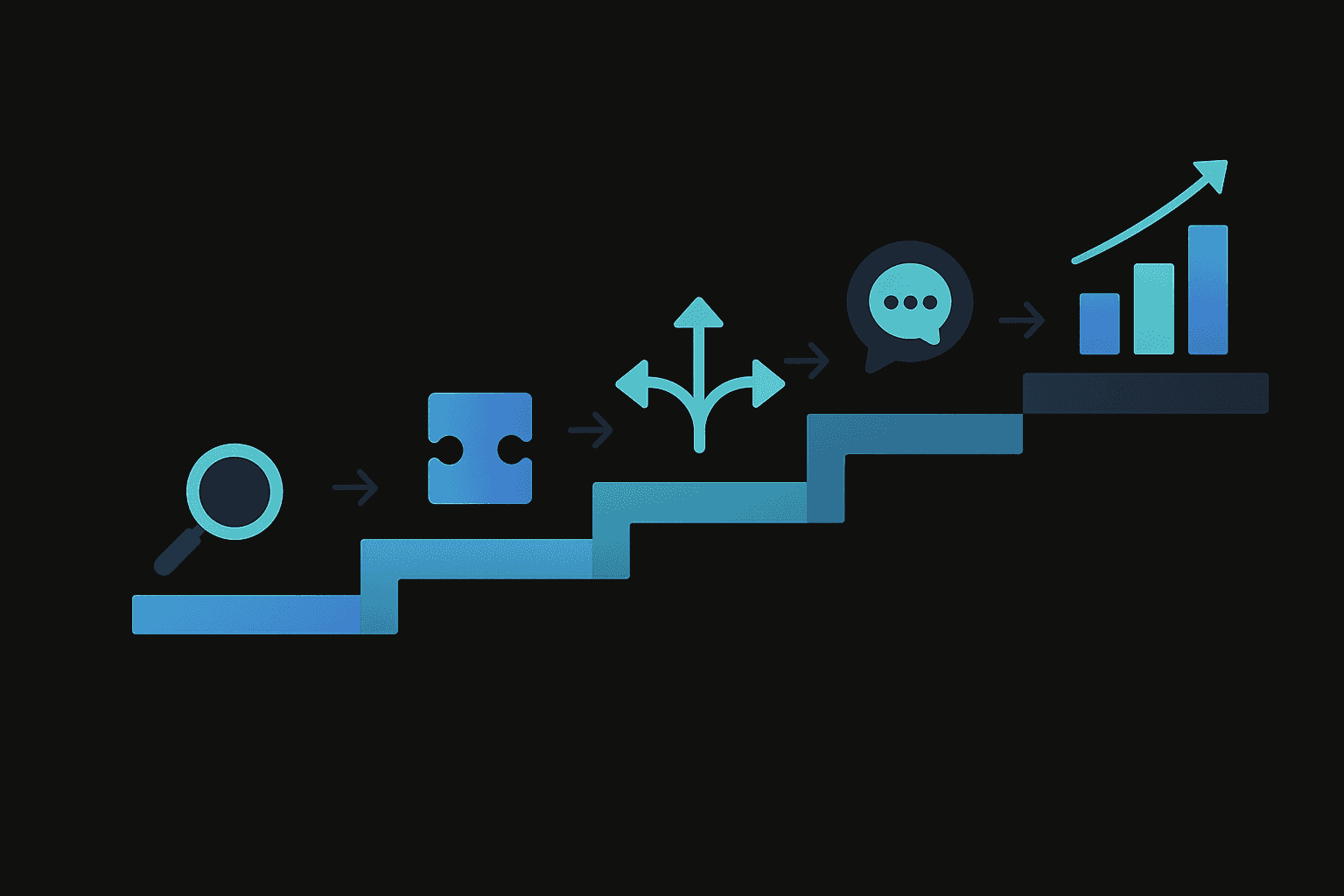

5-Step Plan to Deploy Smart Dunning & Track ROI

Moving from spreadsheets to intelligent recovery requires a structured approach.

Step 1: Baseline Your Current Performance

Before implementing any solution, document your current:

Failed payment rate by decline type

Recovery rate and timeline

Time spent on manual dunning processes

Customer churn attributed to payment failures

Step 2: Choose a No-Code Integration

Modern AI-powered systems deploy in 5 minutes without code requirements. Slicker's platform takes just 5 minutes to set up, integrating with popular billing platforms like Stripe, Chargebee, Recurly, Zuora, and in-house systems.

Step 3: Enable Multi-Gateway Routing

If you use multiple payment processors, leverage AI to forecast cash inflows based on real payment history and route transactions to the gateway with the highest success probability.

Step 4: Configure Intelligent Communication

Provide seamless payment update experiences with Apple Pay and Google Pay ready options. Personalize outreach timing based on customer behavior patterns rather than arbitrary schedules.

Step 5: Track and Optimize

Measure these key metrics weekly:

Recovery rate by decline type

Time-to-recovery

Customer save rate

Revenue recovered versus baseline

Slicker customers typically see between a 10 and 20 percentage point increase in the number of recovered payments.

Stop Bleeding Revenue -- Start Calculating Your Gains

Every 1% lift in recovery can translate into tens of thousands of annual revenue for growing subscription businesses. The gap between your current spreadsheet-based recovery rate and what AI-powered systems achieve represents real money sitting on the table.

Slicker only charges for successfully recovered payments, ensuring that the platform's success directly correlates with your revenue recovery. This pay-for-success pricing model eliminates risk: you only pay when recovery succeeds.

Slicker's AI engine sits on top of your existing billing and payment systems, processing each failing payment individually to reduce involuntary churn, increase recovered revenue, and boost business margins. With a 5-minute no-code setup and SOC-2-grade security measures, the path from spreadsheet chaos to intelligent recovery has never been simpler.

Stop letting manual processes drain your subscription revenue. Calculate your potential gains and see what smart dunning can deliver for your business.

Frequently Asked Questions

What is a smart dunning ROI calculator?

A smart dunning ROI calculator quantifies the potential revenue recovery and operational efficiency gains from switching from manual dunning spreadsheets to AI-powered recovery systems.

How much revenue do subscription businesses lose to failed payments?

Subscription businesses lose approximately 9% of their total revenue annually to failed payments, which equates to around $129 billion industry-wide in 2025.

What are the hidden costs of manual dunning spreadsheets?

Manual dunning spreadsheets incur costs beyond time, including operational burdens like customer support and reactivation campaigns, financial impacts from lost customer lifetime value, and degraded customer experiences due to delayed resolutions.

How do AI-powered dunning engines improve payment recovery?

AI-powered dunning engines improve payment recovery by analyzing each failed transaction to determine optimal recovery strategies, using intelligent retry timing and multi-gateway routing to maximize recovery rates.

What results have companies seen with AI-powered recovery systems?

Companies using AI-powered recovery systems have seen significant improvements, such as a 40% reduction in churn rates and recovery rates on failed payments increasing from 18% to 68%.

How does Slicker's pricing model work?

Slicker operates on a pay-for-success pricing model, charging only for successfully recovered payments, ensuring that the platform's success directly correlates with the client's revenue recovery.

Sources

https://www.slickerhq.com/blog/smart-payment-retries-vs-dunning-which-recovers-more-in-2025

https://www.slickerhq.com/blog/can-smart-payment-retries-reach-90-recovery-reality-check

https://www.slickerhq.com/blog/5-key-metrics-track-proactive-customer-retention-slicker-enhance

https://recurly.com/research/subscriber-retention-benchmarks/

https://www.slickerhq.com/blog/2025-failed-payment-benchmarks-b2c-subscription-ecommerce-ai-recovery

https://www.slickerhq.com/blog/2025-failed-payment-benchmarks-ai-beats-industry-averages

https://info.idc.com/ap-ai-roi-business-value-framework.html

https://www.slickerhq.com/blog/calculating-hidden-cost-failed-payments-2025-revenue-loss-model

https://www.make.com/en/resources/how-to-calculate-automation-roi

https://www.slickerhq.com/blog/how-ai-enhances-payment-recovery

WRITTEN BY

Slicker

Slicker